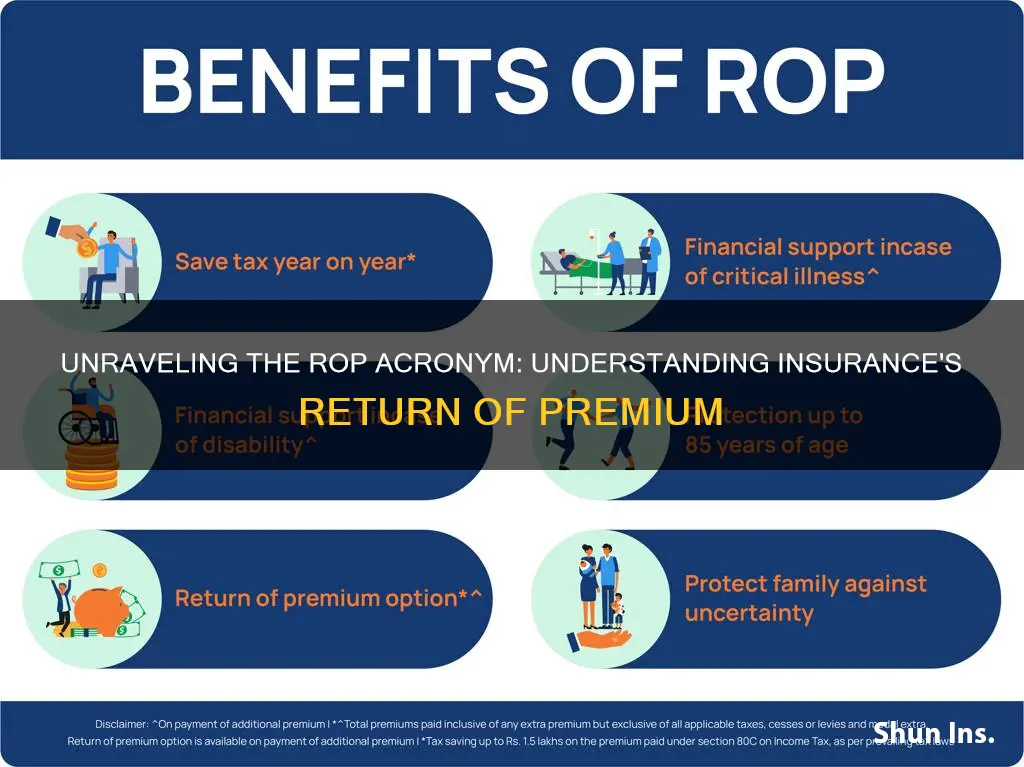

Return of Premium (ROP) is a type of term life insurance policy that provides a death benefit to your beneficiaries if you die during the term of your policy but refunds the premiums paid if you outlive the policy term. In other words, if you are still alive when the policy term ends, the insurance company will pay back all or some of the money you spent on payments. Without an ROP life insurance rider, if you're still living when the policy's term ends, your policy will expire without any benefit or refund.

| Characteristics | Values |

|---|---|

| Type | Term life insurance policy |

| Payout | Refunds all or part of the premiums paid if the policyholder outlives the policy term |

| Cost | Two to three times more expensive than standard term life insurance |

| Benefit | Acts as a forced savings option |

| Tax | Refunded premiums are not taxable |

| Alternatives | Basic term life insurance policy, whole life insurance, universal life insurance |

What You'll Learn

- Return of Premium (ROP) is a type of term life insurance policy

- ROP provides a death benefit to beneficiaries if the policyholder dies during the term

- ROP refunds premiums paid if the policyholder outlives the policy term

- ROP is more expensive than regular term life insurance

- ROP may not be worth the cost due to lost investment opportunities

Return of Premium (ROP) is a type of term life insurance policy

With a standard term life insurance policy, you pay regular premiums to keep the policy active. If you die during the term, your beneficiaries will receive a payout, known as a death benefit. If you are still alive when the policy term ends, there is no payout, and the policy simply expires.

ROP offers the additional benefit of refunding all or some of the premiums you have paid, depending on the type of ROP option purchased. This refund is typically provided in a single lump sum, tax-free, at the end of the term. However, it is important to note that ROP policies are considerably more expensive than standard term life insurance policies, often two to three times the cost.

The main advantage of ROP is that it provides a forced savings option, as your premiums are returned if you outlive the policy term. This can be particularly beneficial if you have future expenditures to cover, such as a mortgage or retirement plan. Additionally, any returns generated from this type of plan are generally not taxed.

However, there are also several disadvantages to consider. Firstly, the cost is significantly higher than a basic term life insurance policy. Secondly, the extra money paid for ROP is often better invested or saved elsewhere, as it could earn interest in other types of accounts. Finally, the value of the refunded premiums will depreciate due to inflation, reducing its purchasing power over time.

Ultimately, the decision to choose ROP depends on your financial goals and risk tolerance. While it offers the security of a refund, it comes at a higher cost, and you may be better off investing the difference in a traditional term life insurance policy.

Short-Term Insurance Obligation: Understanding the Necessity

You may want to see also

ROP provides a death benefit to beneficiaries if the policyholder dies during the term

Return of Premium (ROP) is a type of term life insurance that provides a death benefit to beneficiaries if the policyholder dies during the term of the policy. Term life insurance is a type of life insurance policy that has a specified end date, such as 20 years from the start date. The death benefit will only be paid out if the insured dies during this time period.

ROP is an optional add-on to a term life policy that refunds either a portion or all of the premiums paid at the end of the term if the insured is alive. Without an ROP rider, if the policyholder is still living when the policy term ends, the policy will expire without paying a benefit.

If the policyholder dies during the term of the policy, their beneficiaries can claim the death benefit, just like with any other life insurance policy. The death benefit is a payout to the beneficiary of a life insurance policy when the insured person dies. The amount of the death benefit is set in the terms of the contract and is chosen by the policyholder, who makes regular premium payments.

The death benefit of a life insurance policy is usually tax-free. It may be subject to estate taxes, but that's why wealthy individuals sometimes buy permanent life insurance within a trust. The trust helps them avoid estate taxes and preserve the value of the estate for their heirs.

The Mystery of EPO Insurance Plans Unveiled: Understanding Exclusive Provider Organizations

You may want to see also

ROP refunds premiums paid if the policyholder outlives the policy term

Return of Premium (ROP) is a type of term life insurance policy that refunds the policyholder all or part of the premiums they have paid if they outlive the policy term. This type of insurance is useful for those who want the security of a death benefit, as well as the potential for a full refund of premiums.

ROP policies are usually two to three times more expensive than standard term life insurance policies. The higher premium cost is due to the insurance company taking on the additional financial responsibility of potentially refunding the money at the end of the policy term. This makes ROP policies less accessible for those on a budget or seeking the most affordable coverage.

Despite the higher cost, ROP policies can provide peace of mind for policyholders who want to ensure their financial investment will not be lost if they outlive the policy term. It can be seen as a risk-free way to ensure financial security, as the policyholder will either leave behind a death benefit or receive the premiums back.

However, it is important to note that the money returned is typically without interest, and policyholders may have to submit a formal request to initiate the refund process. Additionally, if the policyholder stops making premium payments or cancels their policy, they may not be eligible for a refund.

When considering an ROP policy, it is essential to weigh the benefits against potential drawbacks, such as higher premiums, opportunity cost, and the risk of not receiving a refund if the policy is cancelled prematurely. Consulting a financial advisor or insurance professional can help individuals evaluate their options and make informed decisions based on their specific needs and goals.

Understanding Level Term Insurance: Unlocking the Benefits of Level Term V Policies

You may want to see also

ROP is more expensive than regular term life insurance

Return of Premium (ROP) insurance is a type of term life insurance policy that provides a death benefit to your beneficiaries if you die during the term of your policy but refunds the premiums paid if you outlive the policy term. With a standard term life insurance policy, you won't receive any payout if you outlive the term.

ROP insurance is considerably more expensive than a regular term policy. According to Policygenius, ROP insurance is typically two to three times more expensive than regular term life insurance. However, the exact amount you will pay depends on several factors, including age, gender, smoking status, pre-existing health conditions, hobbies, and occupation.

The higher cost of ROP insurance is because insurance companies invest the difference in premiums to guarantee that they can pay back your premiums at the end of the policy term. This added benefit of ROP insurance provides peace of mind and financial protection for risk-averse individuals who can afford the increased monthly premium.

Despite the benefits, ROP insurance may not be the best option for everyone. One significant downside is that you provide an interest-free loan to the insurer, and the refunded premiums do not earn any interest. As a result, you may be better off buying a traditional term life insurance policy and investing the difference in a safe investment account that offers higher returns.

In summary, while ROP insurance offers the advantage of refunded premiums, it is more expensive than regular term life insurance. Therefore, individuals should carefully consider their financial situation, risk tolerance, and investment options before deciding which type of policy is best for them.

Salary Slip Significance: Why Term Insurance Requires Proof of Income

You may want to see also

ROP may not be worth the cost due to lost investment opportunities

Return of Premium (ROP) life insurance is a type of insurance that guarantees a refund of all the money paid into a policy if the policyholder outlives the policy. This is in contrast to traditional term life insurance, where policyholders receive no payout if they outlive their policy.

While ROP life insurance may seem like a good deal, especially for young and healthy individuals, there are some drawbacks to consider. One of the main disadvantages of ROP policies is the added cost, which tends to be approximately 30% higher than traditional life insurance. This is partly due to the smaller number of insurance companies that offer ROP policies, as well as the lower number of customers. As a result, insurance companies charge higher premiums to make ROP policies worthwhile.

Another factor to consider is the opportunity cost of choosing ROP over traditional life insurance. Opportunity cost refers to the potential benefits that are missed out on when one alternative is chosen over another. In the case of ROP, the higher premiums paid mean that individuals will have less money to spend or invest elsewhere. Additionally, policyholders only get the premium back at the end of the policy, forfeiting any additional returns they could have made by investing their money in other types of investments.

Due to the higher costs and lost investment opportunities associated with ROP policies, a number of financial advisors tend to advise against buying them. Instead, they often recommend traditional life insurance, which offers the same level of protection without the added expense. Ultimately, the decision to choose ROP or traditional life insurance depends on individual preferences and circumstances. However, it is important to carefully weigh the pros and cons of each option before making a decision.

Unraveling the Intricacies of Insurance Reserves: A Guide to Understanding This Crucial Concept

You may want to see also

Frequently asked questions

ROP stands for Return of Premium. It is a type of term life insurance policy that provides a death benefit to your beneficiaries if you die during the term of your policy but refunds the premiums paid if you outlive the policy term.

With a standard term life insurance policy, you won’t receive any payout if you outlive the term. With ROP insurance, you can get those monthly premiums back if you’re still living when the policy term expires.

ROP life insurance offers the benefit of refunded premiums if you outlive the term of your policy. This can act as a forced savings option.

The main drawback of ROP life insurance is the cost. It is typically much more expensive than a traditional term life insurance policy.