The cash value of a life insurance policy is a crucial aspect to understand when considering the financial benefits of such a policy. It represents the monetary amount that can be withdrawn or borrowed against if the policyholder decides to access the funds before the policy's maturity. This feature allows policyholders to utilize the policy's value for various financial needs, providing a sense of security and flexibility. Understanding the cash value is essential for making informed decisions about the policy's utilization and ensuring the policyholder's financial well-being.

What You'll Learn

Premiums: The amount paid regularly to maintain coverage

When it comes to life insurance, understanding the concept of premiums is crucial. Premiums are the regular payments made by the policyholder to the insurance company to maintain their coverage. These payments ensure that the insurance policy remains active and provides financial protection for the insured individual or their beneficiaries. The amount of premium paid can vary depending on several factors, including the type of policy, the insured's age, health, and the desired coverage amount.

In the context of cash value life insurance policies, premiums play a dual role. Firstly, they contribute to the insurance coverage, providing financial security for the policyholder's loved ones in the event of their passing. Secondly, a portion of the premium is invested and grows over time, accumulating cash value. This cash value can be borrowed against or withdrawn, providing policyholders with a financial asset that can be utilized for various purposes.

The calculation of premiums involves assessing the risk associated with insuring an individual. Insurance companies consider factors such as age, gender, health status, lifestyle choices, and family medical history to determine the likelihood of an insured person making a claim. Younger and healthier individuals often pay lower premiums as they are considered less risky. As one ages, premiums tend to increase due to the higher statistical probability of claims.

It's important to note that the premium structure can vary between different insurance providers and policy types. Term life insurance, for instance, offers coverage for a specified period, and premiums are typically lower compared to permanent life insurance policies. Permanent life insurance, on the other hand, provides lifelong coverage and includes an investment component, which influences the premium amount.

Understanding the premium structure is essential for policyholders to make informed decisions about their insurance coverage. By evaluating their financial situation, risk factors, and long-term goals, individuals can choose the appropriate policy and premium payment options that align with their needs. Regularly reviewing and adjusting premiums can also help ensure that the insurance coverage remains adequate and cost-effective over time.

Endowment Contracts: Life Insurance's Modified Details

You may want to see also

Death Benefit: The payout upon the insured's passing

The death benefit is a critical aspect of life insurance, as it ensures financial security for the policyholder's loved ones in the event of their passing. When an insured individual dies, the life insurance policy comes into effect, and the death benefit is paid out to the designated beneficiaries. This payout can provide a much-needed financial safety net, helping to cover expenses such as funeral costs, outstanding debts, mortgage payments, or even daily living expenses for the family.

The amount of the death benefit is typically predetermined and agreed upon when the policy is purchased. It can be a lump sum payment or an annuity, depending on the type of policy. Term life insurance, for example, usually offers a straightforward death benefit, providing coverage for a specified period, say 10 or 20 years. In contrast, permanent life insurance, such as whole life or universal life, may have a death benefit that increases over time, accumulating cash value.

In the context of cash value life insurance, the death benefit is directly linked to the policy's cash value. As premiums are paid, a portion of the money goes into building this cash value, which grows over time through interest and investment returns. When the insured dies, the cash value is used to fund the death benefit payout, ensuring that the beneficiaries receive the full amount. This feature can be particularly valuable as it provides a financial asset that can be borrowed against or withdrawn, offering flexibility and potential financial benefits beyond the initial insurance coverage.

It's important to note that the death benefit is a promise made by the insurance company, and they are legally obligated to pay it out as per the policy terms. The process of claiming the death benefit involves providing the necessary documentation, such as proof of death and beneficiary information, to the insurance company. Once verified, the payout is made, providing immediate financial support to the policyholder's family during a difficult time.

Understanding the death benefit is essential for anyone considering life insurance, as it directly impacts the financial security of loved ones. By choosing a policy with a suitable death benefit, individuals can ensure that their family's financial well-being is protected, even in the face of tragedy. This aspect of life insurance highlights the importance of careful planning and consideration of one's specific needs and circumstances.

Life Insurance Cancellation: Will You Be Notified?

You may want to see also

Cash Value Accumulation: Growth of money within the policy over time

The concept of cash value accumulation is a fundamental aspect of life insurance policies, particularly those with a permanent or whole life component. This feature allows the policyholder to build up a valuable asset over time, providing financial security and a range of potential benefits. When you invest in a life insurance policy, a portion of your premium payments goes towards building this cash value, which can grow tax-deferred. This growth is a result of the policy's investment strategy, where a portion of the premium is allocated to various investment options offered by the insurance company.

Over time, the cash value in your policy accumulates and grows. This growth is influenced by several factors, including the investment performance of the policy's assets, the frequency and amount of premium payments, and the policy's fees and expenses. The investment options available within the policy can vary, such as stocks, bonds, and mutual funds, each carrying different levels of risk and potential returns. The insurance company typically manages these investments, aiming to provide a steady and potentially substantial return on the policyholder's investment.

As the policyholder, you have the flexibility to choose how much of your premium goes towards building cash value. You can opt for higher cash value accumulation by allocating a larger portion of your premium to this purpose. This strategy can be advantageous as it allows you to build a more substantial financial reserve within the policy. Additionally, the cash value can be borrowed against or withdrawn, providing access to funds without the need for a loan or other financial obligations.

The growth of cash value is a long-term process, and it is essential to understand that it may take several years for the policy to accumulate a significant amount. The rate of growth can vary based on market conditions, investment performance, and the specific features of your policy. It is a strategic investment, offering a way to build wealth while also having the security of life insurance coverage. Policyholders can benefit from this growth in various ways, such as using the accumulated cash value to pay for college tuition, starting a business, or providing financial support during retirement.

In summary, cash value accumulation is a powerful feature of life insurance policies, allowing individuals to grow their money over time within the policy's framework. It provides a means to build financial security and offers policyholders the potential to benefit from investment returns while also ensuring life insurance protection. Understanding the factors that influence cash value growth is essential for making informed decisions about your insurance policy and its long-term financial impact.

Farmers Life Insurance: Is It a Participating Whole Life Policy?

You may want to see also

Policy Loans: Borrowing against the cash value

The cash value of a life insurance policy is a crucial aspect of understanding the financial benefits it offers. When you purchase a life insurance policy, it not only provides financial protection for your loved ones but also accumulates cash value over time. This cash value can be a valuable asset, and one of the ways to access this value is through policy loans.

A policy loan is a loan that you can take out against the cash value of your life insurance policy. It allows you to borrow money using the policy's accumulated value as collateral. This can be particularly useful for individuals who want to access funds without selling their policy or disrupting their insurance coverage. Policy loans offer a way to utilize the cash value while still maintaining the long-term benefits of the insurance.

The process of obtaining a policy loan is relatively straightforward. You can typically borrow up to a certain percentage of the policy's cash value, which may vary depending on the insurance company and the policy type. The loan is secured by the policy itself, so it is essential to understand the terms and conditions to ensure you are borrowing responsibly. Interest rates on policy loans are usually lower compared to traditional loans because they are tied to the policy's investment performance.

One of the significant advantages of policy loans is that they provide immediate access to funds without the lengthy approval processes associated with other loans. This can be beneficial for various purposes, such as funding education, starting a business, or covering unexpected expenses. Additionally, the interest paid on the loan is often tax-deductible, providing further financial benefits.

However, it is crucial to approach policy loans with caution. Borrowing against the cash value means that the death benefit of the policy may be reduced, impacting the financial security of your beneficiaries. It is essential to carefully consider the loan amount, repayment terms, and potential consequences before proceeding. Consulting with a financial advisor or insurance professional can provide valuable guidance in managing policy loans and ensuring a balanced approach to utilizing the cash value of your life insurance policy.

Detecting Life Insurance Fraud: Strategies for Success

You may want to see also

Surrender Value: The amount received if the policy is terminated

When considering the financial aspects of a life insurance policy, it's important to understand the concept of surrender value, which is a crucial component of the cash value of a life insurance policy. This value represents the amount an individual can receive if they decide to terminate or surrender the policy before the designated maturity date. It is essentially the cash equivalent of the policy's accumulated value up to that point.

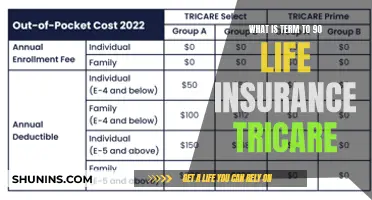

Surrender value is particularly relevant for term life insurance policies, which provide coverage for a specific period, typically 10, 20, or 30 years. If the insured individual decides to cancel the policy before the term ends, they can typically access the surrender value. This value is calculated based on the policy's performance, including the premiums paid, investment earnings, and any other applicable fees. The insurance company uses this value to cover the costs associated with the policy and provide a return on the premiums paid.

The process of surrendering a life insurance policy usually involves the following steps. First, the policyholder must notify the insurance company of their intention to surrender the policy. This often requires completing a surrender request form and providing necessary documentation. Once the request is approved, the insurance company will calculate the surrender value based on the policy's cash value. This calculation considers factors such as the policy's age, the amount of premiums paid, and any applicable fees or penalties.

The surrender value can be a significant financial asset for policyholders, especially if they have been paying premiums for an extended period. It provides individuals with a means to access their investment in the policy, offering financial flexibility. However, it's important to note that surrender values may be subject to certain restrictions and penalties, especially if the policy is surrendered early in its term. Policyholders should carefully review the terms and conditions of their specific insurance policy to understand the surrender value options and any associated costs.

In summary, the surrender value is a critical aspect of the cash value of a life insurance policy, allowing policyholders to access their investment if they choose to terminate the policy. Understanding this value and its implications can help individuals make informed decisions regarding their life insurance coverage and financial planning. It is always advisable to consult the insurance provider or a financial advisor to fully comprehend the surrender value options and their impact on the overall policy.

Canceling TD Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

The cash value of a life insurance policy is the monetary amount that accumulates over time within the policy. It represents the portion of the policy that is not used for insurance protection and can be borrowed against or withdrawn. This value grows through regular premium payments, investment earnings, and interest credited to the policy's account.

You can access the cash value in several ways. One common method is through policy loans, where you borrow money from the policy's cash value, typically at a low-interest rate. Another option is to take out a policy loan and use the funds for various purposes, such as home improvements, education, or business ventures. It's important to note that borrowing from your policy may affect the death benefit and future cash value accumulation.

A A: Yes, there can be fees and penalties. When you withdraw funds or take a loan, the insurance company may charge a surrender charge or a policy loan fee. These fees are designed to cover administrative costs and ensure the policy's continued viability. It's advisable to review the policy's terms and conditions to understand the specific fees and any potential tax implications.

Absolutely! The cash value of a life insurance policy can be a valuable resource for various financial goals, including education funding. You can take out a policy loan and use the proceeds to pay for college tuition, books, and other educational expenses. This can be a strategic way to access funds without selling the policy or disrupting the ongoing insurance coverage.

The cash value grows through a combination of factors. Firstly, regular premium payments contribute to the policy's account. Secondly, the insurance company invests a portion of these premiums, generating investment earnings. Additionally, interest is credited to the policy, further enhancing the cash value. The growth rate can vary depending on market performance and the specific investment options offered by the insurance provider.