Whole life insurance is a comprehensive and permanent form of insurance that provides coverage for the entire lifetime of the insured individual. It offers a range of benefits, including a guaranteed death benefit, a cash value accumulation, and a fixed interest rate. This type of insurance is designed to provide financial security and peace of mind, ensuring that beneficiaries receive a payout upon the insured's passing. Additionally, whole life insurance can be a valuable asset for long-term financial planning, allowing policyholders to build a substantial cash value over time, which can be borrowed against or withdrawn tax-free. With its lifelong coverage and various advantages, whole life insurance is often considered a reliable and stable investment, making it an attractive option for those seeking long-term financial protection.

| Characteristics | Values |

|---|---|

| Definition | Whole life insurance, also known as permanent life insurance, is a type of long-term insurance that provides coverage for the entire lifetime of the insured individual. |

| Type of Policy | It is a form of permanent life insurance, meaning it offers coverage for the insured's entire life, with no option to convert it into a term policy. |

| Premiums | Premiums are typically fixed and level throughout the life of the policy, providing stability and predictability for the insured. |

| Death Benefit | The death benefit is guaranteed and remains the same for the entire policy term, providing a fixed amount upon the insured's death. |

| Cash Value | Over time, whole life insurance policies accumulate cash value, which can be borrowed against or withdrawn, providing financial flexibility. |

| Investment Component | It often includes an investment component, allowing the policyholder to grow their money through investments, which can be used for various financial goals. |

| Flexibility | Policyholders can customize the policy by choosing the death benefit amount, premium payment options, and investment allocations. |

| Long-Term Financial Planning | It is suitable for long-term financial planning, offering both insurance protection and a savings component. |

| Tax Advantages | In many countries, the cash value growth in whole life insurance policies is tax-deferred, providing potential tax benefits. |

| Guaranteed Returns | The investment component typically guarantees a minimum interest rate, ensuring a certain level of return on the policy's cash value. |

| Loan Features | Policyholders can borrow against the cash value without affecting the insurance coverage, providing access to funds when needed. |

| Lapse Risk | Unlike term life insurance, whole life policies cannot lapse due to missed payments, ensuring continuous coverage. |

| Dividend Options | Some whole life policies offer the option to participate in dividends, providing additional cash value growth. |

| Legacy Planning | It can be an effective tool for legacy planning, allowing individuals to pass on a substantial death benefit to beneficiaries. |

| Financial Security | Provides financial security and peace of mind, knowing that the insured and their loved ones are protected. |

What You'll Learn

- Affordable Long-Term Coverage: Provides continuous protection at a fixed rate, ideal for long-term financial planning

- Cash Value Accumulation: Builds cash value over time, offering a savings component alongside death benefit

- Flexible Payout Options: Allows policyholders to access funds through loans or withdrawals, providing financial flexibility

- Tax-Advantaged Growth: Offers tax-deferred growth, similar to retirement accounts, for long-term wealth accumulation

- Guaranteed Death Benefit: Ensures a fixed payout to beneficiaries, regardless of investment performance, providing certainty

Affordable Long-Term Coverage: Provides continuous protection at a fixed rate, ideal for long-term financial planning

Whole life insurance is a type of permanent life insurance that offers a range of benefits, particularly in the context of affordable long-term coverage. This insurance provides a sense of security and financial planning for individuals and their families. One of its key advantages is the guarantee of lifelong coverage, ensuring that your loved ones are protected even in the long run.

When it comes to affordability, whole life insurance offers a fixed rate of premium, which means that the cost of coverage remains consistent over time. This predictability is a significant advantage, especially for those who want to plan their finances effectively. Unlike term life insurance, which has a limited duration, whole life insurance provides continuous protection, allowing individuals to build a financial safety net that grows over the years.

The fixed rate of premium is calculated based on various factors, including the insured individual's age, health, and lifestyle. This personalized approach ensures that the coverage is tailored to the specific needs of the policyholder. As the policyholder ages, the premiums may increase slightly, but the rate of increase is generally lower compared to other insurance types. This stability in pricing makes whole life insurance an attractive option for those seeking long-term financial security.

Moreover, whole life insurance accumulates cash value over time, which can be borrowed against or withdrawn, providing additional financial flexibility. This feature allows policyholders to access their funds for various purposes, such as education expenses, business ventures, or retirement planning. The cash value also ensures that the insurance company can pay out a death benefit to the beneficiaries, even if the policyholder passes away, providing a sense of financial security for the future.

In summary, whole life insurance is an excellent choice for those seeking affordable and long-lasting coverage. Its fixed-rate premiums, combined with the accumulation of cash value, offer a comprehensive financial planning solution. With whole life insurance, individuals can ensure that their loved ones are protected, and they have a reliable financial tool to achieve their long-term goals. This type of insurance provides a sense of peace of mind, knowing that your financial future is secure.

Life Insurance Dividends: Taxable Interest Earnings?

You may want to see also

Cash Value Accumulation: Builds cash value over time, offering a savings component alongside death benefit

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. One of its key features is the accumulation of cash value, which sets it apart from other insurance products. This unique aspect allows policyholders to build a substantial savings component within their insurance policy.

When you purchase a whole life insurance policy, a portion of your premium payments goes towards building this cash value. This value grows over time, often at a guaranteed rate, and it can be used for various purposes. The cash value accumulation in whole life insurance is a significant advantage, as it provides a financial safety net and a means to build wealth. As the policyholder, you have the option to borrow against this accumulated cash value or even withdraw it, provided the policy is in force. This flexibility is particularly beneficial for those seeking long-term financial security and a way to potentially build a substantial nest egg.

The cash value accumulation in whole life insurance works as follows: a portion of each premium payment is invested by the insurance company, typically in a diversified portfolio of assets. These investments generate returns, and the policy's cash value grows accordingly. The growth rate is often guaranteed, meaning it is assured and not subject to market fluctuations. This ensures that the policyholder can rely on the steady accumulation of cash value over the policy's duration.

Over time, the cash value can be used to pay for various expenses, such as college tuition, home renovations, or even as an emergency fund. It provides a sense of financial security and control, allowing individuals to build a substantial savings account within their insurance policy. Additionally, the death benefit, which is the primary purpose of insurance, remains intact, ensuring that the insured's beneficiaries receive the intended financial support upon their passing.

In summary, whole life insurance with cash value accumulation offers a powerful combination of insurance protection and savings. It provides a guaranteed growth rate, allowing policyholders to build a substantial cash reserve while also ensuring a death benefit for their loved ones. This feature makes whole life insurance an attractive option for those seeking long-term financial security and a way to potentially accumulate wealth.

Understanding Incontestability: Unlocking Life Insurance Benefits

You may want to see also

Flexible Payout Options: Allows policyholders to access funds through loans or withdrawals, providing financial flexibility

Whole life insurance is a type of permanent life insurance that offers a range of benefits, including a guaranteed death benefit and a cash value component. One of the key advantages of whole life insurance is the flexibility it provides to policyholders in terms of accessing their funds. This flexibility is primarily achieved through two mechanisms: loans and withdrawals.

Policyholders can borrow money against their whole life insurance policy, allowing them to access funds without selling the policy or disrupting their coverage. These loans are typically interest-free and can be used for various purposes, such as funding education, starting a business, or covering unexpected expenses. The loan amount is usually limited to the cash value of the policy, ensuring that the death benefit remains intact. This feature provides a valuable source of financial flexibility, enabling individuals to utilize their insurance policy as a long-term financial asset.

In addition to loans, whole life insurance policies often offer the option to withdraw funds from the cash value. This allows policyholders to access their money in a more flexible manner compared to traditional savings accounts. Withdrawals can be made periodically or as needed, providing a financial safety net during challenging times. The cash value grows over time, and withdrawals can be made without incurring penalties, making it a convenient way to access funds while still maintaining the insurance coverage.

The ability to access funds through loans and withdrawals gives whole life insurance policyholders control over their finances. It allows them to make financial decisions based on their current needs and goals, providing a sense of security and peace of mind. This flexibility is particularly beneficial for individuals who want to ensure their financial stability and have a reliable source of funds available when needed.

In summary, whole life insurance offers a unique advantage with its flexible payout options. The ability to borrow against the policy and withdraw funds from the cash value provides policyholders with financial flexibility and control. This feature sets whole life insurance apart, making it an attractive option for those seeking both insurance protection and a long-term financial strategy.

Life Insurance Suicides: A Morbid Truth or Urban Myth?

You may want to see also

Tax-Advantaged Growth: Offers tax-deferred growth, similar to retirement accounts, for long-term wealth accumulation

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, hence the name. One of its key advantages is the potential for tax-advantaged growth, which can be particularly beneficial for long-term wealth accumulation. This feature sets it apart from other investment vehicles and traditional savings accounts.

When you invest in whole life insurance, the cash value of the policy grows over time, and this growth is often tax-deferred. This means that the earnings on your investment within the policy are not subject to annual income tax, allowing your money to grow faster. The tax-deferred nature of whole life insurance is similar to that of retirement accounts, such as 401(k)s or IRAs. By investing in a whole life insurance policy, you can build a substantial nest egg without the immediate tax burden that comes with some other investment options.

The tax-advantaged growth aspect of whole life insurance is a powerful tool for those looking to secure their financial future. It provides a structured way to save and invest, ensuring that your money works harder for you over time. As the policy's cash value grows, it can be borrowed against or withdrawn, providing access to funds without the need for a loan or selling other assets. This flexibility allows policyholders to utilize their investments for various purposes, such as funding education, starting a business, or planning for retirement.

Additionally, the tax-deferred nature of whole life insurance encourages long-term thinking and planning. It allows individuals to focus on building wealth steadily, knowing that their investments are growing tax-free. This can be especially attractive to those who want to maximize their savings and investments while also having a safety net in the form of life insurance coverage.

In summary, whole life insurance offers a unique combination of insurance protection and tax-advantaged growth opportunities. By providing tax-deferred growth, similar to retirement accounts, it enables individuals to accumulate wealth over time, making it an attractive option for those seeking a comprehensive financial strategy. This feature, combined with the policy's permanent nature, makes whole life insurance a powerful tool for securing a financially stable future.

Federal Employees: Lifetime Health Insurance Benefits Explained

You may want to see also

Guaranteed Death Benefit: Ensures a fixed payout to beneficiaries, regardless of investment performance, providing certainty

Whole life insurance is a type of permanent life insurance that offers a range of unique features, one of the most appealing being the guaranteed death benefit. This aspect of whole life insurance is a cornerstone of its value proposition, ensuring financial security for the policyholder's loved ones.

The guaranteed death benefit is a fixed amount that the insurance company promises to pay out upon the insured individual's death. This benefit is a key differentiator from other life insurance policies, such as term life insurance, where the payout is dependent on the performance of underlying investments. With whole life, the death benefit is a guaranteed, certain amount, providing peace of mind and financial stability for the beneficiaries.

This feature is particularly attractive to those seeking long-term financial planning. It ensures that the policyholder's family or designated beneficiaries will receive a specific sum of money at the time of their passing, regardless of market fluctuations or investment performance. This certainty is a powerful incentive for individuals to secure their loved ones' financial future.

The guaranteed death benefit is often a fixed amount, agreed upon at the time of policy inception, and it remains constant throughout the life of the policy. This predictability allows individuals to plan and budget with confidence, knowing that their beneficiaries will receive a specified sum without the uncertainty associated with variable investment returns.

In summary, the guaranteed death benefit is a defining characteristic of whole life insurance, offering a level of financial security and certainty that is not typically found in other insurance products. It provides a reliable and consistent source of income for beneficiaries, ensuring that the policyholder's legacy and financial goals are met, regardless of market conditions. This feature, combined with other benefits of whole life insurance, makes it an attractive and comprehensive financial planning tool.

Hospital Bills and Life Insurance: Who Pays?

You may want to see also

Frequently asked questions

Whole life insurance is a permanent life insurance policy that provides coverage for your entire life. It offers a guaranteed death benefit and a fixed premium that remains the same for the life of the policyholder. This type of insurance is designed to provide long-term financial security and peace of mind, as it ensures that your loved ones will receive a financial payout upon your passing.

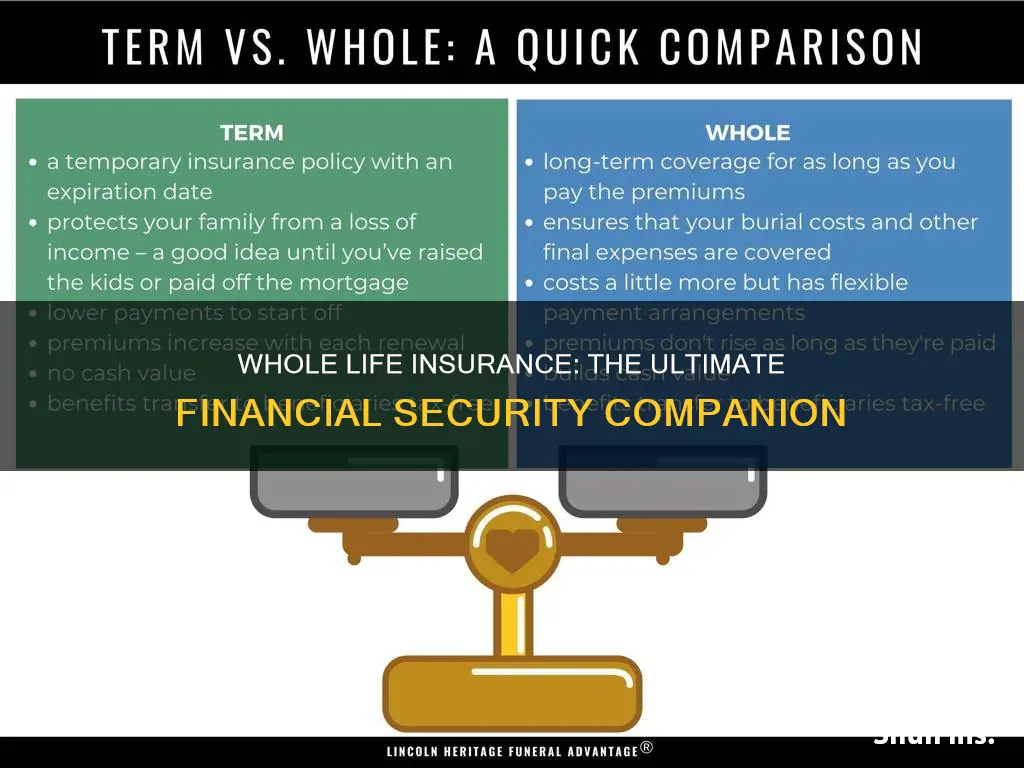

The primary difference lies in their duration and features. Whole life insurance provides coverage for the entire lifetime of the insured individual, hence the term "permanent." It builds cash value over time, which can be borrowed against or withdrawn. In contrast, term life insurance is designed for a specific period, such as 10, 20, or 30 years, and does not accumulate cash value. Once the term ends, the policy may need to be renewed or replaced.

There are several benefits to consider. Firstly, it offers lifelong coverage, ensuring that your family's financial needs are met regardless of when you pass away. Secondly, the cash value component allows policyholders to build a savings account, which can be used for various purposes, such as funding education, starting a business, or supplementing retirement income. Additionally, whole life insurance provides a consistent premium, protecting against potential rate increases that may occur with other types of insurance.