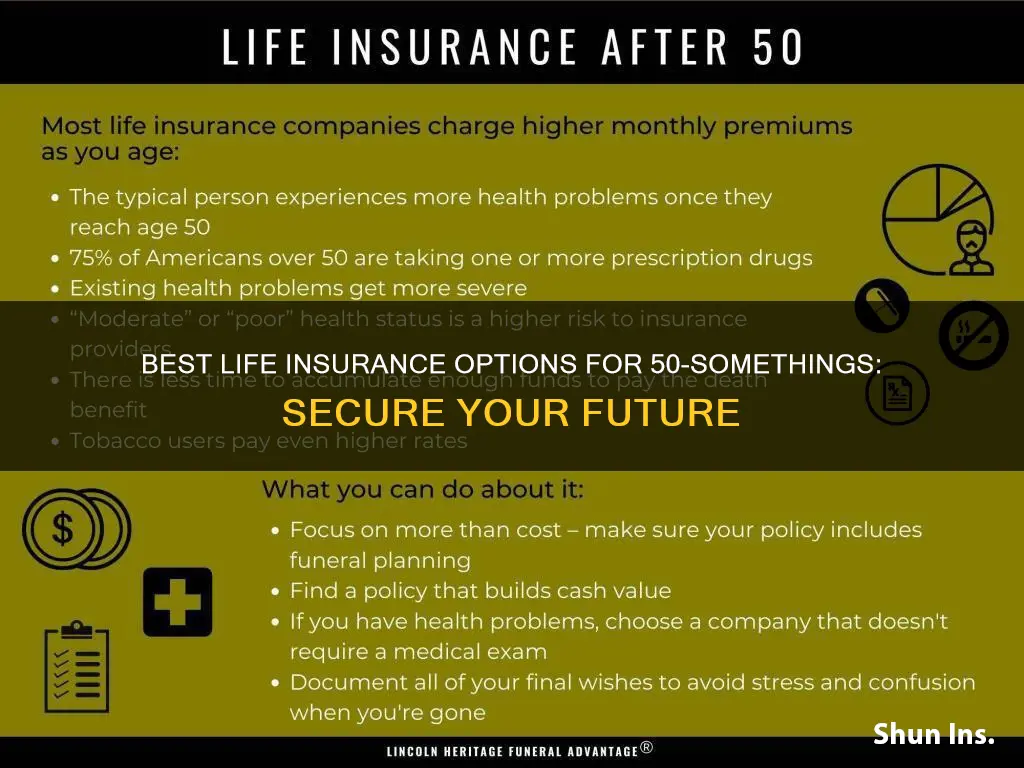

As individuals approach their 50s, they often find themselves at a pivotal point in life, with a desire to secure their loved ones' futures. Choosing the right life insurance at this stage can be a challenging task, as it requires a careful evaluation of personal needs and financial goals. With age, health considerations become more critical, and finding a policy that offers both comprehensive coverage and affordability is essential. This article aims to guide readers through the process of selecting the best life insurance option for their 50s, considering factors such as term length, coverage amounts, and the impact of age-related health conditions.

What You'll Learn

- Term Life Insurance: Affordable coverage for a specific period, ideal for those over 50

- Whole Life Insurance: Permanent coverage with a guaranteed death benefit, suitable for long-term financial planning

- Final Expense Insurance: Covers funeral and burial costs, often preferred by older adults

- Universal Life Insurance: Flexible policy with adjustable premiums, offering potential for cash value accumulation

- Guaranteed Universal Life: Fixed premiums and death benefit, providing stability and predictability for older individuals

Term Life Insurance: Affordable coverage for a specific period, ideal for those over 50

Term life insurance is an excellent choice for individuals over 50 seeking affordable coverage for a defined period. This type of policy provides a straightforward and cost-effective solution, ensuring financial security for a specific duration, typically 10, 15, or 20 years. As you age, your health and financial priorities may change, making term life insurance a flexible and suitable option.

For those in their 50s, term life insurance offers a way to protect your loved ones from financial hardship in the event of your passing. It provides a lump sum payment to your beneficiaries, covering essential expenses like mortgage payments, children's education, or daily living costs. The beauty of term life insurance lies in its simplicity; it is a pure insurance product, focusing solely on providing coverage for a predetermined period. This simplicity often results in lower premiums compared to permanent life insurance, making it financially accessible to many older adults.

When considering term life insurance, it's essential to evaluate your specific needs. Assess your remaining years and the potential financial impact on your family if you were to pass away during that time. For instance, if you have a young child who will require financial support for their education, a 20-year term policy could ensure they have the necessary funds during that critical period. Additionally, consider the potential future financial obligations you may have, such as an existing mortgage or business commitments, and choose a term length that aligns with your goals.

One of the advantages of term life insurance is its affordability. As you age, the risk to the insurance company decreases, leading to lower premiums. This makes it an attractive option for older adults who may have limited budgets but still want to provide for their families. Moreover, term life insurance is highly customizable, allowing you to tailor the policy to your unique circumstances. You can select the coverage amount, term length, and even opt for additional riders or benefits to suit your preferences.

In summary, term life insurance is a practical and affordable solution for individuals over 50, offering a defined period of coverage to protect your loved ones. Its simplicity, affordability, and flexibility make it an ideal choice for those seeking a straightforward insurance product. By carefully considering your specific needs and choosing the appropriate term length, you can ensure that your family is financially secure during the years that matter most.

Lumico Life Insurance: AmBest's Top-Rated Coverage Options

You may want to see also

Whole Life Insurance: Permanent coverage with a guaranteed death benefit, suitable for long-term financial planning

Whole life insurance is an excellent choice for individuals approaching or entering their 50s, offering a range of benefits that make it a valuable financial tool. This type of insurance provides permanent coverage, ensuring that your loved ones are protected throughout your entire life, which is particularly important as you age and your financial needs may change. One of the key advantages of whole life insurance is the guaranteed death benefit. This means that, regardless of when you pass away, your beneficiaries will receive a predetermined amount of money, providing financial security for your family during a time of significant loss. This guaranteed aspect is especially crucial for those in their 50s, as it offers long-term peace of mind and financial stability.

As a permanent policy, whole life insurance builds cash value over time, which can be borrowed against or withdrawn as needed. This feature allows policyholders to access their own money, providing flexibility for various financial goals. For instance, you could use the cash value to fund your retirement, pay for your child's education, or even start a business. The ability to access your own funds without penalties or taxes is a significant advantage, especially for those who want to make the most of their insurance policy's potential.

When considering whole life insurance at 50, it's essential to evaluate your specific needs and financial situation. At this age, you may have accumulated significant assets and financial responsibilities, making it a critical time to review and update your insurance coverage. Whole life insurance can help ensure that your estate is protected and that your beneficiaries receive the financial support they need. Additionally, the guaranteed death benefit can provide a sense of security, knowing that your family's financial future is partially secured.

The benefits of whole life insurance extend beyond financial protection. It can also serve as a valuable financial planning tool. With permanent coverage, you can build a substantial cash value, which can be used to secure your financial future. This type of insurance is particularly attractive for long-term financial planning, as it offers a consistent and reliable source of funds that can grow over time. Moreover, the guaranteed death benefit provides a safety net, ensuring that your loved ones are taken care of, even if other sources of income were to be lost.

In summary, whole life insurance is a comprehensive and suitable option for individuals in their 50s. It offers permanent coverage, a guaranteed death benefit, and the potential for long-term financial growth. By considering your personal circumstances and financial goals, you can make an informed decision about whole life insurance, ensuring that you and your loved ones are protected and that your financial future is secure. This type of insurance is a powerful tool for those seeking to achieve their financial objectives while providing essential coverage.

Bankers Life: Term Insurance Options and Features

You may want to see also

Final Expense Insurance: Covers funeral and burial costs, often preferred by older adults

As we age, the importance of having a comprehensive life insurance plan becomes increasingly clear, especially when it comes to final expenses. Final expense insurance is a specialized type of coverage designed to provide financial support during the most challenging times—when a loved one passes away. This type of insurance is particularly appealing to individuals over 50, as it offers a sense of security and peace of mind, ensuring that the financial burden of funeral and burial costs won't fall on their families.

At 50, many people are at a life stage where they have accumulated significant assets, such as a home, investments, or a successful business. However, they may also be facing increased healthcare costs and a higher risk of mortality. Final expense insurance steps in to bridge this gap, providing a guaranteed death benefit that covers the estimated costs of funeral and burial services. This coverage is often tailored to the individual's needs, ensuring that the policyholder's wishes are honored without causing financial strain on their loved ones.

The beauty of final expense insurance is its simplicity and ease of understanding. Unlike some other life insurance policies, it is straightforward and focused on a specific purpose. When you purchase this type of insurance, you typically choose a benefit amount that covers the estimated costs of your final arrangements. This amount is then paid out as a death benefit to your designated beneficiaries, providing immediate financial relief during a difficult time.

For older adults, final expense insurance can be a strategic decision. It allows individuals to secure their financial legacy while also providing much-needed support to their families. This type of insurance is often more affordable for those over 50 compared to traditional life insurance policies, making it an attractive option for those who want to ensure their loved ones are taken care of without leaving a heavy financial burden.

In summary, final expense insurance is a practical and considerate choice for individuals at the age of 50 and beyond. It provides a safety net for the future, ensuring that the costs associated with end-of-life arrangements are covered. By exploring this insurance option, older adults can take a proactive approach to securing their financial well-being and the peace of mind that comes with knowing their loved ones will be cared for.

Colonial Penn's Term Life Insurance: What's the Duration?

You may want to see also

Universal Life Insurance: Flexible policy with adjustable premiums, offering potential for cash value accumulation

Universal life insurance is a versatile and flexible policy option that can be particularly beneficial for individuals in their 50s seeking a tailored insurance solution. This type of policy offers a unique combination of features that make it an attractive choice for those who want both coverage and the potential for long-term financial growth.

One of the key advantages of universal life insurance is its flexibility. Unlike traditional term life insurance, where premiums are set for a specific period, universal life insurance allows policyholders to adjust their premiums and death benefits over time. This flexibility is especially valuable for those in their 50s, as it enables them to adapt the policy to their changing financial circumstances and needs. For instance, if an individual's financial situation improves, they can increase their death benefit to ensure their loved ones are adequately protected. Conversely, if their financial goals shift, they can adjust the premiums to align with their new priorities.

The policy also provides the potential for cash value accumulation, which is a significant benefit for older individuals. As premiums are paid, a portion of the premium goes towards building cash value, which grows tax-deferred. This accumulated cash value can be borrowed against or withdrawn, providing a financial safety net for various purposes. For example, it can be used to cover unexpected expenses, fund retirement, or even be taken out as a loan with favorable interest rates, allowing the policyholder to access their own money without paying taxes on it.

Over time, the cash value can grow significantly, and this feature is particularly advantageous for those in their 50s who may have specific financial goals or retirement plans. The ability to access and utilize this cash value can provide a sense of financial security and control, ensuring that the policyholder's hard-earned money is working for them in multiple ways.

In summary, universal life insurance is a powerful tool for individuals in their 50s, offering flexibility, potential for cash value accumulation, and the ability to adapt to changing life circumstances. It provides a comprehensive solution that combines insurance coverage with a financial strategy, ensuring that policyholders can make the most of their hard-earned money while also protecting their loved ones. This type of policy is a valuable consideration for anyone seeking a long-term financial plan that offers both security and growth potential.

Life Insurance Options Post-Heart Attack: What You Need to Know

You may want to see also

Guaranteed Universal Life: Fixed premiums and death benefit, providing stability and predictability for older individuals

Guaranteed Universal Life (GUL) is a type of permanent life insurance that offers a fixed premium and a guaranteed death benefit, making it an attractive option for individuals approaching or at the age of 50. As you enter this life stage, it becomes increasingly important to secure financial stability and peace of mind for yourself and your loved ones. GUL provides a sense of predictability and security, which is particularly valuable for older individuals who want to ensure their financial obligations are met.

With GUL, policyholders pay a consistent premium over a specified period, typically 10, 15, or 20 years, after which the insurance coverage becomes permanent. The beauty of this policy lies in its fixed nature; once the initial term is completed, the premiums and the death benefit remain unchanged. This predictability is a significant advantage for those in their fifties, as it allows them to plan and budget effectively without the worry of increasing costs or unexpected changes in coverage.

The guaranteed death benefit is a cornerstone of GUL. It ensures that the insured individual's beneficiaries receive a predetermined amount upon their passing. This aspect is crucial for older individuals who may have specific financial goals or obligations, such as paying off a mortgage, funding their children's education, or providing for their spouse's retirement. Knowing that a fixed sum will be available to meet these needs can provide immense comfort and security.

One of the key advantages of GUL is its simplicity and transparency. The policy structure is straightforward, making it easier for individuals to understand their coverage and make informed decisions. This clarity is especially beneficial for those approaching retirement age, as it allows them to focus on other aspects of their financial planning without the added complexity of more complex insurance products.

In summary, Guaranteed Universal Life insurance is an excellent choice for individuals at 50 years of age or older. It offers fixed premiums and a guaranteed death benefit, providing stability and predictability during a time when financial security is of utmost importance. With GUL, you can ensure that your loved ones are protected, and your financial goals are met, even in the absence of the insured individual. This type of life insurance empowers you to take control of your financial future and make informed decisions with confidence.

Florida's Life Insurance Replacement: What You Need to Know

You may want to see also

Frequently asked questions

At 50, a whole life insurance policy is often recommended. This type of policy offers lifelong coverage and builds cash value over time, which can be borrowed against or withdrawn as needed. It provides financial security and peace of mind, ensuring your loved ones are protected even in your later years.

Life insurance becomes crucial as you age as it provides financial protection for your family or beneficiaries. It ensures that your loved ones have financial support in case of your untimely demise, covering expenses like funeral costs, outstanding debts, mortgage payments, or daily living expenses. This coverage can be a significant financial safety net during a time when you may have fewer earning years left.

Yes, several advantages come with purchasing life insurance at 50. Firstly, you may be eligible for lower premiums compared to younger individuals since statistics show a reduced risk of mortality at this age. Additionally, you can often choose from a variety of coverage options and term lengths to find a plan that aligns with your specific needs and financial goals. This stage in life allows for more tailored and personalized insurance choices.