Life insurance can be a helpful investment, but some may feel they no longer need it and want to get their money back. Permanent life insurance policies can pay out a cash surrender value, allowing you to recoup some of your payments if you no longer need coverage. However, it's important to understand the tax implications of surrendering your policy. The cash surrender value of a life insurance plan is the amount you'll receive if you surrender your policy, and it is based on your cash value. While the cash value of a life insurance policy is often tax-advantaged, you might pay tax on withdrawals in certain situations. This paragraph will explore how the cash surrender value of life insurance is reported to the IRS and the associated tax consequences.

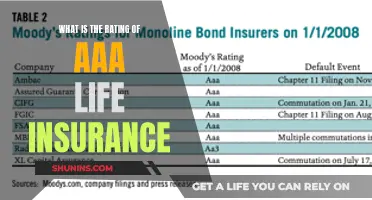

| Characteristics | Values |

|---|---|

| Is the cash surrender value of life insurance taxable? | Yes, any amount received over the policy's basis (the amount paid in premiums) can be taxed as income. |

| When is the cash surrender value taxable? | When the policyholder receives more funds than the policy's cost basis, or has outstanding policy loans that exceed the policy's cost basis. |

| How to report the cash surrender value to the IRS | Consult with a tax expert to report everything properly. |

| How to receive the cash surrender value | Review policy documents, speak with the insurer, fill out paperwork, and receive the cash surrender value. |

| Factors to consider before surrendering a life insurance policy | The cash surrender value, the cost of getting another life insurance policy, future financial goals, and alternatives to getting the cash surrender value. |

| Alternatives to surrendering the policy | Borrowing against the cash value, withdrawing from the cash value, or using the cash value to pay premiums. |

What You'll Learn

When is cash value life insurance taxable?

The cash value of a life insurance policy is generally not taxable as it grows within the policy. However, there are certain instances where you may owe taxes on the cash value.

Withdrawals

If you withdraw an amount exceeding the total premiums you've paid into the policy, you will be taxed on the excess amount. This is because you can generally only withdraw an amount equal to your total premium payments without owing taxes. Withdrawals could also cause your policy to lapse, resulting in a loss of coverage.

Policy Loans

If you take out a loan from your life insurance plan, it won't be taxable unless the policy terminates before you've repaid the loan. In this case, you will be taxed on the outstanding loan balance.

Cashing Out Your Policy

If you cash out or surrender your policy, you may incur taxes on the net cash surrender value, which is the cash value of your account plus accrued interest minus any loans, unpaid premiums, and surrender fees.

Outstanding Loan on Cash Value Policy

If you borrow against the cash value of your policy and the policy ends before you've repaid the loan, you may have to pay taxes on the portion of the loan amount that is above the basis, which includes interest or investment earnings.

Selling Your Life Insurance Policy

If you sell your life insurance policy, the proceeds are considered taxable income and you will likely owe income taxes on some of the proceeds.

Estate Taxes on Life Insurance Policies

If your life insurance policy proceeds go to a taxable estate, they may be subject to estate or inheritance taxes. This typically happens if your beneficiary passes away before you or if you fail to name a beneficiary.

Fegli Life Insurance: Can You Sell It?

You may want to see also

When is cash value life insurance non-taxable?

Cash value life insurance is non-taxable in certain situations. The cash value of a life insurance policy typically grows tax-free or tax-deferred. This means that you won't have to pay taxes on it unless you withdraw the money.

The death benefit from a life insurance policy is generally not subject to taxes. However, there are a few exceptions to this rule. If you opt for monthly installments instead of a lump sum payout, the funds that have yet to be distributed will accrue taxable interest. Additionally, if you name your estate as a beneficiary, you may owe taxes as well.

If you have a cash value life insurance policy, you can access the cash value while you're still alive through a loan, withdrawal, or policy surrender. The cash value of your life insurance policy may be taxable if you:

- Take out a loan from your life insurance plan and the policy terminates before you've repaid the loan.

- Withdraw more than the total premiums you've paid into the policy. Withdrawing up to the amount of the total premiums is not taxable, as it is considered a return of premiums. However, withdrawing any gains, such as dividends, may be taxed as ordinary income.

- Sell your life insurance policy through a viatical or life settlement. A viatical settlement is when a terminally ill person sells their policy to an investor, while a life settlement is when a healthy person sells their policy. Viatical settlements are not taxable, but life settlements are considered taxable income.

- Surrender your policy and there is an outstanding loan balance against it. You will owe taxes on the amount above the basis, which includes interest or investment earnings.

To avoid paying taxes on the cash value of a life insurance policy, you can:

- Only withdraw up to the amount you've put into the policy through premiums.

- Take out a loan against your cash value, as loan proceeds are generally not taxable.

- Be mindful of how much money you put into your policy. If you pay premiums above the amount needed to pay up the policy in seven years, it may become a Modified Endowment Contract (MEC), which doesn't receive the same tax benefits as a standard cash value life insurance policy.

Trustee's Life Insurance: Inter Vivos Trust Eligibility

You may want to see also

What are the tax implications of surrendering a policy?

The cash surrender value of a life insurance plan is the amount you will receive if you surrender your policy to your insurer. This amount is based on your cash value, which is the component of a permanent life insurance policy that helps you build cash value through regular premium payments. A policy's cash surrender value can depend on the policy's duration, growth, and assets.

A life insurance policy's cash surrender value can be taxable. Any amount you receive over the policy's basis, or the amount you paid in premiums, can be taxed as income. There are several scenarios that may result in potential tax consequences when you surrender your policy.

Surrendering your policy may trigger tax consequences if:

- You receive more funds than the policy's cost basis.

- You have outstanding policy loans that exceed the policy's cost basis. The insurance company will deduct the loan amount and any interest from the cash surrender value. You'll owe income tax on the lower surrender value if it exceeds the amount paid in premiums.

The general tax rule is that losses recognized upon the surrender or sale of a life insurance policy are not deductible to the policy owner. However, in some limited cases, a taxpayer may be able to deduct the loss if it was incurred in a trade or business.

If you surrender a cash value life insurance policy, there may be a taxable gain on the sale if the cash received is greater than the investment in the contract. The gain will be taxed at ordinary income tax rates. Any cash received exceeding the policy's cash surrender value will be taxed at long-term capital gain rates. The gain is subject to the 3.8% net investment income tax.

If you sell a term life insurance policy to an unrelated third party, you will have a capital gain to the extent that the sale proceeds are in excess of the investment in the contract. The gain will be subject to the 3.8% net investment income tax.

Life Insurance: Income or Asset?

You may want to see also

What are the tax consequences of an outstanding loan on a cash value policy?

The presence of an outstanding loan on a cash value policy can have significant tax implications if the policy is surrendered or lapses. When a life insurance policy is surrendered, the gains on the policy are typically treated as ordinary income and are taxable to the extent that the cash value exceeds the net premiums (i.e., the cost basis) of the policy.

In the case of an outstanding loan, the insurance company will deduct the loan amount and any accrued interest from the cash surrender value. This will reduce the amount of taxable gain and, consequently, the amount of income tax owed. However, it is important to note that the tax consequences are determined by the surrender or lapse of the policy, not by the presence of the loan itself. The taxable amount is calculated as the difference between the cash surrender value minus the total premiums paid.

For example, if an individual has a cash surrender value of $70,000 and an outstanding loan balance of $10,000, the net surrender value would be $60,000. If the total premiums paid were $50,000, the taxable gain would be $10,000. It is important to consult with a tax advisor to understand the specific tax implications and explore options to minimise the tax burden.

Additionally, it is worth noting that if a policy loan is outstanding when the policyholder dies, the beneficiary would receive a lower death benefit, but this benefit would typically be tax-free.

While the presence of an outstanding loan does not directly impact the taxation of the transaction, it is essential to consider the potential tax consequences when deciding whether to surrender a life insurance policy.

Country Life Insurance: Accident Forgiveness and You

You may want to see also

How to avoid tax on life insurance cash value?

How to avoid tax on life insurance cash value

The cash surrender value of a life insurance plan is the amount you receive if you surrender your policy to your insurer. This amount is based on the cash value, which is a component of a permanent life insurance policy that helps you build cash value through regular premium payments. While the cash value of a life insurance policy is generally not taxed while it's growing within the policy, there are certain situations where taxes may be incurred. Here are some strategies to avoid tax consequences related to a life insurance policy's cash value:

- Stay Below the Cost Basis: Generally, you won't have to pay taxes on the cash value of a policy unless the cash value exceeds the premiums paid, known as the cost basis. Over time, your cash value will grow from interest and investment gains, but you can avoid taxes by only withdrawing up to the amount you've paid in premiums.

- Maintain a Policy with a Loan: You won't be taxed on a loan taken from your policy's cash value, even if it's above the cost basis, as long as the policy remains active. So, you can avoid taxes by taking a loan for the cash value and maintaining coverage.

- Avoid Overfunding: Overfunding your cash value policy will lead to its reclassification as a Modified Endowment Contract (MEC) by the IRS. An MEC requires you to make withdrawals on an income-first basis, meaning you'll have to pay taxes on those withdrawals. To prevent this, communicate with your insurance provider to ensure you don't overfund through premiums.

- Delay Withdrawals: Withdrawing cash value before the age of 59.5 will typically result in a 10% tax penalty. Therefore, it's advisable to delay withdrawals until after this age to avoid the tax penalty.

- Choose Viatical Settlement: If you're terminally ill, you can opt for a viatical settlement, which involves selling your life insurance policy to a company that specialises in buying policies. The IRS doesn't treat any portion of what you receive in a viatical settlement as taxable, as it's considered a payment of the death benefit, which is not taxable.

- Name Beneficiaries: Ensure that you name both primary and contingent life insurance beneficiaries and keep these selections up to date. If no beneficiary is named or the named beneficiary is deceased, the life insurance payout goes into the estate of the insured person and can be taxable.

- Avoid the Goodman Triangle: This situation arises when three people serve different roles in connection with the life insurance policy: the policy owner, the insured, and the beneficiary. To avoid tax implications, limit insurance policy involvement to only two people: a policyholder who is also the insured, and the beneficiary.

Life Insurance and Paramotoring: What's Covered?

You may want to see also