Life insurance is a vital financial tool that provides a safety net for individuals and their families. It offers a sense of security and peace of mind, knowing that your loved ones will be financially protected in the event of your untimely passing. This presentation will delve into the significance of life insurance, exploring its various benefits and how it can serve as a cornerstone of a comprehensive financial plan. We will discuss the different types of life insurance policies, their coverage options, and how they can help secure your family's future, including covering expenses, paying off debts, and providing for education. Understanding the importance of life insurance is the first step towards ensuring your family's long-term financial well-being.

What You'll Learn

- Financial Security: Protects loved ones from financial hardship after your passing

- Debt Management: Helps pay off debts, ensuring a stable financial future

- Medical Expenses: Covers unexpected medical costs, preventing financial strain

- Income Replacement: Provides a steady income stream for dependents

- Legacy Planning: Ensures your wishes are fulfilled and leaves a lasting impact

Financial Security: Protects loved ones from financial hardship after your passing

Life insurance is a crucial financial tool that provides a safety net for your loved ones in the event of your untimely demise. It offers a sense of security and peace of mind, knowing that your family will be taken care of financially even when you're gone. The primary purpose of life insurance is to ensure that your loved ones are protected from the financial impact of your death, which can be devastating without proper planning.

When you pass away, your family may face numerous expenses and financial obligations. These could include funeral costs, outstanding debts, mortgage payments, or even the daily living expenses of your spouse or children. Without life insurance, these financial burdens could fall solely on your loved ones, potentially leading to significant financial hardship and stress. The policy acts as a financial cushion, providing a lump sum payment or regular income to cover these essential costs, ensuring that your family can maintain their standard of living and meet their short-term and long-term financial needs.

The financial security provided by life insurance is especially important for families with dependents, such as children or a spouse who relies on your income. It ensures that their future is secure and that they have the means to continue their education, maintain a home, and cover basic living expenses. For instance, if you have a young family, the insurance payout can be used to cover the mortgage or rent, utilities, groceries, and other daily expenses, allowing your spouse or partner to focus on raising the children without the added pressure of financial strain.

Moreover, life insurance can also help with outstanding debts, such as credit card bills, car loans, or personal loans. By providing a financial cushion, the policy enables your loved ones to pay off these debts, preventing them from becoming a long-term financial burden. This aspect of financial security is vital, as it ensures that your family's financial future is not compromised by the debts you may have accumulated during your lifetime.

In summary, life insurance is a powerful tool to safeguard your loved ones from financial adversity after your passing. It provides the necessary financial support to cover essential expenses, outstanding debts, and daily living costs, ensuring that your family can maintain their lifestyle and financial stability. By investing in life insurance, you are taking a proactive step towards protecting your loved ones and providing them with the peace of mind that comes with knowing they are financially secure.

Life Insurance: Engagements and Policy Changes Explained

You may want to see also

Debt Management: Helps pay off debts, ensuring a stable financial future

Life insurance is a powerful tool that can significantly impact an individual's financial well-being, especially when it comes to managing debt and securing a stable future. Here's how it works:

Managing debt is a critical aspect of financial planning, and life insurance can play a pivotal role in this process. When an individual takes out a life insurance policy, they essentially enter into a commitment with an insurance company. This commitment involves regular premium payments, which can be structured to align with an individual's debt obligations. By allocating a portion of your income to life insurance premiums, you create a dedicated fund that can be utilized to pay off debts. This strategic approach ensures that your financial resources are directed towards a specific goal, which is to eliminate debt. Over time, as you consistently make these payments, your debt burden decreases, providing financial relief and stability.

The beauty of using life insurance for debt management lies in its long-term benefits. As you continue to pay off your debts, the insurance policy grows in value, often accumulating cash value. This cash value can be utilized in various ways, such as taking out loans or making additional debt payments. By doing so, you can accelerate your debt repayment journey, ensuring that you become debt-free faster. Moreover, the peace of mind that comes with knowing your debts are being managed effectively can significantly reduce financial stress.

In the event of an unfortunate demise, the life insurance policy provides a financial safety net. The death benefit, an amount predetermined by the insurance company, is paid out to the policyholder's beneficiaries. This financial cushion can be strategically directed towards settling any remaining debts, ensuring that your loved ones are not burdened with your financial obligations. By incorporating life insurance into your debt management strategy, you create a comprehensive plan that safeguards your financial future and provides security for your family.

Additionally, life insurance offers flexibility in debt repayment strategies. Policyholders can choose to increase or decrease their premium payments, allowing for customization based on their financial goals and capabilities. This adaptability ensures that debt management aligns with an individual's evolving financial circumstances, providing a tailored solution for a stable financial future.

In summary, life insurance serves as a valuable asset in the realm of debt management. It provides a structured approach to paying off debts, offers long-term financial benefits, and ensures a secure future by addressing potential financial obligations. By integrating life insurance into your financial plan, you gain a powerful tool to navigate the complexities of debt and build a stable financial foundation.

Understanding Life Insurance: A Financial Asset or Liability?

You may want to see also

Medical Expenses: Covers unexpected medical costs, preventing financial strain

Life insurance is a crucial financial tool that provides a safety net for individuals and their families, especially when it comes to managing medical expenses. Unexpected medical costs can be a significant burden and often arise without warning, leaving many people financially vulnerable. This is where life insurance steps in as a vital safeguard.

Medical emergencies and chronic illnesses can result in substantial expenses, including hospital stays, surgeries, medications, and specialized treatments. These costs can quickly accumulate and become overwhelming, especially for those without adequate health coverage. A life insurance policy, particularly one with a critical illness rider, offers a comprehensive solution to this problem. It ensures that policyholders have access to a lump sum payment or regular income in the event of a critical illness, providing the necessary financial support to cover medical expenses. This coverage allows individuals to focus on their health and recovery without the added stress of financial strain.

The importance of this coverage becomes even more evident when considering the rising costs of healthcare. Medical expenses can vary widely, and what might seem like a minor issue could turn into a significant financial burden. For instance, a routine surgery could lead to unexpected complications, requiring additional medical attention and prolonged recovery. Without insurance, such unforeseen circumstances can push individuals into debt or force them to deplete their savings.

Moreover, life insurance with a medical expenses rider can provide peace of mind, knowing that your loved ones will be financially protected in your absence. It ensures that your family can afford the necessary medical care and treatments, even if you are no longer around to provide financial support. This aspect is particularly crucial for families with children or elderly dependents who may require specialized care.

In summary, life insurance with a focus on medical expenses is an essential component of financial planning. It empowers individuals to face unexpected medical costs head-on, preventing financial strain and ensuring that their well-being and that of their loved ones remains a top priority. By providing financial security, life insurance allows people to navigate the challenges of healthcare without the added worry of financial instability.

Life Insurance: 5 Key Factors to Consider Before Buying

You may want to see also

Income Replacement: Provides a steady income stream for dependents

Income replacement is a critical aspect of life insurance, especially when considering the financial well-being of your loved ones. In the event of your untimely passing, life insurance can ensure that your family continues to have a steady income stream, providing financial security and peace of mind. This is particularly important if you are the primary breadwinner, as the loss of your income could significantly impact your family's lifestyle and long-term financial goals.

The primary purpose of income replacement is to maintain the financial stability of your dependents, which may include your spouse, children, or other family members who rely on your earnings. By having a life insurance policy with a death benefit, you can provide a consistent financial cushion to cover essential expenses such as mortgage or rent payments, utility bills, groceries, and other daily costs. This ensures that your family can continue to live comfortably and meet their basic needs, even in your absence.

Moreover, income replacement through life insurance can help cover other significant expenses, such as education costs for your children or the down payment on a new home. It provides the financial flexibility to make these important life decisions without the added stress of financial strain. For instance, if your children are still in school, the policy's proceeds can be used to fund their education, ensuring they have the resources to pursue their academic goals.

The benefit of income replacement is that it provides a reliable and predictable source of income for your dependents. Unlike other forms of financial support, which may be subject to change or depletion, life insurance offers a consistent and long-lasting solution. This predictability allows your family to plan for the future with greater confidence, knowing that their financial needs will be met.

In summary, income replacement through life insurance is a vital component of financial planning. It ensures that your dependents can maintain their standard of living and have the financial means to make important life decisions. By providing a steady income stream, life insurance offers a practical and effective way to protect your loved ones' financial future, giving them the security and stability they need during challenging times.

Protecting Your Legacy: Why Family Members Need Life Insurance

You may want to see also

Legacy Planning: Ensures your wishes are fulfilled and leaves a lasting impact

Legacy planning is a crucial aspect of ensuring that your life's work, values, and wishes are honored and preserved for future generations. It involves making thoughtful decisions about how you want to leave your mark on the world and how your assets and possessions should be distributed. This process is not just about the distribution of wealth; it's about creating a meaningful and lasting impact that reflects your unique life story.

When you engage in legacy planning, you have the opportunity to define your values and the causes or individuals you want to support. This could include charitable donations, educational scholarships, or specific requests for beneficiaries. For example, you might want to establish a scholarship fund for underprivileged students in your community or donate a portion of your estate to a charity that aligns with your passions. By clearly outlining these wishes, you can ensure that your legacy is aligned with your core beliefs and values.

One of the key elements of legacy planning is the establishment of a will or trust. These legal documents allow you to specify how your assets should be distributed and who will be responsible for carrying out your wishes. A will can be a simple document that outlines your preferences, or it can be more complex, especially if you own significant assets or have a large family. Trusts, on the other hand, provide a more flexible approach, allowing you to manage and distribute assets during your lifetime and even after your passing.

In addition to financial considerations, legacy planning also involves making decisions about personal possessions and memorabilia. You may want to ensure that certain items are passed down to specific family members or donated to museums or archives to preserve your legacy in a tangible way. This could include family heirlooms, artwork, or even digital assets like photos and videos. By carefully planning the distribution of these items, you can create a lasting impact that goes beyond financial wealth.

Furthermore, legacy planning encourages you to reflect on your life's journey and the lessons you've learned. It prompts you to consider the values you want to impart to your loved ones and the impact you want to have on the world. By taking the time to plan, you can ensure that your life's work and experiences are not forgotten but instead become a source of inspiration and guidance for future generations. This process allows you to leave a lasting legacy that goes beyond material possessions, providing a rich and meaningful impact on the lives of those you care about.

Universal Life Insurance: A Lifelong Financial Safety Net

You may want to see also

Frequently asked questions

Life insurance is a financial tool designed to provide financial security and protection to individuals and their families. It offers a safety net by ensuring that loved ones are financially supported in the event of the insured person's death. The primary purpose is to help cover expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses, which can be a significant burden without proper financial planning.

In the event of your passing, life insurance proceeds can be a lifeline for your family. These funds can help your spouse or partner continue their lifestyle, cover educational expenses for children, or even start a new business venture. It ensures that your family's financial stability is maintained, allowing them to make important life decisions without the added stress of financial worries.

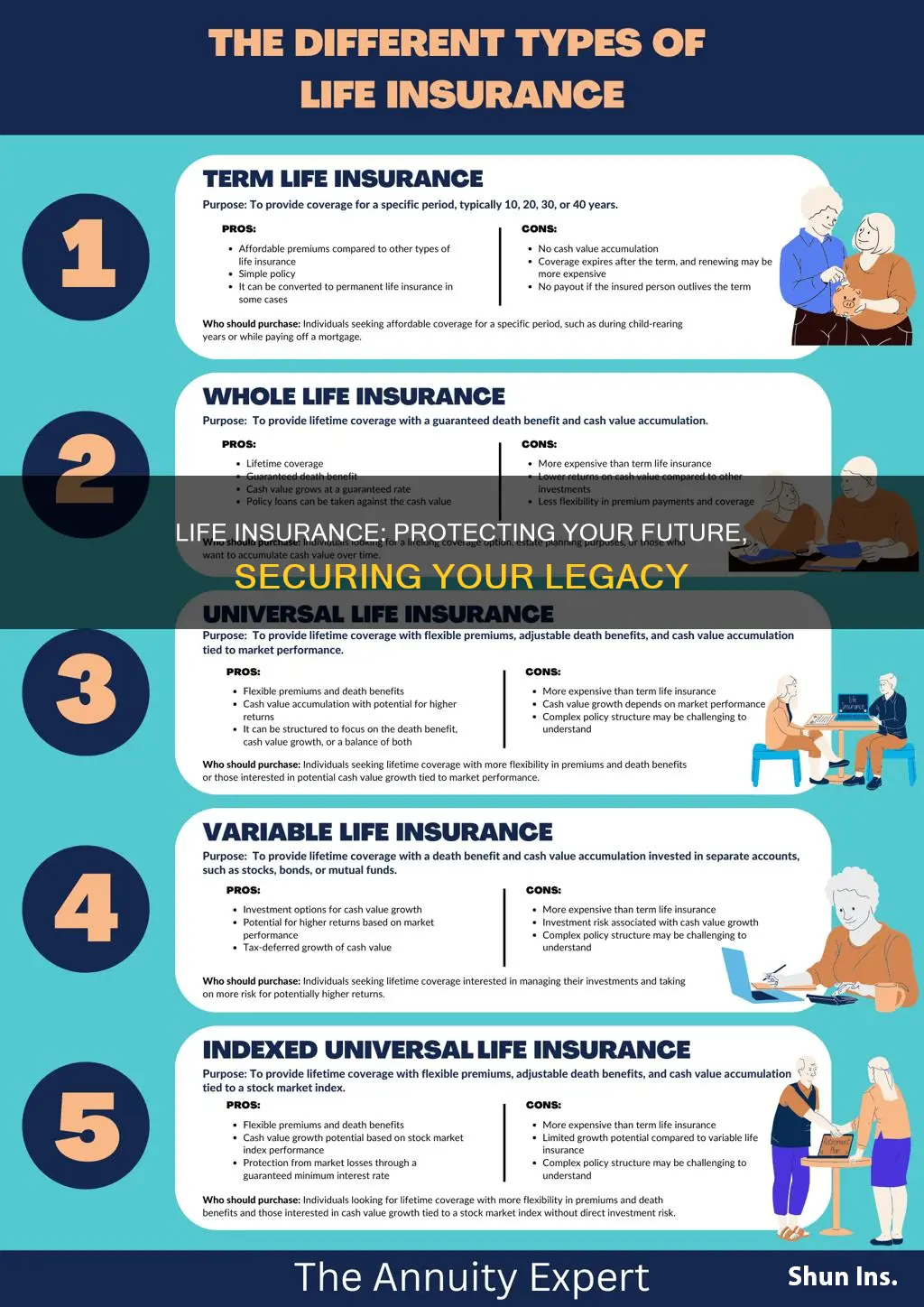

There are several types of life insurance policies, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage with an investment component. Universal life insurance combines coverage with a flexible investment account, and variable life insurance allows for potential higher returns. The choice depends on individual needs, preferences, and financial goals.

Absolutely! Life insurance is not just for the elderly or those with families. Young adults can benefit from life insurance as well. It can provide financial security in case of unexpected events, such as accidents or health issues. Additionally, life insurance can be a valuable tool for young professionals to protect their growing assets, such as rental properties or businesses, and ensure their financial goals are met.