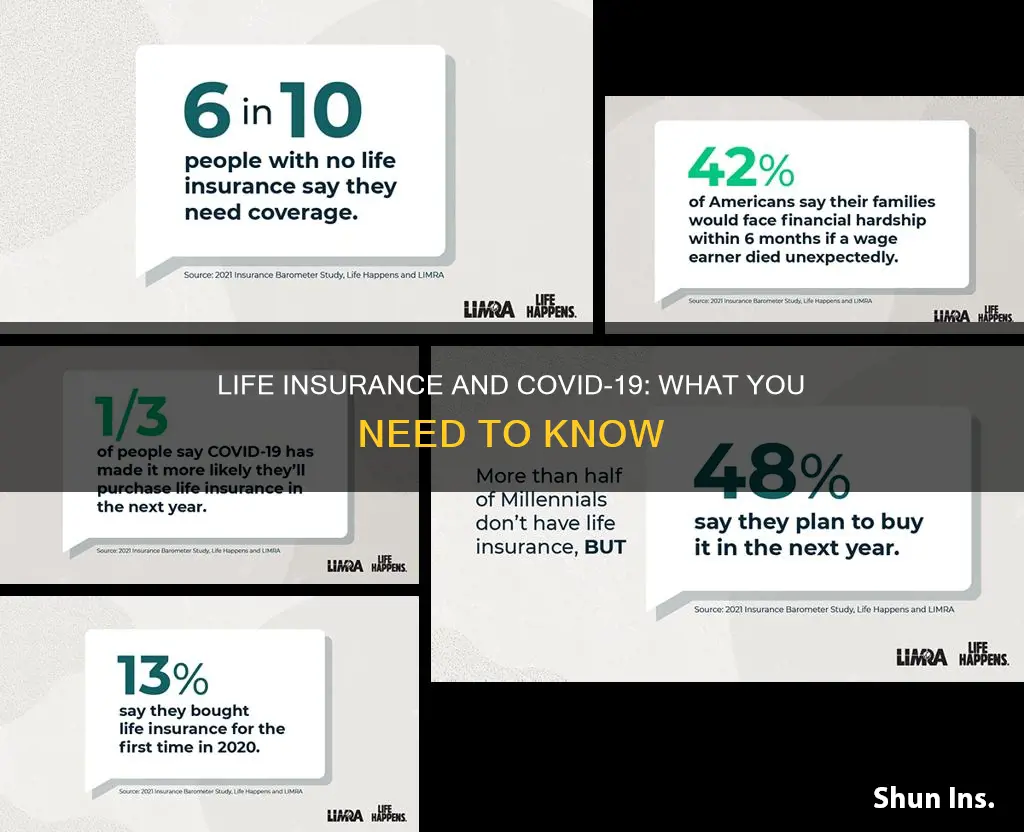

Life insurance is a financial safety net designed to provide financial security for beneficiaries in the event of the insured's death. However, when it comes to the novel coronavirus (COVID-19), the coverage provided by life insurance policies can vary significantly. While many standard life insurance policies do not explicitly cover death caused by the virus, they may still provide a payout if the death is deemed a result of an illness or condition that was pre-existing or exacerbated by the virus. It's crucial for policyholders to review their specific policy terms and conditions to understand the extent of their coverage in the context of the pandemic.

What You'll Learn

- Medical Expenses: Life insurance may cover costs of treatment and hospitalization related to COVID-19

- Income Loss: Policies can provide financial support if you're unable to work due to the virus

- Pre-existing Conditions: Pre-existing health issues may impact coverage, but some policies offer protection

- Death Benefits: In the event of death from COVID-19, life insurance provides a financial payout to beneficiaries

- Policy Exclusions: Some policies may exclude coverage for certain activities or pre-existing conditions related to the virus

Medical Expenses: Life insurance may cover costs of treatment and hospitalization related to COVID-19

Life insurance policies can provide financial security and peace of mind, especially during challenging times like the global health crisis caused by the novel coronavirus (COVID-19). When it comes to the question of whether life insurance would cover coronavirus-related expenses, the answer is often yes, but the specifics can vary depending on the policy and the circumstances.

Many life insurance policies, particularly those with a critical illness rider, are designed to provide coverage for severe medical conditions, including infectious diseases. COVID-19, being a critical illness, can fall under this category. If an individual's life insurance policy includes a critical illness benefit, it may cover the costs associated with the diagnosis, treatment, and hospitalization related to the virus. This coverage can be a significant financial lifeline during a time when medical expenses can quickly accumulate.

The coverage for COVID-19-related medical expenses can vary. Some policies may provide a lump-sum payment, which can be used to cover various expenses, including hospital bills, medical treatments, and even income replacement if the individual is unable to work due to the illness. This financial support can help individuals and their families manage the financial burden of the illness, ensuring that they have the necessary resources to focus on recovery without the added stress of financial strain.

It's important to note that the terms and conditions of life insurance policies can differ significantly. Some policies may have specific exclusions or limitations regarding infectious diseases, so it's crucial to carefully review the policy documents. Additionally, the coverage amount and the process for claiming benefits can vary, so individuals should understand their policy's terms to ensure they are adequately protected.

In summary, life insurance can play a vital role in providing financial support during the COVID-19 pandemic. With the potential to cover medical expenses, hospitalization costs, and even income replacement, life insurance policies can offer much-needed relief. However, it is essential to review the policy details and consult with insurance providers to fully understand the extent of coverage and any specific requirements for claiming benefits related to coronavirus.

Understanding Whole Life Insurance: A Comprehensive Guide

You may want to see also

Income Loss: Policies can provide financial support if you're unable to work due to the virus

The ongoing global health crisis has raised concerns about the financial implications of being unable to work due to illness. Life insurance policies, which are typically designed to provide financial security in the event of death, may also offer coverage for income loss in certain circumstances. Here's how life insurance can provide financial support during the pandemic:

Understanding Income Loss Coverage: Many life insurance policies, especially those categorized as "income replacement" or "income protection," offer benefits designed to replace a portion of your income if you become unable to work due to an illness or injury. This type of coverage is particularly relevant during a pandemic when individuals may face extended periods of absence from work due to self-isolation, medical treatment, or other virus-related reasons.

Policy Benefits: When purchasing a life insurance policy, consider the following features:

- Short-Term Disability Benefits: These provisions typically kick in if you're unable to work for a specified period, often 30 days or more, due to illness or injury. During the pandemic, this could cover the initial days of self-isolation or recovery.

- Long-Term Disability: For more severe cases, long-term disability coverage can provide financial support if you're unable to work for an extended period, potentially covering your entire recovery time.

- Critical Illness Insurance: While not directly related to income loss, critical illness insurance can provide a lump sum payment if you're diagnosed with a severe illness, such as COVID-19, which may result in a prolonged absence from work.

Claim Process: If you find yourself in a situation where you need to claim income loss benefits, the process typically involves:

- Notifying your insurance provider about your inability to work.

- Providing medical documentation or a doctor's note confirming your illness or condition.

- Submitting necessary forms and evidence to support your claim.

- Receiving the agreed-upon income replacement benefit, which can help cover living expenses and other financial obligations during your recovery.

Review and Understand Your Policy: It is crucial to carefully review your life insurance policy to understand the specific terms and conditions related to income loss coverage. Policies may have different waiting periods, benefit amounts, and eligibility criteria. Some policies might also require you to provide regular updates on your medical condition and ability to work.

During these challenging times, having a comprehensive life insurance policy with income loss coverage can provide much-needed financial security, ensuring that you and your loved ones are protected even when you're unable to work due to the virus. It is always advisable to consult with a financial advisor or insurance specialist to tailor a policy that best suits your individual needs and circumstances.

Understanding Term 70 Life Insurance: A Comprehensive Guide

You may want to see also

Pre-existing Conditions: Pre-existing health issues may impact coverage, but some policies offer protection

When considering life insurance coverage during the COVID-19 pandemic, it's important to understand how pre-existing conditions might affect your policy. Life insurance companies typically assess an individual's health history to determine eligibility and set premiums. Pre-existing health issues can indeed impact your coverage, but it doesn't necessarily mean you won't qualify for life insurance. Many policies are designed to provide protection even for those with pre-existing conditions.

For individuals with pre-existing health concerns, such as chronic illnesses or previous surgeries, insurance providers may still offer coverage, but the terms and conditions might differ. These policies often come with specific exclusions or limitations related to the pre-existing condition. For instance, some policies may not cover complications arising from the pre-existing health issue or may have a waiting period before the full coverage amount is available. It's crucial to review the policy details carefully to understand what is and isn't covered.

The impact of pre-existing conditions on life insurance coverage can vary widely depending on the insurance company and the specific policy. Some insurers may offer tailored policies that provide comprehensive coverage despite the pre-existing health issues. These policies might include additional medical exams or require a higher premium to account for the potential risks associated with the pre-existing condition.

If you have a pre-existing health condition, it's advisable to disclose this information to the insurance company during the application process. Being transparent about your health history allows the insurer to provide an accurate assessment and offer suitable coverage options. While pre-existing conditions can influence the terms of your policy, many insurance providers are willing to work with individuals to find a solution that meets their needs.

In summary, having a pre-existing health condition doesn't automatically disqualify you from obtaining life insurance coverage. Insurance companies often have policies in place to accommodate individuals with pre-existing conditions, offering protection despite the potential risks. It is essential to carefully review the policy details and understand the terms and conditions to ensure you have the appropriate coverage for your specific circumstances.

Life Insurance Options with Cardiomyopathy

You may want to see also

Death Benefits: In the event of death from COVID-19, life insurance provides a financial payout to beneficiaries

Life insurance is a critical financial tool that offers a safety net for individuals and their loved ones, especially during unforeseen circumstances like the global health crisis caused by the COVID-19 pandemic. When it comes to the question of whether life insurance would cover death from coronavirus, the answer is a nuanced one, and it largely depends on the specific policy and its terms.

In the context of the COVID-19 pandemic, many life insurance companies have been addressing concerns and adapting their policies to provide coverage for deaths caused by this virus. Typically, life insurance policies offer death benefits, which are financial payouts to the designated beneficiaries upon the insured individual's passing. These benefits can provide much-needed financial support to cover expenses such as funeral costs, outstanding debts, mortgage payments, or simply to ensure the financial well-being of the family.

For individuals who have passed away due to COVID-19, life insurance can be a lifeline for their families. The death benefit payout can help ease the financial burden associated with the loss. It is essential to review the policy documents and understand the specific conditions under which the insurance company will provide coverage for COVID-19-related deaths. Some policies may have specific exclusions or limitations, especially during a global health emergency, so it's crucial to be well-informed.

When considering life insurance coverage for coronavirus-related deaths, it is advisable to consult with insurance professionals or brokers who can provide personalized guidance. They can help assess the current policy, its terms, and any potential adjustments or add-ons that could provide additional coverage for infectious diseases like COVID-19. This ensures that the policy is tailored to meet the specific needs and risks associated with the pandemic.

In summary, life insurance can play a vital role in providing financial security during the challenging times of a global health crisis. While the coverage for COVID-19-related deaths may vary, it is essential to understand the policy's terms and seek professional advice to ensure that the insurance policy adequately protects against the risks associated with the pandemic.

Life Insurance for Underground Miners: Is It Possible?

You may want to see also

Policy Exclusions: Some policies may exclude coverage for certain activities or pre-existing conditions related to the virus

When considering life insurance coverage during the COVID-19 pandemic, it's important to understand that insurance policies can vary widely in their terms and conditions. One critical aspect to be aware of is the potential for policy exclusions, which can significantly impact your ability to receive financial protection in the event of a tragic outcome related to the virus.

Many life insurance policies have specific exclusions related to infectious and contagious diseases, including coronaviruses. These exclusions are often designed to protect the insurance company from financial risks associated with widespread pandemics. For instance, some policies may explicitly state that they do not cover death or disability caused by or resulting from a contagious disease outbreak, including the novel coronavirus. This means that if you pass away or become severely ill due to COVID-19, your beneficiaries might not receive the full death benefit as promised by the policy.

Policy exclusions can also apply to pre-existing conditions related to the virus. If you had underlying health issues before contracting COVID-19, your life insurance policy might not cover the resulting complications or death. For example, if you had pre-existing respiratory issues and then developed severe COVID-19 symptoms, the insurance company may consider this a pre-existing condition and exclude coverage for the related complications or death.

Additionally, certain activities or behaviors could be excluded from coverage. High-risk activities like skydiving, scuba diving, or extreme sports might void your policy's benefits. Similarly, pre-existing health conditions, such as chronic heart disease or diabetes, could also lead to exclusions. It's crucial to review your policy documents carefully to understand what is and isn't covered.

To ensure you have adequate protection, consider consulting with a financial advisor or insurance specialist who can help you navigate the complexities of life insurance policies during this challenging time. They can assist in finding policies that offer more comprehensive coverage, especially if you have specific health concerns or activities that might be excluded. Understanding these policy exclusions is essential to making informed decisions about your life insurance coverage.

Life Insurance Calculator: Haven's Smart Planning Tool

You may want to see also

Frequently asked questions

Yes, many life insurance policies, especially those with a broad definition of "natural causes," will cover deaths resulting from COVID-19. However, the coverage may vary depending on the specific policy terms and the cause of death as determined by a medical professional.

Absolutely. Life insurance typically covers deaths caused by any underlying condition, especially if it leads to severe complications. COVID-19 can cause various health issues, and if these complications result in death, the policy may provide a death benefit.

Even if you were not hospitalized, life insurance policies often have a clause that covers deaths caused by a contagious disease, especially if it is deemed severe or critical. The key factor is the severity of the condition and its impact on your health, as determined by medical evidence.

Yes, it's important to understand that some policies may have specific exclusions or limitations for deaths caused by contagious diseases, including COVID-19. These exclusions might vary, so it's crucial to review your policy documents or consult with your insurance provider to understand the coverage details.

If you have a pre-existing condition or a recent diagnosis of COVID-19, it's essential to disclose this information to your insurance company. They may offer a policy adjustment or a refund if they deem it necessary due to the potential impact on your health and the risk associated with the condition. However, the process and terms will depend on the insurance provider's policies.