Life insurance is a financial tool that provides protection and peace of mind for individuals and their loved ones. At its core, life insurance is a contract between an individual (the policyholder) and an insurance company. The basic premise is that the insurance company agrees to pay a predetermined amount of money (the death benefit) to the policyholder's designated beneficiaries upon the insured individual's death. This financial safety net can help cover various expenses, such as mortgage payments, funeral costs, and outstanding debts, ensuring that the policyholder's family is financially protected during difficult times. Understanding the fundamentals of life insurance, including its types, coverage options, and benefits, is essential for anyone considering this important financial decision.

What You'll Learn

- Definition: Life insurance is a contract between an individual and an insurer, providing financial protection for beneficiaries in the event of death

- Types: Term, whole life, universal life, and variable life are common types with distinct features and benefits

- Benefits: Payouts offer financial security, covering expenses like funeral costs, mortgage payments, and living expenses for dependents

- Premiums: Policyholders pay regular premiums, which can be adjusted based on age, health, and coverage amount

- Claims Process: Upon death, beneficiaries submit a claim, and the insurer verifies eligibility before disbursing the death benefit

Definition: Life insurance is a contract between an individual and an insurer, providing financial protection for beneficiaries in the event of death

Life insurance is a fundamental financial tool that offers individuals and their families a safety net during challenging times. At its core, it is a legal agreement, or contract, between two parties: the policyholder (the individual purchasing the insurance) and an insurance company or insurer. This contract is designed to provide financial security and peace of mind, especially for the policyholder's loved ones, in the event of the policyholder's death.

In this agreement, the policyholder pays a premium (a regular payment made to the insurer) in exchange for a promise from the insurer to pay a specified sum of money (the death benefit) to one or more designated beneficiaries upon the policyholder's passing. The primary purpose is to ensure that the financial obligations and commitments of the deceased are met, providing a financial cushion for their dependents. This can include covering expenses such as funeral costs, outstanding debts, mortgage payments, or simply replacing the income that the deceased provided for their family.

The beauty of life insurance lies in its ability to offer financial protection and stability when it is needed most. It allows individuals to plan for the future, knowing that their loved ones will be taken care of, even if they are no longer around. This contract is a powerful tool for risk management, ensuring that the financial well-being of a family is not compromised by unforeseen circumstances.

When choosing a life insurance policy, individuals can select from various types, such as term life, whole life, or universal life, each with its own features and benefits. The key is to find a policy that aligns with one's financial goals, risk tolerance, and the level of coverage needed to protect one's loved ones.

In summary, life insurance is a critical component of financial planning, offering a safety net and financial protection for beneficiaries when the policyholder passes away. It is a contract that provides peace of mind and ensures that the legacy of the deceased continues through the support of their loved ones.

Debt-Free Life Insurance: What You Need to Know

You may want to see also

Types: Term, whole life, universal life, and variable life are common types with distinct features and benefits

Life insurance is a financial tool that provides a safety net for individuals and their loved ones. It is a contract between an individual (the policyholder) and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the policyholder's death. The primary purpose of life insurance is to offer financial security and peace of mind, ensuring that the policyholder's family or beneficiaries are protected financially during challenging times.

When considering life insurance, it's essential to understand the different types available, each with its own unique characteristics and benefits. Here's an overview of four common types:

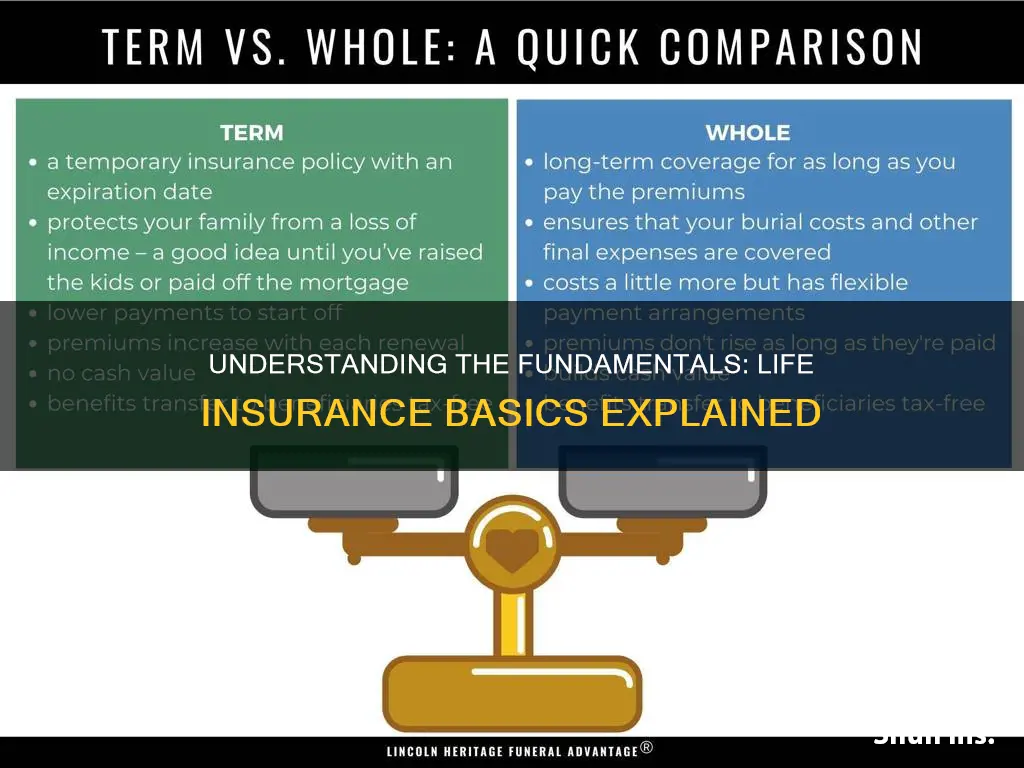

Term Life Insurance: This is a straightforward and affordable type of life insurance. It provides coverage for a specified period, known as the "term," which can range from 10 to 30 years or even longer. During this term, the policyholder pays regular premiums, and in return, the insurer guarantees a death benefit if the insured individual passes away within the term period. Term life insurance is ideal for those seeking temporary coverage, especially for a specific period, such as covering mortgage payments or providing financial support to dependents. One of its key advantages is its simplicity and cost-effectiveness, making it a popular choice for those on a budget.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a guaranteed death benefit and a cash value component that accumulates over time. The premiums for whole life insurance are typically higher than term life but remain constant throughout the policy's life. This type of insurance offers long-term financial security and a fixed interest rate on the cash value, which can be borrowed against or withdrawn. Whole life insurance is suitable for those seeking lifelong coverage and the potential for tax-deferred growth.

Universal Life Insurance: This type of policy offers flexibility and adaptability. It provides permanent coverage and allows policyholders to adjust their premiums and death benefits over time. Universal life insurance has an investment component, where a portion of the premium is invested in various investment options offered by the insurance company. The policyholder can choose to increase or decrease the death benefit and premium payments based on their financial goals and needs. This type of insurance is suitable for those who want control over their policy and the potential for higher returns on their investments.

Variable Life Insurance: Variable life insurance combines permanent coverage with an investment component, similar to universal life. However, the investment options and returns vary, providing more flexibility in investment choices. Policyholders can select from a range of investment accounts, and the death benefit is adjusted based on the performance of these investments. Variable life insurance offers the potential for higher returns but also carries more investment risk. It is suitable for individuals who want to customize their policy and have a higher tolerance for investment-related risks.

Each type of life insurance has its own advantages and is chosen based on individual financial goals, risk tolerance, and long-term plans. Understanding these distinctions is crucial for making an informed decision when selecting the right life insurance policy to meet one's specific needs.

Kansas Death Certificate Requirement for Life Insurance

You may want to see also

Benefits: Payouts offer financial security, covering expenses like funeral costs, mortgage payments, and living expenses for dependents

Life insurance is a financial tool that provides a safety net for individuals and their loved ones. At its core, the primary benefit of life insurance is the financial security it offers through payouts. These payouts are designed to provide a financial cushion during challenging times, ensuring that the insured's family or beneficiaries are protected.

When an individual purchases life insurance, they essentially enter into a contract with an insurance company. This contract specifies the terms and conditions, including the amount of coverage (often referred to as the death benefit) and the premium payments. Upon the insured's passing, the insurance company is obligated to pay out the death benefit to the designated beneficiaries. This payout can be a significant financial resource, offering much-needed support to those left behind.

The versatility of life insurance payouts is one of its key strengths. These funds can be utilized to cover a wide range of expenses, ensuring that the financial burden of the surviving family members is alleviated. For instance, the payout can be used to cover funeral and burial costs, providing peace of mind during an already difficult time. Additionally, it can help with mortgage payments, preventing the loss of a home and the associated financial strain. Perhaps most importantly, the proceeds can be allocated to cover the living expenses of dependents, such as children or a spouse, ensuring their financial well-being and stability.

In many cases, life insurance payouts can provide a sense of financial security that allows individuals to rest easier, knowing that their loved ones will be taken care of. This peace of mind can be invaluable, especially when considering the potential long-term financial implications of an untimely death. By providing a financial safety net, life insurance empowers individuals to make choices and plan for the future with greater confidence.

Furthermore, the flexibility of life insurance payouts allows beneficiaries to make decisions that best suit their needs. They can choose to use the funds to pay off debts, invest in education, or even start a new business, ensuring that the insurance policy's benefits are tailored to the specific requirements of the family. This adaptability is a significant advantage, offering a personalized approach to financial security.

Life Insurance: Legal Fees Coverage and Benefits

You may want to see also

Premiums: Policyholders pay regular premiums, which can be adjusted based on age, health, and coverage amount

Life insurance is a financial product designed to provide financial protection and peace of mind to individuals and their loved ones. At its core, life insurance is a contract between the policyholder and an insurance company, where the insurer promises to pay a designated sum of money (the death benefit) to the policyholder's beneficiaries upon the insured individual's death. This death benefit can be used to cover various expenses and provide financial security during a difficult time.

One of the fundamental aspects of life insurance is the concept of premiums. Premiums are regular payments made by the policyholder to the insurance company in exchange for the coverage provided. These premiums are typically paid annually, semi-annually, quarterly, or monthly, depending on the insurance company's policies and the policyholder's preferences. The amount of the premium is carefully calculated to ensure that the insurance company can fulfill its financial obligations while also providing a fair return on investment for the policyholder.

The calculation of premiums takes into account several factors, primarily the policyholder's age, health, and the coverage amount they wish to purchase. Age is a critical factor because it is associated with an individual's life expectancy and the likelihood of making a claim. Younger individuals generally pay lower premiums as they have a longer lifespan ahead, reducing the risk of an early claim. Health is another crucial consideration, as pre-existing medical conditions or lifestyle factors can impact the likelihood of developing health issues that may lead to a claim. Insurance companies often use medical underwriting to assess the risk associated with insuring an individual.

In addition to age and health, the coverage amount, or the death benefit, also influences premium costs. A higher coverage amount means a larger payout if the insured individual passes away, which typically results in higher premiums. The insurance company must ensure that the premiums collected are sufficient to cover the potential payouts and administrative costs associated with the policy.

Policyholders should be aware that premiums can be adjusted over time. As individuals age, their health may change, and their financial circumstances can also evolve. Insurance companies may review and adjust premiums periodically to reflect these changes accurately. For instance, if a policyholder's health improves significantly, the insurer might lower the premiums to reflect the reduced risk. Conversely, if health deteriorates or if the policyholder's financial situation changes, premiums may increase to maintain the desired level of coverage. This flexibility ensures that the policy remains tailored to the policyholder's needs and provides appropriate protection throughout their life.

Life Insurance Payouts: When and How to Claim Them

You may want to see also

Claims Process: Upon death, beneficiaries submit a claim, and the insurer verifies eligibility before disbursing the death benefit

The claims process for life insurance is a critical aspect of the policy's fulfillment, ensuring that beneficiaries receive the intended financial support upon the insured's passing. When an individual's life insurance policy comes into effect, the process begins with the beneficiaries submitting a claim to the insurance company. This claim typically involves providing the insurer with proof of the insured's death, such as a death certificate, along with any necessary documentation to support the claim. The information provided must be accurate and complete to avoid delays or complications.

Once the claim is received, the insurer's role is to verify the eligibility of the claim. This verification process is a crucial step to ensure that the death benefit is paid out to the rightful recipients. The insurer will review the policy details, including the insured's personal information, the policy type, and the beneficiaries named in the policy. They will also cross-reference the provided death certificate and any additional supporting documents to confirm the accuracy of the information. This step is essential to prevent fraud and ensure the policy's terms are upheld.

During the verification process, the insurer may contact the beneficiaries or the insured's estate administrator to gather further information or clarify any details. This could include requesting additional documentation, such as a will or estate inventory, to ensure the claim is valid and in line with the policy's provisions. The insurer's goal is to make an informed decision and provide the death benefit efficiently while maintaining the integrity of the process.

After the eligibility is confirmed, the insurer will proceed with disbursing the death benefit as per the policy's terms. This benefit is typically paid out to the beneficiaries in a lump sum or according to a predetermined schedule, depending on the policy type. The process may vary slightly depending on the insurance company's procedures and the specific policy in place. However, the core elements of claim submission, verification, and benefit disbursement remain consistent.

In summary, the claims process for life insurance is a structured procedure that ensures the efficient and accurate distribution of death benefits to beneficiaries. It involves a series of steps, from claim submission to verification and, ultimately, the payment of the death benefit. This process is designed to provide financial support to those who have lost a loved one, offering peace of mind and financial security during challenging times.

Life Insurance Dividends: Future Payment Methods Explored

You may want to see also