Return of Premium (ROP) life insurance is an optional add-on to a term life policy that refunds all or some of the money you spent on policy payments if you outlive the policy term. In other words, if you're still living when the policy term ends, the insurance company will pay you back. Without an ROP life insurance rider, your policy will simply expire without any benefit if you're still alive when the term ends.

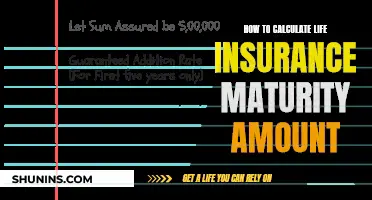

| Characteristics | Values |

|---|---|

| Type | Term life insurance |

| Payout | Refunds up to 100% of premiums at the end of the term |

| Cost | Two to five times the premium costs of other term insurance |

| Add-on | Optional add-on to a term life policy |

| Payment | Monthly |

| Tax | Not taxable |

| Riders | Children's term rider, waiver of premium rider, accidental death benefit, etc. |

What You'll Learn

ROP life insurance refunds

Return of Premium (ROP) life insurance is a type of term life insurance that refunds all or part of your premiums if you outlive the policy term. ROP policies are usually added as a rider to a standard term life insurance policy, and they typically last for the full duration of the policy term, which is often 10, 20, or 30 years.

If you purchase an ROP rider, you will make regular premium payments to keep the policy active. If you pass away while the policy is in effect, your beneficiaries will receive the death benefit as they would with any other life insurance policy. However, if you outlive the policy term, the insurance company will refund you all or some of the premiums you paid, depending on the specific ROP option you selected.

It is important to note that the refund from your ROP policy may not include fees or premiums paid for other riders on your policy. Additionally, missing payments or cancelling your policy may disqualify you from receiving the ROP benefit. The exact rules regarding refunds can vary by insurer, so it is essential to carefully review the terms of your policy.

The refund from your ROP policy is typically not taxable, as it is considered a return of the premiums you paid rather than income. However, it is always a good idea to consult with a financial advisor to understand the potential tax implications of any insurance policy.

While ROP life insurance offers the benefit of potential premium refunds, it is important to consider the higher costs associated with these policies. ROP policies are generally two to three times more expensive than standard term life insurance policies. As a result, most people may be better off purchasing a traditional term life policy and investing the difference in a savings or investment account. This alternative approach could provide higher returns and lower fees compared to the potential refund from an ROP policy, which does not earn interest.

U.S. Life Insurance and Suicide: What You Need to Know

You may want to see also

ROP as a rider

Return of Premium (ROP) life insurance is an optional add-on to a term life policy. It is a type of term life insurance policy that provides a death benefit to your beneficiaries if you die during the term of your policy but refunds the premiums paid if you outlive the policy term.

With a standard term life insurance policy, you won't receive any payout if you outlive the term. You'll pay considerably more for ROP insurance than a regular term policy, but it can be a way to force yourself to save money that you may later get back. ROP term life insurance isn't offered by many companies.

ROP life insurance is often a rider added to a regular term life insurance policy, and you can expect to pay more for it. If you outlive your coverage, 100% of the money you paid in premiums during the term is returned to you, tax-free. However, if you fail to make your payments or cancel the policy, you may not get a premium refund (exact rules vary by insurer).

A return of premium feature is also sometimes available on types of permanent life insurance. For example, Nationwide offers a return of premium rider on one of its universal life insurance policies.

- AAA Life Insurance: Available in 15-, 20- or 30-year terms, with $100,000 and up in coverage.

- Cincinnati Life: The Termsetter ROP policy is available for level terms of 20, 25 or 30 years. Minimum face amounts start at $25,000, depending on your health classification.

- Country Financial: Available as a rider on 20- and 30-year term life insurance policies.

- Illinois Mutual: Coverage ranges from $50,000 to $500,000, and terms can be 20 years, 30 years or to age 65.

- Lincoln Financial: Available on TermAccel and LifeElements in 10-, 15-, 20- and 30-year terms.

- Mutual of Omaha: Available on Term Life Express in 10-, 15-, 20- and 30-year terms.

- Pacific Life: Available on PL Promise Term in 10-, 15-, 20- and 30-year terms and Pacific Elite Term in 10-, 20- and 30-year terms.

- Protective: Available on Protective Classic Choice Term policies in terms from 10 to 40 years.

- State Farm: Coverage amount starts at $100,000 and is available in 20- or 30-year terms.

Selling Life Insurance in Texas: A Guide to Success

You may want to see also

ROP vs. whole life insurance

Return of Premium (ROP) life insurance is a type of term life insurance that refunds your premium payments if you outlive the term of your coverage. In exchange for this benefit, you pay more in premiums while the policy is in force. ROP insurance is not offered by many companies.

Whole life insurance, on the other hand, is a permanent life insurance policy that covers you for your entire life, rather than for a fixed term. It also has a cash value component that can be withdrawn or borrowed against.

Cost

ROP insurance is typically two to three times more expensive than regular term life insurance. The higher cost is due to the added benefit of potential premium refunds. Whole life insurance is also more expensive than term life insurance but for different reasons. Whole life insurance is pricier because it provides lifelong coverage and includes a cash value component.

Coverage Period

ROP life insurance is a type of term life insurance, which means it covers you for a specific period, such as 10, 20, or 30 years. If you outlive the term, the policy ends, and you will need to renew it if you want continued coverage. In contrast, whole life insurance provides coverage for your entire life, as long as you keep up with premium payments.

Premium Refunds

The most significant advantage of ROP life insurance is the potential to receive a refund of your premium payments if you outlive the policy term. This feature can be attractive, especially if you are risk-averse and want to ensure you get something back from your premiums. With whole life insurance, there is no option to receive a refund of your premiums.

Cash Value

Whole life insurance has a cash value component that grows over time. This means you can borrow against the policy, withdraw money, or surrender the policy for cash if your coverage needs change. ROP life insurance may also have a cash value component, but it is not a standard feature across all insurers.

Investment Potential

With whole life insurance, your premiums contribute to the cash value of the policy, which can grow over time and provide investment potential. ROP life insurance does not offer the same investment potential since the refunded premiums are not invested and do not earn interest.

In summary, ROP life insurance can be a good option for those who want the security of a potential premium refund if they outlive the policy term. However, it comes at a higher cost compared to regular term life insurance. Whole life insurance, on the other hand, offers lifelong coverage and includes a cash value component but does not provide the option for premium refunds.

Term Life Insurance: Living Benefits and Their Impact

You may want to see also

Pros and cons of ROP

Return of Premium (ROP) life insurance is an optional add-on to a term life policy that pays you all or some of the money you spent on policy payments if you outlive the policy term. Here are some pros and cons of ROP life insurance:

Pros

- The biggest advantage of ROP life insurance is the ability to reclaim past premium payments if you outlive your term.

- ROP life insurance can function as a savings account with a bonus life insurance add-on.

- Returns generated from this type of plan are generally not taxed.

- ROP life insurance builds cash value over time, which is not typical for term life policies. With enough cash value, policyholders can borrow against the policy, withdraw money, or surrender the policy for cash if coverage is no longer needed.

- ROP plans offer an add-on benefit that is guaranteed after the maturity of the plan, making the monetary benefit a core advantage.

- The survival benefits are returnable in full after maturity, which can be considered an investment component.

- Payable premiums are eligible for tax benefits per the Income Tax Act of 1961.

- In case the policyholder does not survive the policy term, the nominee(s) are eligible to receive the entire sum assured, just like a traditional term plan.

- ROP plans come with the option of being returnable, meaning that if the policyholder decides to discontinue the plan, the premiums paid to date are returned as maturity benefits.

Cons

- One of the biggest disadvantages of ROP life insurance is the cost. ROP life insurance is usually much more expensive than traditional term life insurance.

- The higher cost may be comparable to whole life insurance, but this depends on the specific companies and plans.

- The additional premium costs may be better invested or saved elsewhere, offering higher returns and lower fees, such as in an IRA account.

- The value of the refunded premiums may be depreciated due to inflation.

- Many insurers don't offer an ROP rider, so finding the right policy may be challenging.

- ROP insurance is not suitable for those in average health or middle-aged and older people due to the prohibitive cost.

- The refund typically reflects the sum of premiums paid rather than investment growth, and astute investors may find higher returns in other investment avenues.

- If the policyholder does not survive the term, the additional premiums for the ROP rider will not be refunded.

- Surrendering an ROP term life policy early may result in no premium return, as many companies do not offer premium returns for policies surrendered within the first few years.

Get Life Insurance for Your Parents: A Step-by-Step Guide

You may want to see also

ROP term options

Cost

The cost of ROP term insurance is typically two to three times higher than that of regular term life insurance. This is because the insurance company is taking on the additional risk of having to refund your premiums if you outlive the term. When considering ROP term options, it is important to compare the cost of this type of policy with the cost of a regular term policy to see how much more you would be paying.

Financial Strength

It is important to consider the financial stability of the insurance company when choosing any type of policy, including ROP term options. You can look at ratings from companies like AM Best to get an idea of how likely the company is to be able to honour its contractual obligations in the future.

Customer Satisfaction

You can also look at customer satisfaction ratings and complaints data to get a sense of how well the insurance company treats its customers. J.D. Power and the National Association of Insurance Commissioners (NAIC) are good sources for this type of information.

Convertibility

If you think you may want to convert your term policy to a permanent policy in the future, make sure you choose an insurance company that offers this option. Not all companies allow you to convert ROP term policies to permanent coverage.

Riders

Some insurance companies offer additional riders that can be added to your ROP term policy for an extra cost. These riders can provide additional benefits, such as a waiver of premium if you become disabled or an accelerated death benefit if you are diagnosed with a terminal illness.

Term Length

ROP term policies tend to have more limited term options than regular term life insurance policies. For example, you may only be able to choose a 20- or 30-year term, whereas regular term policies often offer terms of 10, 15, 20, or 30 years.

Life Insurance: Paid-Up Policies Explained

You may want to see also

Frequently asked questions

Return of Premium (ROP) life insurance is an optional add-on to a term life policy that pays you all or some of the money you spent on policy payments if you outlive the policy term.

If you purchase an ROP life insurance rider with your term life policy, you'll make monthly payments to keep your policy active. If you're still living when the policy term ends, the insurance company pays back all or some of the money you spent on payments, depending on your policy, in the form of an ROP benefit.

The biggest pro of ROP life insurance is the ability to reclaim past premium payments. If you outlive your term, you are typically able to receive one lump-sum payment combining all previous premiums that were paid. This may be particularly helpful if there are any new expenditures you'll have to cover later in life, like a mortgage or retirement plan.

One of the biggest cons of ROP life insurance is the cost. For insurance companies to be able to offer this benefit, ROP life insurance is usually much more expensive than a traditional term route.

ROP life insurance is typically two to three times more expensive than regular term life insurance.