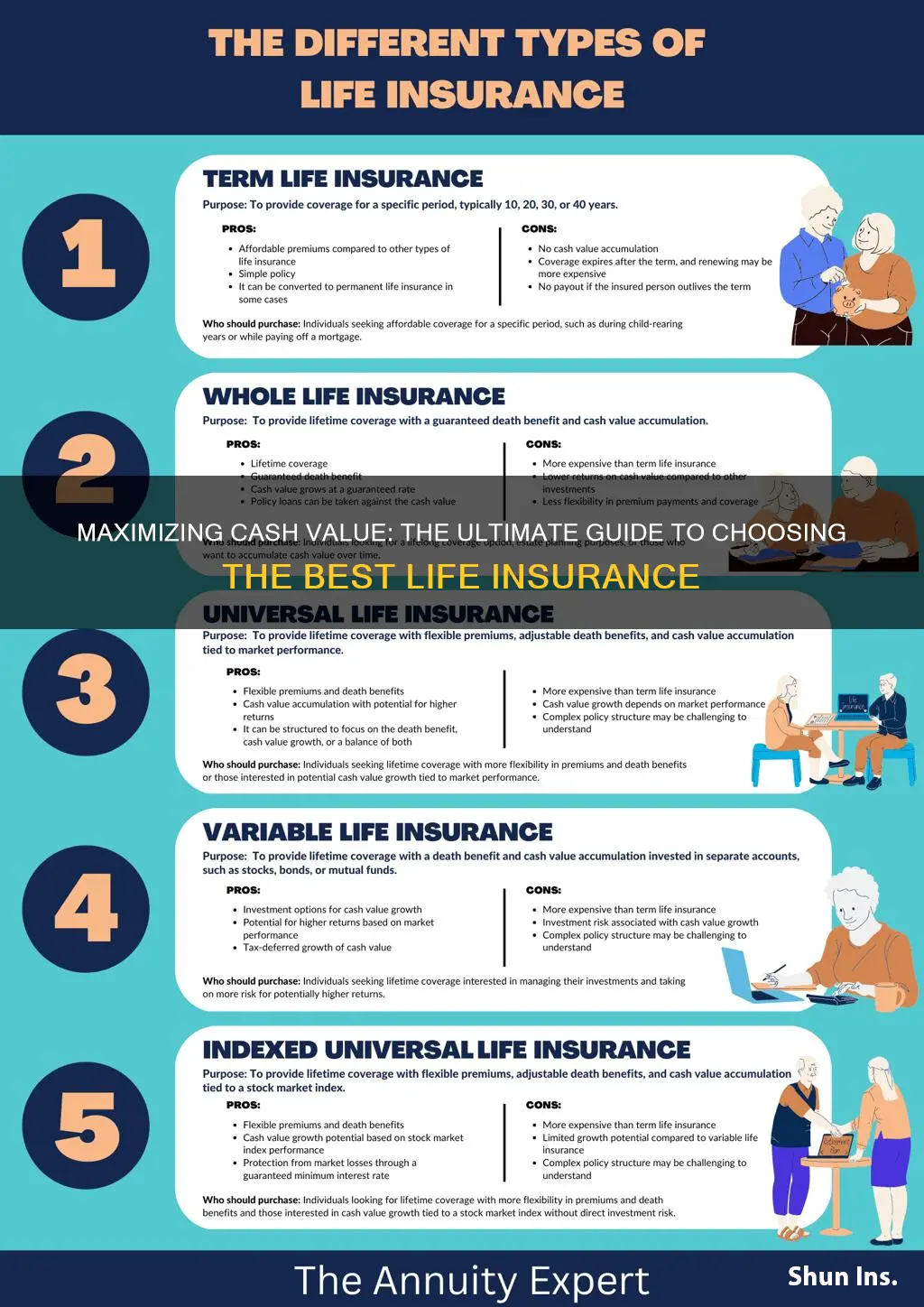

When considering the best cash value life insurance, it's important to understand the various types of policies available and their unique features. Cash value life insurance combines the security of a life insurance policy with the potential for long-term savings. This type of insurance builds cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. The best cash value life insurance policy for an individual will depend on their specific needs, such as the desired level of coverage, investment goals, and financial situation. It's crucial to carefully evaluate different providers, policy terms, and investment options to ensure the chosen plan aligns with one's financial objectives and provides the necessary protection.

What You'll Learn

- Cost-Effectiveness: Compare premiums and coverage to find the most affordable option

- Death Benefit: Ensure the payout meets your financial needs for beneficiaries

- Longevity: Consider term lengths that align with your expected lifespan

- Flexibility: Look for policies with adjustable coverage or conversion options

- Tax Advantages: Understand tax benefits and potential savings on premiums

Cost-Effectiveness: Compare premiums and coverage to find the most affordable option

When considering cash value life insurance, cost-effectiveness is a crucial factor to evaluate. This type of policy combines a death benefit with an investment component, allowing policyholders to build cash value over time. The primary goal is to find an option that offers the best value for your money, ensuring you get adequate coverage without breaking the bank. Here's a guide to help you navigate this aspect:

Compare Premiums: The first step is to examine the premiums charged by different insurance providers. Cash value life insurance premiums can vary significantly, and this is often the most significant expense for policyholders. Lower premiums might indicate a more affordable option, but it's essential to consider the trade-offs. Cheaper premiums could mean reduced coverage or less favorable investment returns. Look for a balance between cost and the features offered.

Evaluate Coverage Amounts: The coverage amount, or death benefit, is a critical aspect of life insurance. Ensure that the policy you choose provides sufficient financial protection for your loved ones. Consider your family's needs, including expenses like mortgage payments, education costs, and daily living expenses. A higher coverage amount will typically result in higher premiums, so finding the right balance is key. Compare the coverage offered by various policies and assess if they align with your financial goals.

Assess Investment Options: Cash value life insurance policies offer investment opportunities, allowing your premiums to grow over time. Research the investment options provided by different insurers. Some companies may offer more competitive investment returns, which can impact the overall cost-effectiveness of the policy. Higher investment returns can potentially offset higher premiums, making the policy more affordable in the long run.

Review Policy Fees and Charges: In addition to premiums, be mindful of other fees and charges associated with the policy. These may include surrender charges, policy loans, and rider fees. These costs can vary between insurers, and some may offer more competitive fee structures. Understanding these charges is essential to make an informed decision and ensure the policy remains cost-effective over its term.

Long-Term Cost Analysis: Consider the long-term implications of your choice. Some policies might offer lower initial premiums but have higher fees or less favorable investment performance over time. Conduct a comprehensive analysis by comparing the total costs, including premiums, fees, and investment returns, over the policy's duration. This will help you identify the most cost-effective option that aligns with your financial objectives.

Get a Life Insurance License in South Carolina Easily

You may want to see also

Death Benefit: Ensure the payout meets your financial needs for beneficiaries

When considering the best cash value life insurance, the death benefit is a critical aspect to evaluate. The death benefit refers to the amount of money that will be paid out to your beneficiaries upon your passing. This payout is a crucial financial safety net for your loved ones, ensuring they have the necessary resources to cover expenses, maintain their standard of living, and achieve their financial goals.

The primary purpose of life insurance is to provide financial security for your family or designated beneficiaries. Therefore, it is essential to choose a policy with a death benefit that aligns with your specific needs and financial obligations. Here are some key points to consider:

- Assess Your Financial Needs: Begin by evaluating your current and future financial responsibilities. Calculate the total amount required to cover expenses such as mortgage or rent, children's education, outstanding debts, and any other long-term financial commitments. Consider the potential future costs, such as healthcare expenses or retirement savings, that your beneficiaries might need to account for. This assessment will help determine the minimum death benefit required.

- Consider Inflation and Interest Rates: Life insurance policies often offer a guaranteed death benefit, which means the payout is fixed and will not be adjusted for inflation. However, to ensure the purchasing power of the death benefit, you should consider the impact of inflation over time. Research the average inflation rate and project future costs to estimate how much the death benefit should be increased annually to maintain its value.

- Review and Adjust Regularly: Life circumstances change, and so should your insurance needs. Regularly review your policy and adjust the death benefit accordingly. Major life events like marriage, the birth of a child, or the purchase of a home may require an increase in the death benefit to accommodate the additional financial responsibilities. Conversely, if you've paid off debts or reduced your financial obligations, you might consider decreasing the death benefit to avoid over-insuring.

- Explore Policy Options: Different life insurance policies offer various death benefit options. Some policies provide a fixed death benefit, ensuring a consistent payout. Others may offer a variable or adjustable death benefit, allowing for potential increases or decreases based on market performance or other factors. Understand the policy terms and conditions to make an informed decision that suits your financial goals.

- Consult a Financial Advisor: Given the complexity of insurance products, seeking professional advice is highly recommended. A financial advisor can help you navigate the various options, assess your unique situation, and recommend the most suitable cash value life insurance policy with an appropriate death benefit. They can also assist in creating a comprehensive financial plan that incorporates life insurance as a vital component.

Smoker's Life Insurance: Affordable Coverage After Quitting

You may want to see also

Longevity: Consider term lengths that align with your expected lifespan

When it comes to choosing the best cash value life insurance, longevity is a critical factor to consider. This is because the term length of your policy should ideally match your expected lifespan, ensuring that you have adequate coverage throughout your life. Here's why this alignment is essential:

Firstly, life insurance is a long-term commitment. It provides financial security for your loved ones during your absence, and the policy's duration should reflect the time it takes for your beneficiaries to potentially need this financial support. If you choose a term length that is too short, you risk leaving your family underinsured, especially if you have a longer life expectancy. On the other hand, a term that is too long might result in unnecessary premiums, as you would be paying for coverage you don't need.

To determine the appropriate term length, consider your personal circumstances and life expectancy. Start by assessing your current age and health. Generally, younger and healthier individuals can opt for longer term lengths, such as 30-year or 40-year terms, as they are more likely to outlive the policy's duration. In contrast, older individuals or those with health conditions might prefer shorter terms, like 20 years, to ensure they are covered during the period when their beneficiaries might need it the most.

Additionally, it's beneficial to consider your financial goals and obligations. If you have a substantial amount of debt or dependants who rely on your income, a longer term might be more suitable to ensure their financial security. Conversely, if you have already paid off your debts and have a stable financial situation, a shorter term could be more cost-effective.

In summary, aligning the term length of your cash value life insurance with your expected lifespan is crucial for providing the right level of coverage. It ensures that your beneficiaries receive the necessary financial support when they need it and helps you manage your insurance costs effectively. By carefully considering your personal circumstances and life expectancy, you can make an informed decision about the best term length for your cash value life insurance policy.

Drunk Drivers' Eligibility for Life Insurance

You may want to see also

Flexibility: Look for policies with adjustable coverage or conversion options

When considering cash value life insurance, flexibility is a key feature to look for. This type of policy offers a range of benefits, but it's important to choose one that suits your current and future needs. One way to ensure flexibility is to opt for policies that provide adjustable coverage. This means you can increase or decrease the amount of coverage as your circumstances change. For instance, if you start with a lower coverage amount and your financial situation improves, you can easily adjust the policy to provide more comprehensive protection. This adjustability is particularly useful if your insurance needs evolve over time, ensuring that you always have the right level of coverage without the need for a new policy.

Additionally, look for policies that offer conversion options. This feature allows you to convert your term life insurance into a permanent policy, typically with a guaranteed cash value accumulation. The ability to convert is advantageous as it provides long-term financial security. If you initially purchase a term life insurance and later decide you want the added benefit of cash value, you can opt to convert it, ensuring your policy adapts to your changing requirements. This option is especially valuable if you want to build a substantial cash reserve within your insurance policy, which can be used for various financial goals.

The flexibility provided by adjustable coverage and conversion options is a significant advantage of cash value life insurance. It allows you to customize your policy to fit your life's changing circumstances, providing both immediate and long-term benefits. With these options, you can ensure that your insurance remains a valuable asset, offering financial security and the potential for wealth accumulation over time. When researching and comparing policies, make sure to understand the terms and conditions of any adjustable features or conversion rights to make an informed decision that aligns with your personal financial strategy.

Verify Your Health and Life Insurance License: Steps and Tips

You may want to see also

Tax Advantages: Understand tax benefits and potential savings on premiums

When considering cash value life insurance, understanding the tax advantages is crucial as it can significantly impact your overall financial strategy. This type of insurance offers a unique opportunity to build cash value, which can be utilized in various ways, providing both financial security and potential tax benefits. Here's a detailed breakdown of how tax advantages can be a game-changer for your insurance choice:

Tax-Deferred Growth: One of the primary tax advantages of cash value life insurance is the tax-deferred growth of the cash value. Unlike traditional savings accounts or investments, the cash value within the policy grows tax-free. This means that any earnings or interest accrued on the policy's investment component are not subject to annual taxes. As a result, your money can grow faster, providing a substantial sum over time. For instance, if you invest $10,000 in a cash value policy, the earnings on that investment can accumulate without any tax implications, allowing the policy to build value more efficiently.

Potential Tax Deductions: In many cases, the premiums paid for cash value life insurance may be tax-deductible. This is particularly beneficial for high-income earners or those in higher tax brackets. By deducting the premiums, you can reduce your taxable income, thus lowering your overall tax liability. It's important to note that the rules regarding tax deductions can vary, and it's advisable to consult a tax professional to ensure compliance with the latest regulations. Additionally, if you have a flexible spending account (FSA) or a health savings account (HSA), you might be able to use these funds to pay for qualified medical expenses, including insurance premiums, offering further tax advantages.

Tax-Efficient Legacy Planning: Cash value life insurance can also be a powerful tool for estate planning. The cash value within the policy can be borrowed against or withdrawn, providing access to funds that are already grown tax-free. This can be advantageous when distributing wealth to beneficiaries, as the death benefit received by beneficiaries is generally tax-free. By utilizing the cash value, you can potentially minimize the tax impact on your heirs, ensuring a more efficient transfer of assets.

Long-Term Savings and Investment: The tax advantages of cash value life insurance extend beyond the immediate benefits. Over time, the cash value can accumulate, providing a substantial savings or investment opportunity. This can be particularly valuable for long-term financial goals, such as retirement planning or funding education expenses. The tax-deferred growth allows your money to work harder, potentially resulting in a more substantial nest egg for the future.

Understanding these tax advantages can empower you to make informed decisions about your insurance choices. It's essential to consult with financial advisors and tax professionals to fully grasp the implications and ensure that your cash value life insurance strategy aligns with your overall financial objectives.

Surrendering Life Insurance: Tax-Free or Taxing?

You may want to see also

Frequently asked questions

The "best" cash value life insurance depends on your individual needs and financial goals. Cash value life insurance is a type of permanent life insurance that builds cash value over time, which can be borrowed against or withdrawn. It offers a combination of death benefit coverage and a savings component. When choosing the best policy, consider factors such as your age, health, financial situation, and long-term goals. It's essential to evaluate different insurance providers, compare policies, and understand the terms and conditions to make an informed decision.

Cash value life insurance operates by investing a portion of your premium payments into investment accounts or sub-accounts within the policy. These investments can grow over time, accumulating cash value. Policyholders can access this cash value in several ways, including taking loans, making withdrawals, or participating in the policy's dividend options. The cash value grows tax-deferred, and any earnings or interest are not subject to income tax until they are withdrawn. This feature provides a source of emergency funds or a means to build wealth over time.

Cash value life insurance offers several benefits:

- Long-Term Savings: The cash value component allows you to build a savings account within your policy, providing financial security and the potential for tax-advantaged growth.

- Death Benefit: It provides a guaranteed death benefit, ensuring your loved ones receive a payout upon your passing.

- Flexibility: Policyholders can access the cash value through loans or withdrawals, offering financial flexibility during emergencies or for other financial needs.

- Investment Options: You can choose from various investment options within the policy, allowing you to customize your investment strategy according to your risk tolerance and goals.

- Tax Advantages: The cash value grows tax-deferred, and withdrawals can be tax-free if used for qualified expenses, providing potential tax benefits.