Whole of life insurance is a long-term financial product that provides coverage for an individual's entire life. In the UK, it is a type of permanent life insurance that offers a guaranteed death benefit to the policyholder's beneficiaries, regardless of the cause of death. This insurance policy builds up a cash value over time, which can be borrowed against or withdrawn, providing financial security and flexibility. It is a popular choice for those seeking a comprehensive and reliable way to protect their loved ones and ensure financial stability for the future.

What You'll Learn

- Definition: Whole of life insurance in the UK provides lifelong coverage, ensuring financial security for beneficiaries

- Benefits: It offers a combination of death benefit, income, and savings, catering to various financial needs

- Cost: Premiums are typically higher due to lifelong coverage, but they can be tailored to individual circumstances

- Flexibility: Policies can be customized, allowing for adjustments over time to meet changing financial goals

- Regulation: The UK's Financial Conduct Authority oversees whole of life insurance, ensuring consumer protection and market integrity

Definition: Whole of life insurance in the UK provides lifelong coverage, ensuring financial security for beneficiaries

Whole of life insurance, also known as permanent life insurance, is a financial product designed to provide coverage for the entire lifetime of the insured individual. In the UK, this type of insurance offers a comprehensive solution for those seeking long-term financial security and peace of mind. It is a commitment that the insurance company will honor, ensuring that the policyholder's beneficiaries receive a payout regardless of the insured's passing at any point in their lives.

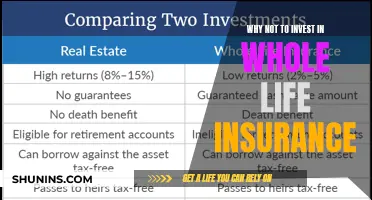

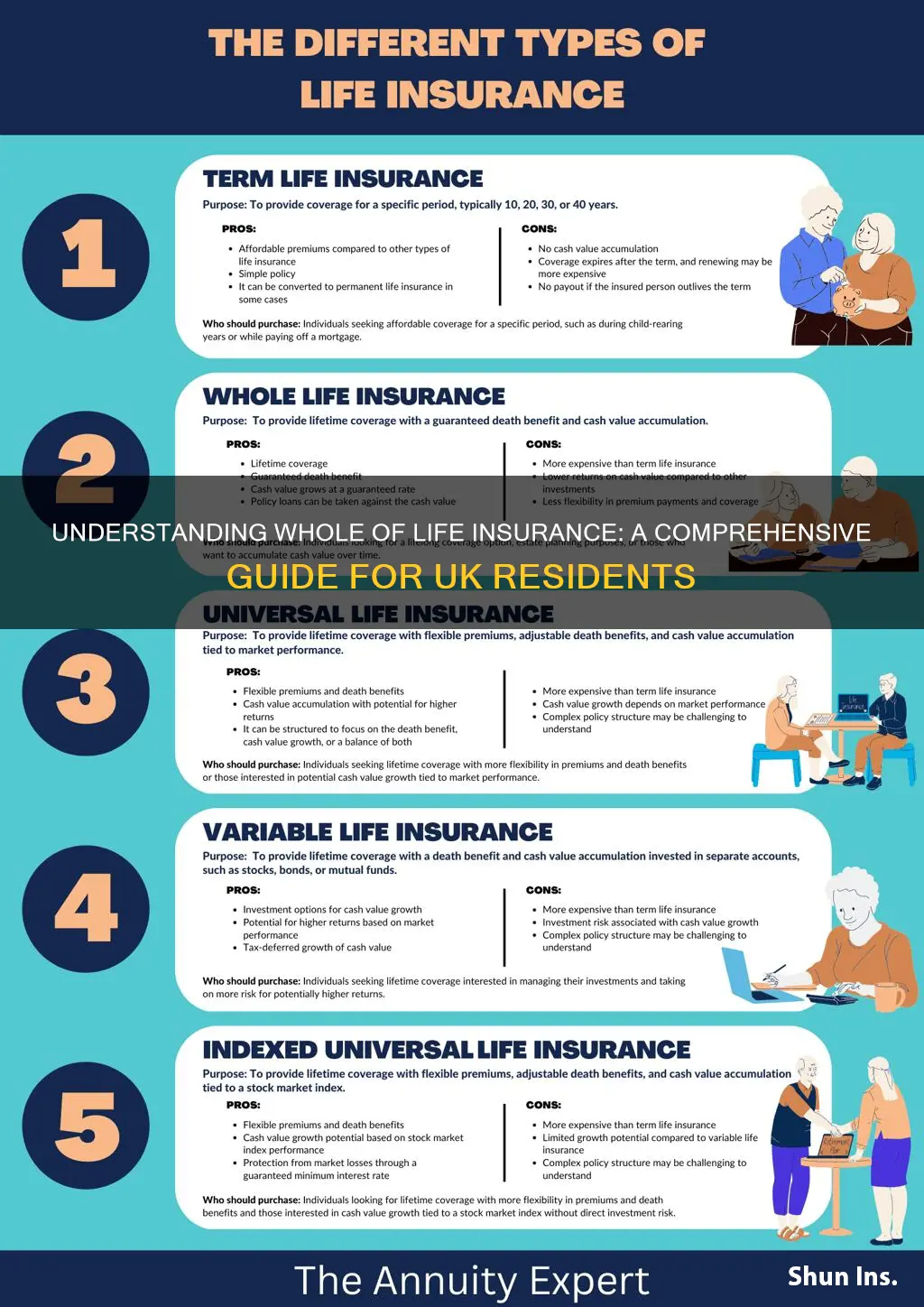

This insurance policy is distinct from term life insurance, which provides coverage for a specified period, typically 10, 20, or 30 years. In contrast, whole of life insurance offers coverage for the entirety of the insured's life, making it a more permanent and long-lasting solution. The primary purpose is to provide financial protection and support to the policyholder's loved ones, covering various expenses and ensuring their financial well-being.

When purchasing whole of life insurance in the UK, policyholders typically pay a fixed premium over an extended period. This premium is calculated based on factors such as age, health, lifestyle, and the amount of coverage required. The insurance company then invests the premiums and any interest earned in various financial instruments, ensuring a steady growth of the policy's cash value. Over time, this cash value can be borrowed against or withdrawn, providing the policyholder with a financial safety net.

One of the key advantages of whole of life insurance is its predictability. The policyholder knows exactly how much they will pay in premiums and how much the beneficiaries will receive upon their passing. This certainty is particularly valuable for long-term financial planning, allowing individuals to make informed decisions about their insurance needs and overall financial strategy. Additionally, the lifelong coverage ensures that the insured's beneficiaries are protected even if they outlive the initial term of coverage.

In summary, whole of life insurance in the UK is a comprehensive financial tool that offers lifelong coverage and financial security. It provides a sense of reassurance to policyholders and their beneficiaries, knowing that financial obligations will be met regardless of the timing of the insured's passing. This type of insurance is a valuable consideration for individuals seeking long-term financial protection and a reliable safety net for their loved ones.

Beneficiaries: Multiple Options for Life Insurance Policies

You may want to see also

Benefits: It offers a combination of death benefit, income, and savings, catering to various financial needs

Whole of life insurance, also known as permanent life insurance, is a comprehensive financial product designed to provide coverage for an individual's entire life. It offers a unique combination of benefits that set it apart from other insurance policies. One of the key advantages is its ability to cater to a wide range of financial needs, ensuring that individuals and their families are protected and supported throughout their lives.

When it comes to financial planning, having a single policy that addresses multiple aspects is invaluable. Whole of life insurance provides a death benefit, which is a guaranteed payout to the policyholder's beneficiaries upon their passing. This financial safety net ensures that loved ones are financially secure even in the event of the insured individual's untimely death. Additionally, this policy offers an income component, providing regular payments to the policyholder during their lifetime. This income stream can be particularly beneficial for covering daily expenses, mortgage payments, or any other financial obligations.

The savings aspect of whole of life insurance is another significant benefit. As with any insurance policy, premiums are paid regularly, and a portion of these premiums contributes to the accumulation of cash value over time. This cash value can be borrowed against or withdrawn, providing policyholders with a source of funds for various purposes. For instance, it can be used to finance major purchases, fund retirement, or even provide a financial cushion for unexpected expenses. The savings component of this insurance policy grows tax-deferred, allowing the cash value to accumulate steadily.

Furthermore, whole of life insurance provides long-term financial security. Unlike term life insurance, which provides coverage for a specified period, whole of life insurance offers lifelong coverage. This means that individuals and their families are protected from financial hardship in the long term, ensuring that their financial goals and objectives remain on track. The policy's flexibility allows policyholders to customize the coverage and benefits to suit their specific needs, making it a versatile and comprehensive financial tool.

In summary, whole of life insurance in the UK offers a unique and comprehensive solution for individuals seeking financial security and protection. By combining death benefits, income provisions, and savings opportunities, this insurance policy caters to various financial needs, providing peace of mind and long-term financial stability for policyholders and their beneficiaries. It is a valuable asset in any financial plan, offering a holistic approach to insurance and wealth management.

Life Insurance: Reviewing Your Policy and Making Changes

You may want to see also

Cost: Premiums are typically higher due to lifelong coverage, but they can be tailored to individual circumstances

Whole of life insurance is a long-term financial commitment that provides coverage for the entire lifetime of the policyholder. This type of insurance is designed to offer a comprehensive solution for individuals seeking to secure their loved ones' financial future and ensure their estate is protected. One of the key aspects of whole of life insurance is its cost, which is typically higher compared to other insurance types due to the lifelong coverage it provides.

The higher premiums are a result of the extended coverage period, which ensures that the insurance company is prepared for potential claims over a more extended duration. This lifelong commitment allows for the accumulation of a substantial cash value within the policy, providing financial benefits to the policyholder. The cost of whole of life insurance can vary significantly depending on several factors, including the individual's age, health, lifestyle, and the amount of coverage required. Younger individuals often benefit from lower premiums as they have a more extended lifespan ahead, reducing the risk for the insurance company.

Tailoring the policy to individual circumstances is a unique feature of whole of life insurance. Policyholders can customize their coverage to meet specific needs. For instance, they can choose the level of coverage, ensuring that the premiums are proportional to the desired protection. Additionally, some policies offer flexibility in premium payments, allowing individuals to make regular contributions or opt for a one-time payment. This customization ensures that the insurance remains affordable and adaptable to changing financial situations.

When considering the cost, it's essential to understand that whole of life insurance offers a comprehensive financial package. The higher premiums provide a safety net for the policyholder's family and beneficiaries, ensuring financial security during challenging times. Moreover, the cash value accumulation can be utilized for various purposes, such as funding education, starting a business, or providing additional financial support during retirement.

In summary, whole of life insurance in the UK provides lifelong coverage, resulting in higher premiums but also offering tailored solutions to meet individual needs. The cost is a significant factor, but it is outweighed by the long-term financial security and benefits it provides. Understanding the customization options and the potential financial advantages is crucial for making an informed decision regarding whole of life insurance.

Life Insurance vs AD&D: What's the Real Difference?

You may want to see also

Flexibility: Policies can be customized, allowing for adjustments over time to meet changing financial goals

Whole of life insurance is a comprehensive financial product that offers long-term coverage and provides a sense of security for individuals and their families. One of its key strengths is the flexibility it offers to policyholders, allowing them to adapt their insurance plans as their financial circumstances evolve. This adaptability is a significant advantage, ensuring that the policy remains relevant and beneficial throughout the policyholder's life.

When taking out a whole of life insurance policy, individuals have the freedom to customize various aspects of their coverage. This customization is a powerful feature, as it enables policyholders to tailor the policy to their unique needs and goals. For instance, they can choose the level of coverage required, ensuring that the policy provides adequate financial protection for their loved ones. Over time, as their financial situation changes, they can adjust the policy accordingly. For example, if an individual's income increases, they might opt to increase the policy's death benefit to align with their new financial standing. Conversely, if their financial goals shift, they can modify the policy to reflect these changes, ensuring that the insurance remains a valuable asset.

The flexibility of whole of life insurance policies is particularly beneficial for those with evolving financial objectives. It allows individuals to make adjustments as they progress through different life stages. For instance, a young professional might start with a basic policy, focusing on building coverage over time as their career and income grow. As they start a family or purchase a home, they can enhance the policy to provide more comprehensive protection. Later in life, when retirement planning becomes a priority, the policy can be further tailored to meet these new financial goals. This adaptability ensures that the insurance remains a dynamic and relevant part of their financial strategy.

Furthermore, the ability to customize and adjust whole of life insurance policies can provide peace of mind. Policyholders can rest assured that their insurance will continue to meet their needs, even as their life circumstances change. This flexibility is especially important in an ever-changing economic landscape, where financial priorities can shift unexpectedly. By having the option to modify their policies, individuals can ensure that their insurance remains a reliable and effective tool for financial security.

In summary, the flexibility of whole of life insurance policies in the UK is a significant advantage, offering policyholders the ability to customize and adjust their coverage over time. This adaptability ensures that the insurance remains a valuable and relevant financial asset, providing security and peace of mind as individuals navigate through various life stages and financial goals. With this level of flexibility, whole of life insurance becomes a powerful tool for long-term financial planning and protection.

How to Stop Others from Taking Out Life Insurance on You

You may want to see also

Regulation: The UK's Financial Conduct Authority oversees whole of life insurance, ensuring consumer protection and market integrity

The Financial Conduct Authority (FCA) plays a pivotal role in regulating the UK's financial services sector, including the insurance industry. When it comes to whole of life insurance, the FCA's oversight is crucial to ensure that consumers are protected and the market operates with integrity. This regulation is designed to safeguard the interests of policyholders and maintain a fair and transparent insurance environment.

Whole of life insurance is a long-term financial commitment, and the FCA's guidelines aim to provide a comprehensive framework for its management. The authority sets out rules and standards that insurance companies must adhere to, ensuring that policies are offered fairly and transparently. These regulations cover various aspects, including the disclosure of policy terms, the accuracy of information provided to customers, and the handling of customer complaints. By doing so, the FCA aims to prevent mis-selling and protect consumers from potential scams or misleading practices.

One of the key focuses of the FCA's regulation is to ensure that insurance companies provide clear and concise information about whole of life insurance policies. This includes explaining the policy's features, benefits, and potential risks. The FCA mandates that insurers must provide policy documents in a language that is easily understandable, allowing customers to make informed decisions. Additionally, the authority requires insurers to disclose any associated fees, charges, and commission structures, ensuring transparency and preventing hidden costs.

Market integrity is another critical aspect of the FCA's regulation. The authority monitors the insurance market to identify and address any potential misconduct or unethical behavior. This includes investigating complaints, conducting market studies, and taking enforcement action against companies that fail to comply with the regulations. By maintaining market integrity, the FCA aims to foster a healthy and competitive insurance environment, benefiting both consumers and businesses.

In summary, the FCA's regulation of whole of life insurance in the UK is a comprehensive approach to consumer protection and market stability. Through its oversight, the FCA ensures that insurance companies adhere to strict guidelines, providing clear and accurate information to customers. This regulation empowers consumers to make informed choices and protects them from potential financial risks. The FCA's commitment to market integrity further reinforces the reliability and trustworthiness of the insurance sector, ultimately benefiting the entire financial ecosystem.

Becoming a Life Insurance Agent in Australia: A Guide

You may want to see also

Frequently asked questions

Whole of life insurance, also known as permanent life insurance, is a long-term financial protection policy that provides coverage for the entire lifetime of the insured individual. It offers a combination of life insurance and an investment component, ensuring that the policyholder's beneficiaries receive a death benefit when the insured person passes away, while also allowing the policy to accumulate cash value over time.

In the UK, whole of life insurance policies are typically offered by insurance companies and provide a guaranteed death benefit, which means the insurer will pay out a specified amount to the policyholder's beneficiaries upon the insured's death. The policy also includes an investment element, where a portion of the premium paid by the policyholder is invested in various assets, such as stocks, bonds, or funds. This investment component grows over time, and the cash value can be used to pay premiums or taken out as a loan, providing financial flexibility.

This type of insurance offers several advantages. Firstly, it provides lifelong coverage, ensuring that your loved ones are financially protected even if you pass away. Secondly, the investment aspect allows your money to grow, potentially outperforming other investment vehicles over time. Additionally, whole of life insurance can be a cost-effective way to build up a substantial cash sum, which can be used for various purposes, such as retirement planning, business ventures, or funding education.

While whole of life insurance has its benefits, there are a few considerations. The premiums can be higher compared to term life insurance, as the policy provides coverage for the entire lifetime. Additionally, the investment performance is not guaranteed, and market fluctuations can impact the growth of the cash value. It's essential to carefully review the policy terms, understand the investment options, and consider seeking professional advice to ensure the policy aligns with your financial goals and risk tolerance.