When it comes to choosing the best life insurance company, there is no one-size-fits-all answer. The ideal provider for you will depend on your unique needs, financial situation, and personal preferences. Some companies offer comprehensive coverage with competitive rates, while others may specialize in specific types of policies, such as term life or whole life insurance. It's essential to research and compare different insurers, considering factors like financial stability, customer service, policy options, and claims processing efficiency. Ultimately, the best life insurance company is the one that provides the coverage you need at a price you can afford, ensuring peace of mind for you and your loved ones.

What You'll Learn

- Affordability: Compare premiums and coverage options to find the most cost-effective plan

- Financial Strength: Assess the insurer's stability and ability to pay claims

- Customer Service: Evaluate responsiveness, support, and overall satisfaction with the insurer

- Policy Flexibility: Consider customization options and ease of policy adjustments

- Reputation & Reviews: Research ratings, testimonials, and industry recognition for the insurer

Affordability: Compare premiums and coverage options to find the most cost-effective plan

When considering life insurance, affordability is a key factor that can significantly impact your financial well-being. It's essential to approach this decision with a strategic mindset to ensure you get the best value for your money. Here's a guide on how to navigate the process of finding the most cost-effective life insurance plan:

Understand Your Needs: Begin by assessing your unique life insurance requirements. Consider factors such as your age, health condition, lifestyle, and financial goals. Younger individuals often have lower premiums due to longer life expectancy, while those with pre-existing health conditions might need to explore specialized plans. Understanding your needs will help narrow down the options and make the comparison process more efficient.

Compare Premiums: Life insurance premiums can vary widely among different providers. Obtain quotes from multiple companies to compare their rates. Look for patterns in pricing and consider the following: Is there a significant difference in premiums for similar coverage amounts? Are there any discounts or incentives offered by specific insurers that could reduce your costs? Remember, the cheapest option might not always provide the best coverage, but finding a balance between affordability and comprehensive protection is ideal.

Evaluate Coverage Options: Life insurance policies offer various coverage amounts and types. When comparing plans, pay close attention to the coverage options provided. Some insurers might offer higher coverage amounts at a premium, while others may provide more affordable plans with lower coverage. Assess your financial obligations and future needs to determine the appropriate coverage level. For instance, if you have a large family and significant financial responsibilities, you might require a higher coverage amount.

Consider Term Length: The duration of your life insurance policy, known as the term length, can also affect affordability. Longer-term policies often come with lower premiums, as the risk for the insurer is spread over a more extended period. However, if you only need coverage for a specific period, such as until your children are financially independent, a shorter-term policy might be more cost-effective.

Review Additional Benefits: Life insurance policies may include additional benefits or riders that can enhance your coverage. These add-ons can provide valuable protection but often come at an extra cost. Carefully review the available options and decide which ones align with your needs and budget. For example, critical illness coverage or accidental death insurance can provide financial security but may increase your premiums.

By comparing premiums, evaluating coverage options, considering term lengths, and reviewing additional benefits, you can make an informed decision when choosing a life insurance provider. Remember, the goal is to find a plan that offers a balance between affordability and comprehensive protection, ensuring your loved ones' financial security without breaking the bank.

Calculating Life Insurance Age Reductions: A Step-by-Step Guide

You may want to see also

Financial Strength: Assess the insurer's stability and ability to pay claims

When evaluating life insurance companies, financial strength is a critical factor to consider. It directly impacts the insurer's ability to honor its commitments to policyholders, ensuring that claims are paid out when needed. Here's a detailed look at why and how to assess an insurer's financial stability:

Understanding Financial Strength:

Financial strength refers to an insurance company's financial health and its capacity to meet its financial obligations. This includes paying out claims, managing expenses, and maintaining a strong balance sheet. A financially strong insurer is more likely to withstand economic downturns and continue providing benefits to its policyholders over the long term.

Key Metrics to Evaluate:

- Ratings from Credit Rating Agencies: Reputable credit rating agencies like A.M. Best, Moody's, and Standard & Poor's assign financial strength ratings to insurance companies. These ratings provide an independent assessment of the insurer's financial stability. Higher ratings indicate a stronger financial position and a lower risk of default.

- Capitalization and Solvency Ratios: These ratios provide insights into the insurer's financial resources. A higher capitalization ratio suggests the company has more capital relative to its liabilities, indicating a stronger financial position. Solvency ratios measure the insurer's ability to meet its financial obligations, with higher values indicating greater stability.

- Financial Statements: Analyzing an insurer's financial statements, including the balance sheet, income statement, and cash flow statement, offers a comprehensive view of its financial health. Look for consistent profitability, strong asset growth, and a healthy reserve position.

Benefits of a Financially Strong Insurer:

- Payout Reliability: A financially strong insurer is more likely to have the resources to pay out claims promptly and in full, providing peace of mind to policyholders.

- Long-Term Viability: Financial stability ensures the insurer can weather economic storms and continue operating for the long term, allowing policyholders to benefit from their insurance coverage over an extended period.

- Product Innovation: With a strong financial foundation, insurers can invest in product development, offering innovative policies and features that better meet the needs of their customers.

Research and Due Diligence:

When assessing life insurance companies, it's essential to conduct thorough research. Review the insurer's financial reports, read independent reviews, and compare ratings from different agencies. Additionally, consider the insurer's market reputation, customer satisfaction ratings, and any regulatory actions or complaints filed against them.

By carefully evaluating an insurer's financial strength, you can make an informed decision, ensuring that your life insurance provider is stable and capable of fulfilling its obligations, providing you and your loved ones with the security they deserve.

Life Shield: Understanding Insurance Protection

You may want to see also

Customer Service: Evaluate responsiveness, support, and overall satisfaction with the insurer

When evaluating the best life insurance company, customer service is a critical aspect that can significantly impact your overall satisfaction and experience. Here's a detailed breakdown of how to assess and compare insurers based on their customer service:

Responsiveness:

- Promptness: Measure how quickly the insurer responds to your inquiries. Contact them via multiple channels (phone, email, live chat) and time the responses. Aim for quick replies, ideally within a few hours during business hours.

- Accessibility: Consider the availability of customer service representatives. Some insurers offer 24/7 support, while others have specific business hours. Choose an insurer that aligns with your needs for accessibility.

- Response Time Metrics: Look for insurers that publicly share their average response times. This transparency allows you to set realistic expectations and compare their performance.

Support Quality:

- Knowledge and Expertise: Assess the knowledgeability of the customer service representatives. They should be able to answer your questions accurately, explain complex concepts in a comprehensible manner, and guide you through the claims process if needed.

- Empathy and Professionalism: Excellent customer service involves empathy and a professional tone. Representatives should listen attentively, acknowledge your concerns, and strive to find satisfactory solutions.

- Problem-Solving Skills: Test their ability to resolve issues. Complex situations may require patience, creativity, and a willingness to go beyond standard procedures to find a resolution.

Overall Satisfaction:

- Customer Surveys and Reviews: Research online reviews and customer satisfaction surveys. These provide valuable insights into other policyholders' experiences. Look for patterns in positive and negative feedback to identify areas of strength and weakness.

- J.D. Power and Other Ratings: Reputable ratings agencies like J.D. Power publish annual reports on life insurance customer satisfaction. These ratings can give you a comprehensive overview of an insurer's performance across various factors, including customer service.

- Long-Term Retention: A high customer retention rate often indicates satisfaction. Insurers that retain customers over time are likely providing good service and meeting policyholder needs.

Remember:

- Personalized Experience: The best insurer for you will depend on your individual needs and preferences. Consider your priorities in customer service (e.g., quick response times, knowledgeable representatives, personalized attention) when making your choice.

- Transparency and Communication: Choose an insurer that communicates openly about their policies, procedures, and fees. Clear communication fosters trust and makes it easier to resolve any issues that may arise.

Disability Insurance: A Smart Financial Safety Net?

You may want to see also

Policy Flexibility: Consider customization options and ease of policy adjustments

When evaluating life insurance companies, policy flexibility is a crucial aspect to consider, especially if your needs may change over time. The best life insurance providers offer a range of customization options, allowing you to tailor your policy to your specific requirements. This flexibility ensures that your insurance plan remains relevant and effective as your life circumstances evolve.

One key aspect of policy flexibility is the ability to customize coverage amounts. Life insurance policies typically offer a range of coverage options, and being able to adjust this amount is essential. For instance, if you start a new high-paying job, you might want to increase your coverage to reflect your higher income and potential liabilities. Conversely, if you decide to downsize or retire, reducing your coverage can help avoid unnecessary costs. The ability to make these adjustments ensures that your policy remains aligned with your financial situation.

Additionally, look for companies that provide various policy riders and add-ons. These optional features can enhance your policy's protection. For example, an accidental death benefit rider can provide an additional payout if your death is caused by an accident, offering extra financial security for your loved ones. Long-term care riders can also be valuable, especially for those concerned about future healthcare costs. The availability of such customization options allows you to create a comprehensive plan that addresses your unique needs.

Ease of policy adjustments is another critical factor. The best life insurance providers should offer straightforward processes for modifying your policy. This includes simple procedures for increasing or decreasing coverage, adding or removing riders, and updating personal information. A user-friendly system ensures that you can make necessary changes promptly without unnecessary complexity or delays. Efficient policy management is essential, especially during significant life events like marriages, births, or career changes.

Furthermore, consider companies that provide online tools and resources to facilitate policy adjustments. Digital platforms can streamline the process, allowing you to make changes from the comfort of your home. These tools might include online portals where you can view and modify your policy, track payments, and receive important documents. Such convenience can significantly enhance your overall experience and ensure that your policy remains up-to-date with your current life situation.

In summary, policy flexibility is a vital consideration when choosing a life insurance company. It empowers you to create a personalized plan that adapts to your changing needs. By offering customization options, various riders, and efficient adjustment processes, the best life insurance providers ensure that your policy remains a valuable asset throughout your life's journey.

Canceling Freedom Life Health Insurance: A Step-by-Step Guide

You may want to see also

Reputation & Reviews: Research ratings, testimonials, and industry recognition for the insurer

When considering the best life insurance company, reputation and reviews are crucial factors to evaluate. A company's reputation can provide insights into its reliability, financial stability, and customer satisfaction. Here's a guide on how to research and assess an insurer's reputation:

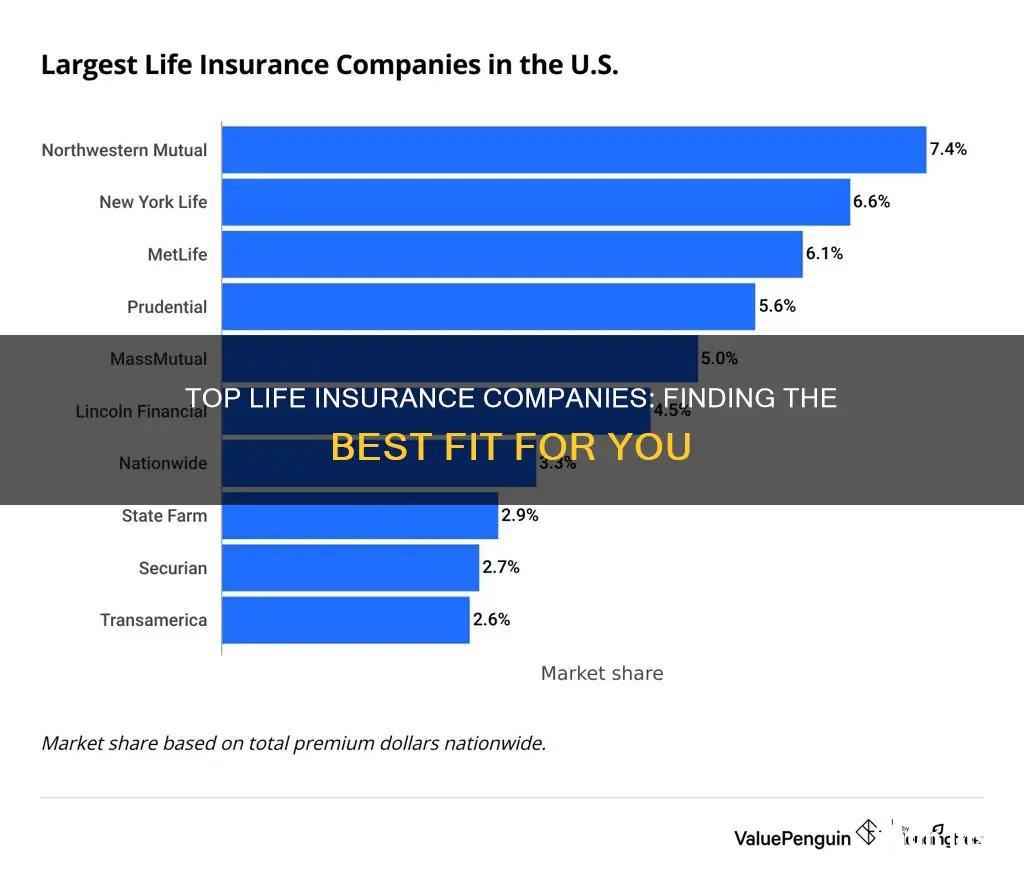

Ratings and Rankings: Start by looking for independent ratings and rankings of life insurance companies. Reputable organizations like A.M. Best, Moody's, and Standard & Poor's provide financial strength ratings that indicate the insurer's ability to meet its financial obligations. These ratings are often categorized as 'A' (excellent), 'B' (good), 'C' (fair), 'D' (poor), and 'F' (poor). Higher ratings suggest a more financially stable company. Additionally, check for overall rankings in industry reports, which often consider factors like customer service, product offerings, and financial stability.

Online Reviews and Testimonials: Scour the internet for customer reviews and testimonials. Websites like Trustpilot, Google Reviews, and Insurify provide platforms for customers to share their experiences. Pay attention to common themes and sentiments expressed in these reviews. Positive reviews might highlight excellent customer service, straightforward claims processes, and competitive pricing. Conversely, negative reviews could indicate issues with policy terms, delays in claims settlements, or difficulty in contacting customer support. Look for a balanced view by checking multiple sources and considering both recent and older reviews.

Industry Recognition and Awards: Reputable life insurance companies often receive industry recognition and awards for their achievements. These accolades can include 'Best Life Insurance Company' awards from financial publications, customer service excellence awards, or recognition for innovation in product offerings. Industry awards can be a good indicator of a company's commitment to quality and customer satisfaction. Researching these awards and their criteria can give you a sense of the company's standing in the market.

Social Media Presence: A strong social media presence can be an indicator of a company's engagement with its customers and the industry. Follow the insurer's official accounts on platforms like LinkedIn, Facebook, and Twitter. Check for regular updates, customer interactions, and responses to inquiries. A responsive and active social media presence suggests a company that values its customers and is committed to building a positive reputation.

Financial Stability and Ratings: Beyond the ratings mentioned earlier, consider the insurer's overall financial health. Look for companies with a strong financial position, as this ensures they can fulfill their policy obligations over the long term. A financially stable company is more likely to provide reliable coverage and efficient claims processing. Research their financial reports and seek advice from financial advisors if needed.

By thoroughly researching ratings, reviews, industry recognition, and financial stability, you can make an informed decision when choosing a life insurance company. This due diligence ensures that you select an insurer with a strong reputation, capable of providing reliable coverage and excellent customer service.

Generate Free Life Insurance Leads: Effective Strategies Revealed

You may want to see also

Frequently asked questions

Selecting the right life insurance provider can be a complex decision, but here are some key factors to consider. Firstly, evaluate your specific needs and the type of coverage you require, such as term life, whole life, or universal life insurance. Research and compare different companies based on their financial strength, reputation, and customer reviews. Look for a company with a strong financial rating from reputable agencies, as this indicates their ability to pay out claims. Additionally, consider the company's customer service, claim settlement process, and any additional benefits or features they offer. It's beneficial to get quotes from multiple insurers to compare premiums, coverage options, and policy terms.

Term life insurance is a popular choice for individuals seeking affordable and straightforward coverage for a specific period, typically 10, 20, or 30 years. One of its main advantages is its simplicity; it provides a death benefit if the insured person passes away during the term, and the policy expires at the end of the term without any cash value accumulation. This type of insurance is ideal for those who want coverage for a particular period, such as when they have a mortgage or dependants, and can be more cost-effective compared to permanent life insurance.

Whole life insurance offers lifelong coverage, providing a death benefit to the policyholder's beneficiaries regardless of when the insured person passes away. One of its key features is the accumulation of cash value over time, which can be borrowed against or withdrawn. This makes whole life insurance a valuable long-term financial tool, allowing policyholders to build equity. In contrast, term life insurance is term-specific and does not accumulate cash value. It is generally more affordable for shorter-term needs but may not provide long-term financial benefits.

Yes, it is possible to obtain life insurance even with pre-existing health conditions, but the process and terms may vary. Insurers often consider factors like the severity and management of the condition, age, and overall health. Some companies offer specialized policies for individuals with health issues, such as critical illness insurance or term life insurance with guaranteed acceptance. It's essential to disclose all relevant health information to the insurer to get an accurate quote and ensure you understand the policy's terms and conditions.