Term life insurance is a type of insurance policy that provides coverage for a specific period, typically 10, 20, or 30 years. In Canada, it is a popular choice for individuals seeking affordable and flexible protection. This insurance offers a death benefit to the policyholder's beneficiaries if the insured person passes away during the term. It is a straightforward and cost-effective way to secure financial protection for loved ones, covering expenses such as mortgage payments, children's education, or other financial obligations. Understanding the features and benefits of term life insurance is essential for Canadians to make informed decisions about their insurance needs.

What You'll Learn

- Definition: Term life insurance in Canada is a temporary policy offering coverage for a set period

- Cost: Premiums are typically lower than permanent policies but do not build cash value

- Benefits: Provides financial protection for loved ones if the insured dies during the term

- Term Lengths: Policies can be for 10, 15, 20, or 30 years

- Renewal Options: Some policies can be renewed at the end of the term

Definition: Term life insurance in Canada is a temporary policy offering coverage for a set period

Term life insurance in Canada is a specific type of life insurance policy that provides coverage for a predetermined period, typically ranging from 10 to 30 years. It is a straightforward and cost-effective way to secure financial protection for your loved ones during a defined time frame. This type of insurance is particularly popular among Canadians due to its simplicity and the fact that it offers a clear and temporary solution to life's uncertainties.

The primary purpose of term life insurance is to provide financial security to your family or beneficiaries in the event of your death during the policy term. It ensures that your loved ones have a financial safety net to cover essential expenses, such as mortgage payments, children's education, or daily living costs, even if you are no longer around. This type of policy is often chosen by individuals who want to protect their family's financial well-being without the complexity of permanent life insurance.

In Canada, term life insurance policies are designed to be flexible and adaptable to various needs. The coverage amount, or death benefit, can be customized to suit the individual's requirements. For example, a policyholder might choose a higher coverage amount to ensure their family's long-term financial stability or opt for a lower amount if the primary goal is to cover short-term expenses. The duration of the policy is another critical aspect, allowing individuals to select the term length that best aligns with their financial goals and the level of risk they are willing to assume.

One of the key advantages of term life insurance in Canada is its affordability. Since the coverage is limited to a specific period, the premiums are generally lower compared to permanent life insurance. This makes it an attractive option for those seeking comprehensive protection without a long-term financial commitment. Additionally, term life insurance can be easily renewed or converted to a permanent policy if the individual's needs change or if they decide to continue the coverage beyond the initial term.

When considering term life insurance in Canada, it is essential to understand the different types available. These include level term, increasing term, and decreasing term policies. Each type has its own unique features and benefits, allowing individuals to choose the one that best suits their financial situation and future plans. By exploring these options, Canadians can make informed decisions about their life insurance needs and ensure their loved ones are protected during the specified term.

Life Insurance for Children: Is Term Coverage an Option?

You may want to see also

Cost: Premiums are typically lower than permanent policies but do not build cash value

Term life insurance is a type of life insurance that provides coverage for a specific period, or "term," typically ranging from 10 to 30 years. It is a straightforward and cost-effective way to secure financial protection for your loved ones during a defined period. One of the key advantages of term life insurance is its affordability compared to permanent life insurance policies.

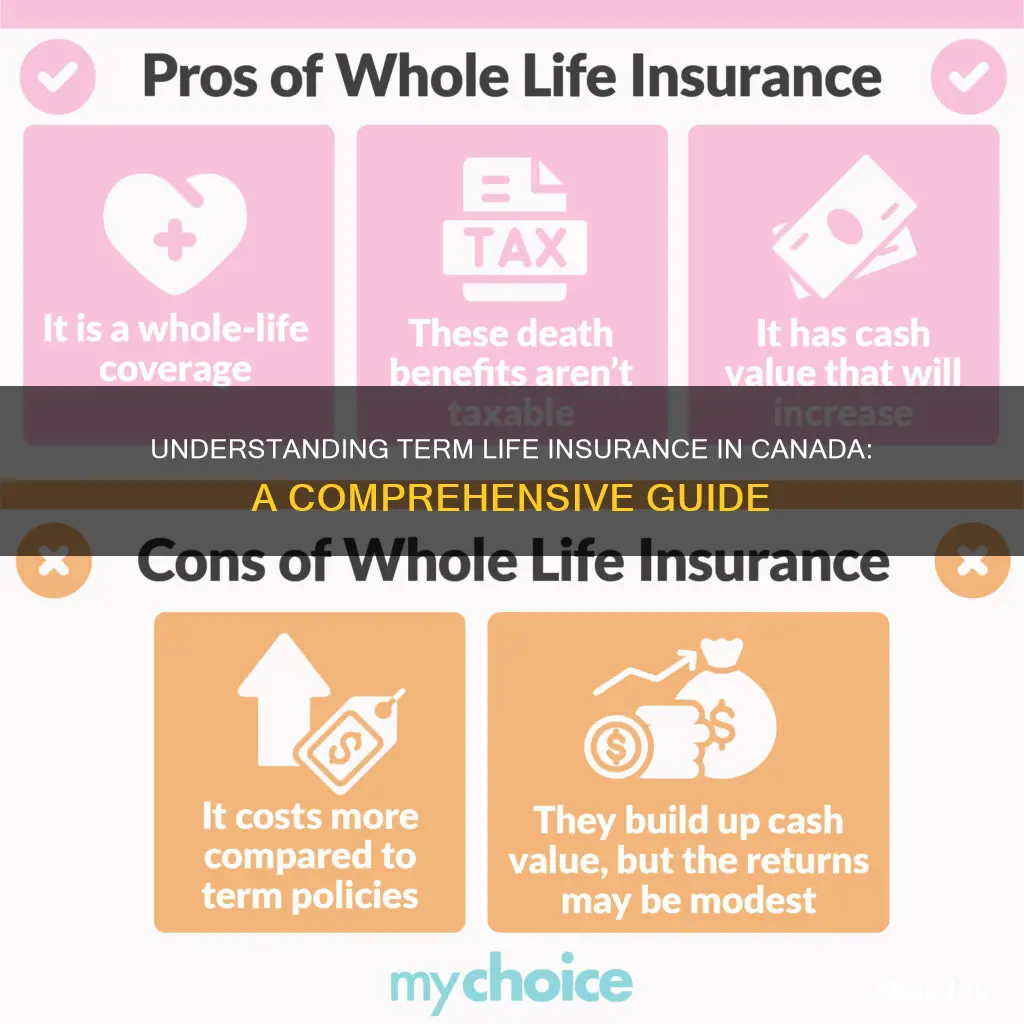

When it comes to cost, term life insurance offers lower premiums than permanent life insurance. Permanent policies, such as whole life or universal life, provide lifelong coverage and accumulate cash value over time, which can be borrowed against or withdrawn. These features come at a higher cost due to the long-term commitment and the investment aspect of the policy. In contrast, term life insurance focuses solely on providing coverage for a specific period, making it more budget-friendly.

The lower premiums of term life insurance are a result of its simplicity and lack of long-term commitments. Since term life insurance does not build cash value, there are no investment components or guarantees of returns, which are typically associated with permanent policies. This simplicity allows insurers to offer more competitive rates, especially for shorter coverage periods. As a result, individuals can secure higher coverage amounts at more affordable prices, ensuring their families are protected without breaking the bank.

It's important to note that while term life insurance may not build cash value, it still provides a critical safety net for your loved ones. The policy pays out a death benefit if the insured individual passes away during the specified term, ensuring financial security for dependents or beneficiaries. This aspect makes term life insurance an excellent choice for those seeking affordable coverage for a defined period, especially when starting a family or during significant financial milestones.

In summary, term life insurance in Canada offers a cost-effective solution for individuals seeking temporary coverage. Its lower premiums and lack of cash value accumulation make it an attractive option for those who prioritize affordability without compromising on essential protection. Understanding the cost structure and benefits of term life insurance can help individuals make informed decisions about their life insurance needs.

Cancel Your Reliance Nippon Life Insurance: A Step-by-Step Guide

You may want to see also

Benefits: Provides financial protection for loved ones if the insured dies during the term

Term life insurance is a type of coverage that offers a straightforward and effective way to secure your family's financial future. This insurance policy is designed to provide a specific period of coverage, hence the term "term," which is typically 10, 20, or 30 years. During this period, if the insured individual (the person who has taken out the policy) passes away, the policy will pay out a predetermined death benefit to the designated beneficiaries. This death benefit is a crucial aspect of term life insurance, as it ensures that your loved ones receive the financial support they need during challenging times.

The primary benefit of term life insurance is its ability to offer financial protection and peace of mind. When you purchase this policy, you are essentially making a promise to your family that, should the worst happen, they will be taken care of. The death benefit can cover various expenses, such as mortgage payments, children's education fees, daily living costs, and even funeral arrangements. By providing this financial cushion, term life insurance allows your loved ones to maintain their standard of living and focus on healing and moving forward without the added stress of financial burdens.

One of the key advantages of term life insurance is its affordability. Compared to permanent life insurance, term policies are generally more budget-friendly, especially for younger individuals. This cost-effectiveness makes it an attractive option for those who want to provide long-term financial security for their families without breaking the bank. Additionally, term life insurance is highly customizable, allowing you to choose the coverage amount and duration that best suit your specific needs and budget.

Another benefit is the flexibility it offers. You can adjust the policy's coverage amount as your life circumstances change. For instance, if you start a new high-paying job, you might want to increase the coverage to reflect your elevated earning potential. Conversely, if you pay off your mortgage or your children become financially independent, you may consider reducing the coverage to match your updated financial situation. This flexibility ensures that your term life insurance remains relevant and effective throughout your life.

In summary, term life insurance in Canada is a valuable tool for providing financial protection and peace of mind. It offers a straightforward way to secure your family's future by ensuring they receive the necessary financial support in the event of your passing. With its affordability, flexibility, and customizable nature, term life insurance empowers individuals to take control of their loved ones' financial well-being and navigate life's challenges with confidence.

Life Insurance Beneficiary: Can Minors Be Named?

You may want to see also

Term Lengths: Policies can be for 10, 15, 20, or 30 years

Term life insurance in Canada offers a straightforward and cost-effective way to protect your loved ones financially. It provides coverage for a specified period, known as the 'term,' during which the insurance company promises to pay out a predetermined death benefit if the insured individual passes away. This type of insurance is particularly useful for those seeking temporary coverage to cover specific financial obligations, such as mortgage payments, children's education, or business startup costs.

The term length is a critical aspect of term life insurance policies, as it determines the duration of coverage. Canadian insurance providers typically offer term lengths of 10, 15, 20, or 30 years. Each term length has its own advantages and considerations, allowing individuals to choose the option that best aligns with their financial needs and goals.

A 10-year term policy provides short-term coverage, often suitable for individuals who want insurance to cover a specific financial gap, such as a recent mortgage or a business venture. It offers a quick and affordable way to secure financial protection during a particular period. On the other hand, a 30-year term policy provides long-term coverage, ensuring that your loved ones are protected throughout a significant portion of your life, which can be especially valuable for those with long-term financial commitments.

For those who anticipate their financial needs changing in the future, a 20-year term policy can be a flexible option. It provides coverage for two decades, allowing individuals to adapt their insurance needs as their circumstances evolve. This term length is often chosen by those who want a balance between affordability and extended coverage.

When selecting a term length, it's essential to consider your financial obligations and life stage. Younger individuals with long-term financial commitments might opt for longer terms, while those with shorter-term goals may prefer shorter terms. Consulting with an insurance advisor can help you navigate these options and ensure you choose the term length that best suits your unique circumstances.

Understanding Supplemental Life Insurance: A Comprehensive Guide

You may want to see also

Renewal Options: Some policies can be renewed at the end of the term

Term life insurance is a popular and straightforward form of coverage in Canada, offering financial protection for a specified period. When purchasing term life insurance, it's essential to understand the concept of renewal options, which can provide flexibility and peace of mind for policyholders.

At the end of the initial term, many term life insurance policies offer the option to renew the coverage. This renewal process allows policyholders to extend their insurance protection without the need for a new application or medical examination. It is a convenient feature, especially for those who have built a trust in their current insurance provider and wish to continue their coverage without disruptions.

Renewal options are typically available for a limited period, often at the end of the initial term, and may vary depending on the insurance company's policies. During this renewal window, policyholders can choose to extend their coverage for another term, usually with the same conditions and benefits as the original policy. This process ensures continuity in financial protection, providing a safety net for the insured individual and their beneficiaries.

It is crucial to review the terms and conditions of the renewal process, as some policies may have specific requirements or limitations. For instance, the insurance company might offer a guaranteed renewal rate, ensuring that the premium remains the same for the next term, or they may provide an option to increase the coverage amount without a medical assessment. Understanding these details will help policyholders make informed decisions about their long-term insurance needs.

Renewing term life insurance at the end of the term is a strategic move for individuals who value long-term financial security. It allows them to maintain coverage without the hassle of switching providers or undergoing medical exams, which are often required for new policies. By taking advantage of the renewal option, policyholders can ensure that their loved ones remain protected even as their insurance needs evolve over time.

Group Term Life Insurance: Payroll Impact and Benefits

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the "term." It offers a death benefit if the insured person passes away during this term. The policyholder pays a premium for this coverage, and the insurance company promises to pay out the death benefit if the insured dies within the agreed-upon term.

In Canada, term life insurance is straightforward. You choose a term length, typically 10, 15, or 20 years, and an agreed-upon death benefit amount. If the insured person dies during this term, the insurance company pays the specified death benefit to the beneficiaries. The policy ends when the term expires, and coverage is no longer active unless you renew or convert it.

This type of insurance offers several advantages:

- Affordability: Term life insurance is generally more affordable than permanent life insurance because it only provides coverage for a specific period.

- Flexibility: You can choose the term length that suits your needs, ensuring coverage during the years when your family's financial obligations are highest.

- No Cash Value: Unlike permanent life insurance, term life insurance does not accumulate cash value, making it a pure insurance product with no investment component.

Term life insurance is available to most Canadians, but eligibility criteria may vary between insurance providers. Generally, it is offered to individuals between the ages of 18 and 65, but younger and older applicants may also be considered. Factors like health, lifestyle, and occupation can influence eligibility and premium rates.

Selecting the appropriate term length depends on your personal circumstances:

- Consider your financial obligations and the number of years you expect to support your family.

- Evaluate your long-term financial goals and whether you need coverage for a specific period, such as until your children are financially independent.

- Consult with an insurance advisor to determine the best term length based on your unique situation.