Nationwide is one of the largest and most diversified insurance and financial services organizations in the United States. It has been in business for almost 90 years and has a rating of 2.9/5 from WalletHub editors and a 3.3/5 average rating from users. It also has an A+ rating from the Better Business Bureau. The company is ranked third overall in a rating of the best car insurance companies and is in the top half of ratings for customer service, claims handling, and customer loyalty. Its average annual rate is the fourth-lowest among providers.

| Characteristics | Values |

|---|---|

| WalletHub editors rating | 2.9/5 |

| WalletHub users rating | 3.3/5 |

| Better Business Bureau rating | A+ |

| WalletHub price comparison | Most expensive quartile |

| NAIC rating | 0.65 |

| J.D. Power rating | N/A |

| U.S. News rating | #3 |

| MarketWatch rating | 4.6/5 |

| Trustpilot rating | 1.6/5 |

| BBB customer rating | 1.1/5 |

What You'll Learn

Nationwide's customer service

Nationwide is rated highly for its customer service. The company is ranked third for customer service by US News, with 61% of customers reporting that they were completely satisfied with how easy it was to contact the company. WalletHub gives Nationwide a rating of 2.9/5 based on customer reviews, with consumers tending to focus on good customer service and quick claims payments. MarketWatch also gives Nationwide a rating of 4.5/5 for customer experience.

In addition, Nationwide has an above-average rating from the National Association of Insurance Commissioners (NAIC), meaning it has received fewer complaints than the average car insurance provider.

Texas Auto Insurance Recognition: Out-of-State Policies Explained

You may want to see also

Nationwide's ratings

Nationwide is one of the largest and most diversified insurance and financial services organisations in the United States. It has been in business for almost 90 years and has a solid reputation.

WalletHub Ratings

WalletHub gives Nationwide a 2.9/5 rating based on customer reviews, sample insurance quotes and ratings from organisations such as J.D. Power and the Better Business Bureau (BBB). WalletHub users give Nationwide an average rating of 3.3/5. WalletHub also notes that Nationwide has an NAIC rating of 0.65, which means it has received fewer complaints than the average car insurance provider.

U.S. News Ratings

Nationwide is ranked #3 overall in U.S. News' rating of the best car insurance companies. It is in the top half of ratings for customer service, claims handling, and customer loyalty.

MarketWatch Ratings

MarketWatch gives Nationwide a rating of 4.6/5. It also notes that Nationwide has an A+ rating from the Better Business Bureau (BBB) and an A financial strength rating from AM Best.

NerdWallet Ratings

NerdWallet gives Nationwide 4/5 stars for overall performance. It notes that Nationwide has fewer than the expected number of complaints to state regulators for auto insurance. However, it also notes that customer satisfaction for auto insurance is lower than average.

Mile Auto: Good Insurance Option?

You may want to see also

Nationwide's insurance rates

Nationwide Insurance is one of the largest and most diversified insurance and financial services organizations in the United States. It has been in business for almost 90 years and has a strong financial backing.

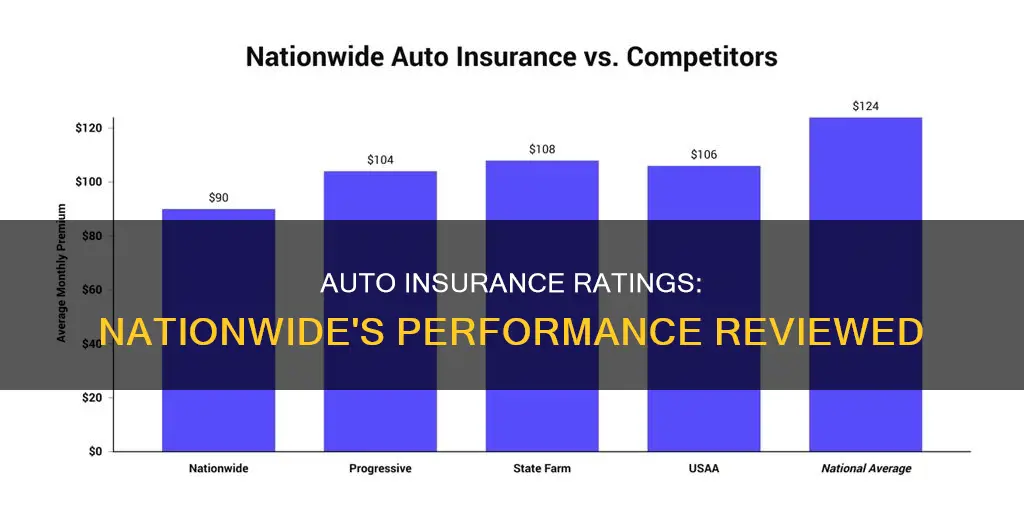

Nationwide's auto insurance rates are below the national average and the company offers a wide range of discounts for its customers. These include safe driver discounts, multi-policy discounts, good student discounts, and discounts for safety or anti-theft equipment. The company also offers SmartRide and SmartMiles programs that allow customers to save money based on their driving habits and the number of miles driven.

Nationwide's auto insurance rates are also competitive for drivers with speeding tickets or accidents on their record. The company is one of the companies most likely to be recommended by its policyholders and it has received positive reviews for its customer service and claims handling.

However, Nationwide's auto insurance rates are more expensive than most of its competitors and the company does not score well for discounts when compared to other insurers. Overall, Nationwide is a good choice for auto insurance, especially for those with a clean driving record who can take advantage of the company's competitive rates and wide range of discounts.

New Auto Insurance: Do They Know Your History?

You may want to see also

Nationwide's discounts

Nationwide offers 11 discounts across three main categories: loyalty-based, driver-based, and payment-based.

Payment-Based Discounts

Almost anyone can access these discounts, which include:

- EasyPay Discount: Customers can get a one-time discount when they set up automatic deductions from their bank account.

- Paperless Discount: Customers may be able to get a recurring discount if they sign up to receive communication about their car insurance policy via email.

Driver-Based Discounts

Certain types of people can qualify for these discounts, including good students and safe drivers. These include:

- Good Student Discount: Drivers between the ages of 16 and 24 can save on car insurance if they maintain a B average or better in school.

- Defensive Driving Discount: Older drivers can get a discount of about 5% upon completing a state-certified defensive driving course with a passing grade. In most states, you must be 55 years or older and have no at-fault accidents in the past 35 months to be eligible.

- Safe Driver Discount: Customers who have been free from accidents and moving violations for the past five years are eligible for a lower premium.

- Accident-Free Discount: If you have at least five years of driving experience and have been free from accidents and major violations for the last five years, you could save up to 10%.

- Anti-Theft Discount: Discounts are offered for certain factory-installed and after-market theft deterrents. Savings vary based on the type of device and your location, and you might have to provide proof of installation.

Loyalty-Based Discounts

Customers who insure more than one car or multiple types of insurance are also eligible for these discounts:

- Multi-Policy Discount: Customers can get a discount for buying multiple types of insurance from Nationwide. For instance, drivers who bundled home and auto coverage saved an average of $646 per year in 2020.

- Multi-Vehicle Discount: Having multiple vehicles registered to the same address could save you money.

- Homeowner Promise Discount: If you promise to insure your home with Nationwide within a year, you can save up to 5% on your home and car insurance bundle.

- Affinity Member Discount: Nationwide partners with hundreds of alumni associations, special interest groups, professional organizations, and more. Get a discount just for being affiliated with one of these partners.

Other Discounts

- SmartRide Discount: Save 10% just for signing up for Nationwide’s usage-based insurance program. The safer you drive, the better your discount will be—up to 40%.

- SmartMiles Discount: Low-mileage drivers can get the same Nationwide coverage for less with flexible monthly payments based on how many miles you drive.

Auto Insurance Lapse: Understanding the Risks and Repercussions

You may want to see also

Nationwide's insurance coverage

Nationwide is one of the largest insurance and financial services organisations in the US, having been in business for nearly 90 years. The company offers a wide range of insurance products, including customisable homeowner's, life, car, and other insurance coverages.

Nationwide's car insurance rates are consistently below national averages, and the company also offers affordable insurance for homeowners, renters, and people from all walks of life. In addition, Nationwide provides a wide selection of discount opportunities for its customers.

Nationwide's WalletHub rating is 2.9/5, based on customer reviews, sample insurance quotes, and ratings from organisations such as J.D. Power and the Better Business Bureau (BBB). The company has an NAIC rating of 0.65, indicating that it has received fewer complaints than the average car insurance provider. It also holds an A+ rating from the BBB.

Nationwide offers a wide variety of coverage options for its customers, including gap insurance, vanishing deductible, accident forgiveness, total loss deductible waiver, and more. The company also provides loyalty rewards, such as minor accident forgiveness, pet injury coverage, car key replacement, and mortgage protection coverage.

Nationwide also offers several discounts for its customers, including multi-policy discounts, safe driver discounts, good student discounts, and discounts for vehicles with safety or anti-theft equipment.

Auto Insurance Brokerage Fees: Are They Refundable?

You may want to see also

Frequently asked questions

Nationwide is rated 2.9/5 by WalletHub's editors, 3.3/5 by WalletHub users, and has an A+ rating from the Better Business Bureau (BBB). It is rated 4.6/5 by MarketWatch, which gave it an A+ rating. U.S. News ranks it as the third-best auto insurance company overall.

Nationwide has a wide variety of coverage options, including gap insurance, vanishing deductible, accident forgiveness, and total loss deductible waiver. It also has a low number of complaints and offers generous extras for loyal customers, such as minor accident forgiveness, pet injury coverage, and car key replacement.

Customer satisfaction for auto insurance is lower than average, according to recent J.D. Power studies. It also doesn't sell auto insurance policies in Alaska, Hawaii, Louisiana, and Oklahoma.

You can get an auto insurance quote from Nationwide online or by contacting a Nationwide agent.