There are many factors that can contribute to high auto insurance rates, even if you have a clean driving record with no accidents. These factors include your age, gender, location, choice of vehicle, credit score, insurance company, and market trends.

Age is a significant factor, with younger and older drivers often facing higher insurance premiums due to increased risk. Insurance companies also consider your location, as certain areas may have higher rates of accidents, theft, or weather-related claims, leading to increased costs. The type of vehicle you drive also matters, as more expensive or luxury cars tend to be more costly to insure due to higher repair costs and the potential for theft.

Your credit score can impact your insurance rates, as those with lower credit scores are perceived as higher-risk by insurance companies. Additionally, the insurance company you choose and the coverage options you select will affect your premium. Market trends, such as increasing repair costs and natural disasters, can also contribute to rising insurance rates across the industry.

It's important to note that insurance rates are individualized, and by comparing quotes from different insurance providers, you may be able to find more affordable coverage that suits your needs.

| Characteristics | Values |

|---|---|

| Age | Drivers under 25 and over 75 tend to have higher rates. |

| Gender | Depending on your age, men and women often end up paying different rates. |

| Location | If you live in a big city or an area with lots of traffic accidents, your premiums will be higher. |

| Credit Score | If you've got a credit score under 600, you'll pay more for car insurance. |

| Driving Record | Speeding tickets, DUIs, and other violations will push your rates up. |

| Choice of Vehicle | Cars with advanced tech features, sport design or functionality, and a high likelihood of theft are more expensive to insure. |

| Insurance Company | Some insurance companies are more expensive than others. |

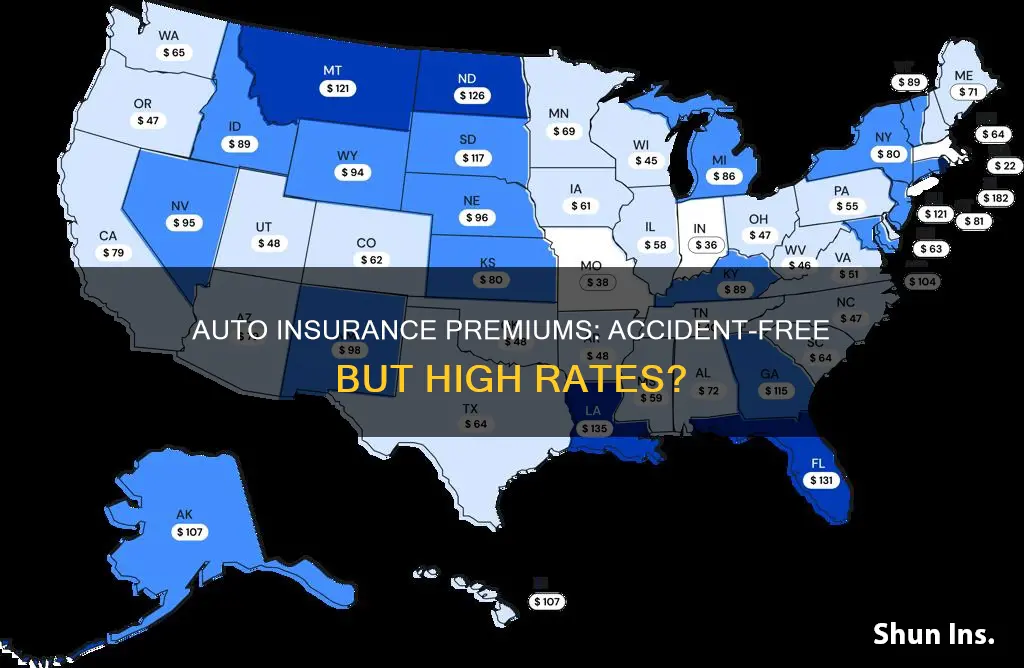

Your location

Additionally, if you live in an area with a high rate of natural disasters, your insurance rates may also be higher. For example, if you live in a state that is frequently affected by hurricanes, your insurance company may factor in the increased risk of damage to your vehicle.

The state you live in also plays a role in the cost of auto insurance. Each state has different regulations, and some states require drivers to carry higher levels of car insurance coverage, which can raise costs. For example, the average annual cost of car insurance in New York is $4,769, while in Idaho, it is only $1,021.

Furthermore, insurance companies may also consider the likelihood of theft and vandalism in your area when determining your rates. If you live in an area with high crime rates, your insurance premiums may be higher to account for the increased risk.

It's important to note that your location is not the only factor that influences your auto insurance rates. Other factors, such as your age, gender, driving record, and the type of car you drive, also play a role in determining your premiums. However, your location is a significant factor that can significantly impact the cost of your auto insurance.

Drunk Driving: Auto Insurance Coverage?

You may want to see also

Your age and gender

Age

Young drivers, particularly teens, are considered high-risk and pay the most for auto insurance. This is because they are inexperienced and more prone to accidents. The high rates for young drivers start to decrease at age 25, with the best rates offered to people in their 50s and early 60s, assuming they have a good driving record. Auto insurance rates begin to increase again around age 65 due to age-related factors such as vision or hearing loss and slower response times.

Gender

In most states, males pay more for auto insurance than females, especially during their teen and young adult years. This is because men are generally riskier to insure, as they tend to drive more miles and engage in riskier driving behaviours like speeding and not wearing seat belts. However, as drivers age and gain more experience, the gender gap in rates narrows, and in some age groups, women pay slightly more than men.

Virginia's Cheapest Vehicles to Insure

You may want to see also

Your driving history

When assessing your driving history, insurers consider various factors, including your age, gender, location, driving record, choice of car, deductible, and claim history. For instance, drivers under 25 and over 75 tend to have higher insurance rates as their policies are considered high-risk. Additionally, insurance companies view areas with high traffic accident rates, such as big cities, as riskier, resulting in higher premiums for residents.

The impact of your driving history on insurance rates also depends on the state you live in. For example, in North Carolina, your driving record includes your name, address, driver's license number, license status, convictions related to motor vehicle violations, accident information, and driver control actions. On the other hand, New York offers three types of driving records: standard, limited, and commercial, each containing different levels of information.

It's important to note that your driving history is not the only factor influencing insurance rates. Other considerations include your credit score, employment status, extra driving courses taken, and where you keep your vehicle.

Understanding Virginia Auto Insurance: What You Need to Know

You may want to see also

Your vehicle

The type of vehicle you drive is a significant factor in determining your insurance rates. Here are some ways your vehicle can impact your insurance premiums:

Vehicle Cost and Type

The cost of your vehicle is a key factor in determining insurance rates. Generally, the more expensive your car is, the higher your insurance premiums will be. This is because costly vehicles tend to be more attractive to thieves, and the insurance company would have to pay a higher amount in the event of a total loss. Additionally, luxury cars, sports cars, and full-size pickup trucks often fall into higher insurance categories due to their high-performance capabilities and the increased risk of accidents.

Vehicle Safety and Repair Costs

The safety features and repair costs of your vehicle also play a role in insurance rates. Cars with advanced safety features and a good safety rating tend to have lower insurance premiums. On the other hand, vehicles with high-tech features and advanced driver-assistance systems can be more expensive to insure, as the cost of repairing or replacing these components is usually higher.

Vehicle Age

The age of your car is another factor in insurance rates. Newer cars are typically more expensive to insure than older ones, as they are generally worth more. However, there may be cases where an older car with a high value may have a higher insurance rate than a newer car with a lower value. Ultimately, the insurance rate depends on the value of the vehicle being insured.

Vehicle Usage and Commute

Your insurance rates can also be influenced by the usage of your vehicle and the length of your commute. If you drive your car frequently or have a long daily commute, especially on dangerous roads or in high-traffic areas, your insurance rates may increase. This is because the more time you spend on the road, the higher the chances of an accident or a violation.

Foreign Visitors: Are They Covered by My Auto Insurance?

You may want to see also

Your credit score

In most states, insurance companies use credit scores as a factor in determining insurance rates. A credit-based insurance score is used to measure how risky you are from an auto insurance claim perspective, based on your creditworthiness. While the specific ranges vary by company, insurance companies typically divide scores into several tiers.

Drivers with poor credit tend to pay significantly more for car insurance than those with good credit. On average, drivers with poor credit pay $144 per month more for full coverage. The difference in cost can be even more drastic depending on the insurance company, with some companies charging over twice as much for drivers with poor credit.

It's worth noting that four states in the US—California, Hawaii, Massachusetts, and Michigan—ban insurance companies from using credit scores to determine insurance rates. Instead, companies in these states base rates on factors such as driving record, location, and other characteristics.

Improving your credit score over time can help you secure better rates for car insurance. Additionally, shopping around and comparing quotes from multiple companies can also help you find more affordable options, as rates can vary significantly between insurers.

Understanding Auto Insurance Payouts: Claims, Coverage, and Compensation

You may want to see also

Frequently asked questions

There are many factors that influence the cost of your auto insurance, including your age, gender, location, driving record, choice of car, deductible, and claim history. If you live in an area with a high cost of living or a high rate of car theft, your insurance rates may be higher. Additionally, insurance companies may view young or elderly drivers as high-risk, which can result in higher premiums.

In most states, insurance companies are allowed to use credit-based insurance scores when determining your rate. Poor credit history has been associated with a higher likelihood of filing a claim, so drivers with poor credit may pay higher premiums. However, some states, such as California, Hawaii, Massachusetts, and Michigan, prohibit the use of credit scores in setting insurance rates.

There are several ways to reduce your auto insurance rates. You can improve your credit score, practice good driving habits, and take advantage of discounts offered by insurance companies. Additionally, you can compare rates from different insurance providers and choose the one that offers the best coverage for your needs at a competitive price.