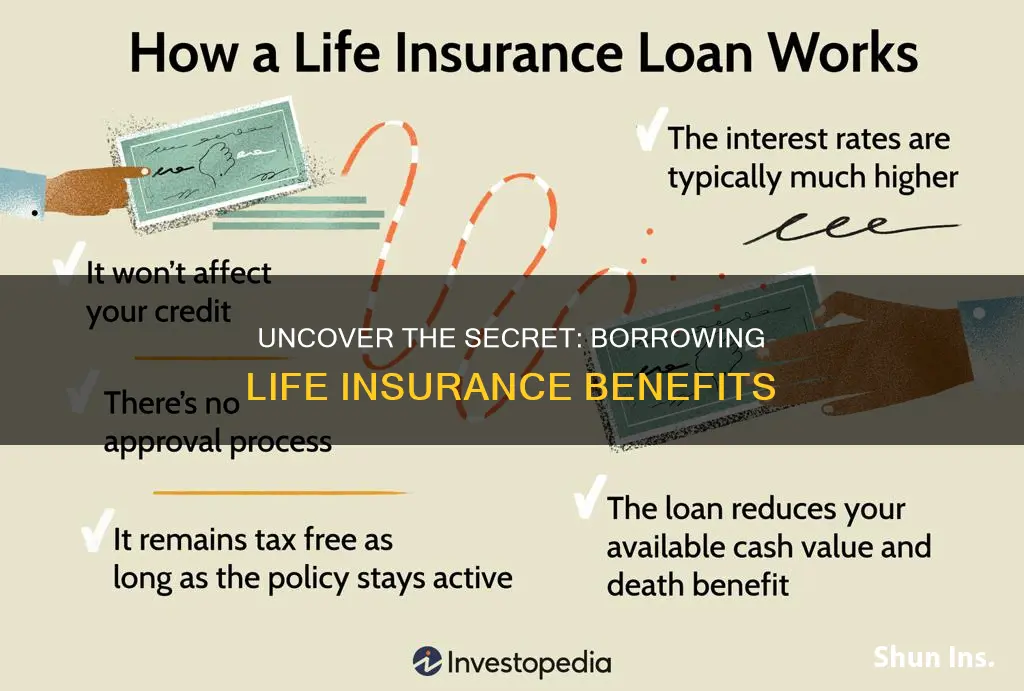

Life insurance is a financial tool that provides a safety net for individuals and their families. One unique aspect of life insurance is the ability to borrow against it, offering policyholders a way to access funds without selling their policy. This feature allows policyholders to borrow money against the cash value of their life insurance policy, providing financial flexibility and security. By borrowing against life insurance, individuals can access funds for various purposes, such as starting a business, funding education, or covering unexpected expenses, all while keeping their insurance coverage intact. This feature is particularly valuable for those who want to make the most of their life insurance policy's potential while maintaining financial stability.

What You'll Learn

- Loanable Life Insurance: A policy that allows policyholders to borrow funds against the cash value

- Term Life Loans: Short-term loans based on term life insurance policies

- Whole Life Advances: Borrowing against the cash value of a whole life policy

- Universal Life Loans: Borrowing against the cash value of a universal life policy

- Mortgage Protection: Life insurance loans to cover mortgage payments if the borrower dies

Loanable Life Insurance: A policy that allows policyholders to borrow funds against the cash value

Loanable life insurance is a unique financial product that offers policyholders a way to access funds by leveraging the cash value of their existing life insurance policy. This type of insurance provides a safety net and financial flexibility, allowing individuals to borrow against the accumulated savings within their policy. Here's a detailed breakdown of how it works and its benefits:

When you purchase a life insurance policy, it typically builds up cash value over time, which is the portion of the premium payments that are invested and earn interest. This cash value grows as the policyholder makes regular premiums, and it can be a substantial amount by the time the policy matures. Loanable life insurance policies are designed to allow policyholders to tap into this cash value. The process is straightforward: the insurance company provides a loan against the policy's cash value, and the borrower repays the loan with interest, using the policy's cash value as collateral. This enables individuals to access funds quickly without the need for extensive paperwork or credit checks, making it an attractive option for those seeking immediate financial assistance.

One of the key advantages of loanable life insurance is its accessibility. Since the loan is secured by the policy's cash value, the approval process can be faster and more straightforward compared to traditional loans. Policyholders can borrow against their insurance without selling their policy or disrupting their coverage. This feature is particularly beneficial for individuals who may not qualify for conventional loans due to credit history or other factors. Moreover, the interest rates on these loans are often competitive, making it a cost-effective way to access funds.

The amount that can be borrowed depends on various factors, including the policy's cash value, the borrower's age, and the insurance company's policies. Typically, policyholders can borrow up to a certain percentage of the cash value, and the loan terms may vary. Repayment terms can be flexible, allowing borrowers to choose a schedule that suits their financial situation. It's important to note that borrowing against life insurance should be a strategic decision, as it may impact the policy's long-term value and death benefit.

In summary, loanable life insurance provides a valuable financial tool for individuals who want to access funds without disrupting their insurance coverage. By leveraging the cash value of their policy, policyholders can borrow money for various purposes, such as home improvements, education expenses, or business ventures. This type of insurance offers a unique combination of financial security, accessibility, and flexibility, making it an attractive option for those seeking alternative lending solutions. Understanding the terms and conditions of such policies is essential to ensure borrowers make informed decisions about their financial well-being.

Universal Life Insurance: What's Guaranteed and What's Not

You may want to see also

Term Life Loans: Short-term loans based on term life insurance policies

Term life loans are a unique financial product that leverages existing term life insurance policies to provide short-term borrowing opportunities. This innovative approach allows individuals to access funds by utilizing their life insurance coverage, offering a convenient and potentially cost-effective way to secure loans. Here's a detailed breakdown of how term life loans work and their key features:

Understanding the Basics:

Term life insurance is a type of coverage that provides financial protection for a specified period, known as the "term." During this term, the insurance company promises to pay a predetermined death benefit to the policyholder's beneficiaries if the insured individual passes away. Term life loans tap into this existing policy, allowing the policyholder to borrow against the potential future payout.

The Loan Process:

When an individual applies for a term life loan, they essentially request a loan amount based on the death benefit of their term life insurance policy. The lender evaluates the policy's value, the remaining term, and the policyholder's creditworthiness to determine the loan amount and terms. This process is similar to securing a traditional loan but with a unique focus on the life insurance policy as collateral. The loan is typically repaid over a short-term period, often with interest, ensuring that the insurance policy remains intact and the death benefit is preserved for the intended beneficiaries.

Benefits of Term Life Loans:

- Quick Access to Funds: One of the primary advantages is the speed at which funds can be accessed. Since the loan is based on an existing policy, the approval process can be faster compared to other loan types.

- No Impact on Insurance: The loan does not typically affect the ongoing life insurance policy. As long as the policy remains in force, the loan repayments are made, and the death benefit is protected.

- Potential Cost Savings: In some cases, term life loans can be more affordable than other short-term borrowing options, especially for those with high-interest credit cards or personal loans.

- Flexibility: Borrowers can choose the loan amount and repayment terms that align with their financial needs and the policy's value.

Considerations:

While term life loans offer flexibility, it's essential to approach them with caution. The loan should not be used as a long-term financial strategy, as the interest rates can be relatively high. Borrowers should ensure they have a clear plan to repay the loan within the agreed-upon term to avoid potential financial strain. Additionally, understanding the tax implications of borrowing against life insurance is crucial, as it may affect the death benefit's value.

In summary, term life loans provide a unique borrowing option for individuals with term life insurance policies, offering quick access to funds without compromising their insurance coverage. It is a specialized financial tool that can be beneficial for short-term financial needs, but borrowers should carefully consider the terms and potential risks before proceeding.

IUL Life Insurance: How Does it Work?

You may want to see also

Whole Life Advances: Borrowing against the cash value of a whole life policy

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. One of the unique features of whole life insurance is the accumulation of cash value over time. This cash value is a significant benefit for policyholders, as it can be utilized in various ways, including taking out loans or advances. This concept is known as a "whole life advance" or "whole life loan."

When you have a whole life policy, a portion of your premium payments goes towards building this cash value, which grows tax-deferred. This cash value can be considered an asset that you can borrow against, similar to a home equity loan. The loan is secured by the policy itself, and the amount you can borrow is typically based on the cash value accumulated in the policy.

Borrowing against your whole life policy can be a useful financial strategy for several reasons. Firstly, it allows you to access funds without selling your policy or disrupting your insurance coverage. This is particularly beneficial for individuals who want to use the cash value for various purposes, such as starting a business, funding education, or making significant investments. By borrowing against your policy, you can leverage the cash value while still maintaining the long-term financial security that whole life insurance provides.

The process of taking out a whole life advance is relatively straightforward. You can typically borrow up to a certain percentage of the cash value, which is determined by the insurance company's policies. The loan is usually interest-free, as it is considered a policy loan, and the repayment terms are flexible, allowing you to pay back the loan over time without affecting your insurance coverage. This feature ensures that you can access funds when needed without compromising the long-term benefits of your whole life policy.

In summary, whole life advances offer a unique way to access the cash value built up in your whole life insurance policy. This borrowing option provides financial flexibility while maintaining the security and benefits of permanent life insurance. It is a valuable feature for policyholders who want to utilize their insurance assets for various financial needs without disrupting their long-term coverage. Understanding how whole life advances work can be a significant advantage for anyone looking to make the most of their life insurance policy.

Pan-American Life Insurance: Understanding the Insurance Category and Benefits

You may want to see also

Universal Life Loans: Borrowing against the cash value of a universal life policy

Universal life insurance policies offer a unique financial tool that can be utilized through universal life loans. These loans are a way to access the cash value accumulated within a universal life policy, providing policyholders with a means to borrow against their insurance investment. This financial strategy can be particularly beneficial for those seeking to access funds without disrupting their insurance coverage or selling their policy.

The process of obtaining a universal life loan is straightforward. Policyholders can borrow a portion of the cash value of their universal life policy, which is built up over time through regular premium payments. The loan is typically secured by the policy itself, ensuring that the insurance coverage remains intact. This type of loan is often more flexible than traditional bank loans, as it is directly linked to the policy's value.

One of the key advantages of universal life loans is the potential for policyholders to access funds quickly and without extensive paperwork. Since the loan is secured by the policy, the lender has a clear asset to fall back on, reducing the typical risks associated with lending. This can result in faster approval processes and more favorable loan terms compared to other forms of borrowing.

When considering a universal life loan, it's essential to understand the policy's cash value and the potential loan amount. The cash value is the accumulated investment portion of the policy, which grows over time. Lenders will typically offer loans based on a percentage of this cash value, allowing policyholders to borrow a portion of their investment. The interest rate and repayment terms can vary, so it's crucial to review the policy's terms and the lender's policies to make an informed decision.

Borrowing against a universal life policy can be a strategic financial move, especially for those who want to access funds while maintaining their insurance coverage. It provides a way to utilize the value of an existing investment without the need for additional collateral or complex financial arrangements. However, as with any loan, it's essential to carefully consider the terms, interest rates, and potential impact on the policy's long-term growth to ensure a wise financial decision.

Life Insurance Trust Taxation: What You Need to Know

You may want to see also

Mortgage Protection: Life insurance loans to cover mortgage payments if the borrower dies

Mortgage protection is a type of life insurance that provides financial security for homeowners. It is designed to ensure that mortgage payments are covered in the event of the borrower's death, providing peace of mind and financial stability for the borrower's family. This type of insurance is particularly important for those with large mortgages, as it can prevent the family from losing their home due to the financial burden of mortgage payments.

When a borrower takes out a mortgage, they typically have a set period of time to repay the loan. If the borrower dies before the loan is fully paid off, the remaining balance can be a significant financial burden for the family. Mortgage protection life insurance steps in to cover these payments, ensuring that the mortgage is paid off and the family's home is protected. This type of insurance is often tailored to the specific mortgage amount and term, providing a customized solution for each borrower.

The process of obtaining mortgage protection insurance is straightforward. Borrowers can work with their insurance provider to determine the appropriate coverage amount based on their mortgage details. This coverage amount is then paid out as a loan if the borrower passes away, and the insurance company becomes the new mortgagee, taking over the payments. This ensures that the mortgage remains in good standing, and the family's home is protected from foreclosure.

One of the key advantages of mortgage protection is its ability to provide financial security and peace of mind. It allows borrowers to focus on their daily lives without the constant worry of mortgage payments if something were to happen to them. Knowing that their family's home is protected can be a significant stress reliever, allowing individuals to live their lives to the fullest while having the assurance that their mortgage is secure.

In summary, mortgage protection life insurance is a valuable tool for homeowners with large mortgages. It provides a safety net in the event of the borrower's death, ensuring that mortgage payments are covered and the family's home remains protected. By working with insurance providers, borrowers can customize their coverage to fit their specific mortgage needs, offering a comprehensive solution for financial security and peace of mind.

Canceling Japanese Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Loanable life insurance, often referred to as 'term life insurance with a loan feature', is a unique type of life insurance policy that offers policyholders the ability to borrow a portion of the death benefit as a tax-free loan while the policy is in force. This feature can be particularly useful for those who need immediate access to funds for various purposes.

When you purchase a loanable life insurance policy, you can choose to opt-in for the loan feature. If you need funds at any point during the policy term, you can borrow up to a certain percentage of the death benefit. The loan is typically interest-free and can be repaid at your convenience, often with the option to make additional payments to reduce the principal.

This type of insurance provides several advantages. Firstly, it offers immediate access to cash, which can be valuable in emergencies or for various financial needs. Secondly, the loan is tax-free, meaning you don't have to worry about paying taxes on the borrowed amount. Additionally, the policy remains in force even if you default on the loan, ensuring your loved ones are still protected.

While loanable life insurance can be beneficial, there are some important considerations. If you default on the loan, the insurer may have the right to reduce the death benefit to cover the outstanding debt. It's crucial to ensure you have the financial capacity to repay the loan to avoid any potential issues. Additionally, understanding the policy's terms and conditions is essential to make an informed decision.