Military spouses and dependent children of service members covered under full-time Servicemembers' Group Life Insurance (SGLI) are eligible for Family Servicemembers' Group Life Insurance (FSGLI). This benefit provides up to a maximum of $100,000 of coverage for a spouse, not exceeding the service member's SGLI coverage, and $10,000 for each dependent child. Civilian spouses of service members with full-time SGLI are automatically covered under FSGLI, while military spouses married on or after January 2, 2013, need to be enrolled by the service member through the SGLI Online Enrollment System. While dependent children are automatically covered for free, spouses have the option to convert spousal FSGLI coverage to a permanent, individual insurance policy within 120 days of the service member's separation from the military or written election to end spousal or SGLI coverage.

| Characteristics | Values |

|---|---|

| Coverage for spouse | Up to $100,000 |

| Coverage for each dependent child | $10,000 |

| Eligibility | Spouse or dependent child of a service member on active duty or a member of the National Guard or Ready Reserve covered by full-time SGLI |

| Premium payment method | Automatically deducted from the service member's pay |

| Spouse enrollment method | Online through the SGLI Online Enrollment System (SOES) |

| Spouse enrollment date | Married on or after January 2, 2013 |

| Coverage extension for dependent child | If the child is a full-time student between 18 and 22 years old or becomes permanently and totally disabled before turning 18 |

| Spousal coverage conversion to an individual insurance policy | Within 120 days from the date of the service member's separation from the military, written election to end spousal or SGLI coverage, or proof of death |

What You'll Learn

- Civilian spouses are automatically insured under FSGLI

- Military spouses married on/after Jan. 2, 2013 are not automatically covered

- Spouses can convert spousal FSGLI coverage to an individual insurance policy

- Dependent children are automatically covered for free until the age of 18

- Service members can make changes to their spouse's coverage

Civilian spouses are automatically insured under FSGLI

Civilian spouses of service members are automatically insured under the Family Servicemembers' Group Life Insurance (FSGLI) if their spouse is signed up for full-time Servicemembers' Group Life Insurance (SGLI). FSGLI provides up to a maximum of $100,000 of coverage for a spouse, not exceeding the service member's SGLI coverage, and $10,000 for each dependent child. The premium for the coverage is automatically deducted from the service member's pay.

It is important to note that military spouses married on or after January 2, 2013, are not automatically covered under FSGLI. In such cases, service members need to proactively enrol their spouses through the SGLI Online Enrollment System via milConnect.

While FSGLI provides some financial protection for civilian spouses, the coverage amount of $100,000 may be inadequate for many families. As a result, it is often recommended to consider additional individual life insurance policies to supplement the FSGLI coverage. This is especially important for young families with concerns such as child care and income replacement.

Life insurance is a crucial aspect of financial planning, and military families should carefully assess their needs and consider additional coverage to ensure adequate protection in the event of a spouse's death. The Navy Mutual Aid Association offers a Life Insurance Calculator to help families estimate their life insurance requirements.

Life Insurance and Divorce: Who Gets the Payout?

You may want to see also

Military spouses married on/after Jan. 2, 2013 are not automatically covered

Military spouses married on or after January 2, 2013, are not automatically covered by Family Servicemembers' Group Life Insurance (FSGLI). This is different from civilian spouses of service members, who are automatically insured under FSGLI.

If you are a military spouse married on or after this date, your service member will need to enrol you through the Servicemembers' Group Life Insurance (SGLI) Online Enrollment System. This can be done by accessing the SGLI Online Enrollment System (SOES) and signing up through Benefits, Life Insurance SOES- SGLI Online Enrollment System.

Your service member can log in with their CAC or DS Logon as soon as they receive notice that they can start using SOES. It is important to note that the service member will be responsible for paying the premium for your coverage, and this amount will increase as you age.

Additionally, if you have spousal coverage and want to reduce, decline, or cancel it, your service member can submit these changes online through the SGLI Online Enrollment System (SOES). This can be accessed in the same way as described above.

It is also worth noting that dependent children of service members are automatically covered under FSGLI and this coverage cannot be turned down, reduced, or cancelled.

Logging into Protective Life Insurance: A Step-by-Step Guide

You may want to see also

Spouses can convert spousal FSGLI coverage to an individual insurance policy

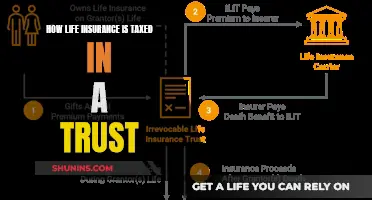

Spouses who are insured under the Family Servicemembers’ Group Life Insurance (FSGLI) program have the option to convert their spousal coverage to an individual insurance policy within 120 days of certain life events. These events include the servicemember's separation from the military, divorce from their spouse, election to terminate spousal SGLI coverage, or the servicemember's death. It is important to note that if any of these events occur, FSGLI coverage will terminate on the 121st day following the event.

Spouses may convert their coverage to a commercial policy at standard premium rates without having to provide proof of good health. The conversion policy must be a permanent policy, such as a whole life insurance policy. Other types of policies, such as term, variable, or universal life insurance, are not allowed as conversion policies. Additionally, supplementary policy benefits, such as accidental death and dismemberment or waiver of premium for disability, are not considered part of the conversion policy.

If a spouse wishes to convert their spousal SGLI coverage, they must take several steps within 120 days of one of the aforementioned events. Firstly, they must select a company from the list of participating companies, which includes American Fidelity Life Insurance Company, Bankers Life and Casualty Company, EMC National Life Company, and more. Secondly, they must apply to the local sales office of the chosen company. Lastly, they must provide the agent with a copy of the most recent Leave and Earnings Statement, showing the deduction for spousal SGLI, along with applicable proof of coverage. This proof of coverage can include the servicemember's separation document, the Certificate of Dissolution of Marriage, the servicemember's FSGLI spousal declination, or other relevant documents.

By converting spousal FSGLI coverage to an individual insurance policy, spouses can ensure continued financial protection and peace of mind during life's transitions.

Faking Death: Insurance Fraud and its Complexities

You may want to see also

Dependent children are automatically covered for free until the age of 18

Family Servicemembers' Group Life Insurance (FSGLI) offers coverage for the spouse and dependent children of service members covered under full-time Servicemembers' Group Life Insurance (SGLI). Dependent children are automatically covered for free until the age of 18. This coverage cannot be turned down, reduced, or cancelled.

The coverage includes $10,000 for each dependent child and is applicable if the service member is on active duty and covered by full-time SGLI or is a member of the National Guard or Ready Reserve covered by full-time SGLI.

If the child meets certain requirements, the coverage can be extended beyond the age of 18. For instance, if the child is a full-time student between the ages of 18 and 22, or if they become permanently and totally disabled before turning 18 and are unable to support themselves, coverage may be extended. In some cases, this extension may be indefinite.

It is important to note that military spouses married on or after January 2, 2013, are not automatically covered under FSGLI. Service members must enrol their spouses through the SGLI Online Enrollment System (SOES) on milConnect. Additionally, the premium for spousal coverage is deducted from the service member's pay and increases as the spouse ages.

Whole Life Insurance: What's the Real Deal?

You may want to see also

Service members can make changes to their spouse's coverage

Military spouses can be covered under Family Servicemembers' Group Life Insurance (FSGLI), which offers coverage for the spouse and dependent children of service members covered under full-time SGLI. This benefit provides up to a maximum of $100,000 of coverage for a spouse, not exceeding the service member's SGLI coverage, and $10,000 for each dependent child. Dependent children get free coverage. Civilian spouses of service members signed up for full-time SGLI are covered under FSGLI automatically, with the premium automatically deducted from the service member's pay.

Military spouses married on or after January 2, 2013, are not automatically covered and must be enrolled by the service member through the SGLI Online Enrollment System (SOES). To access SOES, the service member must go to Benefits, Life Insurance SOES- SGLI Online Enrollment System to sign up and update coverage and beneficiary information. The service member can log in with their CAC or DS Logon as soon as they receive notice that they can start using SOES.

Making Changes to Spousal Coverage

Service members can make changes to their spouses' coverage by submitting their requests online through the SGLI Online Enrollment System (SOES). If a spouse has spousal coverage and wants to reduce, turn down, or cancel it, they can do so through SOES. The service member can access SOES by going to Benefits, Life Insurance SOES- SGLI Online Enrollment System and updating the coverage and beneficiary information.

It is important to note that dependent children are automatically covered under FSGLI, and this coverage cannot be turned down, reduced, or canceled. Service members can, however, extend coverage for their dependent children in certain cases. If the child is a full-time student between the ages of 18 and 22, or becomes permanently and totally disabled before turning 18 and is unable to support themselves, coverage may be extended, in some cases indefinitely.

Life Insurance Proceeds: Oregon's Tax Laws Explained

You may want to see also

Frequently asked questions

FSGLI is a form of insurance coverage for the spouse and dependent children of service members covered under full-time Servicemembers' Group Life Insurance (SGLI).

A surviving spouse can get up to a maximum of $100,000 in coverage, not exceeding the service member's SGLI coverage.

Yes, the service member must be on active duty and covered by full-time SGLI, or they must be a member of the National Guard or Ready Reserve covered by full-time SGLI.

Yes, dependent children are also covered under FSGLI and receive up to $10,000 in coverage. This coverage is provided at no cost until the child is 18 years old and can be extended in certain cases.

Civilian spouses of service members with full-time SGLI are automatically covered under FSGLI. Military spouses married on or after January 2, 2013, need to be enrolled by the service member through the SGLI Online Enrollment System.