Annuities are a type of insurance contract that turns your money into future income payments. They are tax-deferred retirement investments, meaning you don't pay taxes on the money while it grows, but only when you start taking money out. The tax rules vary based on the type of annuity and how you take the money. Annuities can be funded in two ways: with pre-tax money or post-tax money. If you use pre-tax money from an IRA or a 401(k) to purchase the annuity, then all payouts will be fully taxed. If you use post-tax dollars to buy the annuity, then a portion of the payouts will be tax-free, and you will only be taxed on the earnings.

What You'll Learn

Annuities funded with pre-tax money are taxable as income

Annuities are tax-deferred retirement investments. This means that you don't pay taxes on the money while it grows, only when you withdraw it. The amount of tax you pay depends on how your annuity is funded.

Annuities funded with pre-tax money will be taxable as income when you receive payments. This is because the money has not yet been taxed, so the entire withdrawal will be taxed as income. The amount of tax you pay will depend on your federal tax bracket. For example, if you are in a 22% tax bracket and take out $25,000, you will pay $5,500 in taxes.

Qualified annuities are generally funded with pre-tax money. These annuities are subject to required minimum distribution (RMD) guidelines, which means that you must start taking distributions by April 1st of the year after you reach your RMD age, which is currently 73. In 2033, the RMD age will increase to 75.

If you have a 401(k) or IRA, you can use pre-tax money from these accounts to fund a qualified annuity, and all payouts will be fully taxed. You can also use pretax money from a Roth 401(k) to fund a qualified annuity, but these payouts may be tax-free if specific requirements are met.

Annuities funded with pre-tax money are taxed differently from those funded with post-tax money. When an annuity is funded with post-tax money, only the earnings are taxable as income. The principal, or the money you put in, will be returned to you tax-free.

Cracking the NC Life Insurance Exam: Is It Tough?

You may want to see also

Annuities funded with post-tax money are taxed differently

Annuities are a tax-deferred retirement investment. The way in which an annuity is funded determines how it will be taxed. Annuities funded with post-tax money are taxed differently from those funded with pre-tax money.

Annuities funded with post-tax money are known as non-qualified annuities. They are funded with taxable contributions, typically from a brokerage or bank account. These contributions establish a tax basis within the annuity that is not taxable when withdrawn. Only the earnings generated within a non-qualified annuity are taxable as income at the time of withdrawal or payment.

The exclusion ratio is used to determine how much of each payment from a non-qualified annuity is taxable. It takes into account the principal, the amount of time the annuity has been paying, the interest earnings, and the annuitant's life expectancy. Each payment includes a principal component (not taxable) and an earnings component (taxable). The larger the earnings relative to the original premium, the more taxable each payment will be.

Payments will become fully taxable after the annuitant reaches their assumed life expectancy. This is because a person who lives beyond their assumed life expectancy will have earned back all of the premium they used to fund the contract, so all remaining payments will be purely earnings and therefore 100% taxable as income.

If a non-qualified annuity contract is not annuitized, the taxability of withdrawals is calculated using the Last In, First Out (LIFO) standard. All earnings are considered "Last In" and will be withdrawn first for tax purposes. This means that taxes will be paid on all withdrawals up to the point that the earnings are exhausted, after which withdrawals will be tax-free.

Another option for non-qualified annuities is to annuitize them, converting them into a lifetime income stream. In this case, a portion of each payout will be a tax-free return of principal, similar to an immediate annuity.

It is important to note that, while annuities funded with post-tax money offer tax benefits, they may also cause the annuitant or their beneficiaries to pay income tax that could potentially be avoided. For example, stocks in a non-qualified annuity may increase in cost basis at the annuitant's death, while any gains remain taxable to beneficiaries.

Millionaires' Secret: Building Wealth with Life Insurance

You may want to see also

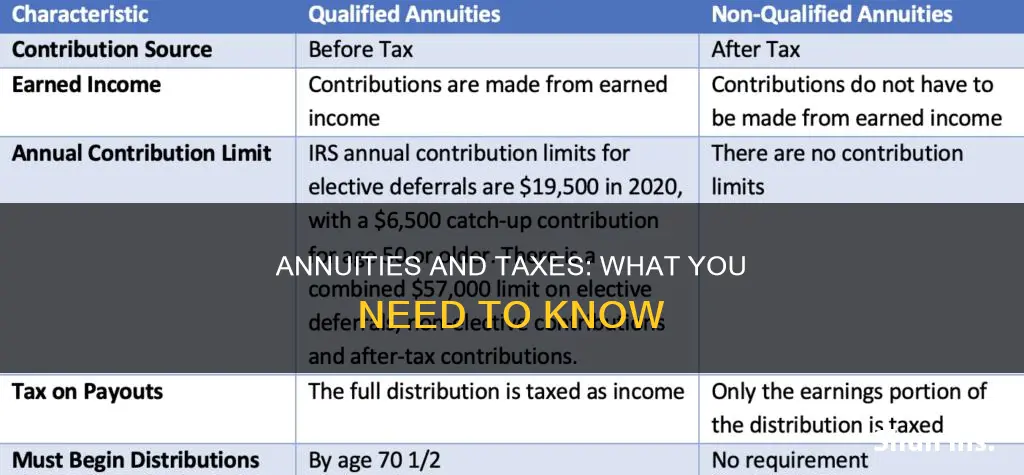

Qualified vs non-qualified annuities

The taxation of annuities depends on whether they are qualified or non-qualified. This, in turn, depends on whether they are funded with pre-tax or post-tax money.

Qualified Annuities

Qualified annuities are funded with pre-tax dollars, like those from retirement accounts such as an IRA or 401(k). Taxes on these annuities are deferred until withdrawal. There is no annual cap on how much money you can put into a qualified annuity, although many companies may have their own limits. Contributing money to an annuity from a retirement plan does not offer additional tax deductions but retains the tax-deferral status already established for retirement assets.

Qualified annuities are subject to normal required minimum distributions (RMDs) at age 73, unless the contracts are annuitized. The entire distribution amount is taxed as ordinary income.

Non-Qualified Annuities

Non-qualified annuities are funded with post-tax dollars. This means that taxes are postponed until withdrawals are made. There is no annual cap on how much money you can put into a non-qualified annuity and there is no mandatory distribution age.

Non-qualified annuities are exempt from RMD guidelines during the owner's life. When distributions are made, any interest or earnings within the annuity will be distributed before the premium or principal amount. The distributions of interest (or earnings) are taxed as ordinary income, but the premium or principal amount is not taxed.

Guardian Life Insurance: Is It Worth Your Money?

You may want to see also

Early withdrawal penalties

The insurance company issuing the annuity also charges surrender fees if funds are withdrawn during the annuity's accumulation phase, or the period during which the initial lump sum is supposed to grow. The amount of the surrender charge depends on how long the owner stayed in the contract. The penalty for early withdrawal changes for each year the investment is held, decreasing the longer the annuity is held. This is called a surrender schedule. It is not uncommon for an early withdrawal penalty made in the first few years of owning an annuity to exceed 5%.

There are, however, some exceptions to the 10% early withdrawal penalty. For instance, annuities allow for early withdrawal with no penalty if the annuitant becomes disabled or dies. Additionally, some contracts offer a benefit for taking penalty-free withdrawals to pay for long-term care expenses. Many annuity contracts also let the owner withdraw up to 10% of the contract value or premium each year, as defined in the contract, penalty-free.

Life Insurance and Felons: A Complex Relationship

You may want to see also

How annuities compare to other investments for tax purposes

Annuities are tax-deferred retirement investments. The taxation of an annuity depends on how it is funded and the type of annuity.

Qualified Annuities

Qualified annuities are funded with pre-tax money, usually through retirement accounts such as a 401(k) or IRA. Contributions to these accounts are tax-deferred and will be subject to income taxes when withdrawals or payments are made. Qualified annuities are also subject to required minimum distributions (RMDs) at age 73, unless the contracts are annuitized.

Non-Qualified Annuities

Non-qualified annuities are funded with taxable contributions, typically from a brokerage or bank account. Only the earnings generated within a non-qualified annuity are taxable as income when a withdrawal or payment is made. The contributions themselves are not taxable.

Withdrawals from Qualified Annuities

Withdrawals from qualified annuities are subject to ordinary marginal tax rates. Income tax must be paid on the entire amount withdrawn—both the principal and the interest or earnings. Withdrawals made before the age of 59 1/2 typically face a 10% tax penalty, with a few exceptions.

Withdrawals from Non-Qualified Annuities

For non-qualified annuities, the interest and earnings withdrawn are subject to ordinary federal tax rates, while the principal can be withdrawn tax-free. However, taxable distributions may be subject to a 3.8% net investment income tax if the annuity holder's modified adjusted gross income exceeds certain thresholds. Unlike qualified annuities, non-qualified annuities are not subject to RMDs. Withdrawals made before age 59 1/2 from a non-qualified annuity are typically subject to a 10% tax penalty on the earnings, but not on the principal.

1035 Exchange

A 1035 exchange allows you to swap one annuity for another while continuing to defer taxes. This can be done with both qualified and non-qualified annuities.

Exclusion Ratio

The exclusion ratio is used to calculate how much of a non-qualified annuity payment is subject to tax. It takes into account the annuity principal, the annuitant's life expectancy, and the estimated total earnings. The exclusion ratio is not available for annuities funded with pre-tax money from a tax-advantaged retirement account.

Comparison to Other Investments

Compared to other investments, such as stocks or taxable brokerage accounts, annuities offer the benefit of tax-deferred growth. This means that earnings within an annuity are not taxed as long as the money remains in the annuity. However, upon withdrawal or payment, annuities may be subject to higher ordinary income tax rates, rather than the more favourable long-term capital gains tax rates.

Additionally, non-qualified annuities may be less tax-efficient than brokerage accounts when taking money out, as the earnings are taxed at ordinary income tax rates. However, they offer the advantage of tax-deferred growth, which a brokerage account does not.

Overall, annuities can be a favourable retirement investment from a tax perspective, particularly for those who expect to be in a lower tax bracket during retirement.

Haven Life: Insurance Without the Medical Exam Hassle

You may want to see also

Frequently asked questions

Yes, but the amount that is taxable depends on the type of annuity and how you take the money.

If you bought the annuity with pre-tax dollars, your future income payments are 100% taxed as income. If you bought the annuity with after-tax dollars, your future income payments will be a combination of a tax-free return of your premiums and taxable gains.

You pay taxes on an annuity from life insurance when you withdraw money or receive payments.

You can reduce the amount of tax you pay by converting a deferred annuity into an income annuity.