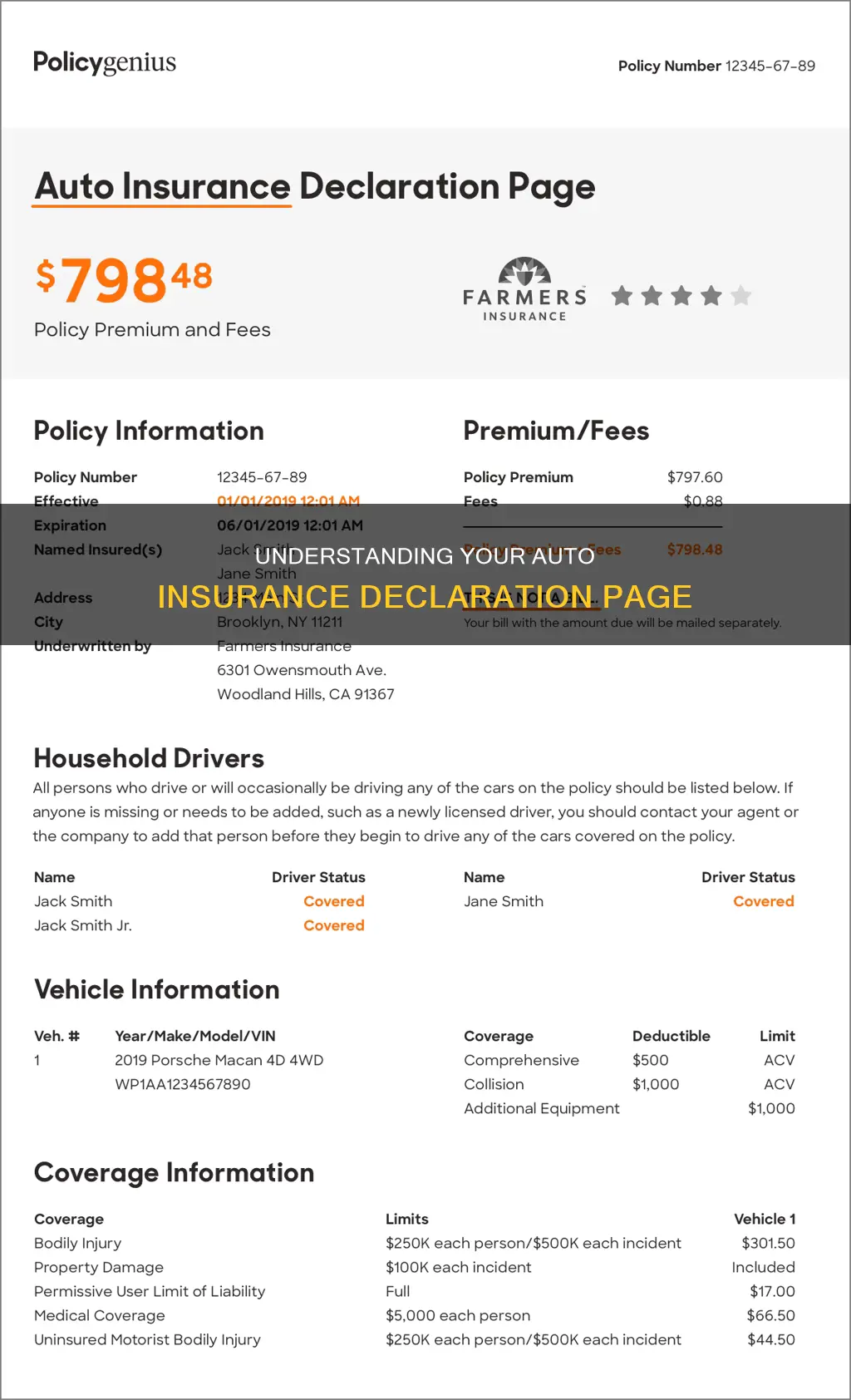

An auto insurance declaration page is a document that provides a summary of your car insurance policy. It includes important details such as the policy number, the date coverage starts and ends, the insured drivers, the covered vehicles, the types of coverage, and the associated costs. This document is typically sent to the policyholder by the insurance company via email, fax, or regular mail. It serves as a quick reference guide for understanding the specific terms and coverages of your auto insurance policy.

| Characteristics | Values |

|---|---|

| Purpose | To provide a summary of your auto insurance policy |

| Coverage | Details of what the policy covers, including types of coverage, limits, and deductibles |

| Policy Details | Policy number, effective date, expiration date, and period |

| Insured Parties | Names of all insured drivers, including the policyholder and any additional drivers |

| Vehicle Details | Year, make, model, vehicle identification number (VIN), and average mileage of covered vehicles |

| Agent Information | Contact information for the insurance agent |

| Lender Information | Name and contact information of the lender |

| Premium | Total premium amount, payment due dates, and applicable discounts |

| Exclusions | Details of any exclusions or items not covered by the policy |

| Accessibility | Provided by the insurance company via email, mail, or online portal |

| Proof of Insurance | Not typically accepted as proof of insurance, a separate insurance card is used for this purpose |

| Use Cases | Useful for quick reference, comparing quotes, and understanding coverage when filing a claim |

What You'll Learn

Policy number, effective date, and expiration date

The auto insurance declaration page provides a summary of your policy and includes essential details such as the policy number, effective date, and expiration date.

The policy number is a unique identifier for your insurance account. It is typically eight to ten digits long and remains the same as long as you stay with the same insurance company. You can find your policy number on your insurance card, bills, and statements. This number is necessary when filing an insurance claim, exchanging information after an accident, or contacting your insurer for support.

The effective date listed on the declaration page is when your policy starts and your coverage begins. This date is essential as it confirms when your insurance coverage is active.

The expiration date indicates when your coverage will end, usually six or twelve months from the start date. It is important to be mindful of this date to ensure you renew your policy on time and maintain continuous coverage.

Together, the policy number, effective date, and expiration date provide critical information about the validity and duration of your auto insurance policy. They are key components of the declaration page, which serves as a concise summary of your insurance coverage.

Auto Insurance Scores: Accessible Without SSN?

You may want to see also

Insured drivers and vehicles

The auto insurance declaration page, also known as a "dec page", is a summary of your car insurance policy. It includes the names of all insured drivers, including the policyholder and any additional drivers covered under the same policy.

All cars covered by your auto insurance policy will be listed on the declaration page, along with their make, model, year, and Vehicle Identification Number (VIN). The page will also detail the types of coverage included in the policy for each vehicle. If you have chosen different types and amounts of coverage for each vehicle, the declaration page will help you keep track of them.

The declaration page will also include the policy period, which is when your coverage starts and ends. This is usually for six months or a year.

It is important to note that the declaration page is not typically used as proof of insurance. While it can be useful for confirming the insured names on the policy, coverage types, limits, and deductibles, it is recommended to carry a physical or digital insurance card in your vehicle to show to law enforcement if you get pulled over.

Missouri's Auto Insurance: Understanding No-Fault Claims and Policies

You may want to see also

Coverage types, limits, and deductibles

The auto insurance declaration page provides a summary of your policy, including the types of coverage, limits, and deductibles you've chosen. It is a concise summary of the vital details of your auto insurance policy.

Coverage Types

The declaration page will list the types of coverage included in your policy. This can include collision coverage, which covers damage to your vehicle if it hits another object or vehicle, or if your vehicle is hit by another car. Comprehensive coverage is another common type of coverage, which helps pay for damages not caused by a collision, such as fire, theft, or weather-related incidents. Other types of coverage listed may include uninsured motorist coverage, personal injury protection, medical payments coverage, and more.

Limits

The insurance declaration page will also outline the limits of your coverage. These are the maximum amounts that your insurance company will pay in the event of a covered loss. There are two main types of limits: per-occurrence limits, which are the maximum funds provided for a single incident, and aggregate limits, which establish the maximum payout for all claims during the policy period. Your policy may have different limits for different types of coverage. For example, there may be per-person and per-accident limits for bodily injury liability.

Deductibles

Your auto insurance declaration page will also specify the deductibles for each type of coverage. A deductible is the amount you are responsible for paying out of pocket when a covered loss occurs. For example, if you have a $1000 deductible and $2000 in covered damages, you will pay the first $1000, and your insurance company will cover the remaining $1000. Deductibles typically apply to comprehensive and collision coverage, but they may also apply to other types of coverage, such as personal injury protection or uninsured motorist property damage coverage.

It's important to note that deductibles apply to each accident you're in within the policy period. Additionally, the deductible amount you choose will impact your insurance premium. Selecting a higher deductible may lower your premium, while choosing a lower deductible will result in a higher premium.

Auto Insurance: Understanding the Basics of Vehicle Coverage

You may want to see also

Premium and discounts

The auto insurance declaration page, also known as the "dec page", is a summary of your auto insurance policy. It is usually the first page or pages of your auto insurance policy. The dec page contains information about your premium, which is the price you pay for auto insurance. It will show the total six-month or yearly premium for your entire policy, as well as individual premiums for each coverage type. The declaration page breaks down the costs to show how much you are paying for each coverage type and vehicle. It also lists any discounts you are eligible for and how they reduce your premium.

Your premium is determined by a number of factors, including personal characteristics such as age, gender, and location, as well as driving history, the type of car you drive, and how often you drive it. The most important factor in determining your car insurance premium is how much coverage you need. The declaration page will also list your deductible, which is the amount you have to pay out of pocket when filing an auto insurance claim before the insurance company pays the rest.

The dec page will also show whether you have paid your premium in full or are paying it in instalments, such as monthly, bi-annually, or annually. If you pay your premium in full, you may be eligible for a discount.

When you renew your car insurance policy, you will receive a new declaration page with updated information, including any changes to your premium, discounts, coverage, and deductible.

Does Arizona Auto Insurance Cover Glass Repairs?

You may want to see also

Agent and lender information

An auto insurance declaration page is a document that provides a summary of your car insurance policy. It includes details such as the name of the insured individual, their address, and the name of their insurance agent. Additionally, it contains crucial information about any lender (loss payee) associated with the policy. This includes the lender's name and address.

The declaration page serves as a quick reference guide to your auto insurance policy. It outlines the types of insurance covering your vehicle, such as liability, collision, comprehensive, or gap insurance. In the event that you lease your car or have an auto loan, the declaration page will include the lender's information. This is important because, in the event of a claim, the insurance company will need to know who to contact.

The declaration page also includes specific details about the covered vehicle, such as its year, make, model, mileage, and vehicle identification number (VIN). This information is essential for identifying the vehicle and determining the terms of the insurance policy.

It is important to note that the declaration page is not the same as proof of insurance. While it provides a comprehensive overview of your policy, it does not serve as official confirmation of insurance coverage. However, it can be useful to have a copy of your declaration page easily accessible, especially if you need to understand your policy coverage in the event of an accident or incident.

When you receive your declaration page, be sure to review it carefully for any errors or omissions. Common mistakes include misspelled names or addresses, but it's crucial to look for more significant errors as well. You should also notify your insurance provider if you experience any life changes that may impact your policy, as this will result in an updated declaration page being issued.

Auto Insurance Rates: What's a Good Deal?

You may want to see also

Frequently asked questions

An auto insurance declaration page is a summary of your auto policy in one or two pages. It provides important information related to your policy, like when coverage starts and ends, what cars are covered, and the types of coverage you’re paying for.

Your auto insurance declaration page contains a summary of the most important aspects of your car insurance policy, including your name and vehicle information, company or agency contact information, lender information, policy details, premium, and discounts.

Most insurance companies will mail or email your declaration page upon signing up for a new policy or renewing an existing one. You may also be able to find it by logging into the insurance company's website or mobile app, or by contacting your insurer or agent directly.