When taking out a life insurance policy, the policyholder must name one or more beneficiaries who will receive the death benefit if the insured passes away while covered by the policy. It is possible to have more than one beneficiary on a life insurance policy. The policyholder can specify any number of co-beneficiaries and how they would like the benefit to be distributed among them. For example, they may choose to split the benefit evenly or allocate specific percentages to each beneficiary.

| Characteristics | Values |

|---|---|

| Number of beneficiaries | You can have as many beneficiaries as you want. |

| Primary beneficiary | The first in line to receive the death benefit. |

| Contingent/secondary beneficiary | Receives the death benefit if the primary beneficiary is deceased or unreachable. |

| Allocation of death benefit | You can allocate a percentage of the death benefit to each beneficiary, adding up to 100%. |

What You'll Learn

Primary and contingent beneficiaries

When setting up a life insurance policy, it is important to designate both primary and contingent beneficiaries to ensure your assets are handled according to your wishes.

Primary Beneficiaries

The primary beneficiary is the first person or entity in line to receive the assets or benefits from your life insurance policy after your death. This individual or group has the primary claim to the inheritance and receives the proceeds directly, bypassing the need for probate. You can name more than one primary beneficiary and specify how the assets should be divided among them.

Contingent Beneficiaries

A contingent beneficiary, also known as a secondary beneficiary, is the person or entity that stands to inherit the assets if the primary beneficiary is unable or unwilling to do so. This ensures that your assets are passed on according to your wishes, even if the primary beneficiary predeceases you or cannot be located. They are essentially a backup to the primary beneficiaries and will only receive the assets if the primary beneficiary is deceased or otherwise unable to claim the inheritance. You can also designate multiple levels of contingent beneficiaries to ensure a clear line of succession.

Why Both Designations Are Important

Naming both primary and contingent beneficiaries is crucial for comprehensive estate planning:

- Avoid Probate: Properly designated beneficiaries can help avoid the lengthy and costly probate process, which can delay the distribution of inheritance to your beneficiaries.

- Ensure Wishes Are Fulfilled: Contingent beneficiaries ensure that your assets are distributed according to your wishes, even if the primary beneficiaries cannot receive them.

- Provide Clarity and Security: Clear designations prevent disputes among potential heirs and provide peace of mind, knowing that your loved ones are taken care of.

Life Insurance Benefits: Adjusted Gross Income Impact

You may want to see also

Per capita distribution

For example, if a policyholder has four children and the life insurance policy is put in place with a per capita distribution, then the benefits would be equally distributed among these four surviving beneficiaries upon the death of the policyholder.

However, per capita distribution is not the only option. Per stirpes distribution is another method, which allows the death benefit to support younger generations of your family. This means that if one of the beneficiaries dies before you, their portion of the death benefit goes to their next of kin, usually their children, instead of being split between the other listed beneficiaries.

U.S.A.A. Life Insurance: Conversion Coverage Options Explored

You may want to see also

Per stirpes distribution

For example, if a policyholder has two children, and one of them dies before the policyholder, a per stirpes distribution would mean that the deceased beneficiary's children (the policyholder's grandchildren) would inherit their parent's share of the insurance money.

H&R Block: Life Insurance for Employees?

You may want to see also

Dollar amount vs. percentage

When it comes to designating beneficiaries for your life insurance policy, you have the option of specifying dollar amounts or percentages for each beneficiary. This allows you to customise the distribution of your policy's death benefit among your chosen beneficiaries. Here are some key considerations regarding dollar amount vs. percentage allocation:

Dollar Amount Allocation:

- Equal Distribution: If you want each of your beneficiaries to receive the same amount, specifying a dollar amount can be a straightforward approach. For example, if you have three beneficiaries, you can allocate a fixed dollar amount to each, ensuring they all get an equal share.

- Specific Amounts: In some cases, you may want to give a specific dollar amount to certain beneficiaries. For instance, if you have both children and grandchildren as beneficiaries, you might want to allocate a larger dollar amount to your children to cover their higher expenses.

- Flexibility: Allocating dollar amounts can provide flexibility, especially if you anticipate changes in your financial situation or that of your beneficiaries. If your financial circumstances change significantly, you can adjust the dollar amounts allocated to each beneficiary accordingly.

Percentage Allocation:

- Proportional Distribution: Percentage allocation ensures that your beneficiaries receive a proportional share of the death benefit. This is useful if you want the distribution to be relative to the beneficiaries' needs or your relationship with them. For example, you might allocate a larger percentage to your spouse or children compared to other beneficiaries.

- Automatic Adjustment: With percentage allocation, the death benefit is automatically adjusted based on the total payout. This means that if the death benefit increases or decreases due to changes in your policy or other factors, the beneficiaries' shares will adjust proportionally without requiring any changes to your beneficiary designations.

- Simplicity: Specifying percentages can be simpler than determining exact dollar amounts, especially if you want to make frequent adjustments to your policy or anticipate changes in the death benefit over time.

When deciding between dollar amount and percentage allocation, it's important to consider your specific circumstances, the needs of your beneficiaries, and the level of flexibility you require. Both approaches have their advantages, and you can even combine them by allocating specific dollar amounts to some beneficiaries while using percentages for others. The key is to ensure that the total allocation adds up to 100%, providing a clear distribution plan for your life insurance policy's death benefit.

Life Insurance: Benefits While Living, Not Just After Death

You may want to see also

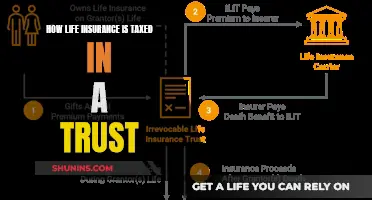

Life insurance trusts

A life insurance trust is a legal arrangement that helps to minimise your current tax burden and the impact of taxes on your estate when you pass away. It does this by transferring assets from you to a separate legal entity (the trust), which then distributes the proceeds to your chosen beneficiaries upon your death.

Benefits of life insurance trusts

- Tax benefits: By removing taxable assets from your current portfolio, a life insurance trust may help lower your current tax burden.

- Estate planning: Life insurance trusts give you a tax-efficient way to transfer wealth to your beneficiaries. They can also protect legacy assets from potential creditors.

- Government benefit protection: Life insurance trusts can be used to set aside assets for the care of family members with special needs without interfering with their eligibility for government benefits.

Downsides of life insurance trusts

The main downside of life insurance trusts is that they are irrevocable. This means that, unlike with a revocable trust, you cannot modify or terminate the trust without legal action or the consent of the beneficiaries.

Life Insurance for Disabled People: Is It Possible?

You may want to see also