Limited lines self-service storage insurance producers are a specialized type of insurance agent or broker who focuses on providing self-storage facility owners and operators with insurance solutions tailored to their unique needs. These producers offer a range of insurance products, including property, liability, and business interruption coverage, specifically designed for the self-storage industry. They cater to the self-storage facility owner's requirement for efficient, self-service options, allowing them to manage their insurance needs independently. This approach streamlines the insurance process, providing a convenient and cost-effective solution for those in the self-storage business.

| Characteristics | Values |

|---|---|

| Definition | Limited lines self-service storage insurance producers are insurance companies that offer storage insurance solutions through a limited number of distribution channels, often with a focus on self-service options for policyholders. |

| Distribution Channels | Online platforms, mobile apps, direct-to-consumer websites, and automated phone systems. |

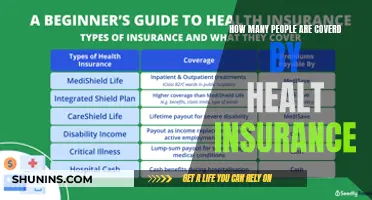

| Policy Types | Typically, these producers offer insurance for personal belongings stored in self-storage units, with options for coverage against theft, damage, and other specified risks. |

| Target Market | Individuals and small businesses who require storage insurance for their personal or business items. |

| Advantages | Quick and easy policy purchase, lower costs due to reduced overhead, and convenient self-service options for policyholders. |

| Challenges | Limited customer interaction may lead to reduced policy customization and potential complexity in handling complex claims. |

| Regulatory Considerations | Adherence to insurance regulations, including licensing, consumer protection laws, and compliance with industry standards. |

| Technology Integration | Utilization of technology for policy management, claims processing, and customer support, ensuring a seamless self-service experience. |

| Market Trends | Growing demand for convenient and affordable insurance solutions, especially in the self-storage industry, drives the market for limited lines self-service storage insurance producers. |

What You'll Learn

- Limited Lines Producers: Only authorized to sell specific types of insurance, like homeowners or auto

- Self-Service Storage: Customers manage their storage units online or through automated kiosks

- Limited Lines Self-Service: Producers offer simplified insurance options, often with online quote and purchase

- Storage Insurance: Covers stored items against theft, damage, and natural disasters

- Producers' Role: Facilitate insurance transactions, provide quotes, and assist with claims for covered losses

Limited Lines Producers: Only authorized to sell specific types of insurance, like homeowners or auto

Limited lines producers, also known as appointed producers or appointed agents, are insurance professionals who are authorized to sell specific types of insurance products. These individuals are typically employed by insurance companies or brokers and are granted the right to offer and sell certain insurance policies on their behalf. The term "limited lines" refers to the restricted scope of their authority and the specific lines of insurance they are permitted to sell.

In the context of self-service storage insurance, limited lines producers often specialize in selling homeowners' insurance and auto insurance. These producers are not licensed to offer a full range of insurance products, which means they can only provide and sell policies within their designated areas of expertise. For instance, a limited lines producer might be authorized to sell homeowners' insurance, covering property damage, liability, and other relevant aspects of homeownership. Similarly, they may be permitted to offer auto insurance, including coverage for vehicle damage, liability, and medical expenses related to car accidents.

The role of these producers is crucial in the insurance industry as they act as intermediaries between insurance companies and policyholders. They understand the specific needs and requirements of their target market and can provide tailored insurance solutions. Limited lines producers often have a deep understanding of the policies they sell, allowing them to explain the coverage, exclusions, and benefits to potential customers effectively. This specialized knowledge enables them to assist clients in making informed decisions about their insurance needs.

When dealing with limited lines producers, customers can expect a more focused and personalized experience. These producers typically have a strong understanding of the insurance products they offer and can provide expert advice. They can help clients assess their risks, choose appropriate coverage, and ensure that their insurance needs are met. However, it is essential for consumers to verify the credentials and authority of these producers to ensure they are dealing with legitimate and authorized representatives.

Limited lines producers play a vital role in the insurance industry by providing specialized knowledge and expertise in specific lines of insurance. Their ability to offer tailored solutions and guide customers through the insurance process makes them valuable resources for individuals seeking insurance coverage for their homes or vehicles. Understanding the scope of their authority is essential for both producers and consumers to ensure a smooth and successful insurance experience.

Unraveling the Mystery: What EAC Insurance Services Offer

You may want to see also

Self-Service Storage: Customers manage their storage units online or through automated kiosks

Self-service storage facilities have revolutionized the way customers access and manage their storage units, offering a convenient and efficient alternative to traditional storage providers. This innovative approach empowers customers to take control of their storage needs, eliminating the need for constant physical presence and providing a seamless experience.

At the heart of this system is the utilization of online platforms and automated kiosks. Customers can now access their storage units from the comfort of their homes or offices, saving time and effort. The process begins with a simple online registration, where customers provide their details and choose a secure login. Once registered, they gain access to a personalized online dashboard, a one-stop shop for all their storage management needs. From this dashboard, customers can view their storage unit's location, size, and any additional services they have opted for.

The online interface is designed with user-friendliness in mind, ensuring a straightforward and intuitive experience. Customers can easily book their storage units, select their preferred dates and times, and make payments online. This digital approach streamlines the entire process, eliminating the need for lengthy paperwork and in-person transactions. Additionally, customers can receive instant confirmations and notifications, keeping them informed about their bookings and any relevant updates.

Automated kiosks further enhance the self-service experience. These kiosks are strategically placed at the storage facility, providing customers with an additional layer of convenience. Customers can use these kiosks to access their storage units, providing their unique access codes or scanning their assigned cards. The kiosks guide customers through the process, ensuring a secure and efficient entry. This technology also allows for real-time monitoring and management, providing facility managers with valuable data and insights.

The benefits of this self-service storage model are numerous. Customers enjoy increased flexibility, as they can access their storage units whenever needed without adhering to strict business hours. The online and automated systems also contribute to cost savings, as there is no need for a large on-site staff. This model is particularly appealing to those with busy schedules or those who prefer a more independent approach to storage management. Furthermore, the convenience of online transactions and 24/7 access can attract a wider customer base, including students, professionals, and families with varying storage requirements.

Cracked Screen Fix or New Phone? AT&T Insurance Decision Guide

You may want to see also

Limited Lines Self-Service: Producers offer simplified insurance options, often with online quote and purchase

Limited lines self-service storage insurance is a type of insurance service that has gained popularity in recent years, especially in the realm of personal and small business storage facilities. This model allows insurance producers to offer simplified and convenient insurance options to customers who need coverage for their stored items. The concept revolves around providing a streamlined and efficient process for obtaining insurance, often with a focus on online interactions.

In this model, producers act as intermediaries between customers and insurance companies, offering a range of insurance products tailored to the specific needs of self-storage customers. These producers typically have a limited scope of insurance services, hence the term 'limited lines'. They specialize in providing insurance for personal belongings, vehicles, and sometimes even business property stored in self-storage units. The key advantage is the convenience it offers to customers, allowing them to obtain insurance without the traditional lengthy processes.

The process is designed to be user-friendly and efficient. Customers can often obtain an online quote for their insurance needs within minutes. This involves providing details about the items to be insured, the duration of storage, and any specific requirements. Once a quote is received, customers can proceed to purchase the insurance online, ensuring a quick and secure transaction. This self-service approach eliminates the need for in-person meetings with insurance agents, making it particularly appealing to those with busy schedules or those who prefer the convenience of online services.

Limited lines self-service storage insurance producers often have partnerships with various insurance companies, allowing them to offer a range of policies. These policies are designed to be flexible and customizable, catering to different customer needs. For instance, customers might choose between different coverage levels, deductibles, and payment plans. The producers guide customers through these options, ensuring they understand the coverage and making the process transparent and accessible.

This model of insurance production has several benefits. Firstly, it reduces the complexity and time associated with traditional insurance processes, making it ideal for busy individuals and small business owners. Secondly, it allows insurance producers to cater to a specific market niche, providing specialized services that might not be readily available through conventional insurance providers. Lastly, it encourages innovation in the insurance industry, driving the development of more efficient and customer-centric solutions.

Understanding Pink Slip Insurance: When and How to Make Changes for Your Family

You may want to see also

Storage Insurance: Covers stored items against theft, damage, and natural disasters

Storage insurance is a specialized type of coverage designed to protect items stored in a third-party facility, such as a self-storage unit or a warehouse. This insurance is crucial for individuals and businesses who entrust their valuable possessions or inventory to storage providers, ensuring that their items remain safe and secure even when they are not in their possession. The primary purpose of storage insurance is to provide financial protection against various risks associated with the storage environment, including theft, damage, and natural disasters.

When you store items, whether it's personal belongings, business equipment, or inventory, you entrust the storage facility with their safety. However, unforeseen events can occur, leading to potential losses. Storage insurance steps in to mitigate these risks, offering financial compensation in the event of a covered loss. This type of insurance is particularly relevant for self-service storage units, where tenants have access to their stored items and are responsible for their security.

The coverage typically includes protection against theft, ensuring that your stored items remain safe from unauthorized access and potential theft. In the event of a theft, the insurance policy will provide compensation to help you replace or repair the stolen items. Additionally, storage insurance covers damage to your belongings, which could result from various incidents like fire, vandalism, or accidental damage within the storage facility. This coverage ensures that you are financially protected against unexpected events that may cause harm to your stored items.

Natural disasters are another critical aspect of storage insurance. These events, such as floods, earthquakes, or severe storms, can cause significant damage to storage facilities and their contents. Insurance policies often include coverage for losses incurred due to natural disasters, providing financial assistance to help you recover and replace affected items. This aspect of storage insurance is essential for individuals and businesses located in areas prone to such events.

Understanding the terms and conditions of storage insurance is vital. Policies may have specific exclusions and limitations, so it's essential to review the coverage carefully. Some insurance providers offer limited lines self-service storage insurance, which may have more straightforward terms and lower premiums, making it accessible to a broader range of customers. When choosing a storage insurance provider, consider your specific needs, the value of your stored items, and the potential risks in your area to ensure adequate coverage.

Farmer Insurance: Protecting People's Livelihoods

You may want to see also

Producers' Role: Facilitate insurance transactions, provide quotes, and assist with claims for covered losses

Limited lines self-service storage insurance producers play a crucial role in the insurance industry, particularly in the context of self-service storage facilities. These producers are authorized to offer and sell specific types of insurance coverage, often tailored to the unique needs of storage unit tenants and facility owners. Their primary function is to facilitate insurance transactions, ensuring that individuals and businesses can protect their valuable possessions stored in these facilities.

One of their key responsibilities is to provide quotes for insurance coverage. Producers must understand the risks associated with self-service storage and design appropriate insurance policies. They assess the value of items stored, the potential risks (such as theft, fire, or natural disasters), and the specific requirements of the facility. By gathering this information, producers can offer customized quotes, ensuring that tenants can choose a policy that suits their needs and budget. This process involves explaining the terms and conditions of the policy, coverage limits, and any exclusions to ensure tenants make informed decisions.

When a tenant decides to purchase insurance, the producer facilitates the transaction, ensuring a smooth and efficient process. This includes providing the necessary documentation, explaining the policy details, and handling any administrative tasks required for activation. Producers also assist in the claims process when a covered loss occurs. They guide tenants through the claims procedure, helping them understand their rights and responsibilities. This involves collecting and verifying the necessary information, such as proof of loss, and assisting with the claims submission process.

In the event of a claim, producers act as intermediaries between the insured tenant and the insurance company. They help expedite the claims settlement process by providing relevant documentation and ensuring all necessary steps are followed. Producers also assist in obtaining appraisals or estimates for damaged or stolen items, especially for high-value possessions. Their role is to ensure that the claims process is fair and efficient, providing tenants with the support they need during challenging times.

Additionally, limited lines self-service storage insurance producers may offer ongoing support and advice to tenants. They can provide recommendations for maintaining and securing stored items, as well as guidance on insurance policy management. By offering these services, producers build trust and establish long-term relationships with their clients, ensuring a comprehensive and personalized insurance experience.

Middle Market Insurance: Defining the Sweet Spot

You may want to see also

Frequently asked questions

Limited Lines Self-Service Storage Insurance is a specialized insurance product designed for individuals and businesses that rent storage units. It provides coverage for personal property stored in these units, offering protection against theft, damage, and other specified perils. This type of insurance is tailored to the unique risks associated with self-storage facilities, allowing customers to access and manage their insurance policies through a self-service platform.

The self-service platform enables insurance producers or brokers to efficiently manage and distribute policies. Producers can use the online system to obtain quotes, compare coverage options, and customize policies according to their clients' needs. They can also facilitate policy changes, payments, and claims processing, providing a convenient and streamlined experience for both producers and their clients.

For storage facility owners, this insurance offers several advantages. It helps protect their business from financial losses due to theft, vandalism, or natural disasters that may affect the stored items. The self-service feature allows owners to easily manage and monitor the insurance coverage for their facility, ensuring that their operations remain protected. Additionally, it can enhance customer trust and satisfaction, as tenants can have peace of mind knowing their belongings are insured.