Top-up in life insurance refers to the additional coverage or premium amount that policyholders can pay to increase their insurance coverage beyond the initial policy limits. It is a strategy used by individuals to ensure they have adequate financial protection for their loved ones in the event of unforeseen circumstances. By opting for a top-up, policyholders can customize their insurance plans to meet their specific needs and provide a safety net for their families, covering potential expenses such as mortgage payments, education costs, or other long-term financial commitments. This feature allows for flexibility and ensures that the insurance policy remains relevant and beneficial throughout different life stages.

What You'll Learn

- Definition: Top-up insurance is an additional policy to increase coverage

- Purpose: It provides extra financial protection for specific risks

- Benefits: Offers increased coverage without changing the main policy

- Types: Common types include critical illness and income protection

- Considerations: Evaluate needs, budget, and policy terms before choosing

Definition: Top-up insurance is an additional policy to increase coverage

Top-up insurance, often referred to as a 'top-up' or 'additional coverage' policy, is a strategic financial tool designed to enhance an individual's existing life insurance policy. It serves the purpose of increasing the overall coverage amount, providing an extra layer of financial protection for the insured individual and their beneficiaries. This type of insurance is particularly useful for those who feel their current life insurance policy may not adequately cover their financial needs or who wish to adapt their coverage as their life circumstances change.

The primary function of a top-up policy is to complement and extend the benefits of a primary life insurance policy. When an individual purchases a standard life insurance policy, it typically provides a specific amount of coverage, which may not be sufficient to cover all potential financial risks and obligations. Top-up insurance steps in to bridge this gap, ensuring that the insured individual's loved ones are financially protected in the event of their passing. For example, if someone has a primary policy with a coverage amount of $500,000 and feels this is insufficient, they might consider a top-up policy to increase this amount.

This additional policy can be tailored to the specific needs of the individual. It allows policyholders to customize the coverage amount, often with the flexibility to choose higher coverage levels. This customization is a key advantage, as it enables individuals to ensure their loved ones are adequately protected, even as their financial responsibilities and goals evolve over time. Top-up insurance is particularly beneficial for those with substantial financial obligations, such as mortgage payments, business ventures, or large families, as it provides an extra safety net.

In essence, top-up insurance is a strategic addition to an existing life insurance policy, offering increased financial security. It empowers individuals to take control of their financial future and provide comprehensive protection for their loved ones. By understanding the concept of top-up insurance, individuals can make informed decisions about their insurance needs and ensure their financial well-being is adequately addressed.

Accidental Death Insurance: A Term Life Alternative?

You may want to see also

Purpose: It provides extra financial protection for specific risks

Top-up insurance, also known as additional or supplementary insurance, serves a specific purpose in the realm of life insurance. It is a strategic financial tool designed to enhance an individual's existing life insurance coverage. The primary objective of a top-up is to provide an extra layer of financial protection against specific risks that may not be adequately covered by the primary insurance policy. This additional coverage is particularly crucial for individuals who want to ensure their loved ones are financially secure in the event of unforeseen circumstances.

The concept of top-up insurance is straightforward: it allows policyholders to increase their insurance coverage beyond the initial amount provided by their primary life insurance policy. This additional coverage can be tailored to address specific concerns, such as providing for children's education, covering mortgage payments, or ensuring a comfortable retirement for a spouse. By doing so, top-up insurance offers a sense of reassurance, knowing that even if the primary insurance policy's coverage is sufficient, there is an additional safety net in place.

One of the key advantages of top-up insurance is its flexibility. Policyholders can customize the coverage to align with their unique needs and financial goals. For instance, a parent might opt for a top-up policy to cover the cost of their child's university education, ensuring that the financial burden is shared even if the primary insurance policy's death benefit is substantial. Similarly, a homeowner with a substantial mortgage might choose to top up their policy to cover the remaining balance, providing peace of mind that their family's financial obligations will be met in the event of their passing.

When considering top-up insurance, it is essential to evaluate the specific risks one wants to mitigate. This may include risks associated with business ownership, such as key-person insurance, which ensures the continuity of a business in the event of the death or disability of a critical employee. Additionally, individuals with high-risk careers or hobbies might want to consider top-up policies to address these unique risks. The purpose is to create a comprehensive financial protection plan that leaves no stone unturned.

In summary, top-up insurance is a valuable addition to any life insurance policy, offering an extra layer of financial security. It empowers individuals to take control of their financial future and provide for their loved ones in specific, often critical, situations. By understanding the purpose and benefits of top-up insurance, individuals can make informed decisions to ensure their financial well-being and the protection of their families.

Life Insurance: A Farm Expense?

You may want to see also

Benefits: Offers increased coverage without changing the main policy

Top-up insurance, also known as additional coverage or rider insurance, is a valuable feature offered by many life insurance companies. It provides an excellent way to enhance your existing life insurance policy without the need for a complete overhaul. This feature allows policyholders to increase their insurance coverage without the hassle and potential delays associated with applying for a new policy.

One of the primary benefits of top-up insurance is the ability to boost your coverage amount. Life insurance policies often have a set limit, and over time, this coverage might become insufficient to meet your evolving needs. With a top-up option, you can add extra coverage to your policy, ensuring that your loved ones are financially protected in the event of your passing. This is particularly useful for individuals who have experienced significant life changes, such as starting a family, purchasing a home, or achieving financial milestones. By topping up your policy, you can create a safety net that adapts to your changing circumstances.

The process of increasing coverage through top-up insurance is straightforward. Policyholders can typically choose the amount they wish to add, ensuring that it complements their existing policy. This flexibility allows individuals to make adjustments as their financial situation and requirements evolve. Moreover, since the top-up is an add-on to the main policy, the underwriting process is often faster and less complex compared to applying for a new policy from scratch. This efficiency is a significant advantage, especially when immediate coverage is required.

Another advantage is the potential cost savings. Instead of purchasing a new, higher-coverage policy, which might be more expensive, top-up insurance provides a more affordable way to increase protection. This is because the additional coverage is calculated based on the existing policy's terms and conditions, often at a lower premium rate. As a result, policyholders can enjoy increased peace of mind without a substantial financial burden.

In summary, top-up insurance offers a convenient and cost-effective solution for individuals seeking to enhance their life insurance coverage. It provides a seamless way to adapt to changing life events while ensuring that your loved ones are adequately protected. By understanding the benefits of top-up insurance, policyholders can make informed decisions about their insurance needs and maintain a comprehensive safety net throughout their lives.

Life Insurance: Millions of Americans Are Underinsured

You may want to see also

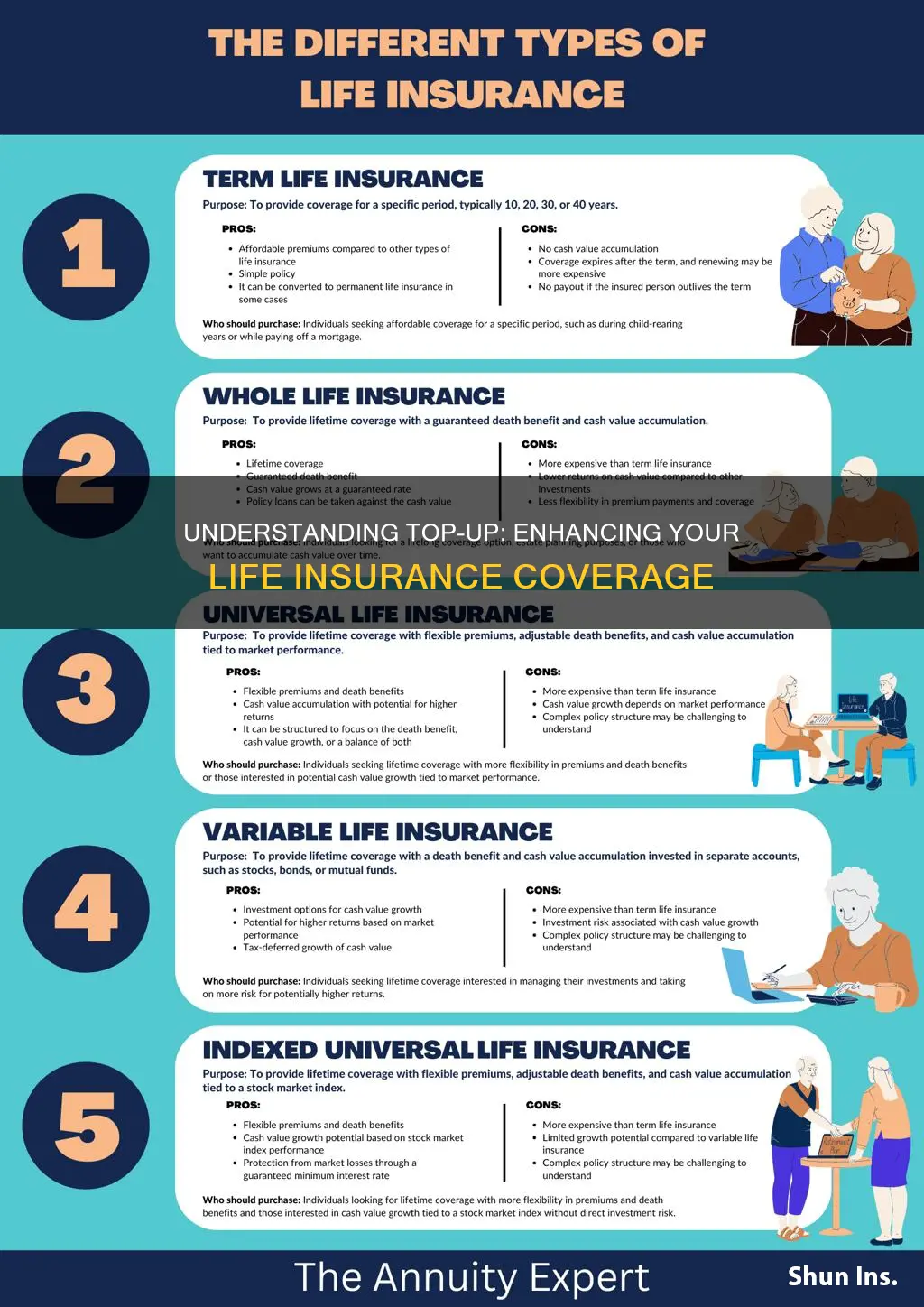

Types: Common types include critical illness and income protection

Top-up insurance, also known as additional or supplementary insurance, is a financial product designed to enhance an existing insurance policy. It provides an extra layer of protection and coverage, ensuring that an individual's financial security is comprehensive and tailored to their specific needs. This type of insurance is particularly useful for those who want to ensure they are adequately covered for potential risks and unforeseen circumstances.

One of the most common types of top-up insurance is critical illness insurance. This policy provides financial support if the insured individual is diagnosed with a critical or serious illness, such as cancer, heart attack, or stroke. It offers a lump sum payment or regular income to cover medical expenses, living costs, and other financial obligations during the recovery period. Critical illness insurance can be a valuable addition to one's insurance portfolio, especially for those with a family history of serious illnesses or individuals in high-risk professions.

Another essential type is income protection insurance, which is designed to replace a portion of the insured's income if they become unable to work due to illness or injury. This policy ensures that individuals can maintain their financial stability and cover their living expenses, mortgage or rent payments, and other regular outgoings. Income protection insurance is particularly crucial for those who rely on a steady income to support themselves and their families. It provides a safety net, allowing individuals to focus on their recovery and return to work without the added stress of financial strain.

These two types of top-up insurance, critical illness and income protection, are often sought after by individuals who want to ensure their financial well-being and peace of mind. By adding these policies to an existing life insurance plan, individuals can create a comprehensive safety net, addressing potential risks and providing financial security for themselves and their loved ones. It is a strategic approach to insurance, allowing people to customize their coverage and protect against various life events.

Battling for My Mother's Life Insurance: A Fight for Justice

You may want to see also

Considerations: Evaluate needs, budget, and policy terms before choosing

When considering life insurance, it's crucial to evaluate your specific needs, financial situation, and the terms of the policy to make an informed decision. One important aspect to consider is the concept of a "top-up" in life insurance. A top-up refers to the process of increasing the coverage amount of an existing life insurance policy to meet evolving financial goals or obligations. This can be particularly useful when your life circumstances change, such as starting a family, purchasing a home, or experiencing a significant increase in income.

To begin, assess your current and future financial obligations. Consider your family's short-term and long-term needs, including expenses for living, education, and any specific goals you may have. For instance, if you have young children, you might want to ensure sufficient coverage to provide for their upbringing and education. Similarly, if you're planning to purchase a property, a top-up in your policy can help cover the potential mortgage payments and associated costs. By evaluating these needs, you can determine the additional coverage required to safeguard your loved ones' financial well-being.

Budgeting is another critical factor. Life insurance premiums can vary depending on several factors, including age, health, lifestyle, and the desired coverage amount. It's essential to create a realistic budget that accounts for the current and anticipated costs of your insurance policy. When considering a top-up, ensure that the increased premium fits within your financial plan without compromising other essential expenses. Striking a balance between adequate coverage and financial affordability is key to making a sustainable choice.

Policy terms and conditions also play a significant role in the decision-making process. Review the terms of your existing life insurance policy to understand the process of top-up. Some insurance providers may offer straightforward options to increase coverage, while others might require a comprehensive review of your application. Additionally, consider the waiting periods and any potential health assessments that may be required before the top-up takes effect. Understanding these terms will help you make a timely and efficient decision.

In summary, evaluating your needs, budget, and policy terms is essential when considering a top-up in life insurance. By assessing your financial obligations and goals, you can determine the necessary coverage increase. Budgeting ensures that the additional premium is manageable, and understanding policy terms streamlines the process. Taking these considerations into account will enable you to make a well-informed decision, providing peace of mind and financial security for yourself and your loved ones.

Life Insurance Payouts: Insolvent Estate's Impact

You may want to see also

Frequently asked questions

A top-up is an additional amount of coverage that can be added to an existing life insurance policy. It allows policyholders to increase their insurance sum assured without having to go through the entire underwriting process again. Top-ups are often used to meet specific financial goals or to cover any gaps in coverage that may have arisen over time.

When you opt for a top-up, the insurance company will typically review your current policy and health status. They may conduct a simplified underwriting process, which is less rigorous than the initial one, to determine the additional coverage amount. The premium for the top-up will be calculated based on your new sum assured and the terms of the policy.

Top-ups offer several advantages. Firstly, they provide an efficient way to increase coverage without extensive medical exams. Secondly, it ensures that your insurance policy keeps pace with your changing financial needs and life goals. Additionally, top-ups can be a cost-effective way to secure additional protection, especially if you have outgrown your initial policy limits.