Property Protection Insurance (PPI) is one of the mandatory types of auto insurance that Michigan law requires drivers to carry. It covers damage to other people's property, such as buildings and fences, and other people's properly parked vehicles. It does not cover damage to cars, their contents, or trailers if they are parked in a way that causes an unreasonable risk of damage. PPI insurance claims must be filed within one year of the accident and will pay up to $1 million in compensation.

| Characteristics | Values |

|---|---|

| What is PPI? | Property Protection Insurance |

| Is it mandatory? | Yes |

| What does it cover? | Damage to tangible property (buildings, fences, trees, etc.) and other people's properly parked vehicles |

| What does it not cover? | Damage to vehicles, their contents or trailers if they are parked in a manner that causes unreasonable risk of damage; property damage to utility transmission lines, wires or cables arising from the failure of a municipality, utility company or cable television company; out-of-state car accidents |

| Claim time limit | 1 year after the accident |

| Payout limit | $1,000,000 |

What You'll Learn

PPI is mandatory in Michigan

In Michigan, drivers are required to carry no-fault insurance to remain legal on the road. This insurance system allows individuals to turn to their insurance carriers to pay for their medical bills and lost wages, regardless of who caused the accident.

Property Protection Insurance (PPI) is one of the mandatory coverages that all drivers must carry as part of Michigan's No-Fault auto insurance law. This insurance covers the cost of damage to tangible property resulting from a car accident.

PPI provides coverage for accidental damage to another person's tangible property, such as buildings, fences, or other safely-parked vehicles. The damage covered by PPI insurance consists of "physical injury to or destruction of the property and loss of use of the property so injured or destroyed."

The payout for a PPI claim will be the "lesser of reasonable repair costs or replacement costs less depreciation," and it will not exceed $1 million. It's important to note that PPI does not cover damage to other vehicles or trailers if they are parked in a manner that causes an unreasonable risk of damage. Additionally, PPI will not cover property damage to utility transmission lines, wires, or cables resulting from the failure of a municipality, utility company, or cable television company.

PPI is a vital component of Michigan's auto insurance requirements, ensuring that drivers have the necessary protection in the event of accidental damage to another person's property.

GST Exemption on Motor Vehicle Insurance

You may want to see also

It covers damage to tangible property

In Michigan, Property Protection Insurance (PPI) is a mandatory part of a no-fault auto insurance policy. It covers damage to other people's tangible property in Michigan, such as buildings, fences, and other vehicles. This includes damage to properly parked cars.

PPI provides coverage of up to $1 million for these types of property damage claims. It is important to note that PPI does not cover damage to cars in general but specifically covers damage to another person's properly parked vehicle.

This type of insurance ensures that drivers can take financial responsibility for losses when they are at fault for an accident. While PPI is specific to Michigan, other states have similar types of insurance, often called Property Damage Liability Insurance. This type of insurance is required by law in almost all states, except for New Hampshire and Virginia.

Property Damage Liability Insurance covers damage to another person's vehicle, such as repairs needed due to an accident. It also covers damage to other types of property, such as fences, lampposts, or mailboxes. This insurance covers the cost of repairs or replacement needed as a result of an accident.

Auto Insurance: Gender Pricing Disparity Explained

You may want to see also

It doesn't cover damage to vehicles

In Michigan, Property Protection Insurance (PPI) is one of the mandatory coverages that all drivers must carry as part of the state's No-Fault auto insurance law. PPI covers the cost of damage to other people's property resulting from a car accident. This includes damage to buildings, fences, and other people's parked vehicles. It is important to note that PPI does not cover damage to vehicles involved in the accident.

PPI provides coverage for accidental damage to tangible property, which includes physical injury to or destruction of the property, as well as the loss of use of the property. If the damaged property can be repaired, PPI will cover the reasonable repair costs. If the property is destroyed, PPI will cover the replacement costs, minus depreciation. Additionally, PPI can provide coverage for the loss of use of a damaged vehicle that was safely parked and unoccupied when it was struck by another driver. This coverage typically includes the cost of a rental car.

It is important to understand the limitations of PPI. It does not cover damage to vehicles involved in the accident, their contents, or trailers if they were parked in a manner that created an unreasonable risk of damage. Additionally, PPI does not cover property damage to utility transmission lines, wires, or cables resulting from the failure of a municipality, utility company, or cable television company. Furthermore, PPI is applicable only to accidents occurring within the state of Michigan and does not provide coverage for out-of-state car accidents.

Auto Insurance: Beyond Collision, What Else is Covered?

You may want to see also

It doesn't cover damage outside Michigan

Property Protection Insurance (PPI) is one of the three mandatory types of auto insurance that Michigan drivers are required to carry. It covers damage to other people's property, such as buildings, fences, and other properly parked vehicles, in the state of Michigan. However, it is important to note that PPI does not cover damage outside of Michigan. If an accident occurs outside of Michigan, PPI will not pay to cover the damage to other vehicles or property.

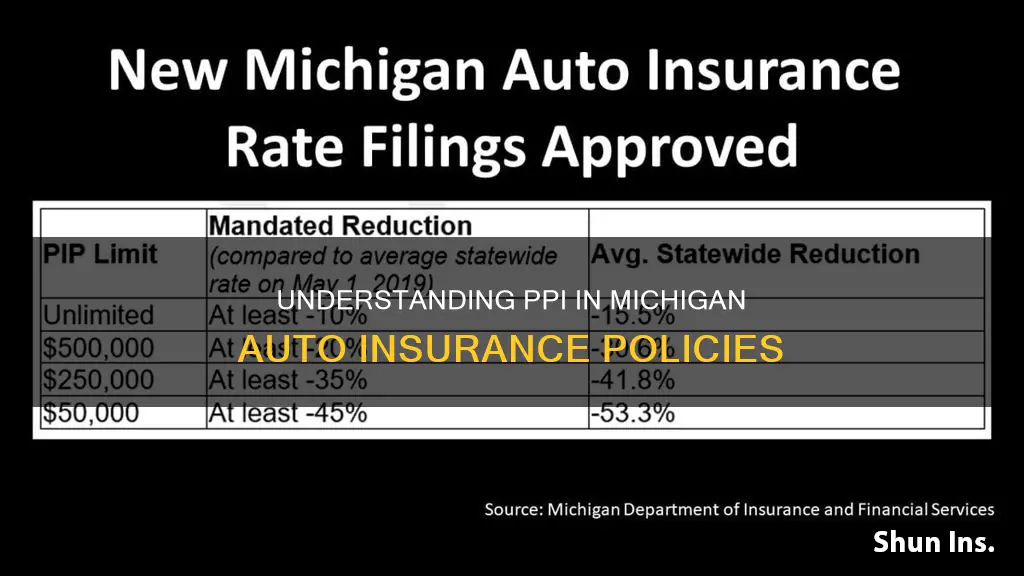

In Michigan, drivers are mandated to carry three essential types of auto insurance: Personal Injury Protection (PIP), Property Protection Insurance (PPI), and Bodily Injury and Property Damage Liability (BI/PD). PPI specifically provides coverage for damage caused to properly parked vehicles or fixed properties, such as buildings or lampposts, within the state. The minimum insurance limits for PPI in Michigan are $1 million in coverage.

While PPI covers damage to other vehicles, it is important to note that this typically only applies to properly parked vehicles. Additionally, PPI will not cover property damage to utility transmission poles, lines, wires, or cables if the damage arises from the failure of a municipality, utility company, or cable television company.

It is crucial for Michigan drivers to understand the scope of their PPI coverage and its limitations, especially when traveling outside of the state. By being aware of the coverage provided by PPI, drivers can make informed decisions about their insurance choices and ensure they have the appropriate protection while driving in Michigan or other states.

The Sneaky Auto Insurance Trap: Why Rates Rise After Two Years

You may want to see also

It doesn't depend on fault

In Michigan, Property Protection Insurance (PPI) is one of the mandatory coverages that all drivers must carry as part of the state's No-Fault auto insurance law. PPI covers the cost of damage to tangible property resulting from a car accident, regardless of who was at fault. This means that if your car causes damage to another person's property, such as buildings, fences, or parked vehicles, your PPI insurance will cover the cost of repairs, up to a limit of $1 million. This type of insurance is specifically for damage to property, not vehicles, and it does not cover damage caused by vehicles parked in a manner that creates an unreasonable risk of damage. It also does not cover damage to utility transmission lines, wires, or cables resulting from the failure of a municipality, utility company, or cable television company. It's important to note that PPI only applies to accidents that occur within the state of Michigan and does not cover out-of-state incidents.

If you need to make a PPI claim, you would typically file it with the auto insurance company of the owner of the vehicle involved in the accident. However, if recovery cannot be made, you can file the claim with the insurer of the driver. There is a time limit for filing a PPI insurance claim; a property owner must file a claim within one year of the accident. If you need to take legal action to obtain these insurance benefits, it's crucial to name the auto insurance company of the vehicle's owner or driver as the defendant, as they are responsible for the claim.

Vehicle Insurance: Third-Party Coverage Mandatory

You may want to see also

Frequently asked questions

PPI, or Property Protection Insurance, is one of the mandatory coverages that all drivers must carry as required by Michigan's No-Fault auto insurance law.

PPI covers the cost of damage to tangible property resulting from a car accident. This includes damage to other people's property, such as buildings and fences, as well as damage to another person's properly parked vehicle.

PPI does not cover damage to vehicles, their contents, or trailers if they are parked in a manner that causes an unreasonable risk of damage. It also does not cover property damage to utility transmission lines, wires, or cables arising from the failure of a municipality, utility company, or cable television company.

No, PPI only covers accidents that occur within the state of Michigan.