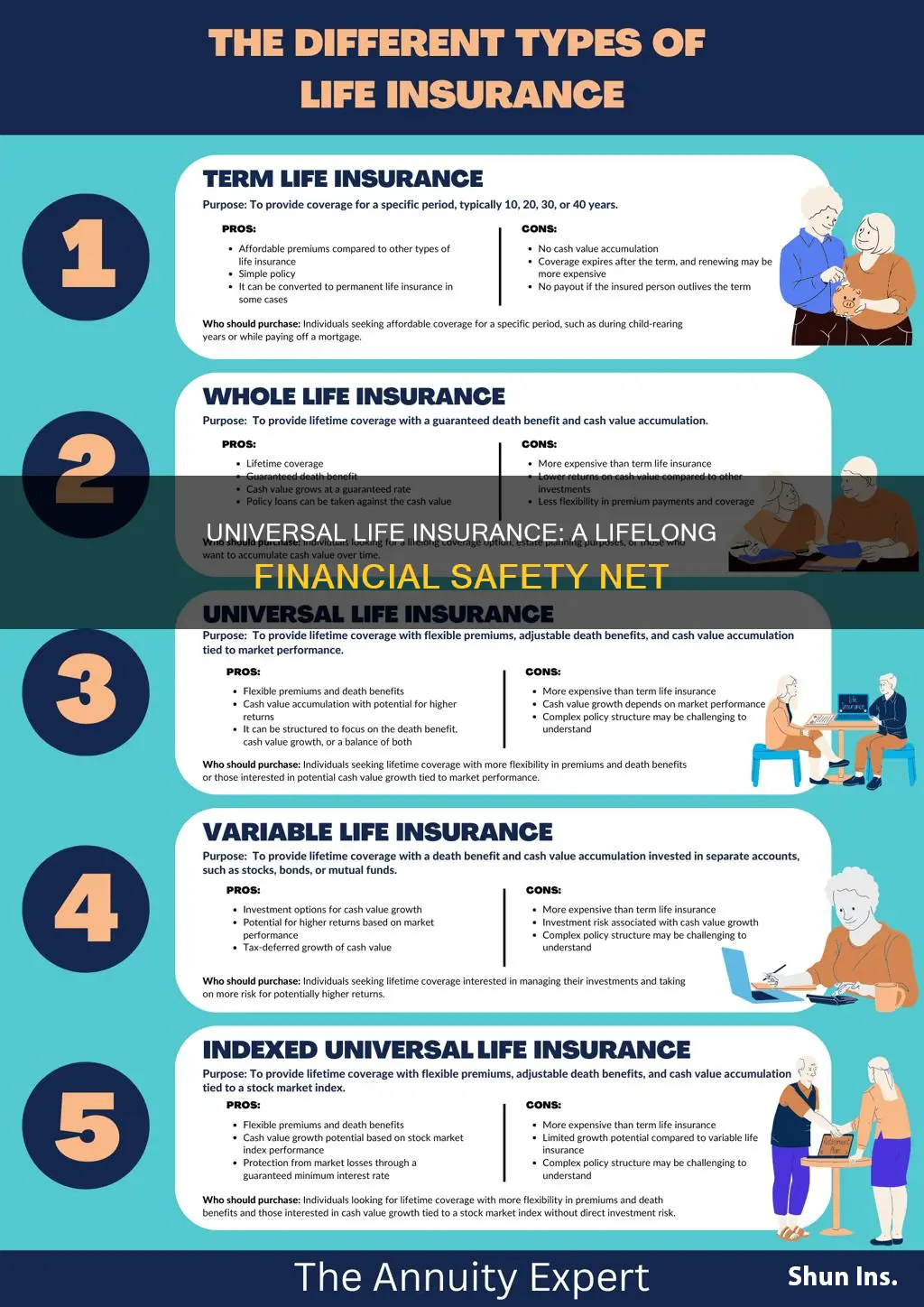

Universal life insurance offers a flexible and customizable financial protection plan. Unlike traditional term life insurance, which provides coverage for a specific period, universal life insurance allows policyholders to adjust their premiums and death benefits over time. This adaptability is particularly beneficial for individuals seeking long-term financial security, as it enables them to tailor the policy to their changing needs and financial goals. With universal life insurance, policyholders can potentially accumulate cash value, which can be borrowed against or withdrawn, providing a source of funds for various financial needs. This feature makes universal life insurance an attractive option for those who want both the security of life coverage and the flexibility to manage their insurance portfolio effectively.

What You'll Learn

- Long-term financial security: Universal life insurance provides a steady income stream for beneficiaries over a long period

- Flexibility: Policyholders can adjust premiums and death benefits to fit their changing financial needs

- Tax advantages: Premiums may be tax-deductible, and cash value grows tax-free

- Investment component: The policy's cash value can be invested, offering potential for growth

- Death benefit guarantee: Ensures a fixed payout upon the insured's death, regardless of market fluctuations

Long-term financial security: Universal life insurance provides a steady income stream for beneficiaries over a long period

Universal life insurance offers a unique and powerful advantage in the realm of long-term financial security. This type of insurance policy provides a steady and reliable income stream for the beneficiaries, ensuring financial stability and peace of mind for those who rely on it. One of the key benefits is the flexibility it offers in terms of payments. Unlike traditional term life insurance, where premiums are fixed for a specific period, universal life insurance allows policyholders to adjust their payments over time. This adaptability is particularly advantageous for those who experience changes in their financial circumstances, such as income fluctuations or unexpected expenses. By making regular contributions, policyholders can build a substantial cash value within the policy, which can then be used to generate a steady income stream.

The income generated from universal life insurance can be a vital source of financial support for beneficiaries, especially in the long run. As the policyholder ages, the cash value accumulated grows, providing a larger sum to be distributed as income. This is particularly beneficial for older individuals or those with extended life expectancies, as it ensures a consistent financial cushion throughout their later years. The steady income stream can cover essential expenses, such as living costs, medical bills, or even provide a financial safety net for retirement. Moreover, the flexibility of universal life insurance allows beneficiaries to tailor the income distribution to their specific needs, ensuring a personalized and secure financial plan.

Over time, the cash value within the universal life insurance policy can accumulate significantly, becoming a substantial financial asset. This asset can be borrowed against or withdrawn, providing policyholders with a valuable financial tool. The ability to access funds within the policy can be especially useful for major life events, such as funding education, starting a business, or investing in property. By utilizing the cash value, individuals can make significant financial decisions without disrupting their long-term insurance coverage. This feature of universal life insurance ensures that the policy remains a dynamic and adaptable financial instrument, catering to the evolving needs of the policyholder.

In summary, universal life insurance provides a robust solution for long-term financial security. Its ability to offer a steady income stream, coupled with the flexibility of payment adjustments and the potential for significant cash value accumulation, makes it an attractive option for individuals seeking comprehensive financial protection. With universal life insurance, beneficiaries can enjoy the peace of mind that comes with knowing their financial future is secure, even as their circumstances change over the years. This type of insurance truly empowers individuals to take control of their financial destiny and provides a reliable safety net for the long term.

Printing Your Life Insurance License: A Step-by-Step Guide

You may want to see also

Flexibility: Policyholders can adjust premiums and death benefits to fit their changing financial needs

Universal life insurance offers a unique advantage in its inherent flexibility, allowing policyholders to adapt their insurance coverage to their evolving financial circumstances. This adaptability is a significant benefit, especially for those who want to ensure their insurance remains relevant and effective over time.

One of the key features of universal life insurance is the ability to adjust the death benefit, which is the amount paid out upon the insured's death. Policyholders can increase or decrease this benefit based on their current financial situation and goals. For instance, when starting a family or purchasing a home, individuals might opt for a higher death benefit to provide financial security for their loved ones. As their financial situation improves, they can then reduce the death benefit, potentially lowering their insurance costs. This flexibility ensures that the insurance policy remains a valuable asset without becoming a financial burden.

Premium payments in universal life insurance are also adjustable, providing further customization. Policyholders can choose to pay higher premiums when they have the financial means, ensuring a higher cash value accumulation in the policy. During economic downturns or periods of reduced income, they can opt for lower premium payments, thus maintaining the policy's value without the need to terminate it. This flexibility in premium payments allows individuals to manage their insurance expenses effectively, making it a more affordable and sustainable long-term financial solution.

The ability to adjust both death benefits and premiums provides universal life insurance with a unique advantage over traditional term life insurance. With the latter, any changes to the policy typically require a medical examination and may result in higher costs or even policy rejection. In contrast, universal life insurance allows for these adjustments without such stringent requirements, making it a more accessible and adaptable insurance option.

In summary, the flexibility offered by universal life insurance is a powerful tool for policyholders. It enables them to tailor their insurance coverage to their specific needs, ensuring that the policy remains a valuable asset throughout their financial journey. This adaptability is a key reason why universal life insurance is considered a versatile and reliable form of insurance coverage.

Who Can Cash a Life Insurance Check?

You may want to see also

Tax advantages: Premiums may be tax-deductible, and cash value grows tax-free

Universal life insurance offers several tax advantages that can be beneficial for policyholders. Firstly, the premiums paid for this type of insurance policy may be tax-deductible, which can provide a significant financial benefit. This is particularly useful for individuals who are in a higher tax bracket or those who have a substantial amount of taxable income. By deducting the premiums, policyholders can reduce their taxable income, thus lowering their overall tax liability. This tax deduction can be especially advantageous for those who are self-employed or have a high level of business expenses, as it allows them to offset some of their business-related costs.

In addition to the tax-deductible premiums, the cash value that accumulates within a universal life insurance policy also grows tax-free. This means that any earnings or interest generated on the policy's cash value are not subject to income tax. Over time, this can result in substantial tax savings, as the cash value can grow significantly, especially with consistent premium payments and favorable investment returns. The tax-free growth of the cash value provides a long-term benefit, allowing policyholders to build a substantial financial asset that can be used for various purposes, such as retirement planning or funding future goals.

The tax advantages of universal life insurance can be particularly appealing for long-term financial planning. As the cash value grows, it can be borrowed against or withdrawn, providing access to funds without triggering taxable events. This flexibility allows policyholders to utilize their insurance policy as a financial tool, taking advantage of the tax-free growth and potential tax deductions. Furthermore, the tax-free nature of the cash value growth encourages policyholders to keep the policy in force for an extended period, ensuring a continuous tax advantage.

It is important to note that the specific tax regulations and deductions may vary depending on the jurisdiction and individual circumstances. Consulting with a tax professional or financial advisor is recommended to fully understand the tax implications and ensure compliance with applicable laws. By taking advantage of these tax benefits, universal life insurance can be a valuable component of a comprehensive financial plan, offering both insurance protection and potential tax savings.

Life Insurance for UPS Employees: What You Need to Know

You may want to see also

Investment component: The policy's cash value can be invested, offering potential for growth

Universal life insurance is a flexible and powerful financial tool that offers a unique combination of insurance and investment benefits. One of its key advantages is the investment component, which allows the policyholder to utilize the cash value of the policy as an investment vehicle. This feature is particularly beneficial for those seeking to maximize their financial growth and build long-term wealth.

When you purchase a universal life insurance policy, a portion of your premium payments goes towards funding the death benefit, ensuring financial protection for your loved ones. The remaining amount is allocated to a cash value account, which acts as a savings component within the policy. This cash value can be invested in various investment options offered by the insurance company, providing an opportunity for the policy's value to grow over time.

The investment component of universal life insurance offers several advantages. Firstly, it provides a way to potentially increase the overall value of the policy. The cash value can be invested in a range of investment options, such as stocks, bonds, or mutual funds, which have the potential to generate returns. These investment returns can then be used to enhance the policy's performance, allowing the policyholder to benefit from market growth. For example, if the invested portion of the policy performs well, the policy's cash value can grow, providing additional financial resources or even increasing the death benefit amount.

Secondly, the investment aspect of universal life insurance offers policyholders control and customization. They can choose how to allocate their cash value among different investment options, allowing for a personalized investment strategy. This flexibility enables individuals to align their investments with their risk tolerance and financial goals. Over time, as the policy's cash value grows, it can become a substantial asset, providing financial security and the potential for long-term wealth accumulation.

Furthermore, the investment component of universal life insurance can be particularly advantageous for those seeking to avoid the volatility often associated with traditional investment vehicles. By investing within the policy, individuals can benefit from professional management and diversification, reducing the risks typically associated with individual stock or bond investments. This feature makes universal life insurance an attractive option for those who want a more stable and controlled investment environment while still having the potential for growth.

In summary, the investment component of universal life insurance is a powerful feature that allows policyholders to utilize the cash value for potential growth. It provides an opportunity to increase the policy's value, offering financial benefits and the potential for long-term wealth accumulation. With the ability to customize investments and benefit from professional management, universal life insurance becomes a comprehensive financial tool, combining insurance protection with a strategic investment approach.

Life Insurance Surrender Value: What You Need to Know

You may want to see also

Death benefit guarantee: Ensures a fixed payout upon the insured's death, regardless of market fluctuations

Universal life insurance offers a unique advantage in the form of a death benefit guarantee, which is a crucial aspect of its long-term financial planning. This feature ensures that the insured individual's beneficiaries will receive a predetermined amount of money upon their passing, regardless of market conditions or economic fluctuations. The death benefit is a cornerstone of universal life insurance, providing financial security and peace of mind to both the insured and their loved ones.

In traditional insurance policies, the death benefit might be subject to market volatility, where the payout could decrease or increase based on the performance of the underlying investments. However, universal life insurance separates the investment component from the insurance aspect, allowing the insured to control and manage their investments. This separation ensures that the death benefit remains a stable and secure element, providing a fixed amount to the beneficiaries, which is a significant advantage in uncertain economic times.

The death benefit guarantee is particularly valuable as it offers long-term financial protection. It ensures that the insured's family or designated recipients will have a substantial financial cushion to cover various expenses, such as funeral costs, outstanding debts, or the day-to-day living expenses that arise after the insured's passing. This guarantee provides a sense of financial security, knowing that the basic needs of the family will be met, even in the absence of the primary income earner.

Moreover, this feature of universal life insurance allows the insured to plan for the future with confidence. By having a fixed death benefit, individuals can make more accurate financial plans, knowing that their beneficiaries will receive a specific amount. This predictability enables better decision-making regarding retirement planning, estate distribution, and ensuring the financial well-being of loved ones.

In summary, the death benefit guarantee in universal life insurance is a powerful tool for individuals seeking long-term financial security. It provides a stable and predictable payout, offering peace of mind and financial protection for the insured's beneficiaries, irrespective of market fluctuations. This feature sets universal life insurance apart, making it an attractive option for those who prioritize financial stability and the well-being of their loved ones.

Fiduciary Duties in Life Insurance: Understanding Your Agent's Role

You may want to see also

Frequently asked questions

Universal Life Insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefits. It provides a way to build cash value over time, which can be borrowed against or withdrawn, allowing policyholders to use the money for various financial needs.

Unlike term life insurance, which provides coverage for a specific period, universal life insurance offers coverage for the entire life of the insured. It also allows policyholders to adjust the death benefit and premium payments, providing more control and flexibility.

The key advantage is the potential for cash value accumulation, which can grow tax-deferred. Policyholders can access this cash value through loans or withdrawals, providing financial flexibility. Additionally, universal life insurance offers a guaranteed death benefit and the ability to customize the policy to fit individual needs.

Yes, one of the unique features is its flexibility. Policyholders can adjust the death benefit, increase or decrease the premium payment, or even convert it to a different type of policy if their needs change. This adaptability is a significant benefit for long-term financial planning.

It is a complex financial product, and whether it's suitable depends on individual circumstances. It is often chosen by those seeking long-term financial security and the ability to build wealth. However, it may not be the best option for those who prefer simpler, more straightforward insurance plans with fixed terms.