Progressive auto insurance ID cards are a form of proof of insurance. After purchasing a Progressive policy, customers can access their auto insurance card and coverage information 24/7 by calling or logging in online. The insurance card can also be accessed on a smartphone or tablet through the Progressive app, or by printing it out. The auto insurance card includes basic information such as the name and address of the insurance company, the NAIC (National Association of Insurance Commissioners) number or Company Number, the effective and expiration dates, the insured's name, and the make and model of the insured vehicle(s). Progressive also sends new and renewing customers proof of insurance in the mail, unless they have opted for paperless communication.

| Characteristics | Values |

|---|---|

| Purpose | Used for insurance-related transactions and records |

| Assigned by | Department of Motor Vehicles (DMV) |

| Format | 3-digit code |

| Usage | Specifically by the DMV for insurance-related purposes |

| Variation | May vary by state |

| Source | State's DMV or Department of Financial Services website |

| Importance | Crucial for DMV transactions and policyholder identification |

What You'll Learn

Progressive auto insurance ID cards are available via the mobile app

The app provides easy access to your insurance whenever and wherever you need it. You can view your coverages, discounts, ID cards, documents, and policy details. You can also report and add photos to a claim, pay your bill, view your billing history and upcoming payment schedule, and see your progress in Snapshot®.

In addition to the mobile app, there are several other ways to obtain your Progressive auto insurance card. After purchasing a Progressive policy online, over the phone, or through an agent, you will receive an email with a link to your insurance card. You can then log in to your account to print or download your ID cards. Alternatively, you can call Progressive, and they can fax or mail your insurance card to your home, office, car dealership, DMV/BMV, or any other location of your choice.

It's important to note that while most states accept digital insurance cards as proof of insurance, it's still recommended to carry a paper copy as well. This is because, in most states, you are required to have an insurance card with you while driving, and a dead phone battery or lack of service could leave you without proof of insurance.

Understanding Auto Insurance in BC: A Comprehensive Guide

You may want to see also

The ID card can be accessed by logging in online or calling

Progressive auto insurance ID cards can be accessed by logging in online or calling. Here's a step-by-step guide on how to access your Progressive auto insurance ID card:

Online Access

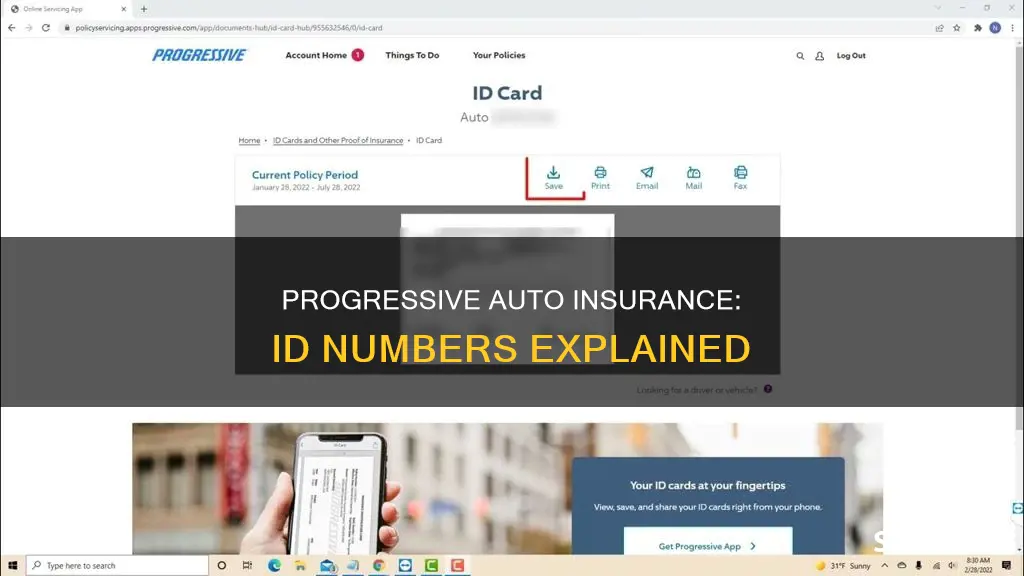

Progressive offers a convenient way to access your auto insurance ID card through their website or mobile app. Here's how you can do it:

- Visit the Progressive website and log in to your account. You can create an account on their website if you don't have one already.

- Once logged in, navigate to the “Documents” section by clicking on it in the top navigation bar.

- In the "Documents" section, you will find the option to download, print, or request to have your ID card mailed or faxed to you. You can choose the option that best suits your needs.

- If you're using the Progressive mobile app, you can easily access your ID card by logging in and navigating to the relevant section.

Access by Calling

If you prefer, you can also call Progressive to request your auto insurance ID card. Here's how you can do it:

- Call Progressive at 1-866-749-7436.

- Speak to a customer service representative and request your auto insurance ID card.

- Provide them with the necessary information, such as your policy number or personal details.

- You can request to have your ID card faxed or mailed to your preferred address.

It's important to note that Progressive also sends new and renewing customers proof of insurance by mail, unless you have opted for paperless communication. In that case, you can always access and print your ID card online. Additionally, Progressive allows you to download state-specific policy information, so be sure to select the correct state when accessing your ID card.

Understanding Arizona's Auto Insurance: No-Fault or Not?

You may want to see also

Proof of insurance is also sent by mail

Proof of insurance is a document provided by your insurer that shows you have an active insurance policy that meets the requirements of your state. It is often in the form of an ID card, and it is used when you are pulled over, in an accident, leasing a vehicle, or otherwise when requested by police officers, the DMV, or BMV.

If you have a Progressive policy, you can access your auto insurance card and coverage information 24/7 by calling or logging in online. You can also access your proof of insurance card on your phone through the mobile app. Additionally, Progressive sends new and renewing customers proof of insurance by mail, unless you are a paperless customer. In that case, you can print out a copy of your ID card when you access it online.

If you don't have access to a computer or fax machine, Progressive can mail your insurance card to you. However, keep in mind that choosing to receive your insurance card by mail may cause you to lose your paperless discount.

Progressive's proof of insurance card includes some basic information, such as:

- The name and address of the insurance company

- The NAIC (National Association of Insurance Commissioners) number or "Company Number"

- The effective date and expiration date of the policy

- The first and last name of the "named insured"

- The make, model, year, and VIN of the insured vehicle(s)

This card generally represents that you carry at least the minimum amount of coverage required by your state. However, it does not show your coverage selections and limits. That information can be viewed on your policy's declarations page, which includes more detailed information about your coverage.

Auto-Owners Insurance: Is It Worth the Hype?

You may want to see also

The NAIC number is on the Progressive insurance card

Progressive insurance customers can find their NAIC (National Association of Insurance Commissioners) number on their insurance card. This 5-digit code, issued by the NAIC, is used to identify insurance companies and is required for regulatory and documentation processes. It is also needed to report fraud or file an insurance claim.

The NAIC number for Progressive insurance customers is 24260. This number is listed on the insurance card, along with other basic information such as the name and address of the insurance company, the effective and expiration dates of the policy, the first and last name of the "named insured", and the make, model, year, and VIN of the insured vehicle(s).

The NAIC number is important for legality and adherence to regulations. It verifies that Progressive is a legitimate and authorized insurance provider in your area. This number is also used by the NAIC to track customer complaints and ethics violations across state lines. By using this number, anyone can access information about Progressive's financial data and any enforcement actions taken against the company.

It is important to note that Progressive has different NAIC numbers for its affiliate companies, and the number on your insurance card may vary depending on your specific policy. Progressive's NAIC number is different from the three-digit code assigned by each state's department of motor vehicles.

Mercury Auto Insurance: Accident Rate Impact on Premiums

You may want to see also

The DMV assigns a 3-digit code to Progressive Insurance

Insurance identification is a crucial aspect of the insurance landscape, serving as the linchpin that connects policyholders, insurance providers, and regulatory bodies. One of the key components of insurance identification is the insurance company code, which is used to identify specific providers. In the context of Progressive Insurance, the focus is on the 3-digit code assigned by the Department of Motor Vehicles (DMV).

The DMV assigns a unique 3-digit code to Progressive Insurance, and this code holds significant importance in insurance-related transactions and record-keeping. This code is not static across states; instead, it varies depending on the state in question. For instance, the 3-digit DMV code for Progressive Insurance in New York may differ from that in California. This state-specific nature of the code underscores the importance of consulting the appropriate sources, such as the respective state's DMV or Department of Financial Services website, to obtain accurate information.

The role of the 3-digit code assigned by the DMV is integral to the efficient management of insurance-related matters. It serves as a critical tool for validating vehicle insurance status during registration and post-accident investigations. Each insurance provider, including Progressive Insurance, is allocated a distinct identifier that streamlines the process of verifying insurance coverage. This expedites administrative tasks and helps ensure compliance with state insurance regulations.

The 3-digit code is not just a bureaucratic necessity; it is a powerful instrument in the responsible management and verification of insurance coverage within the DMV system. It is essential for various DMV-related transactions, including vehicle registration, renewal, and accident reporting. The code can typically be found on an individual's insurance card, along with other crucial policy information.

In addition to the DMV code, Progressive Insurance, like other insurance providers, also has a National Association of Insurance Commissioners (NAIC) code. While the DMV code is state-specific, the NAIC code is a five-digit national code that remains consistent across all states. The NAIC code can be found on the NAIC website or through insurance documentation.

Direct General Insurance: Auto-Focused or Misnomer?

You may want to see also

Frequently asked questions

Progressive Insurance's 3-digit code is a unique identifier used by the DMV for insurance-related transactions and records. This code can vary by state, so it is important to check with your local DMV or the appropriate state department to obtain the correct code for your specific location.

A DMV code is typically a 3-digit number used specifically by state DMVs for identification and transactions. On the other hand, an NAIC number, or National Association of Insurance Commissioners number, is a 5-digit code that serves as a standardized nationwide identifier for each insurance company. While DMV codes can differ across states, NAIC numbers remain consistent across the country.

Your Progressive Insurance ID number, or 3-digit code, can be located on your insurance card. This code is used by the DMV to verify insurance coverage for your vehicle. If you cannot locate the code on your insurance card, you can contact your insurance company's customer service or access your state's DMV or Department of Financial Services website.

You can obtain proof of your Progressive auto insurance by accessing your auto insurance card and coverage information. This can be done by calling Progressive or logging into your online account. Additionally, you can access your proof of insurance card through the Progressive mobile app on your smartphone or tablet. Progressive also sends new and renewing customers proof of insurance by mail, unless you have opted for paperless communication.