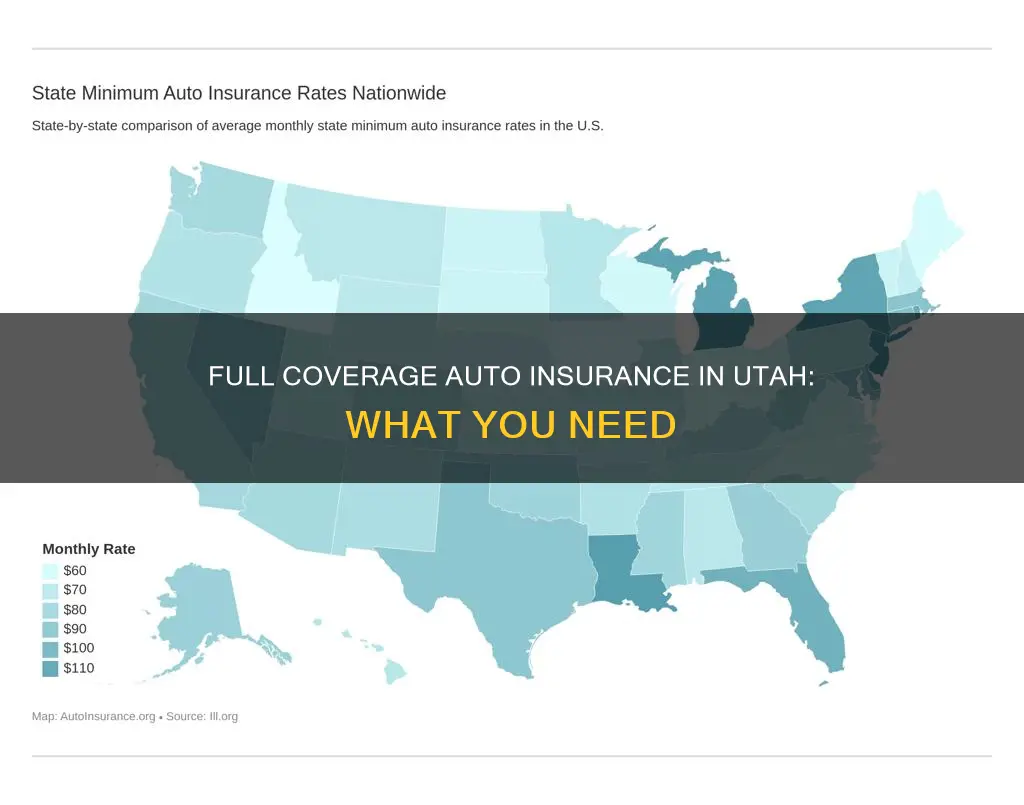

To drive legally in Utah, you must carry at least the minimum liability limits of $25,000 of bodily injury liability per person, $65,000 of bodily injury liability per accident, and $15,000 of property damage liability. As a no-fault state, Utah also requires $3,000 in personal injury protection (PIP) insurance. However, to get full coverage, you will need to add collision and comprehensive insurance to your policy, as well as other optional coverage types such as gap insurance or rental coverage.

What You'll Learn

Liability coverage

The minimum liability coverage required by Utah law for bodily injury is $25,000 per person and $65,000 per accident. This means that in the event of a covered accident, the insurance will cover up to $25,000 per person for bodily injuries, with a total maximum of $65,000 per incident. This coverage safeguards your assets if you are found legally responsible for the accident and covers certain expenses associated with the bodily harm sustained by the other parties.

The minimum liability coverage for property damage is $15,000 per accident. This type of coverage protects you if you are legally responsible for a covered accident and need to pay for damage to another person's property or vehicle.

In addition to the minimum requirements, it is recommended to carry more than the mandatory minimum liability coverage. This is because the minimum coverage may not be sufficient to cover all expenses in the event of a major accident. By having higher liability limits, you can protect yourself from financial hardship if you are sued for a large amount.

Utah is a no-fault state, which means that in the event of an accident, each driver's insurance company will cover the cost of their injuries and property damage, regardless of who was at fault. This is why personal injury protection (PIP) coverage is also mandatory in Utah. The minimum required PIP coverage is $3,000, which will pay for medical expenses in case of an accident.

Creating Fake Auto Insurance Cards: A How-To Guide

You may want to see also

Personal Injury Protection (PIP)

Utah requires all drivers to have at least $3,000 of PIP coverage, which can be extended up to $100,000. The minimum PIP insurance provides coverage for $3,000 of medical expenses per person, $3,000 in death benefits to heirs, $1,500 in burial costs per deceased person, 85% of lost income due to injuries, and up to $20 per day as a special allowance for necessary services if the insured cannot perform certain tasks due to their injuries.

PIP insurance covers most reasonable medical procedures and services, including X-rays, dental services, nursing, hospital costs, prescriptions, rehabilitation, and ambulance transportation. It also reimburses lost wages if the insured can demonstrate that they are unable to work due to their injuries. It is important to note that the minimum required coverage in Utah limits the payout to 85% of lost income or $250 per week, whichever is lower, and for a maximum of 52 weeks.

In the event that the insured is unable to perform normal household tasks due to their injuries, PIP will provide a special allowance of up to $20 per day for up to 365 days. This can cover expenses for services such as cleaning, childcare, cooking, home maintenance, yard work, and other typical household activities.

To receive PIP benefits for lost income or household services, the insured may need to provide a doctor's written confirmation that they are unable to work or perform these tasks due to injuries sustained in the collision.

Misplaced Card, Intact Coverage: Navigating Auto Insurance Without the Physical Reminder

You may want to see also

Uninsured/underinsured motorist coverage

In the state of Utah, Uninsured/Underinsured Motorist Coverage is an optional extra that can be added to your auto insurance policy. This coverage is designed to protect you in the event of an accident where the other driver is at fault and does not have insurance, or does not have sufficient insurance to cover the costs of the accident.

In Utah, motorists must carry proof of insurance and present it to any law enforcement officer upon request. This is also the case for electronic proof of insurance. Uninsured/Underinsured Motorist Coverage can provide peace of mind for drivers concerned about uninsured drivers. While not a requirement, it is a valuable addition to your policy.

This type of coverage will help pay for property damage to your vehicle, which you are legally entitled to claim from the other driver. It will also cover bodily injury expenses for you and your passengers, which you would be entitled to claim from the other driver if they had sufficient insurance.

The minimum insurance requirements in Utah are $25,000 per person for bodily injury, with a maximum total of $65,000 per incident, and $15,000 for damage to another person's property. Uninsured/Underinsured Motorist Coverage will ensure that, even if the other driver does not have this level of insurance, you can still claim these amounts to cover your losses.

Given the potential costs of an accident involving an uninsured driver, it is a good idea to consider this optional extra when purchasing auto insurance in Utah.

Gap Insurance: Vehicle Protection

You may want to see also

Collision coverage

When deciding whether to choose collision coverage, consider the following factors:

- Your personal financial situation: If you couldn't afford to pay for repairs or a replacement vehicle out of pocket, collision coverage can provide peace of mind.

- The value of your vehicle: If your vehicle is brand new or still worth a significant amount, collision coverage can help with expensive repairs or replacement.

- Whether your vehicle is in storage: If your vehicle won't be driven for an extended period, such as a boat or RV, you may not need collision coverage while it's in storage.

- The cost of collision coverage: Weigh the cost of collision coverage against the value of your car and your chosen deductible. If your car is older and worth less than your deductible, collision coverage may not be cost-effective.

In Utah, collision coverage is not mandated by law, but it is an important consideration for anyone looking to protect their vehicle in the event of a collision. While it may not be required, adding collision coverage to your policy can provide valuable financial protection and peace of mind.

Auto Insurance and Your Teen: What California Parents Need to Know

You may want to see also

Comprehensive coverage

Comprehensive auto insurance coverage is not a legal requirement in Utah. However, it is often mandated by lenders if you are financing or leasing a car. This type of insurance policy provides protection against various situations that minimum coverage doesn't, such as theft, vandalism, and natural disasters.

Comprehensive insurance covers repairs to non-collision damages, including theft, fire, hail, wind, flood, and vandalism. It is important to note that comprehensive insurance does not cover damages from a collision or personal injuries.

While not legally required, comprehensive coverage can provide valuable protection for your vehicle. It is worth considering, especially if you have an older car, as it can help cover the costs of repairs or replacement in the event of non-collision damage.

The cost of comprehensive coverage can vary depending on various factors, including your age, driving record, and the make and model of your car. It is recommended to shop around and compare quotes from different insurance providers to find the best rate for the coverage you need.

In addition to comprehensive coverage, collision coverage is also optional in Utah. Collision insurance pays for damages to your car caused by a collision with another vehicle or object. If you finance or lease a vehicle, lenders often require both collision and comprehensive coverage to protect their investment.

Does Your Auto Insurance Cover Parade Float Towing?

You may want to see also

Frequently asked questions

The minimum liability coverage required by law in Utah is $25,000 in bodily injury coverage per person, $65,000 per accident, and $15,000 in property damage coverage per accident.

Personal Injury Protection (PIP) is a type of coverage that pays for your medical expenses in the event of an accident. In Utah, the minimum amount of PIP required is $3,000 per person.

Driving without insurance in Utah is considered a Class B misdemeanor and can result in fines, suspension of your license and vehicle registration, and a requirement to file an SR-22 certificate. For a first offense, the fine is $400, and for subsequent offenses, the fine increases to $1,000.