When considering whole life insurance, finding the best value is crucial for ensuring financial security for your loved ones. The best value in whole life insurance is often determined by a combination of factors, including coverage amount, premium cost, investment options, and the insurer's financial strength. It's essential to evaluate policies from multiple providers, considering their reputation, customer service, and the flexibility of their policies to meet your specific needs. Additionally, understanding the long-term benefits, such as guaranteed death benefit and cash value accumulation, can help you make an informed decision about the best value for your whole life insurance policy.

What You'll Learn

- Cost-Benefit Analysis: Compare premiums, coverage, and long-term savings

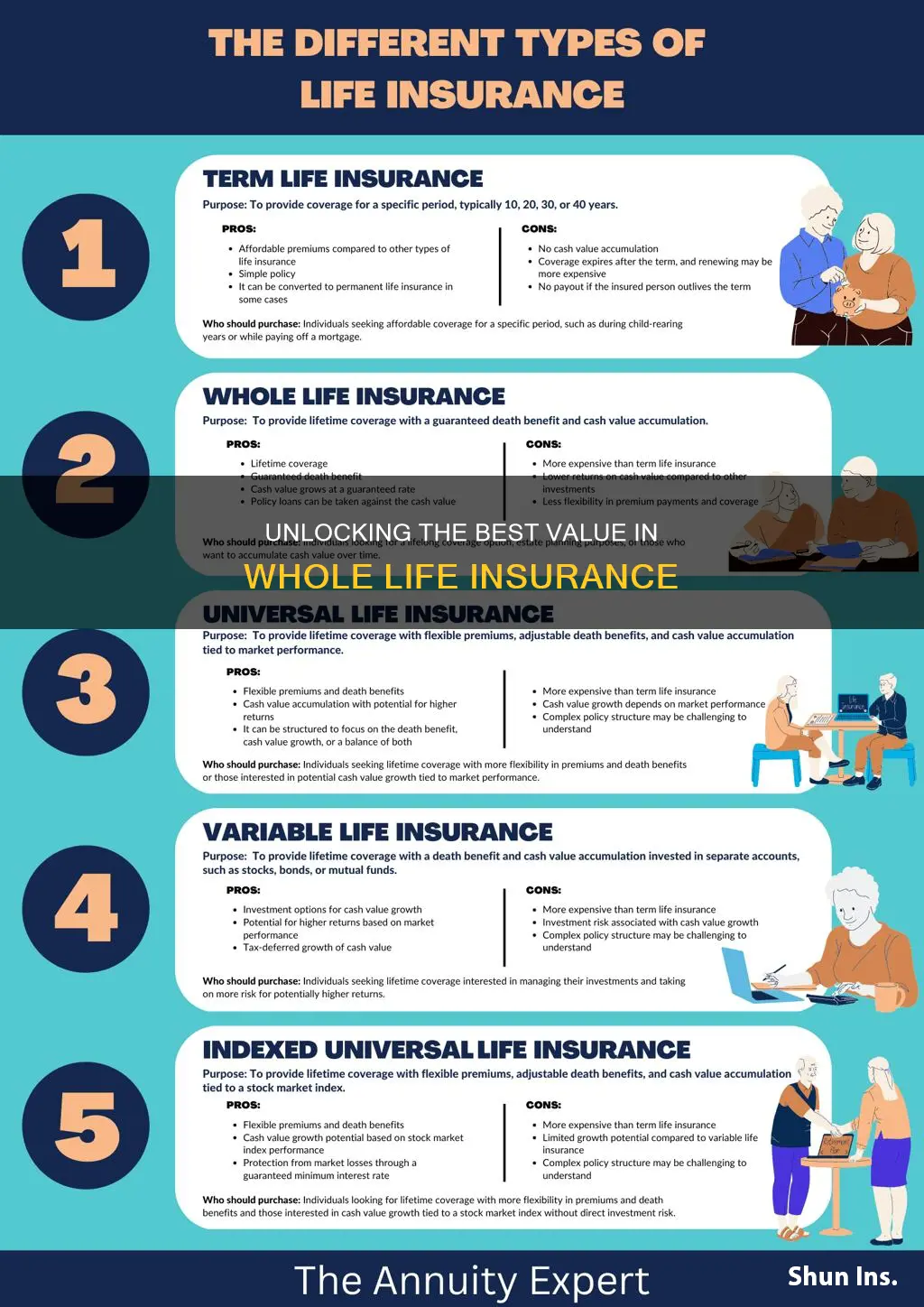

- Term vs. Permanent: Understand the trade-offs between term and permanent insurance

- Health and Age: Consider health status and age for optimal coverage

- Financial Goals: Align insurance with financial objectives and risk tolerance

- Provider Reputation: Research insurance companies' financial stability and customer service

Cost-Benefit Analysis: Compare premiums, coverage, and long-term savings

When considering whole life insurance, a cost-benefit analysis is essential to determine the best value for your needs. This analysis involves evaluating the premiums, coverage, and long-term savings associated with different insurance policies. Here's a breakdown of how to approach this comparison:

Premiums: The first and most obvious cost is the premium you pay regularly (monthly, quarterly, or annually). Whole life insurance premiums are typically higher compared to term life insurance, especially for higher coverage amounts. However, it's crucial to compare rates from various insurers. Some companies offer more competitive premiums, especially for those with a healthy lifestyle and no significant medical history. Understanding the factors that influence premium rates, such as age, health, and lifestyle, can help you negotiate better terms or find more affordable options.

Coverage Amount: The coverage amount you choose directly impacts the premium. Higher coverage amounts mean higher premiums. It's essential to strike a balance between the desired coverage and your financial capabilities. Consider your family's financial needs and potential future expenses when deciding on the coverage. For instance, if you have a large family with young children, you might opt for a higher coverage amount to ensure financial security in the event of your passing.

Long-Term Savings Component: Whole life insurance includes a savings component that accumulates cash value over time. This feature can be a significant benefit, as it allows your money to grow tax-deferred. The long-term savings aspect is particularly valuable if you're considering the insurance as an investment tool. Compare the interest rates offered by different insurers and consider how these savings can be utilized, such as loaning against the policy's cash value or withdrawing funds for major purchases or retirement.

Term Life vs. Whole Life: It's worth noting that term life insurance might be more cost-effective for shorter-term needs, especially if you're young and healthy. In contrast, whole life insurance provides lifelong coverage and the aforementioned long-term savings, making it a more comprehensive but potentially more expensive option. Understanding the differences between these two types of insurance will help you make an informed decision.

By carefully comparing premiums, coverage amounts, and the long-term savings potential, you can identify the best value for your whole life insurance policy. This analysis ensures that you make a financially sound decision, balancing the immediate costs with the long-term benefits.

Financial Advisors: Life Insurance Payment Structures Explained

You may want to see also

Term vs. Permanent: Understand the trade-offs between term and permanent insurance

When considering the best value for whole life insurance, it's essential to understand the fundamental distinction between term and permanent insurance. This knowledge will empower you to make an informed decision that aligns with your financial goals and needs.

Term Insurance:

Term insurance provides coverage for a specific period, known as the "term." This type of insurance is often more affordable than permanent insurance because it doesn't accumulate cash value over time. It is a straightforward and cost-effective solution for temporary coverage needs, such as protecting your family during a specific period, like the time it takes to pay off a mortgage or until your children become financially independent. The primary advantage of term insurance is its simplicity and predictability in pricing. You pay a fixed premium for the duration of the term, and if a covered event occurs (e.g., death), the insurance company pays out a death benefit. Once the term ends, you can choose to renew the policy or shop for a new one, depending on your evolving circumstances.

Permanent Insurance:

Permanent insurance, on the other hand, is designed to provide lifelong coverage. It includes a combination of death benefit protection and an investment component, which allows the policy to accumulate cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. Permanent insurance is more expensive than term insurance due to the added investment features. It offers several benefits, including the potential for tax-deferred growth of the cash value and the ability to build equity that can be borrowed against. This type of insurance is suitable for those seeking long-term financial security and the peace of mind that comes with knowing they have coverage for life.

Understanding the Trade-offs:

The choice between term and permanent insurance depends on your specific circumstances and financial objectives. Here are some key trade-offs to consider:

- Cost: Term insurance is generally more affordable, especially for shorter coverage periods. Permanent insurance, with its investment component, can be more expensive but offers long-term financial benefits.

- Flexibility: Term insurance provides flexibility in terms of coverage duration and the option to renew or change policies. Permanent insurance, once issued, is typically non-cancellable and offers lifelong coverage.

- Financial Goals: If your primary goal is to protect your family during a specific period, term insurance is likely the best choice. For those seeking long-term financial security and the potential for investment growth, permanent insurance might be more suitable.

- Risk Tolerance: Consider your risk tolerance. Term insurance is less risky in terms of premium increases, while permanent insurance may offer more stable long-term pricing.

In summary, when evaluating the best value for whole life insurance, it's crucial to assess your unique needs and financial objectives. Term insurance offers simplicity and affordability for temporary coverage, while permanent insurance provides lifelong protection and investment opportunities. Understanding these trade-offs will enable you to make an informed decision that ensures your loved ones are protected and your financial goals are met.

Life Insurance Beneficiary: Can a Corporation Benefit?

You may want to see also

Health and Age: Consider health status and age for optimal coverage

When it comes to whole life insurance, understanding the impact of health and age is crucial for making informed decisions about your coverage. These two factors significantly influence the cost and benefits of your insurance policy. Here's a detailed breakdown of how health and age play a pivotal role in determining the best value for your whole life insurance:

Health Status:

Your overall health is a critical determinant of insurance premiums. Insurance companies assess your health to gauge the likelihood of future claims. A good health status, including a history of regular check-ups, a balanced diet, and a lack of chronic diseases, can lead to lower premiums. For instance, individuals with no significant medical history and no ongoing health issues may qualify for preferred rates, making their whole life insurance more affordable. On the other hand, those with pre-existing conditions or a history of serious illnesses might face higher premiums or even be considered a higher risk, which could impact the overall value of their policy.

Age:

Age is another essential factor in the insurance industry. Younger individuals typically have lower insurance rates because they are statistically less likely to require insurance payouts. As you age, the risk of developing health issues increases, and so do the insurance premiums. For example, a 30-year-old might find that their whole life insurance is more cost-effective compared to someone in their 60s. However, it's important to note that age also influences the long-term benefits of the policy. Younger individuals may have more time to build up the cash value of their policy, which can be a valuable asset in the future.

Considering your health and age together allows for a more comprehensive evaluation of your insurance needs. Younger, healthier individuals might opt for higher coverage amounts to ensure they have adequate protection during their most productive years. As you age, you may want to review and adjust your policy to ensure it still meets your financial goals and provides the necessary coverage.

In summary, when seeking the best value for whole life insurance, it is essential to consider your health and age. A healthy lifestyle and a younger age can contribute to lower premiums and more favorable terms. However, as you age, regular policy reviews are necessary to ensure your insurance remains aligned with your changing circumstances and financial objectives. This approach ensures that your whole life insurance provides optimal coverage and value throughout your life.

Life Insurance: WCI Term Lengths Explored

You may want to see also

Financial Goals: Align insurance with financial objectives and risk tolerance

When considering whole life insurance, aligning your insurance coverage with your financial goals and risk tolerance is crucial for making informed decisions. Here's a detailed guide to help you navigate this process:

Understanding Financial Goals: Begin by clearly defining your financial objectives. Insurance is a tool to protect and support your financial future. For instance, if you have a family that depends on your income, life insurance can provide financial security in case of your untimely demise. Similarly, if you're saving for your child's education, whole life insurance can offer a guaranteed payout at a future date, ensuring educational expenses are covered. Understanding your short-term and long-term goals will help you determine the appropriate insurance coverage.

Risk Tolerance and Insurance: Risk tolerance refers to your capacity to withstand financial losses or market volatility. It's essential to assess your risk tolerance when choosing insurance. For example, if you have a low risk tolerance, you might prefer a more conservative investment-linked policy, ensuring a steady growth rate. On the other hand, if you're comfortable with higher risks, you could opt for a policy with higher potential returns but also higher volatility. Understanding your risk tolerance helps in selecting a policy that aligns with your financial comfort level.

Matching Insurance to Objectives: The key is to find a balance between insurance coverage and your financial goals. For instance, if your primary goal is to build a substantial savings pot for your child's education, a whole life insurance policy with a higher cash value accumulation rate could be ideal. This way, you can ensure a significant payout for educational expenses while also benefiting from tax-advantaged savings. Conversely, if your goal is to provide immediate financial support to your family, a term life insurance policy might be more suitable, offering coverage for a specific period at a lower cost.

Regular Review and Adjustment: Financial goals and circumstances evolve over time. It's essential to periodically review your insurance policies and make adjustments as needed. Life events like marriage, the birth of a child, or a career change can significantly impact your insurance needs. Regularly assessing your risk tolerance and financial objectives will help you stay on track and ensure your insurance coverage remains aligned with your evolving goals.

Seek Professional Guidance: Given the complexity of insurance products, consulting a financial advisor or insurance specialist can be invaluable. These professionals can provide personalized advice, helping you navigate the various policy options and ensure you make choices that align with your financial goals and risk tolerance. They can also assist in creating a comprehensive financial plan that incorporates insurance as a vital component.

Life Insurance: Brainly's Guide to Making the Right Choice

You may want to see also

Provider Reputation: Research insurance companies' financial stability and customer service

When considering whole life insurance, provider reputation is a critical factor to evaluate. It's essential to research and understand the financial stability and customer service of insurance companies to ensure you're making an informed decision. Here's a detailed guide on how to assess these aspects:

Financial Stability:

Whole life insurance is a long-term commitment, and you want to ensure that your chosen provider will be around to honor their promises. Financial stability is a key indicator of an insurance company's ability to meet its obligations. Here's how to research this:

- Ratings from Credit Rating Agencies: Reputable credit rating agencies like A.M. Best, Moody's, and Standard & Poor's assign financial strength ratings to insurance companies. These ratings provide an independent assessment of the company's financial stability. Look for companies with strong ratings, typically "A" or higher, as this indicates a lower risk of financial failure.

- Financial Reports: Review the insurance company's annual financial reports, which are publicly available. These reports provide insights into the company's financial health, including assets, liabilities, and profitability. A healthy financial position suggests a greater ability to withstand financial challenges.

- Regulatory Oversight: Check if the insurance company is regulated by a reputable financial regulatory body in your jurisdiction. Regulators ensure companies adhere to strict financial standards and provide protection for policyholders.

Customer Service:

Exceptional customer service is crucial for a positive experience throughout your whole life insurance journey. Here's how to evaluate this aspect:

- Online Reviews: Scour online review platforms and forums for feedback from current and past policyholders. Pay attention to common themes, such as claim processing efficiency, responsiveness to inquiries, and overall satisfaction. Positive reviews can indicate a company's commitment to customer service.

- Complaint History: Research any complaints filed against the insurance company with regulatory bodies. While not all companies will be perfect, a pattern of unresolved complaints may raise red flags.

- Customer Support Channels: Assess the availability and effectiveness of customer support channels. Look for multiple communication options like phone, email, and live chat, indicating a commitment to accessibility.

By thoroughly researching provider reputation, focusing on financial stability, and evaluating customer service, you can make a well-informed decision when choosing whole life insurance. Remember, a reputable company with strong financial stability and excellent customer service is more likely to provide a reliable and satisfying experience over the long term.

Roth IRA Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Whole life insurance offers a combination of coverage and long-term savings, making it an excellent value for those seeking financial security. It provides a guaranteed death benefit, meaning the insurance company promises to pay out a specified amount upon your passing. Additionally, it includes an investment component, allowing your premiums to grow over time, accumulating cash value that can be borrowed against or withdrawn. This feature makes whole life insurance a valuable asset, especially for those who want a consistent and reliable financial plan.

The cost of whole life insurance can vary depending on several factors, including your age, health, and the amount of coverage you require. Generally, it is more expensive than term life insurance, especially for higher coverage amounts. However, the premiums are typically lower compared to other permanent life insurance policies like universal life. The advantage of whole life is its predictability; the premiums remain fixed for the entire policy term, providing stability and ensuring you won't face sudden rate increases.

Yes, you can find good value in whole life insurance by considering the following: First, purchase it early in life when you are healthier, as rates tend to increase with age. Second, compare quotes from multiple insurers to find the best rates. Third, consider the coverage amount you need and avoid over-insuring, as this can lead to unnecessary costs. Finally, review your policy regularly and make adjustments as your circumstances change to ensure you're getting the best value for your money.

While whole life insurance offers numerous benefits, there are a few potential drawbacks to consider. Firstly, the premiums can be a significant financial commitment, especially for those on a tight budget. Secondly, the cash value growth may be slower compared to other investment options, and it might take several years to accumulate a substantial amount. Lastly, some people may prefer the simplicity of term life insurance, as whole life policies can be more complex and may require careful management to maximize their value.