The average six-month auto insurance premium varies depending on several factors, including the driver's age, gender, location, driving record, and the type of coverage selected. For example, the national average annual cost of car insurance is $1,766 for full coverage and $497 for minimum coverage, according to NerdWallet's September 2024 analysis. Bankrate's research, on the other hand, puts the average monthly cost of car insurance in the U.S. at $196 for full coverage and $53 for minimum coverage.

When it comes to six-month policies, specifically, the average rates can differ from company to company. For instance, The Zebra reports that Liberty Mutual's average six-month premium is $751, while Allstate's rates depend on factors such as state laws, the vehicle driven, driving habits, and chosen limits and deductibles. Additionally, factors like credit score, zip code, and vehicle type can also influence insurance rates.

| Characteristics | Values |

|---|---|

| Average 6-month auto insurance premium | $435 for minimum coverage and $1,341 for full coverage |

What You'll Learn

- The average six-month premium is $1,341 for full coverage and $435 for minimum coverage

- The premium depends on factors like location, age, driving record, credit history, gender, marital status, vehicle, and deductible

- A six-month policy is beneficial if your driving record is improving or you're paying off your car loan

- The premium is adjusted sooner than an annual plan

- The premium can be paid in full or in monthly instalments

The average six-month premium is $1,341 for full coverage and $435 for minimum coverage

The average six-month premium for auto insurance varies depending on several factors, including the type of coverage, driving record, age, and location.

Full Coverage vs Minimum Coverage

On average, a six-month premium for full coverage auto insurance is $1,341, while minimum coverage costs around $435. Full coverage includes liability protection, as well as comprehensive and collision coverage, offering more comprehensive financial protection in the event of an accident. Minimum coverage, on the other hand, only meets the state's legal requirements and tends to be more affordable.

Factors Affecting Premiums

In addition to the level of coverage, auto insurance premiums are influenced by various factors. These include:

- Driving Record: A history of accidents, speeding tickets, or DUIs can significantly increase premiums. For example, rates may increase by 44% after an at-fault accident and by 83% after a DUI.

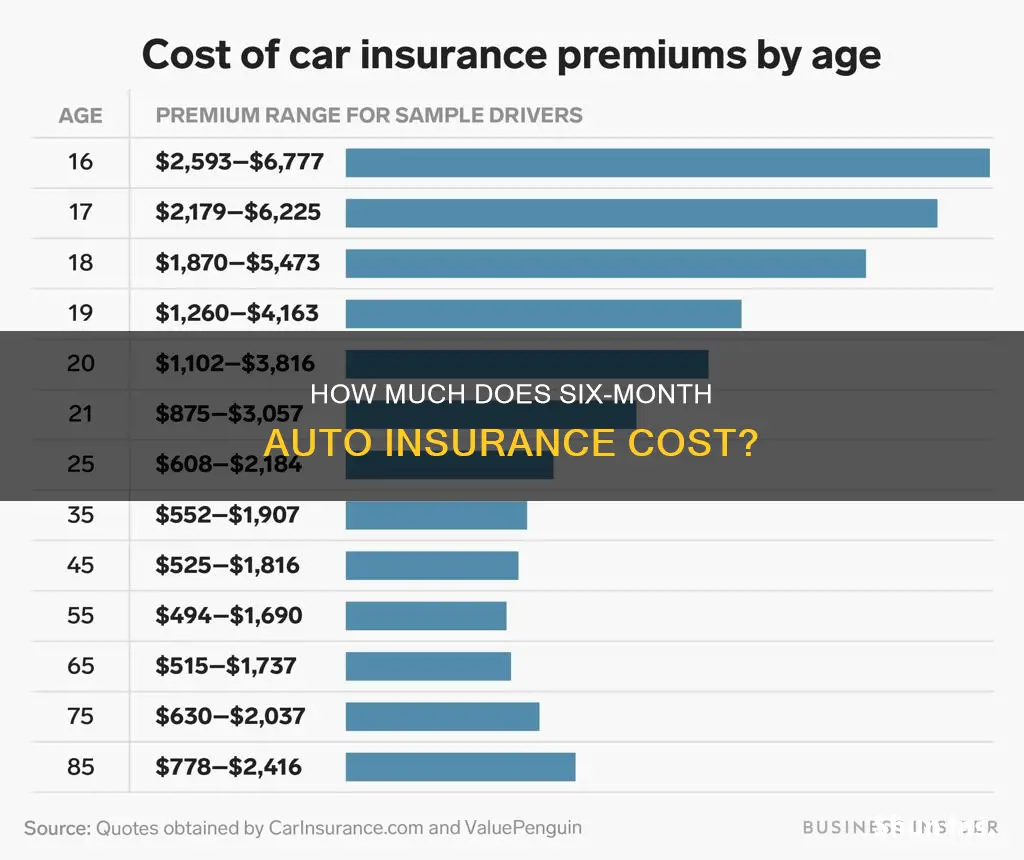

- Age and Gender: Younger and less experienced drivers are often considered higher-risk and, therefore, pay higher premiums. Additionally, male drivers tend to pay more than female drivers, especially at younger ages, due to higher accident rates.

- Location: The state, city, and ZIP code can impact premiums due to variations in accident rates, theft, and coverage requirements. For instance, Michigan has one of the highest average premiums, while South Dakota has the lowest.

- Credit History: In most states, a higher credit score can lead to lower insurance rates, as those with good credit are seen as less likely to file claims.

- Vehicle: Newer and more expensive vehicles tend to be more costly to insure, and certain makes and models may have higher premiums due to higher repair costs or theft rates.

- Deductible: Choosing a higher deductible can lower your premium, but it means you'll pay more out of pocket if an accident occurs.

Benefits of Six-Month Policies

Six-month auto insurance policies offer flexibility and the opportunity for revision. They allow you to switch providers or reevaluate your coverage needs more frequently. Additionally, if your driving record improves or you pay off your car loan, you can take advantage of lower rates sooner rather than waiting a full year.

However, there are also disadvantages to consider. Six-month policies may increase the risk of a lapse in coverage if payments are missed or forgotten, and there is a chance of experiencing premium increases more frequently.

Switching Auto Insurance: What You Need to Know

You may want to see also

The premium depends on factors like location, age, driving record, credit history, gender, marital status, vehicle, and deductible

The average six-month auto insurance premium in the US is influenced by a multitude of factors, including location, age, driving record, credit history, gender, marital status, vehicle, and deductible. Here's a detailed breakdown of how these factors come into play:

Location

Location plays a significant role in determining auto insurance premiums. Insurance companies analyze data related to your place of residence, including accident frequency, weather conditions, population density, crime rates, and road conditions. Urban areas typically result in higher premiums due to increased accident risks and higher population density. Additionally, states with higher claim requirements, such as Michigan, tend to have more expensive insurance rates. On the other hand, rural states like Vermont and South Carolina often have lower premiums.

Age

Age is a critical factor in calculating insurance rates, with younger and older drivers usually paying more. Statistically, younger drivers are more prone to accidents and distracted driving, leading to higher premiums. Similarly, advanced age can lead to decreased reaction times and poorer eyesight, increasing the likelihood of accidents and, consequently, insurance rates.

Driving Record

Your driving record has a substantial impact on your premium. Drivers with at-fault accidents, speeding tickets, or DUI convictions on their records will likely face higher rates. For example, an at-fault accident can increase your premium by approximately 44%.

Credit History

In most states, credit history influences auto insurance rates. Drivers with poor credit scores often pay higher premiums since they are perceived as more likely to file claims. Insurance companies use credit-based insurance scores, similar to regular credit scores, to assess risk and set rates accordingly.

Gender

Gender also affects insurance rates in most states, with men generally paying more than women. This is attributed to men engaging in riskier driving behaviors and having a higher rate of accident severity, according to the Insurance Information Institute. However, the gender-based rate difference tends to decrease as drivers age, becoming negligible after 25.

Marital Status

Married individuals often benefit from lower insurance rates compared to single drivers. Insurance companies associate marriage with more stable and safer driving behaviors, resulting in reduced premiums for married couples.

Vehicle

The type of vehicle you drive significantly impacts your insurance premium. Factors such as the price, availability of parts, safety features, repair costs, and statistical likelihood of accidents are considered when determining rates. Luxury and sports cars often have higher premiums due to their higher value and powerful engines. Additionally, SUVs and vans may have higher liability costs as they can cause more damage to other vehicles in an accident.

Deductible

Your choice of deductible level also affects your premium. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your monthly premium, while a lower deductible will result in a higher premium.

StateFarm Auto-Renew: Opt-Out and Take Control of Your Insurance

You may want to see also

A six-month policy is beneficial if your driving record is improving or you're paying off your car loan

A six-month auto insurance policy is a great option if you're looking for more flexibility and want to avoid being locked into a year-long contract. This type of policy is especially beneficial if your driving record is improving or you're paying off your car loan.

Here's why:

Improving Driving Record

A six-month policy gives you the freedom to find a fair rate based on your current driving record. For example, if your record previously included reckless driving charges but has improved because you've been driving more cautiously, a six-month plan allows you to take advantage of your positive changes sooner rather than later. Your existing provider may even consider lowering your next six-month premium to keep your business.

Paying Off Car Loan

If you're close to paying off your car loan, a six-month policy could work in your favour. Insurance providers typically use your credit score when calculating your rate, so once your loan is paid off, you may be able to secure a better rate.

Flexibility and Revision

With a six-month policy, you have the option to switch insurance providers if you're not happy with the terms offered by your current provider. You can also pay in installments, which can provide financial relief by eliminating the need to pay all your insurance fees upfront. Additionally, you can reevaluate your car insurance needs more frequently, ensuring that your coverage remains aligned with your circumstances.

However, it's important to keep track of your recurrent due dates and renewals to avoid missing payments and potentially losing your coverage.

Auto Insurance: Which State is Cheapest?

You may want to see also

The premium is adjusted sooner than an annual plan

A six-month car insurance premium is adjusted sooner than an annual plan because the policy is only effective for half a year before it's up for renewal. This means that the premium can be adjusted twice a year.

A six-month car insurance policy is a type of insurance in which the car owner makes a single payment to cover their car for six months instead of the traditional 12-month policy plan. This reduced car insurance term gives consumers the flexibility to determine whether they should stay with their current insurer or move to another. It also helps insurance providers re-evaluate the driver's policy rates for the next term.

The benefits of a six-month car insurance policy fall into two categories: flexibility and revision. Flexibility benefits include the ability to switch from one insurance provider to another if the current provider does not offer the terms you like. It also gives you the freedom to re-evaluate your car insurance needs. Revision benefits include the ability to quickly re-establish terms that minimise the risks accepted by the insurance provider.

The premium for a six-month car insurance policy is typically adjusted twice a year, whereas a 12-month policy is only adjusted once a year. This means that the premium for a six-month policy is more likely to change than a 12-month policy.

Get the Cheapest Auto Insurance in California: Tips and Tricks

You may want to see also

The premium can be paid in full or in monthly instalments

The premium for a six-month car insurance policy can be paid in full or in monthly instalments. This type of insurance is a single payment that covers your car for six months instead of the traditional 12-month policy. The reduced term gives consumers the flexibility to determine if they should stay with their current insurer or move to another. It also allows insurance providers to re-evaluate the driver's policy rates for the next term.

The average six-month car insurance premium depends on several factors, including state laws, the type of car, driving habits, and the chosen limits and deductibles. For instance, the average six-month premium for Liberty Mutual is $751. However, rates change over time, so this value may not be the conclusive rate.

When it comes to paying the premium, you can either pay the full amount for the six months upfront or break it down into monthly instalments. Some companies offer a small discount for paying the entire sum at once. Additionally, paying in instalments can provide financial relief by avoiding the need to pay a large sum upfront.

It is important to note that a six-month car insurance policy comes with benefits and drawbacks. On the positive side, it offers flexibility and the opportunity for revision. You can switch providers if desired, and your insurance rates can be adjusted based on improvements in your driving record or milestones such as paying off a car loan. However, one disadvantage is the need to track recurrent due dates and renewals to avoid losing coverage due to missed payments.

Reporting Auto Insurance Fraud in California: What You Need to Know

You may want to see also

Frequently asked questions

The average six-month auto insurance premium in the US varies depending on the company and the type of coverage. The average cost of full coverage car insurance is $2,026 per year, or $1,013 for six months. The average cost of minimum coverage car insurance is $638 per year, or $319 for six months.

Several factors influence the cost of a six-month auto insurance premium, including age, driving record, location, vehicle type, and credit score.

Six-month auto insurance policies offer more flexibility than annual policies. They allow drivers to switch providers or reevaluate their coverage needs more frequently. Additionally, insurance providers can adjust rates more quickly based on changes in a driver's record or risk factors. However, six-month policies may result in higher processing fees and a greater risk of lapses in coverage if payments are missed.