Life insurance is a financial product that provides a safety net for individuals and their families in the event of the insured's death. It is a contract between the policyholder and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the death of the insured. This coverage offers peace of mind, knowing that loved ones will be financially protected in the event of an untimely passing. People often view life insurance as a crucial tool for risk management, ensuring that their dependents can maintain their standard of living and cover essential expenses, such as mortgage payments, education costs, and daily living expenses, even if the primary breadwinner is no longer around.

What You'll Learn

- Financial Security: Life insurance provides financial protection for loved ones in the event of death

- Peace of Mind: It offers reassurance and reduces stress about the future

- Legacy Planning: A tool to ensure a legacy is left for beneficiaries

- Debt Management: It can help pay off debts and loans upon death

- Medical Expenses: Covers unexpected medical costs and funeral expenses

Financial Security: Life insurance provides financial protection for loved ones in the event of death

Life insurance is a powerful tool that offers a sense of financial security and peace of mind to individuals and their families. It is a contract between an individual and an insurance company, where the insurer promises to pay a designated sum of money to the policyholder's beneficiaries upon their death. This financial protection is a cornerstone of many people's financial planning strategies, especially for those with loved ones who depend on their income.

When it comes to financial security, life insurance plays a crucial role in ensuring that the financial obligations and commitments of the deceased are met. It provides a safety net for the family, covering expenses such as mortgage payments, children's education, daily living costs, and even future financial goals. For instance, if a primary earner were to pass away, the remaining family members could face significant financial strain, especially if they are not prepared for such an eventuality. Life insurance steps in to bridge this gap, providing the necessary funds to maintain the family's standard of living and cover any outstanding debts.

The beauty of life insurance lies in its ability to offer financial stability during emotionally challenging times. It ensures that the loved ones are not burdened with the stress of financial matters while grieving the loss of a family member. This financial protection allows the beneficiaries to focus on healing and adjusting to life without the immediate worry of financial survival. Moreover, it provides a sense of security, knowing that the family's long-term financial goals and plans remain intact despite the tragic circumstances.

In the context of 'Financial Security', life insurance is a vital component of a comprehensive financial plan. It complements other financial instruments and strategies, such as savings accounts, retirement plans, and estate planning. By incorporating life insurance, individuals can create a robust financial safety net, ensuring that their loved ones are protected and their financial future is secure. This is especially important for those with a large financial responsibility or a family that relies on a steady income.

In summary, life insurance is a critical aspect of financial security, offering a safety net for loved ones in the event of the insured's death. It provides the necessary financial protection to cover essential expenses and maintain the family's standard of living. With life insurance, individuals can rest assured that their family's financial future is secure, allowing them to focus on the emotional healing process during difficult times. This financial security is a key reason why many people view life insurance as an essential tool for long-term financial planning.

HIV Testing: A Prerequisite for Life Insurance?

You may want to see also

Peace of Mind: It offers reassurance and reduces stress about the future

Life insurance is often described as a powerful tool that provides peace of mind and a sense of security to individuals and their loved ones. It serves as a safety net, offering reassurance and a reduced burden of stress when it comes to the future. This financial product allows people to plan for unforeseen circumstances and ensures that their families are protected in the event of their untimely demise.

One of the primary benefits of life insurance is the peace of mind it brings. Knowing that your loved ones will be financially secure in your absence can alleviate a significant amount of worry. It provides a sense of control and stability, especially during challenging times. With life insurance, individuals can rest easy, knowing that their family's financial well-being is protected, and they can focus on living their lives to the fullest without constant financial concerns.

The reassurance provided by life insurance is invaluable. It allows people to make long-term plans with confidence. Whether it's covering educational expenses for children, paying off a mortgage, or ensuring daily living expenses are met, life insurance provides a financial safety net. This peace of mind enables individuals to make decisions and take actions that might not have been possible without this security. For example, someone might feel more comfortable starting a business venture, knowing their family's financial future is protected.

Moreover, life insurance reduces stress by providing a sense of continuity. It ensures that the financial responsibilities and commitments of the deceased are honored, even if they are no longer present. This continuity can help maintain the family's standard of living and provide the necessary funds to cover funeral expenses, outstanding debts, and other immediate needs. By offering this financial stability, life insurance allows the bereaved to grieve and heal without the added pressure of financial worries.

In summary, life insurance is a valuable asset that provides peace of mind and reduces stress. It empowers individuals to face the future with confidence, knowing their loved ones are protected. This financial product allows people to make decisions, plan for the long term, and ensure their family's financial security, ultimately leading to a more peaceful and stress-free life.

Wealthy Estate Planning: Life Insurance and Tax Avoidance

You may want to see also

Legacy Planning: A tool to ensure a legacy is left for beneficiaries

Legacy planning is a crucial aspect of financial strategy that often goes overlooked, yet it plays a pivotal role in ensuring your loved ones are taken care of and your values and wishes are honored. It involves a comprehensive approach to safeguarding your legacy and providing for the people and causes you hold dear. This process is not merely about the distribution of assets but also about the impact you want to have on the lives of your beneficiaries and the world around you.

The primary goal of legacy planning is to create a structured plan that outlines how your assets will be managed and distributed after your passing. This includes deciding on the allocation of your estate, such as real estate, investments, personal belongings, and other valuables, to ensure they are utilized according to your wishes. It also involves making decisions about the timing and manner of distribution, whether it's through a will, trust, or other legal mechanisms. By doing so, you gain control over your legacy, ensuring it aligns with your values and intentions.

One of the key benefits of legacy planning is the ability to provide for your beneficiaries in a way that suits their unique needs and circumstances. This might involve setting up trust funds for children or grandchildren, ensuring they have financial security for their education and future endeavors. For example, you could establish a trust that provides a regular income for your spouse during their lifetime and then passes the remaining assets to your children. This level of customization allows you to create a lasting impact that goes beyond the financial, encompassing emotional and practical support.

Moreover, legacy planning enables you to support causes and charities that are close to your heart. Many individuals choose to dedicate a portion of their estate to philanthropic endeavors, ensuring their legacy extends to making a positive difference in the world. This could involve setting up a charitable trust that donates a percentage of your estate's value to a chosen charity or foundation, ensuring your contributions continue long after your passing. By integrating your values and passions into your legacy plan, you can leave a profound and meaningful impact.

In summary, legacy planning is a powerful tool that empowers individuals to take charge of their legacy, providing for their loved ones and supporting causes they believe in. It offers a structured approach to wealth management, ensuring your assets are utilized according to your specific wishes and values. Through careful consideration and professional guidance, you can create a comprehensive plan that not only secures your legacy but also leaves a lasting impression on the lives of those you care about.

Health and Life Insurance: What's the Difference?

You may want to see also

Debt Management: It can help pay off debts and loans upon death

Life insurance is often seen as a financial safety net, a tool to provide security and peace of mind for individuals and their loved ones. One of the key aspects that people associate with life insurance is its ability to manage and alleviate financial burdens, particularly in the context of debt management. When an individual passes away, the financial obligations they leave behind can be overwhelming for their family. This is where life insurance steps in as a crucial component of financial planning.

Upon death, life insurance policies typically provide a lump sum payment, known as a death benefit, to the designated beneficiaries. This financial cushion can be utilized to settle various debts and loans that the deceased had accumulated. For instance, it can cover mortgage payments, ensuring that the family's home remains in their possession, or it can be used to pay off personal loans, student loans, or credit card debts, preventing the loved ones from being burdened with these financial responsibilities. By having life insurance, individuals can ensure that their passing does not lead to a financial crisis for their families, as the death benefit can be strategically directed towards debt repayment.

The process of managing debts through life insurance is straightforward. The policyholder, or the individual who owns the policy, can choose to name beneficiaries and specify how the death benefit should be distributed. Upon the policyholder's death, the insurance company pays out the designated amount to the beneficiaries, who then have the financial means to address the outstanding debts. This approach not only provides financial relief but also ensures that the family's creditworthiness remains intact, allowing them to continue their financial commitments without disruption.

Furthermore, life insurance can be a strategic tool for those with substantial debts. High-interest debts, such as credit card balances or personal loans, can quickly accumulate and become unmanageable. By having a life insurance policy in place, individuals can allocate the death benefit to pay off these debts, preventing them from growing larger over time. This proactive approach to debt management can significantly reduce financial stress and provide a sense of security, knowing that one's loved ones will not be burdened with overwhelming financial obligations.

In summary, life insurance is indeed a valuable asset for managing debts and providing financial security. It offers a practical solution to the challenges that arise when an individual's passing leaves behind a trail of financial commitments. By understanding the role of life insurance in debt management, individuals can make informed decisions to protect their families and ensure a more stable financial future. This aspect of life insurance highlights its importance as a comprehensive financial planning tool.

Life Insurance: Tax Write-Offs and Their Benefits

You may want to see also

Medical Expenses: Covers unexpected medical costs and funeral expenses

Life insurance is a financial safety net that provides peace of mind and security for individuals and their loved ones. It is a contract between an individual and an insurance company, where the insurer promises to pay a designated sum of money to the policyholder's beneficiaries upon their death. This financial protection is particularly crucial when it comes to covering unexpected medical costs and funeral expenses, which can be overwhelming and financially devastating for families.

Medical emergencies and unexpected illnesses often require immediate and costly treatment, and having life insurance can significantly ease the financial burden. When an individual falls ill or suffers an accident, the associated medical expenses can be substantial. From hospital stays and surgeries to specialized treatments and medications, these costs can quickly accumulate. Life insurance policies typically include a clause that covers such unforeseen medical expenses, ensuring that the insured person's family is not left with a mountain of debt. This coverage can be a lifeline, allowing individuals to focus on their health and recovery without constantly worrying about financial constraints.

Funeral and burial expenses are another aspect of life that can be emotionally and financially challenging. When a loved one passes away, the last thing the family needs to worry about is the financial burden of funeral arrangements. Life insurance policies often provide a dedicated sum for funeral and burial costs, ensuring that the deceased's wishes are honored and the family can grieve without added financial stress. This coverage can cover various expenses, including funeral services, casket or urn costs, transportation, and even legal fees associated with the death.

The beauty of life insurance in this context lies in its ability to provide financial security and stability during emotionally challenging times. It empowers individuals to take control of their financial future and that of their dependents. By having a comprehensive life insurance policy, one can ensure that their loved ones are protected from the financial impact of unexpected medical crises and the emotional strain of funeral arrangements. This financial safety net allows families to focus on honoring their loved ones' memories and moving forward with their lives.

In summary, life insurance is a powerful tool that offers financial protection and peace of mind. Its ability to cover unexpected medical costs and funeral expenses is a testament to its value. By providing a financial cushion during challenging times, life insurance ensures that individuals and their families can navigate through life's uncertainties with greater confidence and security. It is a wise investment that demonstrates a commitment to the well-being of oneself and one's loved ones.

Understanding Whole of Life Insurance: A Comprehensive Guide for UK Residents

You may want to see also

Frequently asked questions

Life insurance is a financial tool designed to provide financial security and protection to individuals and their families. It offers a safety net by ensuring that loved ones are financially supported in the event of the insured person's death. The primary purpose is to help cover expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses, and to provide financial stability during a difficult time.

When you purchase a life insurance policy, you agree to pay a premium (a regular payment) to the insurance company. In return, the insurance company promises to pay a death benefit (a lump sum amount) to your beneficiaries upon your passing. The death benefit can be used for various purposes, such as replacing lost income, funding education, or covering final expenses. The policy can be term life insurance, which provides coverage for a specific period, or permanent life insurance, offering lifelong coverage with an investment component.

Life insurance is beneficial for anyone who has financial responsibilities or dependents. It is especially important for those with a family to support, a mortgage or rent to pay, or specific financial goals they want to achieve. Young adults starting their careers, parents, and individuals with long-term financial commitments are often advised to consider life insurance. It ensures that their loved ones are protected financially, even if they are no longer around.

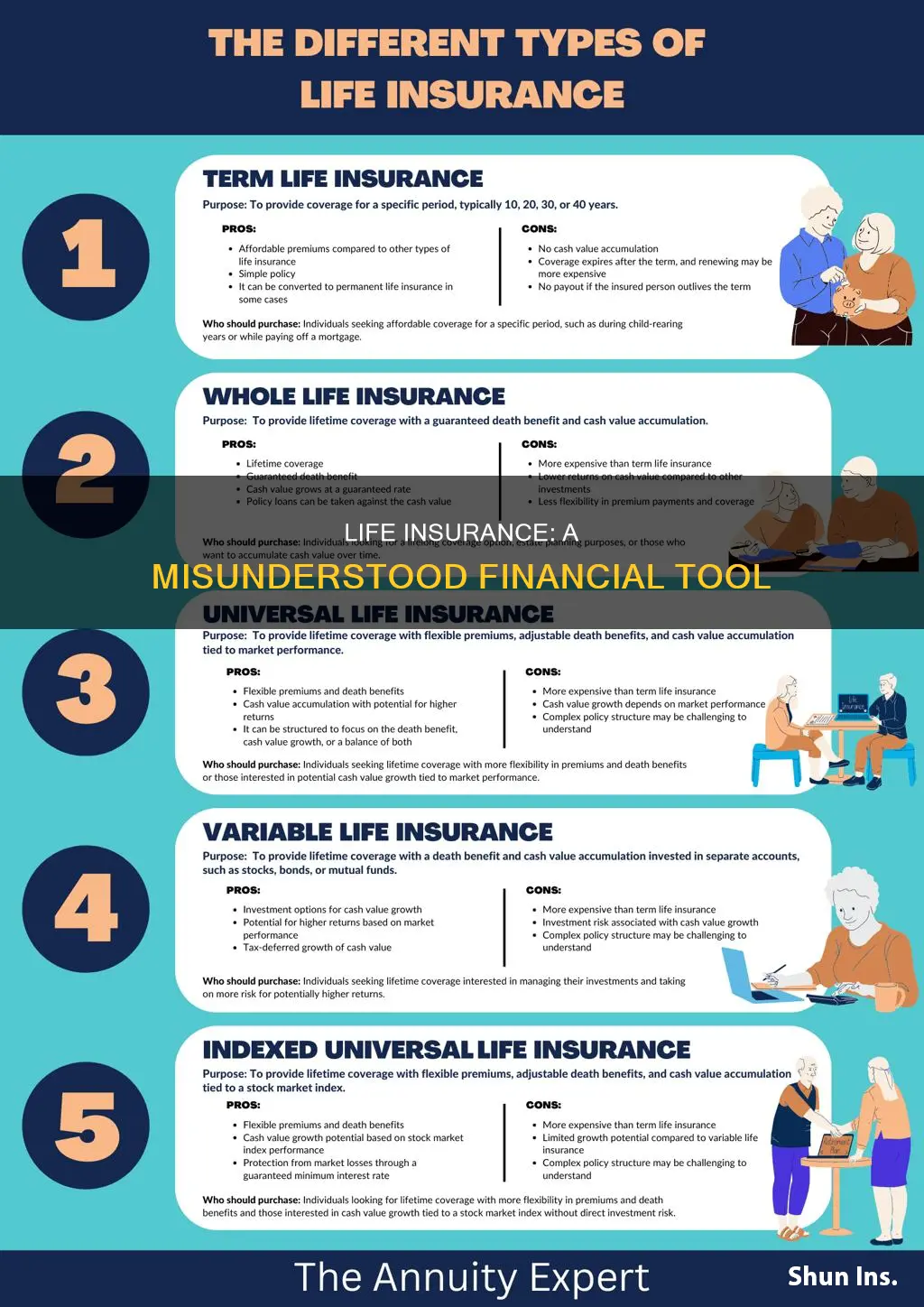

There are several types of life insurance policies available, each with unique features and benefits:

- Term Life Insurance: Provides coverage for a specified term, such as 10, 20, or 30 years. It offers high coverage amounts at lower premiums but terminates upon the policy's end.

- Permanent Life Insurance: Offers lifelong coverage and includes an investment component, allowing cash value accumulation over time. It provides flexibility and can be used for various financial goals.

- Universal Life Insurance: Provides flexible coverage and allows policyholders to adjust their premiums and death benefits. It offers a combination of insurance and investment features.

- Whole Life Insurance: Offers guaranteed coverage for the entire lifetime of the insured individual, with fixed premiums and a cash value component.