Travelers, Erie Insurance, Nationwide, State Farm, and USAA are some of the best auto insurance companies in Pennsylvania. The best auto insurance provider for you will depend on your age, budget, coverage needs, and other factors.

What You'll Learn

- Who has the cheapest auto insurance in Pennsylvania?

- What are the best auto insurance companies in Pennsylvania for young drivers?

- What are the best auto insurance companies in Pennsylvania for drivers with poor credit?

- What are the best auto insurance companies in Pennsylvania for military members?

- What are the best auto insurance companies in Pennsylvania for customer satisfaction?

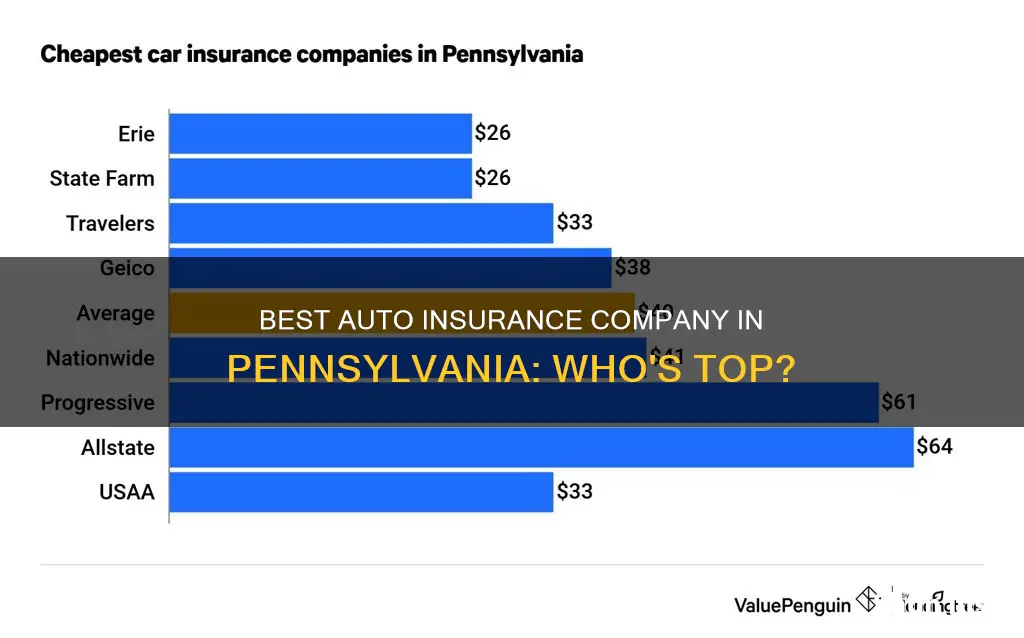

Who has the cheapest auto insurance in Pennsylvania?

The cheapest car insurance in Pennsylvania depends on several factors, including age, driving history, and location.

For 22 to 29-year-old drivers, Travelers offers the cheapest full coverage at $1,284 annually ($107 per month) and the cheapest minimum coverage at $601 annually ($50 per month).

For teens, State Farm offers the cheapest rates, with full coverage costing an average of $3,732 per year.

For senior drivers, State Farm is also the cheapest option, with full coverage costing an average of $1,497 per year.

In Pennsylvania, the average cost of full coverage is $3,909 per year, while minimum coverage costs an average of $893 per year.

Some of the cheapest car insurance companies in Pennsylvania include:

- State Farm

- Erie Insurance

- Nationwide

- USAA

- Progressive

- Geico

- Auto-Owners

- Travelers

Auto Insurance Ratings: Nationwide's Performance Reviewed

You may want to see also

What are the best auto insurance companies in Pennsylvania for young drivers?

When it comes to auto insurance for young drivers in Pennsylvania, there are a few companies that stand out as offering the best rates and services. Here is a detailed overview of the top providers:

Travelers

Travelers is consistently ranked as one of the most affordable options for car insurance in Pennsylvania, especially for young drivers. Their rates are significantly lower than the state average, offering a cheap alternative for those on a budget. For example, their average annual premium for young adult drivers is $971, compared to the statewide average of $1,669. They also have a below-average customer satisfaction rating, which is something to keep in mind.

Erie

Erie is another excellent option for young drivers in Pennsylvania, particularly for those seeking minimum coverage. Their rates are highly competitive, often coming in well below the state average. For instance, their minimum coverage policy for young drivers is 41% cheaper than the state average. They also receive positive reviews for their customer service and quick claims process, which can be invaluable in the event of an accident.

The Hartford

The Hartford is a good choice for young drivers in Pennsylvania who are seeking full coverage. Their rates are very competitive, offering full coverage for an 18-year-old at $210 per month, which is 42% cheaper than the state average for teen drivers. While their customer service reviews are not as strong as Erie's, they still provide a solid option for those seeking comprehensive protection.

USAA

USAA is a highly-rated insurance company that caters specifically to active military members, veterans, and their families. They offer some of the best rates and customer service in the industry, but their limited eligibility restricts their accessibility. If you qualify for their services, they are definitely worth considering.

Nationwide

Nationwide is a good option for young drivers in Pennsylvania, especially those with poor credit. Their rates are lower than the state average, and they offer a range of discount programs that can further reduce costs. They also have two telematics programs, SmartRide and SmartMiles, which can help tailor your coverage and pricing to your driving habits.

In conclusion, while there are several strong contenders for the best auto insurance companies in Pennsylvania for young drivers, the stand-out options are Travelers, Erie, The Hartford, USAA, and Nationwide. These providers offer a combination of competitive rates, strong customer service, and tailored coverage options that cater to the unique needs of young drivers. It is always recommended to compare quotes and review the specific details of each company's offerings before making a decision.

Auto Insurance Class 28: What Does it Mean?

You may want to see also

What are the best auto insurance companies in Pennsylvania for drivers with poor credit?

When it comes to auto insurance in Pennsylvania, drivers with poor credit may find themselves facing higher premiums. This is because insurance companies consider those with lower credit scores to be high-risk. However, there are still some great options for drivers in this situation.

Nationwide is a good choice for drivers with poor credit, as it offers affordable rates and a variety of add-on coverages. They also have a wide range of discount opportunities, so you may be able to save even more on your premium. In addition, they have received high ratings from the Better Business Bureau and AM Best, indicating financial stability.

Another option to consider is State Farm. While their rates may be slightly higher than some other providers, they offer a wide range of optional coverages, including rideshare insurance and roadside assistance. They also have a highly-rated mobile app that makes it easy to manage your policy and submit claims. State Farm also received high marks in customer satisfaction surveys.

If you're looking for a more affordable option, The Hartford might be a good choice. They offer cheap rates for drivers with poor credit, and they have excellent customer service reviews. However, it's important to note that The Hartford is not available in all states.

When choosing an auto insurance company, it's important to consider your own needs and preferences. Be sure to shop around and compare quotes from multiple providers to find the best rate and coverage for your situation.

Registering and Insuring a Vehicle in Hawaii

You may want to see also

What are the best auto insurance companies in Pennsylvania for military members?

Pennsylvania is home to the fourth-largest veteran population in the United States, with 800,000 veterans and approximately 80,000 active-duty military and National Guard members and their families.

USAA is the best auto insurance company for military members and their families in Pennsylvania. It offers the best cheap insurance for military members, with rates costing an average of $88 per month. USAA also provides both cheap rates and great service tailored to the military lifestyle.

USAA has the best rates and customer service, with rates 30% cheaper than the average cost of insurance from top companies. It also has great customer satisfaction, with a five out of five rating in J.D. Power's survey for shopping experience, claims processing, and overall satisfaction.

USAA is only available to current and former military members and their families. However, Erie Insurance is another good option for military members who are not eligible for USAA. Erie has positive customer service reviews and some of the cheapest rates in the state.

Other auto insurance companies in Pennsylvania that are good for military members and veterans include:

- State Farm: Offers cheap rates and discounts for military members.

- Geico: Offers a 15% military discount and good rates for retired service members and those not deployed.

- Nationwide: Offers competitive rates and discounts for military members.

- Travelers: One of the cheapest auto insurers for military members and veterans.

Auto Rental Companies in Scotland: US CDW Insurance Valid?

You may want to see also

What are the best auto insurance companies in Pennsylvania for customer satisfaction?

When it comes to customer satisfaction for auto insurance in Pennsylvania, several companies stand out for their impressive performance and competitive pricing. Here is a list of the top auto insurance companies in Pennsylvania for customer satisfaction:

- Auto-Owners Insurance: Auto-Owners excels in customer satisfaction, claims handling, and coverage options. They offer a range of common and rare discounts, ensuring drivers have ample opportunities to save money. Auto-Owners also provides unique coverages, such as diminished value coverage, which compensates for a vehicle's loss in value after an accident. Their customer satisfaction rating is 44 out of 45, and they have a perfect coverage score of 10 out of 10.

- Erie Insurance: Erie Insurance is known for its high customer satisfaction and claims satisfaction ratings, especially in the Mid-Atlantic region. They offer affordable rates and a variety of discounts, including for young drivers. Erie also provides valuable add-ons, such as first accident forgiveness, rental car reimbursement, and new car replacement coverage.

- State Farm: State Farm is a popular insurer with high customer satisfaction ratings. They offer generous coverage and discounts for good driving habits. State Farm's website and mobile app are easy to use, allowing drivers to view their policies and submit claims conveniently. They also have better-than-average customer satisfaction ratings for buying auto insurance, according to J.D. Power.

- NJM Insurance: NJM Insurance stands out for its high customer satisfaction and low number of customer complaints relative to its size. They offer a great set of discounts and the possibility of dividend payments for New Jersey policyholders. However, NJM is only available in five states.

- Travelers: Travelers is one of the largest insurance providers in the nation and offers a broad range of coverage options and discounts. They have received slightly below-average customer satisfaction ratings but excel in other areas, such as coverage options and financial strength.

- Chubb: Chubb is a close contender when it comes to customer service in Pennsylvania. While they have higher costs than Auto-Owners, they still offer impressive customer satisfaction and claims handling services.

- The Hartford: The Hartford specializes in providing affordable rates for senior drivers in Pennsylvania who are AARP members. They offer various endorsements, including gap insurance, accident forgiveness, and new car replacement. The Hartford also provides unique coverage for household chores if you're injured in an accident.

Auto Insurance Shopping: Tricks to Find the Best Deals

You may want to see also

Frequently asked questions

The best auto insurance company in Pennsylvania is subjective and depends on individual needs and preferences. However, some of the top-rated companies include Erie, State Farm, and USAA.

When choosing an auto insurance company in Pennsylvania, it is important to consider factors such as cost, coverage options, customer service, and financial strength. It is also essential to ensure that the company is licensed to operate in the state.

Pennsylvania requires drivers to have bodily injury liability coverage of at least $15,000 per person and $30,000 per accident, property damage liability coverage of $5,000 per accident, and medical benefits coverage of $5,000.

To switch your auto insurance to a new company in Pennsylvania, you will need to contact your current insurance provider and cancel your existing policy. You will then need to purchase a new policy from the new company and provide them with the necessary documentation, such as your driver's license and vehicle registration.

To get the best auto insurance rates in Pennsylvania, consider comparing quotes from multiple companies, maintaining a good driving record, and taking advantage of discounts offered by insurance providers. Additionally, consider increasing your deductible, as this can lower your premium.