A life insurance license is a requirement for anyone wanting to work as a life insurance agent. The process for acquiring one varies from state to state, but there are some common steps. These include completing pre-licensing education, passing a state exam, undergoing a background check, and applying for the license. The exams are multiple-choice and cover topics such as insurance policies, state laws, and insurance concepts. While a degree is not necessary, relevant education in fields like marketing, business, or management can be beneficial.

| Characteristics | Values |

|---|---|

| Age requirement | 18+ |

| Education | High school diploma or equivalent |

| Pre-licensing education | Varies by state |

| Exam | State insurance licensing exam |

| Exam format | 105-150 multiple-choice questions |

| Exam topics | Life insurance general knowledge, life insurance policies, policy riders and options, life insurance tax issues, annuity policy tax issues |

| Exam cost | $43-$150 |

| Passing score | 70% |

| Background check | Yes |

| Fingerprinting | Yes |

| License application | Apply through the state's licensing provider |

| License renewal | Every two years |

What You'll Learn

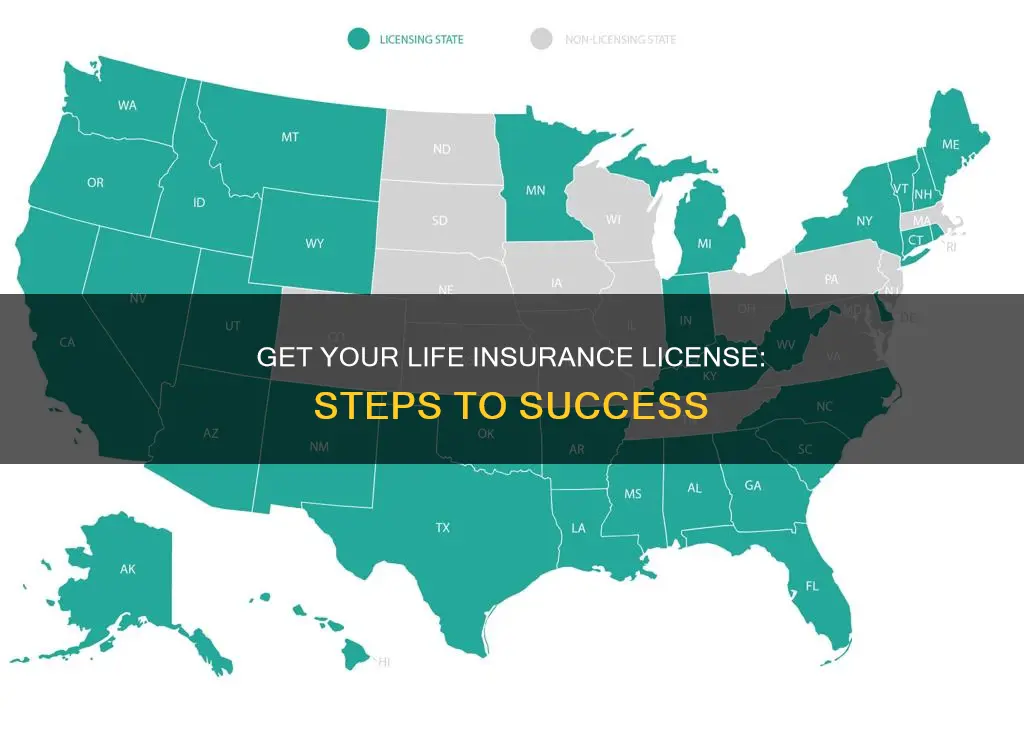

Check your state's requirements

Each state in the US has its own set of requirements and procedures for obtaining a life insurance license, so it's important to familiarize yourself with the specific rules and regulations of your state before initiating the licensing process. Here's a step-by-step guide to help you navigate the process efficiently:

Understand the State-Specific Licensing Authority: Recognize the entity responsible for regulating and overseeing the insurance industry in your state. This could be a department, division, or commissioner's office specifically dedicated to insurance-related matters. Their website will be a valuable resource for obtaining up-to-date information on the licensing requirements and procedures.

Review the State's Licensing Guidelines: Carefully review the guidelines provided by your state's licensing authority. These guidelines will outline the eligibility criteria, including any age, residency, and educational requirements that you must meet before applying for a life insurance license. Understanding these criteria beforehand will ensure that you are qualified and prepared for the licensing process.

Complete any Required Pre-Licensing Education: Many states mandate that individuals intending to sell life insurance products must complete a certain number of pre-licensing education hours. These courses are designed to provide you with the fundamental knowledge and skills needed to sell life insurance. The hours and content of the courses may vary by state, so ensure you enroll in an approved program that meets your state's requirements.

Check for Any State-Specific Examinations: Stay informed about any state-specific licensing examinations that may be required. Some states conduct their own exams in addition to general industry exams, so familiarize yourself with the format, content, and passing requirements specific to your state.

Application and Background Check: Adhere to the application and background check process outlined by your state's licensing authority. This typically involves submitting an application, paying the associated fees, and undergoing a background check to ensure your reliability and integrity in the insurance industry.

Maintain Compliance with Continuing Education: Once licensed, understand that most states require ongoing continuing education to maintain your license. Stay updated with your state's requirements to ensure your license remains in good standing, demonstrating your commitment to staying informed about industry changes and relevant laws.

By diligently following these steps and tailoring them to your state's specific requirements, you'll successfully obtain your life insurance license and embark on a rewarding career in the insurance industry.

Whole Life Insurance: Smart Choice for Young Couples?

You may want to see also

Take a pre-licensing course

To obtain a life insurance license, you must pass an exam and meet other requirements. One of the steps to getting your license is to complete any prelicensing education required by the state in which you want to be licensed. The number of hours and the cost of these courses vary by state. Some states do not require prelicensing education, so be sure to check with the state's insurance organization before you begin the process.

Pre-licensing courses are designed to prepare you to pass your state's insurance exam. These courses cover the fundamentals of insurance and are tailored to the content expected on the exam. The courses are worth a set number of credit hours, which you will need to take the exam. For example, in Michigan, completion of Life, Accident, and Health coursework requires 40 hours and awards a certificate necessary for taking the exam.

Pre-licensing courses are offered by various providers and can be taken online or in-person. Some providers offer packages that include additional study tools such as flashcards, recorded review classes, and exam simulators. These packages can help maximize your studying by providing various learning formats.

When choosing a pre-licensing course, it is important to select one that satisfies the requirements of your state. The course should cover the topics that will be on your state's exam, such as general knowledge of insurance concepts, policy riders, tax considerations, state-specific regulations, and marketing practices.

It is also beneficial to choose a course that suits your learning style and provides you with the necessary study materials to prepare for the exam effectively. You may also want to consider the pass rate of the course provider to increase your chances of passing the exam on your first attempt.

Is Bankers Life & Casualty Life Insurance Trustworthy?

You may want to see also

Register for the exam

Registering for the exam is the final step before you can take the state insurance licensing exam. Here's a detailed breakdown of what you need to do:

Check State Requirements

Firstly, it's important to note that each state has its own requirements for taking the insurance licensing exam. Therefore, you should check the specific requirements for your state. You can usually find this information on your state's official website or the website of the relevant state government department, such as the Department of Insurance. Understanding the requirements beforehand will ensure you don't encounter any surprises during the registration process.

Complete Pre-licensing Education

Before registering for the exam, most states require you to complete a pre-licensing education course. The number of hours and the cost of these courses vary by state, so be sure to check the specifics for your state. Some states don't require pre-licensing education, but even in those cases, it's recommended to take a course to prepare for the exam.

Register and Pay the Fee

Once you've met the necessary requirements, you can register for the exam. The registration process can usually be done online or over the phone. Keep in mind that you'll need to pay a registration fee, which is determined by each state. After registering, choose an exam date and time that suits you. In most states, you have the flexibility to select your preferred schedule.

Familiarize Yourself with the Exam Format

To increase your chances of passing the exam, it's essential to understand the exam format. The life insurance exam is a proctored, multiple-choice exam, typically consisting of around 100-150 questions. It is computer-based and takes place at an official test centre. Knowing what to expect on exam day will help you feel more confident and prepared.

Prepare for the Exam

Give yourself ample time to study for the exam. Create a study plan that suits your learning style and covers all the relevant topics. Utilize preparation materials, such as study guides and practice exams, to enhance your understanding of the material. Additionally, consider reviewing your state's outlines, as they provide valuable insights into the exam content.

Know the Exam Centre Process

Familiarize yourself with the exam centre beforehand. Know the location and how long it takes to get there. Understand the identification requirements and any other procedures you need to follow on the day of the exam. This will help ensure a smooth and stress-free experience on exam day.

Life Insurance: Key Considerations for Smart Choices

You may want to see also

Pass the exam

Passing the exam is a crucial step in obtaining your life insurance license. Here are some detailed instructions and tips to help you prepare for and pass the exam:

Know the Exam Format and Content:

The life insurance exam is a computer-based, multiple-choice exam. The number of questions can vary from 100 to 150, and the exam duration is usually around 2.5 to 3 hours. The exam covers various topics, including life insurance general knowledge, life insurance policies, policy riders and options, life insurance tax issues, and annuity policy tax issues. Some states may also include health insurance topics if you are pursuing a combined life and health insurance license.

Understand the Requirements and Outline:

Each state has its own specific requirements and exam outline. Check with your state's department of insurance to obtain the exam outline and requirements. Understanding the topics that will be covered and their relative weight on the exam is essential for effective preparation.

Create a Study Plan:

Developing a realistic study plan that spreads out over several weeks is recommended. Cramming is not advisable. You can use preparation courses, review courses, and study materials specifically designed for the life insurance exam. These resources can help you stay on track and ensure you cover all the relevant topics.

Practice with Sample Questions and Exams:

Taking practice exams is an excellent way to prepare for the real thing. Practice exams help you identify your strengths and weaknesses and allow you to familiarize yourself with the question types and format. Focus on the questions you answered incorrectly or found challenging and revisit the relevant concepts. Additionally, pay attention to the explanations provided for each answer choice, as this will deepen your understanding of the material.

Know the Exam Center Process:

Familiarize yourself with the test center before the exam day. Know how to get there, and estimate your travel time. Find out the required identification documents and any other specific instructions from the testing center. This will help you feel more relaxed and confident on exam day.

Stay Calm and Focused During the Exam:

On the day of the exam, stay calm and composed. Read each question carefully and thoroughly before answering. Start with the questions you are confident about, and come back to the more challenging ones later. Remember, you only need a passing score of 70% in most states.

Choosing the Right Term Life Insurance Duration

You may want to see also

Apply for your license

Once you have passed the state exam, you can apply for your license through the state's licensing provider. This process can sometimes take a few weeks, depending on the backlog of applications.

Each state has its own license application process, and these applications can generally be filled out online. The application fee can range from $30 to $200. Some states require this before your exam, and some after, so be sure to check your individual state's steps.

All states will run some form of a background check while reviewing your application. Some will also require fingerprint data to be taken prior to licensing. This is normally run through a third party and carries a fee of around $30.

If you have questions about the background checks or any other detailed license questions, you can find your state's Department of Insurance contact information on your state's license page.

Additional licenses

If you are working to become a life insurance agent or financial advisor, you will need securities licensing on top of your state's insurance license. A securities license is required to sell securities, a common job role for both financial advisors and insurance agents.

Selling life insurance or other retirement products tied to the stock market will require federal-level licensing from the Financial Industry Regulatory Authority (FINRA). In most cases, Series 6 and Series 63 licenses are what you need to obtain to sell these products.

The SIE exam, which demonstrates your basic knowledge of the securities industry, will be a qualification you must complete before attempting to get your Series 6 or Series 63.

Some agents choose to get their Series 7 license instead of Series 6, as this allows them to market and sell a much broader line of securities products. The Series 7 exam, however, is one of the most difficult exams offered by FINRA, so be sure you understand which license would fit your needs best.

Transamerica Life Insurance: Is It a Good Option?

You may want to see also

Frequently asked questions

To take the life insurance exam, you must:

- Be at least 18 years old.

- Have a high school diploma or equivalent.

- Know the state in which you want to sell insurance and meet its specific requirements.

The life insurance exam is a proctored, multiple-choice exam. It is computer-based and consists of between 105 and 150 questions, which must be completed within 2.5 to 3 hours.

The exam covers topics such as life insurance general knowledge, life insurance policies, policy riders and options in life insurance coverage, and life insurance tax issues.