Life insurance risk refers to the potential for financial loss or uncertainty that arises from the death or illness of an individual covered by a life insurance policy. It is a critical aspect of the insurance industry, as it directly impacts the financial well-being of policyholders and their beneficiaries. Understanding and managing these risks are essential for insurance companies to ensure the stability and profitability of their life insurance products. This paragraph sets the stage for a deeper exploration of the various factors that contribute to life insurance risk and the strategies employed to mitigate it.

What You'll Learn

- Health and Lifestyle: Risks tied to health, lifestyle choices, and age

- Financial Status: Income, assets, and debt impact insurance

- Occupational Hazards: Certain jobs pose higher risks due to nature

- Accidents and Injuries: Physical harm leading to claims

- Natural Disasters: Weather events and geological risks

Health and Lifestyle: Risks tied to health, lifestyle choices, and age

Life insurance is a financial product designed to provide financial protection and peace of mind to individuals and their families. When considering life insurance, understanding the various risks associated with health, lifestyle choices, and age is crucial. These factors significantly influence the assessment of risk by insurance companies, which, in turn, determines the cost and availability of life insurance coverage.

Health Risks:

Individuals with pre-existing health conditions or chronic illnesses may face higher life insurance premiums or even be deemed uninsurable. Conditions such as heart disease, diabetes, cancer, and severe mental health disorders can significantly impact life expectancy and the likelihood of developing severe health issues. Insurance companies often require medical examinations or health questionnaires to assess the risk associated with insuring an individual. The severity and management of these health conditions play a vital role in determining the terms of coverage. For instance, a person with well-controlled diabetes may be offered different premium rates compared to someone with uncontrolled diabetes.

Lifestyle Choices:

Lifestyle factors can significantly impact life insurance risks. Smoking, excessive alcohol consumption, drug use, and unhealthy dietary habits can all contribute to an increased risk of various health issues, including cardiovascular disease, cancer, and respiratory problems. Insurance companies often consider these behaviors when evaluating risk. Smokers, for example, may face higher premiums due to the increased risk of smoking-related illnesses. Similarly, individuals with a sedentary lifestyle or those who engage in extreme sports may also be considered higher-risk cases.

Age:

Age is a critical factor in life insurance risk assessment. Generally, younger individuals are considered lower-risk candidates for life insurance. As people age, the risk of developing health issues increases, and life expectancy tends to decrease. Insurance companies often offer more competitive rates to younger individuals as they are statistically less likely to require early payouts. However, as one gets older, the risk assessment becomes more complex. Older adults may face higher premiums or limited coverage options due to the increased likelihood of health complications.

Additionally, age-related risks can vary based on gender. For instance, women tend to have longer life expectancies than men, which can influence the pricing of life insurance policies. It's important to note that age is just one factor in risk assessment, and insurance companies consider a comprehensive set of health and lifestyle factors to determine the most appropriate coverage.

Understanding these health, lifestyle, and age-related risks is essential for individuals seeking life insurance. It empowers them to make informed decisions, choose suitable coverage, and potentially secure more favorable terms. By being aware of these risks, individuals can also take proactive steps to improve their health and lifestyle, which may lead to better insurance rates and overall financial security.

Term Life Insurance: 20-Year Policy Explained

You may want to see also

Financial Status: Income, assets, and debt impact insurance

Life insurance is a financial tool that provides a safety net for individuals and their families, but it also comes with certain risks, especially when considering one's financial status. Understanding how income, assets, and debt can impact insurance is crucial for making informed decisions.

Income: The level of income an individual earns plays a significant role in determining insurance coverage. Higher income often translates to higher insurance premiums. Insurance companies assess the financial stability and risk profile of an individual based on their income. For instance, a person with a stable, high-income job may be offered more comprehensive coverage at a competitive rate. Conversely, those with lower incomes might face challenges in obtaining extensive insurance policies, as they may be considered higher-risk. Additionally, income stability is essential; a consistent income stream ensures that premium payments can be made regularly, reducing the risk of policy lapse.

Assets: The value of one's assets can influence the type and cost of life insurance. Assets, such as property, investments, or savings, can be used to secure a loan or as collateral for a policy. When an individual has substantial assets, insurance companies may offer more favorable terms, including lower premiums and higher coverage amounts. This is because the presence of assets indicates a level of financial security and the ability to manage potential financial losses. However, it's important to note that the insurance company will also consider the liquidity of these assets to ensure they can be accessed quickly if needed.

Debt: Debt can significantly impact the decision to purchase life insurance and the overall financial risk assessment. Individuals with substantial debt may face challenges in obtaining insurance or may need to pay higher premiums. This is because debt can reduce financial flexibility and increase the risk of default. When applying for life insurance, insurers will consider the amount and nature of an individual's debt. A person with significant debt obligations might be required to provide additional financial information or may need to secure the policy with a larger down payment. Managing debt effectively is essential to ensure that life insurance remains an affordable and viable option.

In summary, an individual's financial status, including income, assets, and debt, is a critical factor in the life insurance risk assessment process. Income determines the affordability and extent of coverage, while assets and debt influence the terms and cost of insurance. Understanding these relationships can help individuals make informed choices when selecting and managing their life insurance policies, ensuring they have adequate protection without incurring unnecessary financial burdens.

Unlocking Life Insurance: Withdrawing Money from Your Policy

You may want to see also

Occupational Hazards: Certain jobs pose higher risks due to nature

Occupational hazards are an essential consideration when evaluating life insurance risks, as certain jobs expose individuals to unique and often severe dangers. These risks can significantly impact an individual's life expectancy and overall health, making it crucial for insurance providers to understand the potential challenges associated with specific occupations.

One of the most prominent examples of occupational hazards is the presence of hazardous materials and substances. Jobs in industries such as construction, mining, and chemical manufacturing often involve exposure to toxic chemicals, heavy metals, and other harmful substances. For instance, construction workers may encounter lead-based paints, while miners might be exposed to silica dust. These materials can have long-term health consequences, including respiratory issues, organ damage, and increased cancer risks. As a result, individuals in these professions may require more comprehensive life insurance coverage to account for the heightened likelihood of health complications.

Physical demands and workplace injuries are another set of occupational hazards. Occupations like construction, manufacturing, and emergency services often require strenuous physical activity, which can lead to chronic injuries and health issues. For example, construction workers may experience repetitive strain injuries from constant lifting and manual labor, while emergency responders might face the risk of musculoskeletal damage due to the physical nature of their duties. These injuries can result in long-term disabilities, affecting an individual's ability to work and earn an income.

Outdoor occupations, such as forestry, fishing, and agriculture, also present unique risks. Workers in these fields are often exposed to extreme weather conditions, including harsh temperatures, heavy rainfall, and strong winds. They may also face the dangers of machinery, livestock, and wildlife. For instance, farmers might encounter the risk of tractor rollovers or livestock-related accidents, while forestry workers could be exposed to falling trees or hazardous terrain. These occupations require specialized training and equipment to mitigate risks, and individuals in these lines of work may need tailored life insurance policies to address the increased potential for accidents and health issues.

Furthermore, jobs in high-risk environments, such as aviation, firefighting, and law enforcement, demand exceptional physical and mental fitness. These professions expose individuals to extreme physical exertion, dangerous situations, and the constant stress of high-pressure scenarios. For example, firefighters battle intense blazes, while police officers may encounter violent incidents. The physical and mental toll of these jobs can lead to accelerated aging and increased health risks, making it crucial for insurance providers to consider the unique challenges faced by these professionals.

In summary, understanding the nature of certain occupations is vital in assessing life insurance risks. Occupational hazards, including exposure to hazardous materials, physical demands, outdoor dangers, and high-risk environments, can significantly impact an individual's health and longevity. By recognizing these risks, insurance companies can offer appropriate coverage, ensuring that individuals in these professions receive the necessary protection and support for their well-being.

Term-Life Insurance: Facts and Fiction

You may want to see also

Accidents and Injuries: Physical harm leading to claims

Accidents and injuries are a significant aspect of life insurance risk, as they can lead to substantial financial claims for insurance companies. When an individual purchases life insurance, they are essentially agreeing to transfer a portion of their financial risk to the insurance provider in exchange for a regular premium payment. This risk assessment is crucial, especially when considering the potential consequences of accidents and injuries.

Physical harm resulting from accidents can have severe implications for life insurance policies. For instance, a policyholder might suffer a critical injury, such as a spinal cord injury or a traumatic brain injury, which could lead to long-term disability or even death. In such cases, the insurance company is obligated to pay out the policy's death benefit or the agreed-upon amount to the policyholder's beneficiaries. The severity and impact of these injuries can vary widely, and the insurance provider must carefully evaluate the potential risks and financial liabilities associated with each claim.

In addition to the immediate impact, accidents and injuries can also have long-term effects on an individual's life. For example, a severe injury might require extensive medical treatment, rehabilitation, and ongoing care, which can be financially burdensome. The insurance company may need to consider the potential for future medical expenses, lost income, and the overall impact on the policyholder's quality of life when assessing the risk and determining the claim amount.

It is essential for insurance companies to have robust risk assessment models and processes to evaluate the likelihood and severity of accidents and injuries. This includes analyzing statistical data, considering the policyholder's lifestyle and occupation, and assessing their overall health and well-being. By doing so, insurers can make informed decisions about premium pricing and policy terms, ensuring that they can adequately cover potential claims.

Furthermore, insurance providers often offer various policy options and riders to address specific risks associated with accidents and injuries. For instance, critical illness insurance or disability insurance can provide additional financial protection in the event of a severe accident or injury. These riders allow policyholders to customize their coverage, ensuring that they have the necessary financial support during challenging times. Understanding and effectively managing the risks associated with accidents and injuries is vital for both insurance companies and policyholders, as it directly impacts the financial security and well-being of individuals and their loved ones.

Life Insurance: Who Gets the Top Ratings?

You may want to see also

Natural Disasters: Weather events and geological risks

Natural disasters, including weather events and geological risks, present significant challenges to life insurance companies and policyholders alike. These events can lead to substantial financial losses and, in some cases, even loss of life, making risk assessment and management a critical aspect of the insurance industry. Weather-related disasters, such as hurricanes, floods, and wildfires, can cause widespread damage to property and infrastructure, while geological disasters like earthquakes, volcanic eruptions, and tsunamis can have devastating effects on entire communities.

Weather events are becoming increasingly unpredictable and severe due to climate change. Hurricanes, for instance, have grown stronger and more frequent in recent years, leading to catastrophic consequences for coastal regions. Floods, too, are a common occurrence in many parts of the world, often resulting from heavy rainfall, storm surges, or the rapid melting of snow. These events can displace populations, destroy homes, and disrupt essential services, all of which can significantly impact life insurance claims.

Geological risks, on the other hand, are often associated with specific geographic areas. Earthquakes, for example, are a major concern in regions like California, Japan, and New Zealand, where tectonic plate boundaries are active. Volcanic eruptions can also cause significant damage and loss of life, particularly in areas like Indonesia, the Philippines, and the Pacific Northwest of the United States. These geological events can lead to property damage, business interruptions, and even the loss of entire communities, making them high-risk areas for life insurance companies.

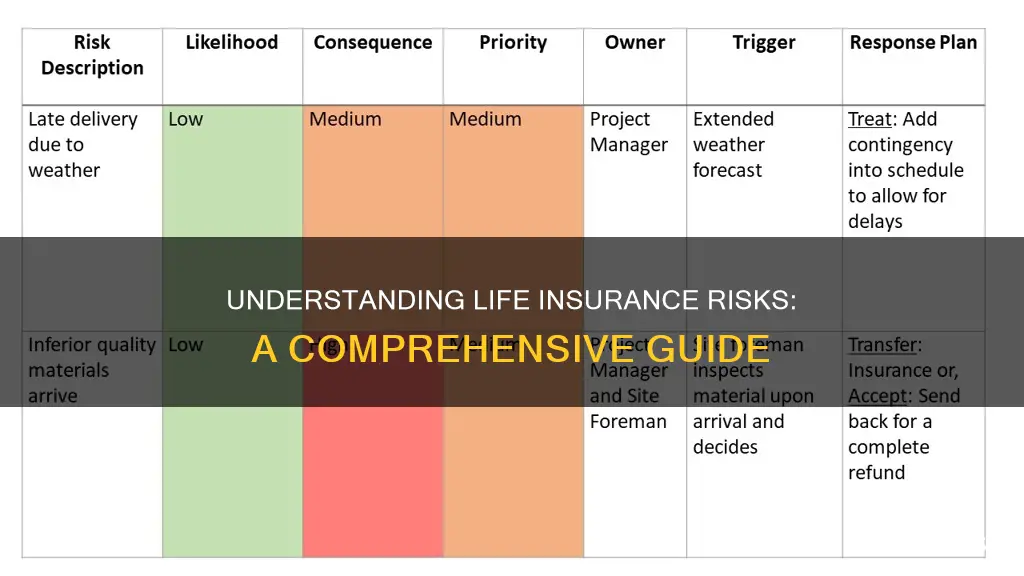

Assessing and managing these risks is a complex task for insurance providers. They must consider historical data, current weather patterns, and geological activity to predict the likelihood and potential impact of natural disasters. This involves analyzing trends, understanding local conditions, and employing advanced modeling techniques to estimate the risk of various weather and geological events. By doing so, insurance companies can set appropriate premiums and provide coverage that adequately protects policyholders.

In addition to risk assessment, insurance companies also focus on mitigation strategies. This includes providing policyholders with resources to prepare for and respond to natural disasters, such as emergency kits, evacuation plans, and insurance awareness programs. Furthermore, insurers may offer incentives for policyholders to implement risk-reducing measures, such as installing earthquake-resistant structures or purchasing flood insurance. Effective risk management and communication can help reduce the overall impact of natural disasters on both the insurance industry and the communities it serves.

Dying with Dignity: Impact on Life Insurance Policies

You may want to see also

Frequently asked questions

The main risk in life insurance is the possibility of the insured individual's death or a critical illness before the policy's maturity, which could lead to financial loss for the policyholder or beneficiaries. This risk is mitigated by the insurance company's assessment of the insured's health and lifestyle, which determines the premium and coverage amount.

Life insurance risk is unique because it is based on the uncertainty of an individual's lifespan. Unlike property or liability insurance, where the risk is tied to specific assets or potential losses, life insurance risk is about the likelihood of an event (death) that may or may not occur. This makes it a complex assessment, requiring detailed health and lifestyle information.

Several factors are considered when evaluating life insurance risk, including age, gender, medical history, family medical history, lifestyle choices (such as smoking, alcohol consumption, and physical activity), occupation, and overall health. These factors help insurers determine the likelihood of the insured individual developing health issues or dying prematurely.

Managing life insurance risk involves adopting a healthy lifestyle, maintaining regular medical check-ups, and being transparent about any pre-existing health conditions. For non-smokers, regular exercise, a balanced diet, and avoiding harmful habits can significantly reduce risk. Additionally, choosing a suitable coverage amount and term length can also help manage the associated risks.