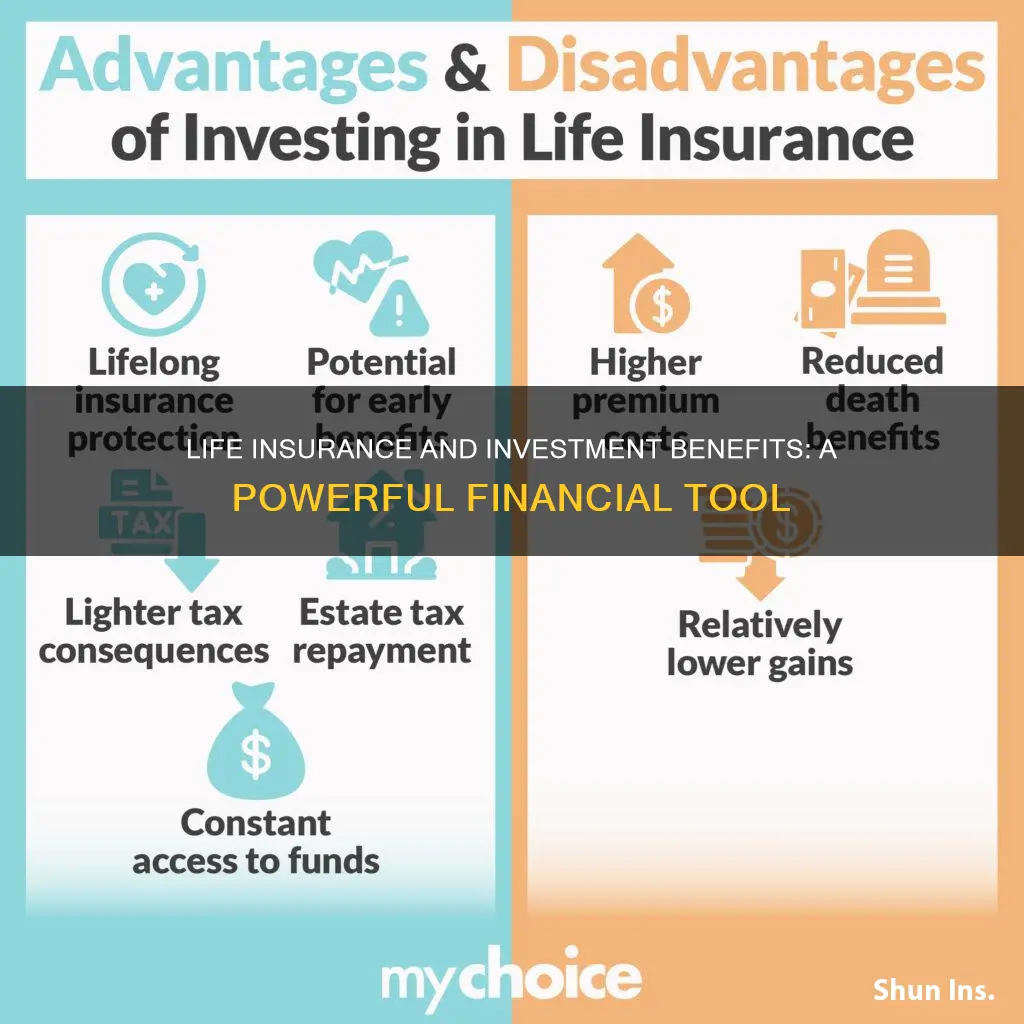

Life insurance is a crucial financial tool that offers both a safety net for your loved ones and investment opportunities. It provides a means of financial security by ensuring that your beneficiaries receive a payout in the event of your passing. Additionally, life insurance policies often include investment components, allowing policyholders to grow their money over time. This combination of protection and investment makes life insurance a valuable asset for anyone looking to secure their family's future and build long-term wealth.

What You'll Learn

- Term Life Insurance: Provides coverage for a set period, offering a straightforward investment-linked policy

- Whole Life Insurance: Offers lifelong coverage with a cash value component, providing investment growth

- Universal Life Insurance: Flexible coverage with adjustable premiums and potential investment returns

- Variable Universal Life: Combines insurance with investment options, allowing for potential higher returns

- Indexed Universal Life: Ties insurance to market indexes, offering investment opportunities with guaranteed minimums

Term Life Insurance: Provides coverage for a set period, offering a straightforward investment-linked policy

Term life insurance is a popular and straightforward financial product that offers a unique combination of life coverage and investment benefits. This type of insurance provides a fixed period of coverage, typically ranging from 10 to 30 years, during which the policyholder's beneficiaries receive a death benefit if the insured individual passes away. What sets term life insurance apart is its simplicity and the potential for long-term financial gains.

In a term life insurance policy, the policyholder pays a premium to the insurance company, and in return, they receive a death benefit if the insured dies during the specified term. This coverage is particularly valuable for individuals who want to provide financial security for their loved ones in the event of their untimely demise. The beauty of term life insurance lies in its simplicity; it offers a clear and defined period of protection, making it easy to understand and manage.

The investment aspect of this policy is where it truly shines. Term life insurance policies often include an investment component, allowing the policyholder to grow their money over time. The insurance company invests the premiums collected from policyholders and uses these funds to generate returns. These investment returns can accumulate and be used in various ways. For instance, some policies offer the option to increase the death benefit over time, providing more coverage as the policyholder's needs evolve. Additionally, the investment portion can be used to build a cash value, which can be borrowed against or withdrawn, providing financial flexibility.

One of the advantages of term life insurance is its affordability. Since the coverage is for a specific period, the premiums are generally lower compared to permanent life insurance. This makes it an attractive option for those seeking comprehensive protection without a long-term financial commitment. As the term progresses, the policyholder can decide to continue the investment portion, allowing their money to grow further, or they can opt to convert the policy into a permanent life insurance plan if their needs change.

In summary, term life insurance offers a practical solution for individuals seeking both life coverage and investment opportunities. Its straightforward nature, combined with the potential for long-term financial growth, makes it an excellent choice for those who want to secure their loved ones' futures while also building a valuable asset. With its clear benefits and manageable structure, term life insurance is a powerful tool in financial planning, providing both protection and the potential for wealth accumulation.

Converting Term Insurance: Whole Life Policy Options

You may want to see also

Whole Life Insurance: Offers lifelong coverage with a cash value component, providing investment growth

Whole life insurance is a comprehensive financial product that offers both immediate and long-term benefits, making it an attractive option for those seeking a secure and reliable way to protect their loved ones and build wealth over time. This type of insurance provides lifelong coverage, ensuring that your beneficiaries receive a death benefit when you pass away, regardless of the term length. One of the key advantages of whole life insurance is its cash value component, which acts as a savings account within the policy. As you make regular premium payments, a portion of each payment goes towards building this cash value, which grows tax-deferred. This feature allows your money to accumulate over time, providing a valuable asset that can be borrowed against or withdrawn, offering financial flexibility and security.

The investment growth aspect of whole life insurance is a significant benefit for those who want to grow their money while also having a safety net in place. The cash value in your policy can be invested in various investment options offered by the insurance company, such as stocks, bonds, or mutual funds. These investments have the potential to generate returns that can outpace the interest earned on traditional savings accounts, allowing your money to grow faster. As the cash value builds, it becomes a substantial asset that can be used for various purposes, such as funding education, starting a business, or providing financial security for retirement.

Over time, the cash value in your whole life insurance policy can become a substantial sum, providing a financial cushion that can be used to pay for major expenses or to supplement your income during retirement. This feature is particularly beneficial for those who want to ensure that their loved ones are financially protected, even in the event of their passing. The guaranteed death benefit and the growing cash value provide a sense of security and peace of mind, knowing that your family's financial needs will be met.

Furthermore, whole life insurance offers a level of financial planning that is often lacking in other insurance products. The cash value accumulation allows you to build a substantial financial asset, which can be used to secure your family's future and achieve long-term financial goals. With proper management and investment strategies, the cash value can grow significantly, providing a valuable resource that can be utilized for various financial needs.

In summary, whole life insurance is a powerful financial tool that combines life insurance protection with a cash value investment component. It offers lifelong coverage, ensuring that your beneficiaries are protected, while also providing an opportunity for investment growth and financial security. By understanding the benefits of whole life insurance, individuals can make informed decisions to safeguard their loved ones and build a more secure financial future.

Variable Life Insurance: An Asset or a Liability?

You may want to see also

Universal Life Insurance: Flexible coverage with adjustable premiums and potential investment returns

Universal life insurance offers a unique and flexible approach to life coverage, combining the security of a death benefit with the potential for long-term financial growth. This type of insurance is designed to provide a tailored solution for individuals seeking both life insurance and investment opportunities. Here's an overview of its key features:

In universal life insurance, policyholders have the freedom to adjust their coverage over time. Unlike traditional term life insurance, where premiums are fixed for a specified period, universal life policies offer flexibility. Policyholders can increase or decrease the death benefit amount, ensuring that the coverage aligns with their evolving needs and financial goals. This adjustability is particularly beneficial for those who want to adapt their insurance as their life circumstances change, such as when starting a family, purchasing a home, or achieving significant career milestones.

One of the most attractive aspects of universal life insurance is its potential for investment growth. The policy's cash value, which accumulates over time, can be invested in various investment options offered by the insurance company. These investment options may include stocks, bonds, and mutual funds, allowing policyholders to potentially earn higher returns compared to traditional savings accounts. The investment aspect of universal life insurance provides a way to build wealth while simultaneously securing a financial safety net for loved ones.

The investment returns in universal life insurance are not guaranteed and can vary depending on market performance. However, this feature allows individuals to actively manage their insurance portfolio, potentially increasing their overall wealth. Policyholders can choose to allocate more funds to investment options with higher growth potential, thus maximizing their returns. Additionally, the investment strategy can be adjusted periodically to reflect changing financial objectives and risk tolerances.

Another advantage is the potential for long-term savings. As the cash value grows, it can be borrowed against or withdrawn, providing access to funds for various purposes, such as education expenses or business ventures. This feature offers policyholders financial flexibility and the ability to utilize their investment returns without permanently disrupting their insurance coverage.

In summary, universal life insurance provides a comprehensive solution for those seeking both life insurance and investment opportunities. Its flexibility in coverage adjustments, potential for investment growth, and long-term savings capabilities make it an attractive option for individuals who want to take control of their financial future while ensuring the security of their loved ones.

Life Insurance and Estate Planning: What's the Connection?

You may want to see also

Variable Universal Life: Combines insurance with investment options, allowing for potential higher returns

Variable Universal Life (VUL) is a type of life insurance that offers a unique blend of insurance and investment opportunities, providing individuals with a comprehensive financial solution. This innovative product combines the security of life coverage with the potential for significant growth, making it an attractive choice for those seeking both protection and investment benefits.

In a VUL policy, the insured individual pays regular premiums, which are then invested in a variety of options. These investment choices can include stocks, bonds, and mutual funds, offering a diverse range of potential returns. The beauty of this approach is that it allows policyholders to potentially earn higher returns compared to traditional fixed-rate life insurance policies. As the investments grow, so does the cash value of the policy, providing a financial cushion that can be used for various purposes.

One of the key advantages of VUL is its flexibility. Policyholders can adjust their investment allocations based on their financial goals and risk tolerance. For instance, during periods of market growth, one might choose to allocate more funds to stocks to potentially maximize returns. Conversely, in times of market volatility, a more conservative approach with a higher allocation to bonds could be adopted. This adaptability ensures that the policy can be tailored to the individual's changing needs over time.

Additionally, VUL policies offer a level of protection that is often lacking in pure investment vehicles. The insurance component provides a guaranteed death benefit, ensuring that the insured's beneficiaries receive a specified amount upon their passing. This aspect of VUL makes it a valuable tool for estate planning and providing financial security for loved ones.

In summary, Variable Universal Life presents a compelling option for those seeking a financial strategy that combines insurance and investment. With its potential for higher returns, flexibility in investment choices, and the assurance of life coverage, VUL empowers individuals to take control of their financial future while providing a safety net for their loved ones. It is a powerful tool that can help individuals achieve their financial objectives while also ensuring peace of mind.

Understanding Top-Up: Enhancing Your Life Insurance Coverage

You may want to see also

Indexed Universal Life: Ties insurance to market indexes, offering investment opportunities with guaranteed minimums

Indexed Universal Life (IUL) is a type of permanent life insurance policy that combines the security of life coverage with the potential for investment growth. It is designed to offer a unique blend of insurance and investment benefits, providing a safety net for your loved ones while also allowing you to potentially grow your money over time. This type of policy is particularly attractive to those who want to secure their family's financial future while also benefiting from market opportunities.

The key feature of IUL is its connection to market indexes, which are used to determine the policy's performance and growth. Market indexes, such as the S&P 500 or the NASDAQ, are carefully selected and tied to the policy's performance. When the market performs well, the policyholder can benefit from the growth, and when the market is less favorable, the policy still offers a guaranteed minimum return. This approach provides a level of security and predictability that is often lacking in traditional investment vehicles.

In an IUL policy, a portion of your premium is allocated to an investment account, which is linked to the chosen market index. The investment account grows based on the performance of the index, allowing your money to potentially increase in value. For instance, if the S&P 500 index has a strong year, your investment account may grow significantly, providing a higher cash value in your policy. This growth is often tax-deferred, allowing your money to compound over time without incurring additional tax liabilities.

One of the most appealing aspects of IUL is the guaranteed minimum return. Unlike other investment options, IUL policies offer a minimum level of growth, ensuring that your money does not decrease in value. This guarantee provides peace of mind, especially during market downturns, as your policy will still provide the expected benefits. Additionally, the guaranteed minimum return is often higher than the average interest rate offered by traditional savings accounts, making IUL an attractive option for those seeking to maximize their savings.

IUL policies also offer flexibility in premium payments and death benefits. Policyholders can choose to pay premiums at regular intervals, and the death benefit, which is the amount paid to your beneficiaries upon your passing, can be adjusted over time. This flexibility allows you to customize the policy to fit your financial goals and changing circumstances. With IUL, you can secure your family's future while also having the potential for significant investment growth, making it an excellent choice for those seeking a comprehensive financial strategy.

Ford Retiree Benefits: Life Insurance Coverage Explained

You may want to see also

Frequently asked questions

A combination of life insurance and investment is known as a "life insurance with investment" or "investment-linked life insurance." This type of product offers both financial protection and long-term savings. It typically involves a life insurance policy that provides a death benefit to beneficiaries, while also allowing the policyholder to invest a portion of their premium in an investment account. The investment component can be structured in various ways, such as a cash value account or an investment fund, which grows over time and can be used to increase the policy's value or pay future premiums.

In this product, a portion of the premium paid by the policyholder is allocated to an investment account, where it can grow tax-deferred. The investment options vary depending on the provider, but common choices include stocks, bonds, or a mix of both. The policyholder can choose to increase their investment allocation over time, allowing their money to potentially grow faster. As the investment account grows, it contributes to the overall value of the life insurance policy, providing additional cash value. This cash value can be borrowed against or withdrawn, providing financial flexibility. Upon the insured's death, the death benefit is paid out, and the investment account's value is also considered in the policy's overall worth.

The main advantage is that it offers a dual purpose. Firstly, it provides financial security to the insured's loved ones in the event of their passing, ensuring a lump sum payment is available to cover expenses and provide for beneficiaries. Secondly, the investment component allows the policyholder to potentially grow their money over the long term, providing additional financial benefits. This can be particularly useful for those seeking to save for retirement or future financial goals while also protecting their loved ones. Additionally, the cash value accumulation can be a source of loanable funds, offering policyholders financial flexibility during their lifetime.

Yes, as with any financial product, there are risks and considerations. The investment component is subject to market fluctuations, and the performance of the investment account can vary. If the investment underperforms, it may impact the overall value of the policy. Additionally, policyholders should be aware of the fees and charges associated with the life insurance policy, investment options, and any potential surrender charges if the policy is terminated early. It is essential to carefully review the product details, understand the investment risks, and consider seeking professional advice to ensure the chosen product aligns with one's financial goals and risk tolerance.