A State Farm declarations page, or DEC page, is a crucial component of an insurance policy that provides essential details about your personal insurance policy. It is not available online due to technical limitations, so to access it, you must log in to your State Farm account and follow a specific set of steps.

| Characteristics | Values |

|---|---|

| What is a DEC page? | A key component of an insurance policy that provides the most important information about your personal insurance policy. |

| How to find your State Farm DEC page | Log into your State Farm account, click on the circle icon in the upper right-hand corner, select 'Documents', look for the correct 'Policy Notice' and select 'View Documents', then select 'Renewal Notice'. |

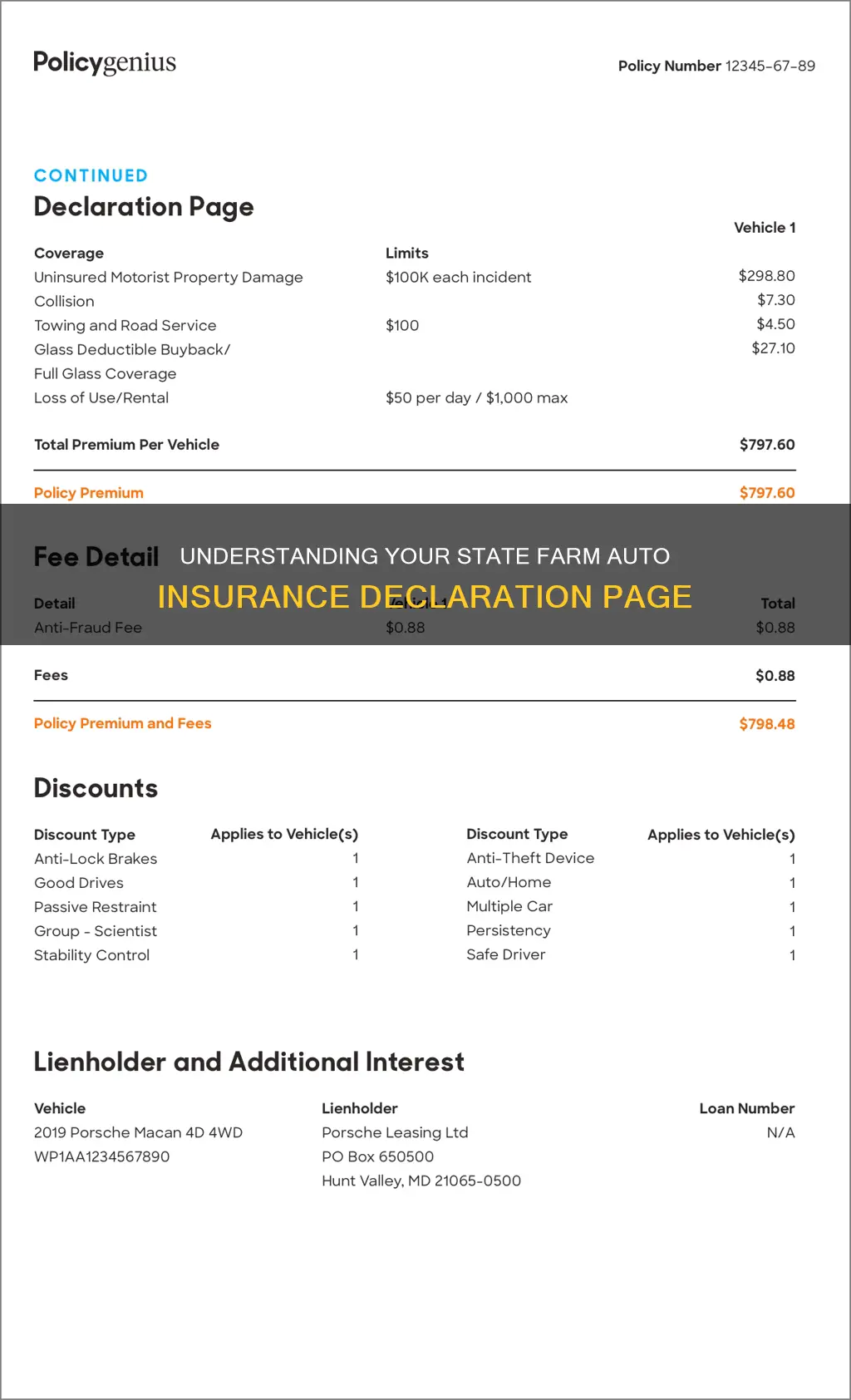

| What does a State Farm DEC page look like? | A DEC page will include details such as the name of the registered owner, prior insurance carrier and expiration date, driver information and history, driver's license number and state of issue, ticket and accident history, and license suspension information. |

| What is not included on a State Farm DEC page? | The DEC page is not proof of coverage. To access your proof of insurance, you must go to the 'My Accounts' tab. |

What You'll Learn

Logging into your State Farm account

To log in, you will need your user ID and password. If you have forgotten these, you can use the ''Forgot User ID' and 'Forgot Password' links on the State Farm website.

Once logged in, you can view and pay bills, set payment reminders, update payment information, contact your agent, file and track claims, and more. You can also view your policy and ID cards, without needing to search for paper documents.

If you are uncomfortable with making an online payment, you can forward your application to a State Farm agent, who will contact you about payment arrangements.

Removing Relatives from Your Auto Insurance

You may want to see also

Finding the documents section

To find your State Farm declarations page, log into your State Farm account. Then, click on the circle icon in the upper right-hand corner of the screen. From the menu, select 'Documents'.

Next, you need to look for the correct 'Policy Notice' that you want to upload. You will be given options such as 'Auto', 'Home', or 'Pet'. After selecting the relevant option, click on 'View Documents'.

Finally, select the 'Renewal Notice' option, and you will be able to view and access your State Farm declarations page.

Autoimmune Disorders and Insurance Coverage: Unraveling the Blood Work Mystery

You may want to see also

Selecting the right policy notice

Selecting the right policy for your auto insurance is a crucial decision that balances your needs, preferences, and budget. Here are some essential factors to consider when choosing the right policy notice:

Understanding Your Needs and Requirements:

Before selecting a policy, it's important to assess your unique situation. Consider factors such as the number of vehicles you own, your driving history, and the level of coverage you require. Ask yourself how much coverage you need for yourself, your passengers, and your vehicle. This introspection will help you choose a policy that adequately protects you and your assets in the event of an accident.

Types of Coverage:

Familiarize yourself with the different types of insurance coverage available. Some core coverages to focus on include liability coverage, which includes bodily injury liability and property damage liability; collision coverage, which covers damage to your vehicle in an accident; and comprehensive coverage, which protects against non-accident damage, such as theft or weather damage. Other important coverages to consider are uninsured/underinsured motorist coverage and medical or personal injury protection.

Affordability and Budget:

When selecting a policy, it's essential to be mindful of your financial capabilities. Consider what you can comfortably afford in terms of monthly or annual premiums. Opting for a higher deductible can lower your monthly payments, but ensure you have the liquidity to cover that deductible when needed. Assess your financial situation and choose a policy that aligns with your budget without compromising the level of protection you need.

Choosing a Reputable Insurance Company:

Research and select a reputable insurance company with a strong track record of financial stability and excellent customer service. Look for a company that offers attentive and responsive support, a fast claims process, and solid financial standing. Check reviews, ratings, and referrals from family and friends to make an informed decision.

Compare Rates and Shop Around:

Don't settle for the first quote you receive. Shop around and compare rates from multiple insurance companies. Get at least three viable quotes and perform a side-by-side comparison to ensure you're getting the best value for your money. Remember, rates can vary widely between carriers, so it's worth investing time in finding the right fit.

Additional Coverages and Discounts:

In addition to the core coverages, consider adding extra coverages such as roadside assistance, rental car reimbursement, or gap coverage. These add-ons can provide valuable peace of mind and protection in various scenarios. Also, inquire about discounts offered by different insurance companies, such as safety equipment discounts, association discounts, or safe driving discounts, as these can significantly reduce your overall costs.

Remember, selecting the right policy is a personalized process that depends on your unique circumstances. Take the time to understand your needs, compare options, and choose a reputable company that offers the coverage you require at a price that suits your budget.

Canceling belairdirect Auto Insurance: A Step-by-Step Guide

You may want to see also

Viewing the documents

Viewing your State Farm insurance declarations page is a straightforward process. Here is a step-by-step guide to accessing and understanding your insurance documents:

Logging In and Navigation

Firstly, log into your State Farm account. You can do this by visiting the State Farm website and entering your login credentials. Once you are logged in, navigate to the upper right-hand corner of the screen and click on the circle icon. From the options presented, select 'Documents'.

Selecting the Correct Policy Notice

After accessing the 'Documents' section, you will need to locate the relevant 'Policy Notice'. State Farm offers a range of insurance policies, including auto, home, and pet insurance. Select the specific policy notice that you require by clicking on the appropriate option.

Viewing the Renewal Notice

To view your State Farm declarations page, you will need to select the 'Renewal Notice'. This document provides an overview of your personal insurance policy and contains essential information. It is important to review this document to understand the specifics of your coverage.

Understanding the Declarations Page

The declarations page, often referred to as the "DEC" page, outlines the key components of your insurance policy. It includes details such as the type of coverage, applicable deductibles, policy limits, and other relevant information. This page is crucial as it summarizes your insurance protection and allows you to verify that your policy meets your needs.

Downloading and Storing the DEC Page

You may want to download and securely store your DEC page for future reference. You can download it as a PDF file and save it in a designated folder on your device. Additionally, consider uploading it to a digital wallet, such as Marble, which allows you to keep all your insurance policy details in one place.

Remember, if you encounter any issues or have specific questions about your insurance policy, don't hesitate to contact your State Farm agent. They are available to provide personalized assistance and ensure you fully understand your coverage.

Auto Insurance: Holiday Hours

You may want to see also

Adding the DEC to your wallet

A declarations page, or "dec page", is a summary of your insurance policy. It includes information such as the policy period, coverage, coverage limits, deductible, premium, and endorsements. Auto insurance dec pages also list the insured vehicles and drivers, while homeowners dec pages list the location of the property being insured.

State Farm® does not currently offer the option to access your declaration page online. However, you can contact your State Farm agent to request a declaration page. Here is some information on adding the DEC to your wallet:

Adding your DEC to your wallet can be a convenient way to keep your insurance information easily accessible. It is important to note that a physical or digital insurance card is generally considered to be the standard form of proof of insurance when pulled over. However, in some cases, you may be required to provide additional documentation, such as when obtaining financing for a vehicle or renting a new home.

To add your DEC to your wallet, you will need to first obtain a physical copy of the document. As mentioned, you can contact your State Farm agent to request a copy of your declaration page. Once you have the physical copy, there are a few different ways you can add it to your wallet:

- Photocopy or Scan: You can make a photocopy of the DEC and keep it in your wallet. Alternatively, you can scan the document and save it on your phone or mobile device, which you can then access when needed.

- Mobile Wallet Apps: There are several mobile wallet apps available that allow you to store important documents. Simply take a photo of your DEC or upload the scanned copy, and you can access it anytime through the app. Some apps even allow you to set reminders for important dates, such as policy renewal dates.

- Email: You can email the scanned copy of your DEC to yourself so that you can access it from anywhere. Create a folder specifically for important documents in your email so that you can easily find it when needed.

- Insurance Company App: Some insurance companies offer their own apps that allow customers to access their policy information, including the DEC. Check with your State Farm agent to see if there is an app available to you and how to set it up.

Having easy access to your DEC can be beneficial in various situations. For example, if you need to file a claim, having the DEC readily available can help streamline the process. Additionally, when reviewing your policy or shopping for new coverage, having the details of your current policy at hand can aid in making informed decisions.

Remember to keep your DEC up to date. Request an updated copy from your agent if any changes are made to your policy or when it is up for renewal.

Pleasure vs Commute: Cheaper Insurance?

You may want to see also

Frequently asked questions

Log into your State Farm account, click on the circle icon in the upper right-hand corner, select 'Documents', look for the correct 'Policy Notice' and select 'View Documents', then select 'Renewal Notice'.

A declarations page is a key component of an insurance policy that provides important information about your personal insurance policy.

A State Farm declarations page includes all the policy details, such as the type of insurance (auto, home, pet, etc.), the policy number, and the renewal notice.

Due to technical limitations, the declarations page is not available to print online. However, some information is available in the 'My Accounts' tab, but this is not proof of coverage. To request a declarations page, contact your State Farm agent.