Life insurance is a crucial financial tool that provides peace of mind and financial security for individuals and their families. When considering purchasing life insurance, many people wonder about the average age at which individuals typically obtain this coverage. Understanding this average can help individuals make informed decisions about when to start planning for their long-term financial well-being. The average age for obtaining life insurance varies depending on several factors, including personal circumstances, health, and financial goals. This paragraph will explore these factors and discuss the average age range for people to start considering and purchasing life insurance.

What You'll Learn

- Demographic Factors: Age, gender, health, and lifestyle influence average life insurance ages

- Statistical Trends: Historical data shows average life insurance ages increase with age

- Financial Goals: People often get life insurance as they approach major financial milestones

- Risk Assessment: Younger individuals may get insurance due to lower risk profiles

- Industry Norms: Insurance companies set average ages based on risk and profitability

Demographic Factors: Age, gender, health, and lifestyle influence average life insurance ages

The average age at which individuals consider and purchase life insurance can vary significantly based on several demographic and personal factors. Age is a critical determinant, as younger individuals often have less financial responsibility and may not perceive the immediate need for life insurance. On average, people tend to start considering life insurance in their late 30s or early 40s, when they have established careers, families, and financial commitments. This is when the awareness of the importance of financial security for their loved ones becomes more pronounced.

Gender also plays a role in the timing of life insurance purchases. Historically, women have been more likely to purchase life insurance at younger ages, often due to their longer life expectancy and the desire to provide financial security for their families. However, this trend is changing, with more men recognizing the value of life insurance at younger ages as well.

Health and lifestyle choices are significant factors that can influence the average age of life insurance acquisition. Individuals with healthier lifestyles, including regular exercise, balanced diets, and non-smoking habits, often have lower life insurance premiums. Insurance companies consider these factors because they contribute to a longer life expectancy and reduced risk of health-related issues. Conversely, individuals with pre-existing health conditions or those who engage in high-risk activities may be required to pay higher premiums or may be deemed uninsurable by some companies.

Lifestyle choices, such as occupation and hobbies, also impact life insurance ages. High-risk occupations, such as construction or emergency services, may require individuals to purchase life insurance at a younger age due to the increased likelihood of accidents or injuries. Similarly, adventurous hobbies like skydiving or rock climbing can lead to higher insurance premiums or the need for specialized coverage.

In summary, the average age at which people get life insurance is influenced by a combination of demographic and personal factors. Age, gender, health, and lifestyle choices all play a role in determining when and why individuals decide to purchase life insurance. Understanding these factors can help individuals make informed decisions about their financial security and ensure they have the appropriate coverage at the right time in their lives.

Whole Life Insurance: The Never-Ending Coverage Plan

You may want to see also

Statistical Trends: Historical data shows average life insurance ages increase with age

The average age at which individuals purchase life insurance has been a subject of interest for insurance companies and researchers alike, and historical data reveals some interesting trends. Over the years, there has been a noticeable shift in the age at which people decide to secure life insurance coverage. This trend is particularly evident when examining the average age across different demographic groups and regions.

Historically, life insurance was often associated with older individuals, as the need for financial protection and coverage for dependents was more pronounced in later stages of life. However, recent statistical analysis indicates a gradual increase in the average age of life insurance purchase. This trend suggests that more people are recognizing the importance of life insurance at an earlier age, which could be attributed to various factors.

One possible explanation for this shift is the changing dynamics of modern families. With extended education and career paths, many individuals are now financially independent for longer periods before starting a family. As a result, they may feel more inclined to secure life insurance to protect their families and assets, even at a younger age. Additionally, the increasing awareness of long-term financial planning and the desire to provide for one's loved ones have likely contributed to this trend.

Furthermore, the availability and accessibility of life insurance products have improved, making it more convenient for people to obtain coverage. Insurance companies have tailored their policies to cater to different age groups, offering a range of options that can be customized to suit individual needs. This has likely encouraged more people to consider and purchase life insurance, regardless of their age.

In summary, historical data indicates a positive trend in the average age of life insurance purchase, with more people recognizing the value of coverage at an earlier stage of life. This shift could be attributed to changing family dynamics, increased financial awareness, and the availability of tailored insurance products. Understanding these statistical trends can help individuals make informed decisions about their life insurance needs and ensure they are adequately protected.

Get Active Life and Health Insurance License: Steps and Tips

You may want to see also

Financial Goals: People often get life insurance as they approach major financial milestones

As individuals progress through life, they often encounter significant financial milestones that prompt them to consider life insurance. These milestones can include major purchases, such as a house, or the responsibility of raising a family. For many, the decision to get life insurance is a strategic move to ensure financial security and peace of mind.

When people are planning to buy a home, it becomes a crucial aspect of their financial strategy. Life insurance can provide a safety net for the borrower and their family in the event of an untimely death. This is especially important for those with dependents, as it ensures their financial obligations, such as mortgage payments, are covered. By securing a life insurance policy, individuals can protect their loved ones from the potential financial strain of losing their primary income.

Starting a family is another significant life event that often coincides with the need for life insurance. Young parents might consider this coverage to safeguard their children's future. If the primary breadwinner were to pass away, the insurance payout could cover essential expenses like education, healthcare, and daily living costs, ensuring the family's financial stability. Moreover, life insurance can also be a valuable tool for estate planning, allowing individuals to leave a financial legacy for their heirs.

Additionally, life insurance can be a strategic move for those planning to retire comfortably. As retirement approaches, individuals often want to ensure their financial independence is protected. A life insurance policy can provide a lump sum payment to cover retirement expenses, such as travel, healthcare, and daily living costs, allowing retirees to maintain their desired standard of living. This financial safety net can provide peace of mind, knowing that their future is secured.

In summary, life insurance is a critical financial tool that individuals often consider as they approach major life milestones. It provides a sense of security and peace of mind, ensuring that financial obligations and loved ones' well-being are protected. Whether it's for a new home, a growing family, retirement planning, or estate preservation, life insurance offers a comprehensive solution to meet various financial goals.

Choosing a Contingent Beneficiary: Life Insurance Essentials

You may want to see also

Risk Assessment: Younger individuals may get insurance due to lower risk profiles

The average age at which people typically consider and purchase life insurance is a crucial factor in understanding the insurance market and its demographics. While there is no universal average, research suggests that individuals often start thinking about life insurance in their late 30s or early 40s. However, this is not a one-size-fits-all rule, as many factors influence when and why someone decides to get life insurance.

Younger individuals often have lower risk profiles when it comes to life insurance. This is primarily because they are generally healthier, with lower chances of developing severe medical conditions that could increase insurance premiums. Additionally, younger people often have fewer financial responsibilities, such as large debts or families to support, which can make them less attractive candidates for life insurance companies. As a result, insurance providers may offer more competitive rates to younger individuals, making it an attractive option for those who want to secure their financial future without incurring high costs.

The risk assessment process for younger applicants involves evaluating their overall health, lifestyle choices, and any potential genetic predispositions to certain diseases. Insurance companies often use medical history, family health, and lifestyle factors like smoking, alcohol consumption, and exercise habits to determine the likelihood of future health issues. Younger individuals who can demonstrate a low-risk profile may be eligible for lower premiums or even preferred rates, making life insurance more accessible and affordable for this demographic.

Furthermore, younger people often have more time to build their financial portfolios and secure their long-term financial goals. They can take advantage of the compound interest and long-term investment strategies that life insurance policies offer. By starting early, they can potentially accumulate more significant benefits over time, ensuring their financial security and providing for their loved ones in the event of an unforeseen tragedy.

In summary, younger individuals often benefit from lower risk profiles, making life insurance more accessible and cost-effective for them. Insurance companies use various risk assessment tools to evaluate younger applicants, considering their health, lifestyle, and family history. This approach allows younger people to secure their financial future, build wealth, and provide for their families, all while taking advantage of the lower premiums associated with their age and health status.

Borrowing from AAA Life Insurance: Is It Possible?

You may want to see also

Industry Norms: Insurance companies set average ages based on risk and profitability

The average age at which individuals purchase life insurance is a critical factor in the insurance industry, as it significantly influences risk assessment and profitability. Insurance companies have established norms and guidelines based on extensive data analysis and market trends to determine the optimal age range for policyholders. These norms are primarily driven by the understanding that younger individuals generally present lower risks compared to older adults, and this risk assessment plays a pivotal role in pricing and profitability.

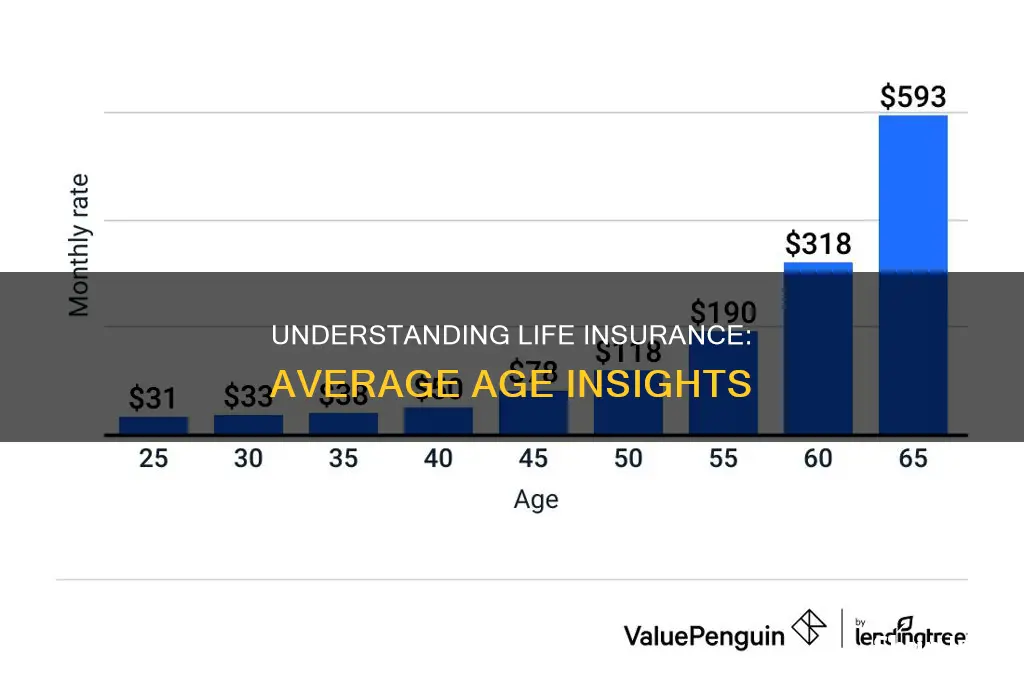

Industry standards suggest that life insurance is often sought at a younger age, typically between 25 and 35 years old. During this period, individuals are considered to be in good health, with fewer pre-existing medical conditions that could impact insurance premiums. Lowering the age range for life insurance policies is a strategic move by insurers to attract a younger demographic, as it allows them to build a robust customer base early on. This approach also enables insurance companies to benefit from the long-term financial stability of younger policyholders, who are more likely to maintain their policies for extended periods.

As individuals progress through their 30s and 40s, the average age for obtaining life insurance may shift slightly. During this phase, people often have established careers, families, and financial responsibilities, making them more inclined to consider life insurance as a means of securing their loved ones' futures. Insurance providers recognize this life stage as a prime opportunity to offer comprehensive coverage, as individuals are more likely to have stable incomes and assets that can be protected through insurance policies.

However, it is essential to note that the average age for life insurance purchases can vary depending on the type of policy and the insurance company's specific offerings. For instance, term life insurance, which provides coverage for a specified period, is often purchased at younger ages, while permanent life insurance, offering lifelong coverage, may be sought at older ages. Additionally, certain life events, such as getting married or starting a family, can prompt individuals to reconsider their life insurance needs and adjust their purchasing decisions accordingly.

In summary, insurance companies set average age norms for life insurance based on a careful evaluation of risk and profitability. Younger individuals are typically encouraged to purchase life insurance due to their lower health risks, while older adults may seek coverage to protect their families and assets. These industry norms guide insurance providers in tailoring their products and services to meet the diverse needs of policyholders at different life stages.

VA's Right to Recover: Resident's Life Insurance

You may want to see also

Frequently asked questions

The average age for purchasing life insurance varies depending on several factors, including the type of policy and the individual's health and lifestyle. Generally, term life insurance is more commonly taken out at a younger age, typically between 25 and 35, as it provides coverage for a specific period, often 10, 20, or 30 years. This age group often has higher premiums due to the perceived risk of mortality.

Yes, getting life insurance at a younger age can be advantageous. Younger individuals often have lower premiums because they are considered healthier and have a longer life expectancy. Additionally, younger people might find it easier to qualify for certain types of policies, especially those with higher coverage amounts. The younger you are when you take out a policy, the more time your beneficiaries have to benefit from the coverage.

Absolutely! Life insurance is not exclusively for the young. Older individuals can still find value in having a life insurance policy, especially if they have financial dependents or specific goals they want to achieve. Permanent life insurance, such as whole life or universal life, can provide lifelong coverage and accumulate cash value over time. However, premiums for older individuals may be higher, and underwriting processes might be more rigorous.

Several factors contribute to the cost of life insurance, and these factors can vary with age. Younger individuals might have lower premiums due to their age, health, and perceived longevity. As people age, factors like health conditions, lifestyle choices, family medical history, and occupation can impact the cost. Additionally, the type of policy, coverage amount, and term length also play a significant role in determining the premium.