The 3-digit insurance code, often referred to as the DMV code, is a unique identifier used by Departments of Motor Vehicles (DMVs) to verify insurance coverage for vehicles. This code is essential for various DMV-related transactions, such as vehicle registration, renewal, or reporting an accident. It serves as a quick reference to an individual's insurance provider and expedites the verification process. While the NAIC code is a broader, nationwide identifier, the 3-digit DMV code is state-specific and can vary by state. To locate your insurance company's 3-digit DMV code, you can refer to your insurance card, contact your insurer, or access the official state DMV or Department of Financial Services website.

| Characteristics | Values |

|---|---|

| Purpose | Identification and verification of insurance coverage for vehicles |

| Use | Insurance-related transactions and records |

| Availability | Insurance ID card, insurance company, state DMV or Department of Financial Services website |

| Variability | State-specific, may vary by state |

| Format | 3-digit number |

What You'll Learn

Where to find your 3-digit insurance code

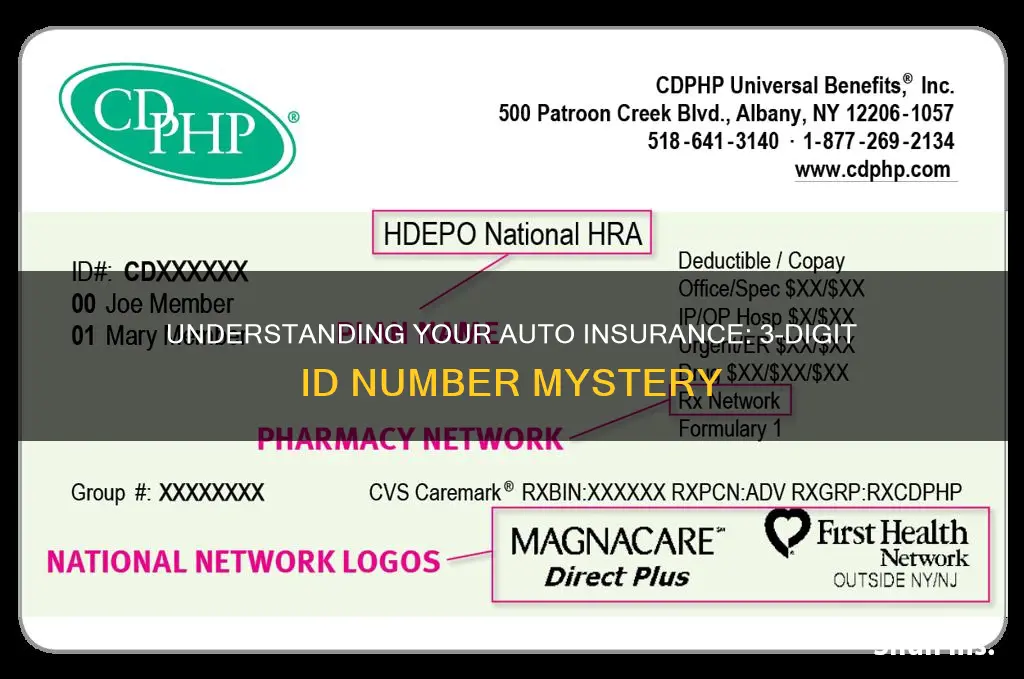

If you're looking for your 3-digit insurance code, you may need to look at your insurance card, which is usually kept in the glove box. Your insurance company code is typically based on how you purchased your policy.

In the state of New York, the Department of Motor Vehicles (DMV) provides a list of New York State DMV insurance codes and company contacts on the New York State Department of Financial Services website. You can search for insurance companies by name or by their 3-digit code.

In New Jersey, the insurance company that issued your policy has its own name, known as the "underwriting company". Many of the documents you've received from your insurance company will have the name of your underwriting company on them. Look for language such as "policy issued by" or "underwritten by".

If you're a New Jersey customer and need to request a new insurance ID card, you can contact your insurance company and they will send one to you in the mail.

In addition to the name and code of your insurance company, you'll generally need other pieces of information when registering your car, such as your social security number, your car's current odometer reading, and your driver's license number.

Self-Insuring Your Car: Is It Worth the Risk?

You may want to see also

Why you need a 3-digit insurance code

Insurance company codes are strings of digits used to identify specific providers. Each insurance company has two codes: one from the National Association of Insurance Commissioners (NAIC) and one from the Department of Motor Vehicles (DMV).

NAIC codes are five-digit national codes, while DMV codes are three-digit codes assigned on the state level. For example, in New York, the DMV provides a list of insurance codes and company contacts, which can be searched by the company name or their three-digit code.

The three-digit insurance code is essential for several reasons. Firstly, it helps consumers determine a provider's legitimacy and trustworthiness. By reviewing a provider's NAIC code, consumers can access information such as closed customer complaints, enforcement actions against the provider, financial data, and market conduct reports. This enables consumers to make informed decisions about their insurance choices.

Secondly, the three-digit insurance code is necessary for various administrative purposes. For instance, in New Jersey, the insurance company code is typically required when registering a car or renewing registration with the New Jersey Motor Vehicle Commission (MVC). This code, along with other information like your social security number and driver's license number, ensures a smooth and efficient registration process.

Moreover, the three-digit insurance code can be crucial in instances of insurance fraud or disputes. The NAIC code allows consumers to file claims of fraud against specific providers, ensuring accountability and consumer protection.

Lastly, the three-digit insurance code can be used to access various consumer studies and ratings, helping consumers make informed decisions. Reputable sources like the J.D. Power Auto Claims Satisfaction Survey and the AM Best financial strength rating system provide insights into customer satisfaction, financial health, and the ability of providers to pay out claims.

In conclusion, the three-digit insurance code is vital for consumers as it helps verify the legitimacy of insurance providers, facilitates administrative processes, enables fraud reporting, and assists in making informed decisions through access to consumer studies and ratings.

Roadside Risks: Navigating Insurance Coverage for Debris Damage

You may want to see also

What is the difference between DMV and NAIC codes?

Every car insurance provider in the US is assigned two insurance codes: one from the National Association of Insurance Commissioners (NAIC) and one from the Department of Motor Vehicles (DMV). These codes are used to help consumers determine a provider's legitimacy.

NAIC codes are five-digit national codes assigned by a regulatory oversight committee to ensure insurance carriers abide by federal laws. The NAIC is responsible for setting the regulations and standards for the insurance industry in the US. The NAIC number is a unique five-figure identification code associated with the insurer and carries data on their finances, complaints, and more. This number is helpful in many cases, especially accidents and collision coverage.

DMV codes, on the other hand, are three-digit codes assigned on the state level. Each insurance provider that operates within a state is given a state-specific code to account for differences in state laws.

To find your provider's NAIC code, you can visit the NAIC website and search for it on the Consumer Insurance Search Results page. Your provider's DMV code can be found on your insurance ID card.

Auto Insurance in Illinois: What You Need to Know

You may want to see also

How to find your insurance company's 3-digit DMV code

To find your insurance company's 3-digit DMV code, you can refer to several sources. Firstly, check your insurance card, as insurance companies typically list their DMV code along with other policy information on the card that you carry in your vehicle. If the code is not apparent or you do not have your card, you can contact your insurance company's customer service team, who will be able to provide you with the correct code.

Additionally, many states maintain online databases that list the insurance companies operating in their jurisdiction along with their corresponding codes. These databases can be accessed through the official website of your state's Department of Motor Vehicles (DMV) or Department of Financial Services. For example, the New York State Department of Financial Services website provides a searchable list of New York State DMV insurance codes and company contacts. You can search for insurance companies by name or by their 3-digit code. Remember that DMV codes are state-specific, so ensure you are referring to the correct state database, as the codes may vary across states.

It is important to note that the 3-digit DMV code is different from the NAIC (National Association of Insurance Commissioners) number, which is a 5-digit code used for broader regulatory and compliance purposes across states. While the DMV code is used for state-level identification and transactions, the NAIC number serves as a standardised nationwide identifier for insurance companies.

Full Coverage Auto Insurance in Maryland: What's Included?

You may want to see also

What is the purpose of 3-digit insurance codes?

The purpose of 3-digit insurance codes, also known as DMV codes, is to provide a unique identifier for insurance companies, enabling efficient validation of vehicle insurance status by state motor vehicle departments. These codes are crucial for various legal and administrative processes, such as verifying insurance coverage during traffic stops, accidents, and vehicle registrations.

DMV codes are assigned by state motor vehicle departments and are used primarily for state-level identification and transactions. They are an essential tool for ensuring compliance with state insurance regulations and streamlining administrative procedures. Each state's DMV or Department of Financial Services website typically provides a list of these codes for insurance companies operating within their jurisdiction.

The 3-digit insurance codes play a pivotal role in maintaining accurate insurance records and combating fraud. They facilitate the exchange of information between policyholders, insurance companies, and regulatory entities, thereby enhancing transparency and efficiency in the motor vehicle insurance industry.

It is important to note that DMV codes are distinct from NAIC (National Association of Insurance Commissioners) numbers. While DMV codes are state-specific, NAIC numbers are five-digit identifiers that remain consistent across all states, serving as a standardised nationwide reference for insurance companies.

Full Auto Insurance Coverage in North Carolina: What's Included?

You may want to see also

Frequently asked questions

Your 3-digit DMV code can be found on your insurance card. If you don't have your insurance card, you can contact your insurance company's customer service to request the code. You can also find it on your state's DMV or Department of Financial Services website.

The 3-digit insurance code is used by DMVs to verify insurance coverage for vehicles. It is a crucial piece of information for DMV transactions, as it serves as a reference to your insurance provider and expedites administrative procedures.

The 3-digit DMV code is assigned by state motor vehicle departments and is used specifically for insurance-related transactions and records at the state level. On the other hand, the 5-digit NAIC code is a national identifier assigned by the National Association of Insurance Commissioners to standardize insurance company identification across states.

You can find your insurance company's 3-digit DMV code by checking your insurance card, contacting your insurance provider directly, or accessing your state's DMV or Department of Financial Services website.