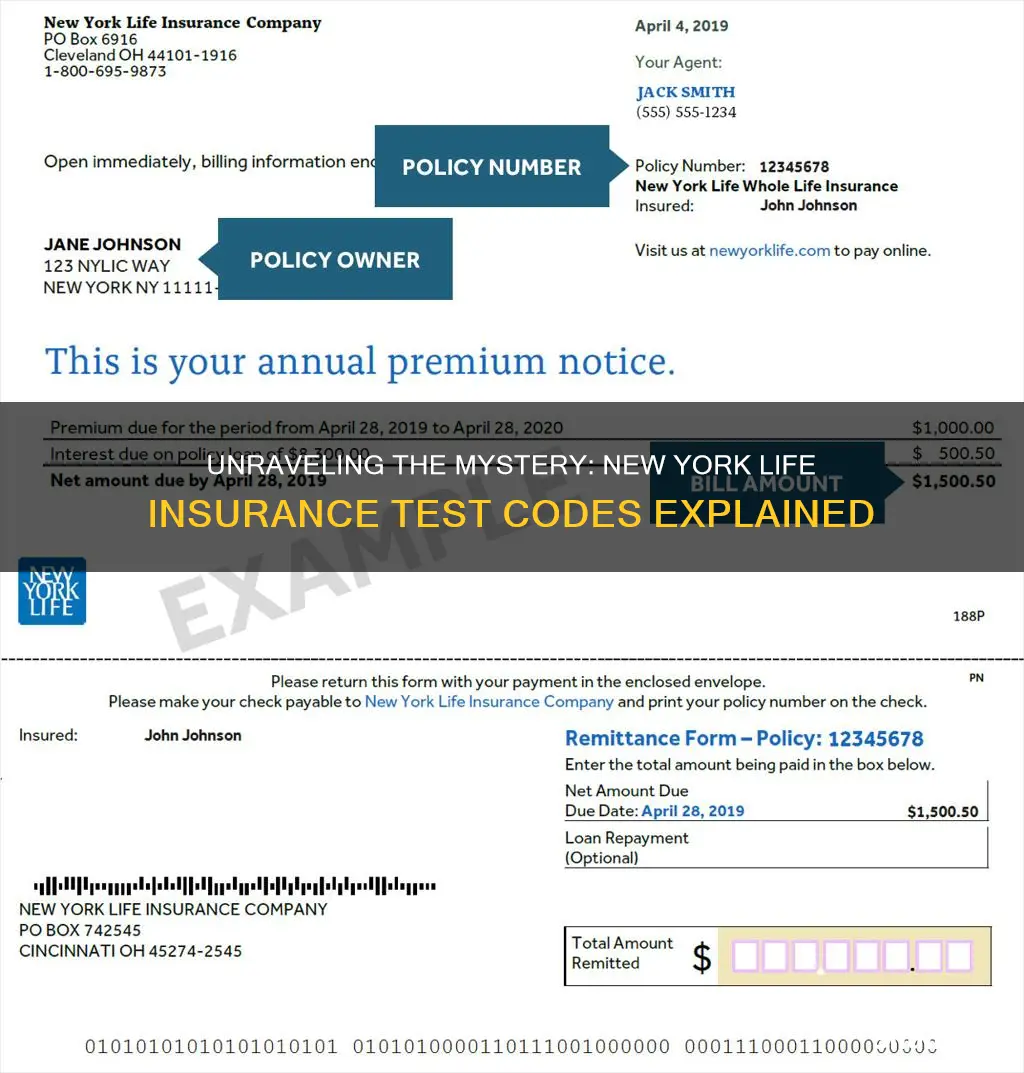

The New York Life Insurance Company, a prominent financial institution, offers various insurance products, and understanding the specific code or test associated with their services is crucial for customers. This paragraph aims to provide an overview of the code or test related to New York Life Insurance, ensuring that individuals can navigate the application process or claim procedures with clarity and confidence.

What You'll Learn

- Eligibility Criteria: Understand who qualifies for the New York Life Insurance test

- Application Process: Learn the steps to apply for the insurance test

- Test Content: Know the topics covered in the New York Life Insurance test

- Passing Score: Discover the minimum score required to pass the test

- Preparation Tips: Get advice on how to prepare for the test effectively

Eligibility Criteria: Understand who qualifies for the New York Life Insurance test

The New York Life Insurance test is a standardized assessment designed to evaluate an individual's knowledge and understanding of insurance principles, particularly in the context of life insurance. This test is crucial for anyone seeking to work in the insurance industry, especially in roles that involve selling or advising on life insurance products. Here's an overview of the eligibility criteria to help you understand who qualifies for this test:

Educational and Professional Background: Candidates must possess a high school diploma or its equivalent. While a specific degree is not mandatory, a background in finance, business, or a related field is advantageous. Insurance agents and brokers often have a strong foundation in these areas, ensuring they can effectively communicate complex insurance concepts to clients. Additionally, a certain number of hours of pre-licensing education are required, which can be completed through approved training programs.

Age and Residency: There are no strict age restrictions for taking the New York Life Insurance test, but it is typically recommended that candidates be at least 18 years old. Residency requirements may vary, but New York residents often have priority in obtaining insurance licenses within the state. Non-residents may still be eligible, but they might need to meet additional criteria set by the New York Insurance Department.

Knowledge and Skills: The test assesses candidates' understanding of various insurance topics, including life insurance types, coverage options, policy terms, and regulatory requirements. It evaluates their ability to interpret and explain complex insurance concepts, assess risk, and provide appropriate advice to clients. Strong communication and interpersonal skills are essential, as insurance professionals need to build trust and explain intricate policies to potential customers.

Ethical and Legal Compliance: Candidates must demonstrate a commitment to ethical conduct and legal compliance. This includes understanding and adhering to New York's insurance laws, regulations, and industry standards. A clean criminal record is generally required, and candidates may need to undergo a background check to ensure they meet the necessary standards of integrity.

Passing the Test: To be eligible for a life insurance license in New York, candidates must achieve a passing score on the New York Life Insurance test. The specific passing criteria may vary, but it typically involves achieving a certain percentage of correct answers. Once qualified, individuals can proceed to the next steps of obtaining their insurance license and starting their career in the insurance industry.

Army Health Insurance: Free for Life?

You may want to see also

Application Process: Learn the steps to apply for the insurance test

The application process for the New York Life Insurance Test involves several steps to ensure a comprehensive evaluation of applicants. Here's a detailed guide on how to navigate this process:

Step 1: Gather Required Documents

Before initiating the application, it's essential to gather all the necessary documents. This includes proof of identity, such as a valid driver's license or passport, and proof of residency in New York. Additionally, you'll need to provide personal details like your full name, date of birth, and contact information. Having these documents ready will streamline the application process and ensure a smooth start.

Step 2: Complete the Application Form

New York Life Insurance provides an application form that applicants must fill out accurately. This form typically covers various aspects of your life, including personal history, health information, and financial details. Be thorough and honest in your responses, as any false information may lead to complications during the testing process or future policy administration. Pay attention to instructions and ensure all required fields are completed.

Step 3: Submit Medical Examination Results

A critical part of the application is providing medical examination results. New York Life Insurance requires applicants to undergo a medical exam to assess their health and determine eligibility. The exam typically includes a physical examination and may involve blood tests and other medical assessments. After the exam, you will receive a report with the results. Submit this report along with the application form to ensure a comprehensive evaluation.

Step 4: Provide Additional Information

Depending on your circumstances, you might need to supply additional documentation. This could include proof of income, employment records, or any relevant medical history. New York Life Insurance may request this information to verify your eligibility and ensure the accuracy of your application. Be prepared to provide these documents promptly to avoid delays in the testing process.

Step 5: Review and Finalize

Once you've completed all the required steps, carefully review your application. Double-check for any errors or missing information. If everything is in order, submit the application to New York Life Insurance. Keep a copy of your application and all supporting documents for your records. This step ensures that your application is complete and ready for the subsequent testing phase.

Remember, providing accurate and comprehensive information is crucial for a successful application. Each step is designed to assess your eligibility and ensure the integrity of the insurance process. By following these instructions, you'll be well-prepared to apply for the New York Life Insurance Test.

Continuing Education: A Lifelong Classroom for Health Insurance

You may want to see also

Test Content: Know the topics covered in the New York Life Insurance test

The New York Life Insurance test is a comprehensive examination designed to assess an individual's knowledge and understanding of various aspects of life insurance. This test is crucial for those seeking to become licensed life insurance agents or advisors in the state of New York. Here's an overview of the key topics you can expect to encounter:

Life Insurance Fundamentals: The test will delve into the core principles of life insurance, including the definition of life insurance, its various types (term, whole life, universal life), and the concept of coverage. Candidates should be prepared to explain how life insurance provides financial security to beneficiaries in the event of the insured individual's death. Understanding the basic mechanics and benefits of life insurance is essential for this section.

Policy Types and Features: A significant portion of the test will focus on different policy types and their unique characteristics. For instance, you should be able to differentiate between term life insurance, which provides coverage for a specified period, and permanent life insurance, which offers lifelong coverage. Additionally, topics like universal life insurance, whole life insurance, and variable universal life insurance will be covered, along with their respective advantages and disadvantages.

Regulatory and Legal Framework: New York's insurance regulations play a vital role in the industry. Test-takers should be familiar with the New York Insurance Law, particularly sections related to life insurance. This includes understanding the requirements for policy issuance, the regulation of premiums, and the obligations of insurance companies and agents. Knowledge of the New York State Department of Financial Services (DFS) guidelines and the role of the DFS in overseeing the insurance sector is also crucial.

Ethics and Professional Conduct: Ethical considerations are paramount in the insurance industry. The test will likely assess your understanding of professional conduct, including customer confidentiality, fair treatment of policyholders, and the prevention of fraudulent activities. Candidates should demonstrate knowledge of New York's insurance industry codes of ethics and the potential consequences of unethical behavior.

Calculations and Policy Illustrations: Practical application is an essential aspect of the test. You may be required to perform calculations related to policy premiums, death benefits, and policy values. Additionally, understanding how to illustrate policy performance over time, including premium payments, cash values, and death benefits, is crucial. These calculations and illustrations are fundamental to providing accurate advice to clients.

Preparing for the New York Life Insurance test requires a thorough understanding of these topics and a strong grasp of the state's specific insurance regulations. It is recommended to study comprehensive study guides and practice question banks to ensure a solid foundation in all the areas mentioned above.

Lightning McQueen: Life Insurance for a Racing Legend?

You may want to see also

Passing Score: Discover the minimum score required to pass the test

The New York Life Insurance Company, a prominent player in the financial services industry, conducts a comprehensive test for prospective employees. This test is designed to assess a wide range of skills and knowledge relevant to the insurance industry, including product knowledge, customer service, and sales techniques. Understanding the passing score is crucial for anyone preparing for this assessment, as it sets the threshold for success.

The passing score for the New York Life Insurance Test is typically set at 70%. This means that candidates must achieve a score of 70% or higher to be considered for employment. It is important to note that this score is a general guideline and may vary depending on the specific role and department within the company. For instance, a role requiring advanced technical skills might have a higher passing threshold.

To achieve this score, candidates should focus on a comprehensive study plan. This should include reviewing the company's product offerings, understanding the sales process, and familiarizing themselves with the company's policies and procedures. Additionally, practicing with sample questions and mock tests can significantly improve performance. These resources can be found on the company's website or through external preparation materials.

It is beneficial to break down the test into manageable sections. For instance, the product knowledge section might cover various insurance products, their features, and benefits. In contrast, the customer service segment could focus on communication skills and problem-solving techniques. By targeting specific areas, candidates can tailor their preparation and increase their chances of success.

Lastly, time management is crucial during the test. Candidates should allocate their time effectively, ensuring they answer all questions to the best of their ability. This might involve quickly identifying the most efficient approach to each question, especially in time-sensitive scenarios. With proper preparation and a strategic approach, achieving the passing score is well within reach.

Breaking Free: Navigating HDFC Life Insurance Maze

You may want to see also

Preparation Tips: Get advice on how to prepare for the test effectively

Preparing for the New York Life Insurance Test requires a strategic approach to ensure you are well-equipped with the necessary knowledge and skills. Here are some detailed preparation tips to help you succeed:

Understand the Test Format: Begin by familiarizing yourself with the structure and content of the test. The New York Life Insurance Test likely covers various aspects of life insurance, including types of policies, coverage options, premium calculations, and regulatory requirements. Research the specific areas that are frequently tested to identify the key topics you need to focus on. This initial step will provide a clear roadmap for your preparation.

Create a Study Plan: Develop a structured study plan to cover all the relevant subjects. Break down the material into manageable sections and allocate specific time slots for each topic. Consider the weightage of different subjects in the test and adjust your study schedule accordingly. For instance, if 'Life Insurance Mathematics' is a significant portion of the exam, dedicate more time to mastering premium calculations, interest rates, and policy illustrations. A well-organized study plan will ensure comprehensive coverage and help you retain information effectively.

Utilize Reputable Resources: Gather high-quality study materials to enhance your understanding. Refer to reputable textbooks, study guides, and online resources specifically designed for life insurance exams. These resources often provide comprehensive explanations, examples, and practice questions. Look for materials that align with the test's curriculum and cover both theoretical concepts and practical applications. Additionally, consider joining study groups or online forums where you can discuss complex topics and gain insights from peers.

Practice with Sample Questions: One of the most effective ways to prepare is by practicing with sample questions and past exam papers. This practice will help you become familiar with the test format, improve your speed, and identify areas that require further study. Obtain a set of practice questions that cover a wide range of topics, including those you've identified as challenging. Attempt these questions under simulated test conditions to get a realistic feel for the exam. Review your performance, focusing on areas where you made mistakes, and revise those topics thoroughly.

Seek Expert Guidance: Consider enrolling in a preparatory course or seeking guidance from industry professionals. These experts can provide valuable insights into the test's expectations and offer tailored advice. They may also conduct mock tests, review your performance, and provide personalized feedback. Additionally, industry professionals can clarify complex concepts and help you apply theoretical knowledge to real-world scenarios, ensuring a deeper understanding of the subject matter.

Stay Updated with Industry Trends: Life insurance regulations and industry practices evolve over time. Stay updated with the latest trends, changes in legislation, and industry innovations. This awareness will ensure that your knowledge remains current and relevant. Subscribe to industry newsletters, follow reputable sources, and engage with professional networks to stay informed. By keeping up with industry developments, you can demonstrate a comprehensive understanding during the test and in your future career.

Becoming an Independent Life Insurance Broker in the UK

You may want to see also

Frequently asked questions

The New York Life Insurance Test is a standardized assessment used by New York Life Insurance Company to evaluate an individual's financial knowledge and decision-making abilities related to insurance products. It is designed to ensure that customers understand the complexities of insurance policies and can make informed choices.

This test is typically required for individuals who are applying for life insurance policies with New York Life. It is a standard procedure to ensure that applicants have a basic understanding of insurance terminology and concepts.

The test is usually conducted online and consists of multiple-choice questions covering various topics, including insurance basics, coverage options, policy types, and risk assessment. It is a self-paced exam that can be taken at the applicant's convenience.

The passing score may vary, but it generally requires achieving a certain percentage of correct answers. New York Life provides a score report after the test, indicating the applicant's performance and whether they have passed or failed.

Yes, New York Life offers study materials and resources to help applicants prepare. These may include online tutorials, sample questions, and insurance-related guides to assist individuals in understanding the test content and improving their chances of success.