Finding the best auto insurance company in New Jersey can be challenging, but it's important to do your research to ensure you get a plan that suits your needs and budget. Several companies offer competitive rates in the state, including Geico, State Farm, and NJ Manufacturers. When choosing an auto insurance company, it's essential to consider factors such as coverage options, discounts, customer satisfaction, and financial strength ratings. By comparing these factors, you can find a plan that offers the best value for your money. Additionally, it's worth noting that New Jersey is a no-fault state, which means that personal injury protection (PIP) coverage is required by law. When shopping for auto insurance in New Jersey, be sure to keep these factors in mind to find the plan that best suits your needs.

| Characteristics | Values |

|---|---|

| Best Car Insurance in New Jersey | Travelers, Geico, State Farm, Progressive, NJM Insurance |

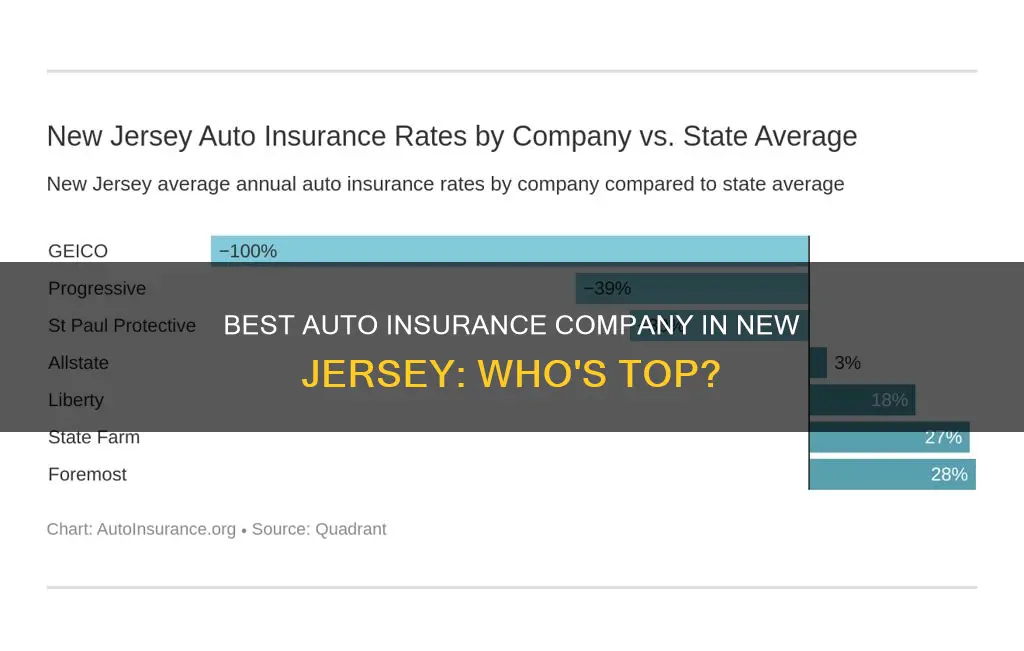

| Cheapest Car Insurance in New Jersey | Geico |

What You'll Learn

Best auto insurance for young drivers in New Jersey

Young drivers in New Jersey can expect to pay higher insurance premiums than older drivers due to their lack of driving experience. However, there are several insurance companies that offer competitive rates for young drivers in the state.

Geico

Geico is a popular choice for young drivers in New Jersey, as it offers affordable premiums and a long list of potential discounts. These include savings for federal employees, military members, safe drivers, and good students. Geico also has a robust digital app that allows users to request roadside assistance, view ID cards, make payments, file claims, and request policy changes. According to Bankrate, Geico is the best insurance company in New Jersey for young drivers.

State Farm

State Farm is another good option for young drivers in New Jersey, especially given its Steer Clear and good student discounts. The company has a vast network of local exclusive agents in the state, providing accessible and localized services for residents. State Farm is the largest insurance company in the country by market share.

Travelers

Travelers could be a good choice for young drivers who are looking to bundle their home and auto insurance, as it offers competitive rates and the opportunity to save through bundling. Travelers also offers unique coverage options, such as gap coverage and umbrella policies. In addition, Travelers has a strong financial standing and is one of the biggest insurers in the country.

NJM

NJM is a regional insurer based in West Trenton, New Jersey, serving customers in Connecticut, Maryland, New Jersey, Ohio, and Pennsylvania. While NJM does not offer a wide selection of coverage packages, it has lower-than-average rates for drivers with an accident on their record. NJM also ranked second in overall customer satisfaction in J.D. Power's 2023 U.S. Auto Claims Satisfaction Study.

Progressive

Progressive is a good option for young drivers seeking the best discounts. The company offers savings for smart students, distant students, claim-free drivers, getting a quote online, enrolling in autopay, and more. Progressive also has a safe driver rewards program called Snapshot, which can provide additional savings.

Allstate

Allstate is a good choice for first-time young drivers purchasing car insurance, as it offers helpful online tools and resources, such as a coverage calculator and car payments calculator. Allstate also offers a good selection of discounts.

Insuring Your Vehicle: Tax and Insurance Days

You may want to see also

Best auto insurance for seniors in New Jersey

When it comes to auto insurance for seniors in New Jersey, there are a few companies that stand out. According to a few sources, Geico is a great option for seniors, as it offers the cheapest rates in the state. In fact, Geico has the lowest rate at $1,065 per year for both 60-year-old married men and women.

However, other sources suggest that New Jersey Manufacturers (NJM) is the cheapest option for seniors in the state. According to CarInsurance.com, NJM offers the cheapest rate for senior drivers at about $1,171 per year, or $98 per month. Additionally, NJM received the fewest customer complaints relative to insurers of its size and ranked third for overall customer satisfaction in J.D. Power's 2023 U.S. Auto Claims Satisfaction Study.

Other options for auto insurance for seniors in New Jersey include:

- State Farm: State Farm is a popular insurer with fewer complaints compared to other large competitors. It also has a highly-rated mobile app and offers generous coverage and discounts for good driving habits.

- Travelers: Travelers offers a broad range of coverage options and discounts, and it is one of the biggest insurers in the country. However, its customer satisfaction ratings are below average.

- Selective: Selective is a regional insurer that offers some of the cheapest average car insurance rates in New Jersey. It also provides unique add-ons like pet injury coverage.

It's important to note that auto insurance rates are highly personalized, and the best option for you may depend on various factors, such as your age, driving record, and coverage needs. It's always a good idea to shop around and compare quotes from multiple companies to find the best rate and coverage for your specific needs.

Verify Auto Insurance Coverage: Quick and Easy Steps

You may want to see also

Best auto insurance for military families in New Jersey

Military families in New Jersey have a few options for auto insurance. Here are some of the best:

USAA

USAA is a great choice for military families in New Jersey. It provides car insurance for current and former military personnel and their families. While state-specific rates aren't available, USAA is known for its cheap rates and high levels of customer satisfaction. USAA also has a track record of financial strength and is available in all 50 states and Washington, D.C.

Geico

Geico is the largest car insurance company in New Jersey, selling roughly a quarter of all auto policies in the state. It has the cheapest car insurance in New Jersey, with an average price of just $49 per month for a liability-only policy. Geico also offers a discount of up to 15% for current and former military, and up to 25% off for those deployed to an imminent danger zone. Geico has a robust website and mobile app, and a strong network of local agents in New Jersey.

Armed Forces Insurance (AFI)

AFI offers auto insurance to veterans, active-duty service members, and their families. It's available in all 50 states and has an A+ rating from the Better Business Bureau. AFI members receive identity theft resolution services and resources for a permanent change of station. However, customer service is not available on weekends.

Farmers

Farmers Insurance has a long roster of agents in New Jersey's largest cities, including Edison and Newark. It offers a 10% discount for former and current military, as well as discounts for students, veterans, certain professions, safe drivers, and customers with a history of no missed payments. Farmers has a strong network of agents in New Jersey, but its policies typically cost more than the state average.

Auto-Owners

Auto-Owners Insurance is only available in 26 states, but it offers affordable premiums with high customer satisfaction ratings. It has a low NAIC complaint index score and offers 12 types of discounts, as well as various other types of insurance besides auto. Auto-Owners also has useful add-ons like gap insurance and additional expense coverage.

Weekend Worries: Auto Insurance Automatic Payments

You may want to see also

Best auto insurance for drivers with poor credit in New Jersey

Poor credit can lead to higher car insurance premiums. If you're a driver with poor credit in New Jersey, you may want to consider the following companies:

- Geico: With an average rate of $91 a month for full coverage, Geico is the cheapest car insurance option in New Jersey. The company also offers a host of car insurance discounts. However, it does not offer gap insurance.

- State Farm: State Farm offers numerous discounts and extras, including travel expense coverage. It is the largest personal auto insurance company in the country and has fewer complaints compared to other large competitors.

- Travelers: Travelers is one of the biggest insurers in the country and has a strong financial standing. It offers unique coverage packages, such as its Premier Responsible Driver Plan, which provides accident forgiveness and disappearing deductibles for accident-free drivers.

- NJM: NJM is a regional insurer based in West Trenton, New Jersey, and sells auto insurance in only five states. It has the fewest customer complaints to state regulators relative to insurers of its size. It also ranked third for overall customer satisfaction in J.D. Power's 2023 U.S. Auto Claims Satisfaction Study.

- Selective: Selective is a regional insurer based in Branchville, New Jersey, and is one of the cheapest car insurance companies in the state. It offers unique add-ons like pet injury coverage.

Does Being Hit Mean Higher Auto Insurance?

You may want to see also

Best auto insurance for drivers with a DUI in New Jersey

If you have a DUI on your driving record, you will likely pay more for car insurance than other drivers. This is because a DUI is considered a serious driving violation that will remain on your driving record for several years. The best auto insurance for drivers with a DUI in New Jersey will depend on your individual needs and budget. Here are some options to consider:

- Geico: Geico is one of the largest auto insurance providers in the country and offers affordable rates for drivers with a DUI. They provide a user-friendly mobile app and a DriveEasy program that incentivizes safe driving habits with rate discounts. Geico also offers accident forgiveness coverage, which can be beneficial if you have a DUI on your record.

- Progressive: Progressive is known for offering reasonable rates to high-risk drivers, including those with a DUI. They have a usage-based insurance program called Snapshot, which can help you save money on your premium by monitoring your driving habits. Progressive also offers accident forgiveness coverage.

- State Farm: State Farm is a reputable insurance company with a strong financial standing. They offer a safe driving program called Steer Clear, which may help offset the cost of insurance for drivers with a DUI. State Farm also provides good student discounts, which can be beneficial for young drivers.

- Travelers: Travelers is another reputable insurance company with a strong financial standing. They offer accident forgiveness and a telematics program called IntelliDrive, which can help you access lower rates by monitoring your driving habits. Travelers also provide a good student discount.

- Local or Regional Insurance Companies: In addition to the larger insurance companies, you may want to consider getting quotes from local or regional insurance providers in New Jersey. These smaller companies often have competitive rates and may be more flexible in insuring high-risk drivers.

When shopping for auto insurance with a DUI, it's essential to compare rates and coverage options from multiple companies. Consider the discounts offered, the financial strength of the company, and the level of customer service provided. Additionally, maintaining a clean driving record going forward and improving your credit score can also help you secure better rates over time.

Auto Inspections: The Key to Unlocking Lower Insurance Rates?

You may want to see also

Frequently asked questions

According to sources, the best auto insurance company in New Jersey is Travelers, with Geico, State Farm, Progressive, and NJM Insurance following closely behind.

The ranking was based on coverage, reputation, industry standing, availability, cost, discounts, and customer experience.

The average cost of car insurance in New Jersey is $2,412 per year for full coverage and $984 for a minimum coverage policy.