Life insurance is a crucial aspect of financial planning, especially in the event of significant life changes such as divorce. When a marriage ends, individuals often overlook the topic of life insurance, but it can have a significant impact, especially if there are alimony and child support payments involved. In certain situations, it is possible to take out a life insurance policy on an ex-spouse, but this usually requires proving an insurable interest, such as financial dependency or court-ordered obligations like alimony or child support. Understanding the complexities of life insurance during and after divorce can help individuals make informed decisions to protect their financial well-being and that of their children.

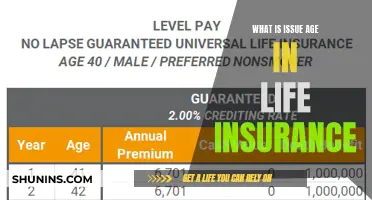

| Characteristics | Values |

|---|---|

| Can you get short-term life insurance on your ex? | Yes, but you'll need to prove insurable interest and get their consent. |

| Who can be the beneficiary of the policy? | The ex-spouse, children, or a trust can be the beneficiary of the policy. |

| What type of policy should you get? | Whole life or term life insurance are popular options. |

| How much coverage do you need? | Enough to cover alimony and/or child support payments. |

| How long should the coverage last? | Until alimony and/or child support obligations end. |

What You'll Learn

Court-ordered life insurance

During a divorce settlement, the court may order one spouse to purchase life insurance on their ex-spouse. This ensures that if the paying spouse dies before fulfilling their alimony or child support obligations, the policy proceeds will be used to complete the remaining payments. While this can be a useful tool to protect the financial interests of the beneficiary spouse and any children involved, it can also be a source of contention if the paying spouse is reluctant to take out such a policy.

The specifics of court-ordered life insurance policies, such as the term length, coverage amount, policy ownership, and premium payments, should be coordinated between both spouses and their respective lawyers. It is crucial to start the application process as early as possible, as it can take several weeks to complete. Additionally, proof of the policy may be required by the court, which can be provided by the broker or insurance company.

Divorce can have a significant impact on life insurance policies, and it is important to carefully review and update beneficiaries and policy details to reflect the changes in marital status and financial obligations. In some cases, the cash value of permanent life insurance policies may be considered a financial asset and divided between spouses during divorce proceedings. On the other hand, term life insurance policies typically do not require any changes, but it is still recommended to update beneficiaries.

Overall, court-ordered life insurance plays a crucial role in protecting the financial interests of spouses and dependent children during and after divorce proceedings. It ensures that alimony and child support payments are secured, providing peace of mind and stability for all parties involved.

Insuring Life: Understanding the Basics of Coverage and Benefits

You may want to see also

When an ex-spouse can collect life insurance proceeds

An ex-spouse can collect life insurance proceeds if they are the beneficiary listed on the policy. This is because a life insurance policy is a contract, and only the policyholder can make changes to it. In the case of a divorce, the beneficiary can be changed, but only by the policyholder. If the beneficiary is not changed, and the policyholder dies, the proceeds will go to the ex-spouse listed as the beneficiary.

There is no universal rule on who receives life insurance after a divorce. Factors such as the type of policy, the state where the policy was issued, and the language in the divorce decree will come into play when determining who receives the life insurance benefit. In some cases, a court decree might require an ex-spouse to be named as the beneficiary of the life insurance policy.

During divorce proceedings, the court may require one spouse to maintain life insurance for a certain amount of time, with their ex-spouse listed as the beneficiary. This is called court-ordered life insurance. It doesn't require the ex-spouse to take out a policy on their former partner, but it can serve the same function of securing alimony and child support payments if the policyholder ex-spouse passes away.

If you are considering taking out life insurance on your ex-spouse, you will need to prove that you have an insurable interest, meaning that you would experience financial hardship if you stopped receiving income from them. You will also need their consent and they will need to participate in the application process.

Life Insurance: Your Ultimate Financial Safety Net

You may want to see also

When an ex-spouse can't collect life insurance proceeds

There are several scenarios in which an ex-spouse cannot collect life insurance proceeds.

Firstly, some insurance policies contain specific clauses that prohibit an ex-spouse from receiving life insurance benefits. These clauses are often included to prevent conflicts among family members and reduce the potential for life insurance fraud.

Secondly, some states have laws in place to prevent ex-spouses from receiving life insurance benefits. These laws automatically revoke the beneficiary status of an ex-spouse following a divorce, ensuring that they cannot claim benefits after the policyholder's death. The aim of these laws is to prevent family disputes and limit litigation over disputed policies. However, it's important to note that these laws don't guarantee that all claims will fall under this category, and there may be exceptions.

Thirdly, even if an ex-spouse is the named beneficiary on a policy, they will not receive the benefits if the policy has been cancelled or the beneficiary has been changed. This can occur if the policyholder actively removes their ex-spouse as a beneficiary or if they create a new will or trust that supersedes the existing policy.

Additionally, in the case of military or federal insurance policies, certain federal laws can override conflicting state laws or divorce decrees. For example, if a policyholder has an SGLI (Servicemembers' Group Life Insurance) policy and names their parents as beneficiaries, the parents will receive the benefit even if a divorce decree states that the ex-spouse should be the beneficiary.

Finally, if the ex-spouse cannot prove insurable interest, they may not be able to purchase a life insurance policy on their ex-partner. Insurable interest means that the ex-spouse would experience financial hardship if they stopped receiving income from the policyholder due to alimony or child support payments.

It's important to note that the laws and regulations surrounding life insurance and divorce can be complex and vary by state and policy type. Consulting with a legal professional who specializes in life insurance law can help ensure that an individual's rights and interests are protected.

Life Insurance and Divorce: Who Gets What?

You may want to see also

Updating beneficiaries

The person who has taken out the life insurance policy will be the one to decide who the beneficiary is. If you are the policyholder, you can determine the beneficiary at any time, depending on the terms of the policy, without any penalty or fee. The policyholder should also be able to name a contingent beneficiary who will receive the death benefit payout if the primary beneficiary is deceased or unable to receive the funds.

To change the beneficiary of your life insurance policy, you need to contact your insurance company. The process for changing a beneficiary may differ depending on the provider. Generally, you will need to fill out a change of beneficiary form, which includes information such as the policyholder's name, the new beneficiary's name, and the reason for the change. Once you complete the form, you must submit it to the insurance company for approval.

It is recommended that you review your beneficiary information at least once a year to ensure everything is current. Certain life events, such as marriage, the birth of a child, or divorce, should also trigger a review of your beneficiary information. This will save your family members unnecessary grief in the future.

Life Insurance: Where and How to Invest Your Money

You may want to see also

Protecting child support for minor dependents

The death of a parent can have a significant impact on a child, and it is crucial to ensure that the child's financial needs are met during this difficult time. Here are some ways to protect child support for minor dependents:

Understanding Child Support Obligations

It is important to recognize that the legal and financial obligations of a parent towards their children do not end with their death. Child support orders are typically still in effect even if the payee or payor parent dies. Therefore, it is essential to consult with a family law attorney to understand your specific state's laws and the surviving parent's options for continuing to receive child support.

Reviewing Life Insurance Policies

One of the first steps in securing child support payments is to review the deceased parent's life insurance policy. If the policy names the child as a beneficiary, the surviving parent can contact the insurance company to initiate the claims process. This will help ensure that the child receives the financial support intended by the deceased parent.

Seeking Social Security Benefits

The surviving parent may be able to seek Social Security benefits on behalf of the child from the Social Security Administration (SSA). Typically, children up to the age of 19 or still in high school can receive these benefits. Additionally, children with disabilities that began before the age of 22 may also be eligible for extended benefits.

Exploring Estate Claims

The estate of the deceased parent may also be tapped to meet child support obligations. This includes assets such as houses, bank accounts, retirement accounts, and vehicles. The surviving parent can work with an estate lawyer to navigate the complex terrain of probate and make claims against the estate to ensure the continuation of child support payments.

Considering Court-Ordered Life Insurance

During divorce proceedings, the court may order one spouse to maintain life insurance with their ex-spouse listed as the beneficiary for a specified period. This ensures that alimony and child support payments remain secure in the event of the paying spouse's death.

Appointing a Guardian

If the custodial parent dies, the priority becomes determining child custody. The non-custodial parent is generally given custody unless there are factors such as supervised visitation that complicate the situation. An appointed guardian can receive child support from both parents' estates and seek modifications to ensure the child's financial needs are met.

In summary, protecting child support for minor dependents involves a combination of legal and financial strategies. By understanding the surviving parent's rights and options, consulting with attorneys, and reviewing the deceased parent's financial resources, you can help ensure that the child's financial needs are met during this challenging time.

Life Insurance: Enrolling Life Events for Coverage

You may want to see also

Frequently asked questions

Yes, you can get life insurance on your ex-spouse as long as there is an "insurable interest" such as court-ordered life insurance or your ex-spouse allowing you to take out a policy on them and signing the application.

No, it is illegal to get life insurance on your ex-spouse without their knowledge. If the insurance company can prove you took out a policy without their consent, they can refuse to pay the claim.

You could still work around it and either cancel it or take it over while your ex-spouse purchases a new one. If you choose to cancel and buy a new one, the premiums will not be the same because of age issues and possible health problems.

Nothing happens to your life insurance policy if you divorce. However, the owner of the policy can make any changes they deem necessary, such as who the policy will pay out to or keeping the policy active. While the court may order you to have an individual policy, they cannot do anything to your current life insurance policy.