Whole or universal life insurance is a long-term financial product that offers a range of benefits. It provides coverage for the entire lifetime of the insured individual, ensuring that beneficiaries receive a death benefit when the insured person passes away. This type of insurance also includes an investment component, allowing policyholders to accumulate cash value over time, which can be borrowed against or withdrawn. The policy's cash value grows tax-deferred and can be used to pay premiums or taken out as a loan, providing financial flexibility. Understanding the features and advantages of whole life insurance is essential for anyone considering long-term financial planning and risk management.

What You'll Learn

- Definition: Whole life insurance is a permanent policy with a guaranteed death benefit and cash value accumulation

- Premiums: Premiums are typically level and paid for a set period, ensuring predictable costs

- Death Benefit: The death benefit is a fixed amount paid to beneficiaries upon the insured's death

- Cash Value: Accumulated cash value grows tax-deferred and can be borrowed against or withdrawn

- Longevity: Whole life provides coverage for a lifetime, offering security for the long term

Definition: Whole life insurance is a permanent policy with a guaranteed death benefit and cash value accumulation

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It is a long-term financial commitment that offers a range of benefits, making it a popular choice for those seeking comprehensive protection. One of the key features of whole life insurance is its guaranteed death benefit, which means that the insurance company promises to pay out a specified amount to the policyholder's beneficiaries upon the insured's death. This guarantee provides financial security and peace of mind, knowing that the policy will not lapse and the beneficiaries will receive the intended financial support.

In addition to the death benefit, whole life insurance also includes a cash value component. Over time, a portion of the premiums paid by the policyholder is invested and grows tax-deferred. This accumulated cash value can be borrowed against or withdrawn, providing the policyholder with a source of funds that can be used for various purposes. The cash value grows as the insured individual ages, and it can be a valuable asset that can be passed on to beneficiaries or used to secure the policyholder's financial future.

The permanent nature of whole life insurance is a significant advantage. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force for the entire life of the insured. This ensures that the policyholder and their family are protected from financial loss due to premature death at any age. The guaranteed death benefit and the accumulation of cash value make whole life insurance a robust and reliable financial tool.

When considering whole life insurance, it is essential to understand the concept of "permanent" coverage. This means that the policy is not subject to term limits and will continue to provide benefits as long as the premiums are paid. Permanent insurance offers a level of financial security that can be particularly important for long-term financial planning, especially for those with a desire to build a substantial cash value over time.

In summary, whole life insurance is a permanent policy that offers a guaranteed death benefit and the potential for cash value accumulation. Its long-term nature provides comprehensive protection and financial security, making it an attractive option for individuals seeking a reliable and enduring insurance solution. Understanding the features and benefits of whole life insurance is crucial for making informed financial decisions.

Life Insurance for Transformers: Who Gets Covered?

You may want to see also

Premiums: Premiums are typically level and paid for a set period, ensuring predictable costs

Whole or universal life insurance is a type of permanent life insurance that offers lifelong coverage. One of its key features is the level premium structure, which provides a sense of financial stability and predictability for policyholders. When you purchase this type of insurance, you typically pay a fixed premium amount at regular intervals, such as annually, semi-annually, or monthly. This level premium ensures that your costs remain consistent over the entire term of the policy, without any significant increases.

The predictability of premiums is a significant advantage of whole life insurance. Unlike term life insurance, where premiums can vary based on the policyholder's age and health, whole life insurance premiums remain the same throughout the policy's duration. This means that you can accurately plan and budget for your insurance expenses without worrying about unexpected rate hikes. For example, if you pay an annual premium of $1,200 for your whole life insurance policy, you can expect to pay the same amount every year until the policy's maturity.

This level premium structure is particularly beneficial for long-term financial planning. It allows individuals to secure their loved ones' financial future with the assurance that the insurance costs will not become a financial burden as they age. By paying a fixed amount regularly, policyholders can build a substantial cash value over time, which can be borrowed against or withdrawn as needed. This feature provides a financial safety net and can be a valuable tool for wealth accumulation and retirement planning.

Furthermore, the predictability of premiums in whole life insurance encourages policyholders to maintain their payments consistently. Knowing that the cost will remain stable can motivate individuals to stay committed to their insurance commitments, ensuring continuous coverage and potential financial benefits. This aspect of whole life insurance is especially important for those who want to provide long-term financial security for their families or beneficiaries.

In summary, the level premium structure of whole or universal life insurance offers a predictable and stable financial arrangement. By paying a fixed premium for a set period, policyholders can enjoy the peace of mind that comes with knowing their insurance costs will not fluctuate. This feature, combined with the potential for cash value accumulation, makes whole life insurance an attractive option for those seeking long-term financial security and protection.

The W9 Form: Its Role in Life Insurance Applications

You may want to see also

Death Benefit: The death benefit is a fixed amount paid to beneficiaries upon the insured's death

Whole or universal life insurance is a type of permanent life insurance that offers a unique and valuable feature: a death benefit. This death benefit is a crucial aspect of the policy and is a fixed amount that is guaranteed to be paid out to the designated beneficiaries when the insured individual passes away. It provides financial security and peace of mind, ensuring that the loved ones of the insured person are taken care of in the event of their untimely death.

The death benefit is a fundamental promise made by the insurance company. When you purchase a whole life insurance policy, you are essentially entering into a contract with the insurer. This contract stipulates that the company will pay out the specified death benefit amount to the beneficiaries named in the policy. The amount is predetermined and remains constant throughout the life of the policy, providing a level of certainty and reliability that is often lacking in other forms of insurance.

Upon the insured's death, the beneficiaries can rely on receiving the full death benefit. This financial payout can be used to cover various expenses and provide financial support to the family, including funeral costs, outstanding debts, mortgage payments, or even as a source of income replacement. The death benefit is typically tax-free, ensuring that the beneficiaries receive the full amount without any deductions.

One of the key advantages of whole life insurance is that the death benefit is guaranteed, regardless of the insured's age or health at the time of death. This is in contrast to term life insurance, where the death benefit is only valid for a specific period. With whole life, the death benefit is a long-term commitment, providing coverage for the entire life of the insured individual. This feature makes it an attractive option for those seeking long-term financial protection and peace of mind.

In summary, the death benefit is a critical component of whole or universal life insurance, offering a fixed and guaranteed amount to beneficiaries upon the insured's death. It provides financial security and ensures that the loved ones of the insured person are protected, even in the face of tragedy. Understanding the death benefit is essential when considering life insurance options, as it forms the core promise and value of this type of coverage.

Life Insurance Options for the Paralyzed: What You Need to Know

You may want to see also

Cash Value: Accumulated cash value grows tax-deferred and can be borrowed against or withdrawn

Whole or universal life insurance is a type of permanent life insurance that offers a unique feature: the ability to accumulate cash value over time. This cash value is a significant benefit of this insurance type, providing policyholders with a financial asset that can be utilized in various ways.

As the policyholder, you contribute a portion of your premium payments into an investment account, which is known as the cash value account. This money is invested by the insurance company, often in a diversified portfolio of assets, and it grows tax-deferred. Tax-deferred means that the earnings on this investment are not taxed until they are withdrawn or borrowed against. This feature allows your money to grow faster, providing a substantial financial benefit over time.

The accumulated cash value can be used in several ways. Firstly, it can be borrowed against, allowing policyholders to access funds for various purposes, such as home improvements, education expenses, or business ventures. These loans typically have favorable terms, including low-interest rates, and the borrowed amount is repaid with interest, ensuring the policy's value remains intact. Secondly, the cash value can be withdrawn, providing access to the funds without incurring penalties or taxes, as long as the policy has been in force for a certain period.

This flexibility is a key advantage of whole or universal life insurance. It allows individuals to build a substantial cash reserve that can be utilized for financial goals or emergencies. Over time, the cash value can grow significantly, providing a safety net and a valuable financial asset that can be passed on to beneficiaries.

In summary, the cash value component of whole or universal life insurance is a powerful feature, offering policyholders the ability to build a tax-deferred investment, access funds through loans, and withdraw money when needed. This insurance type provides a unique combination of insurance protection and financial growth, making it an attractive option for those seeking long-term financial security.

Graded Death Benefit: Life Insurance's Lesser-Known Clause

You may want to see also

Longevity: Whole life provides coverage for a lifetime, offering security for the long term

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It is a long-term financial commitment that offers a range of benefits, particularly in terms of longevity and financial security. This type of insurance is designed to provide a sense of peace of mind, knowing that your loved ones will be financially protected even in the event of your passing.

One of the key advantages of whole life insurance is its longevity guarantee. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force as long as the policyholder pays the premiums. This means that the coverage is secure and will not lapse, providing a reliable safety net for the insured and their beneficiaries. With whole life, the insured can rest assured that their loved ones will receive the intended financial support, no matter how long they live.

The concept of whole life insurance is straightforward: you pay a fixed premium over a set period, and in return, you receive a guaranteed death benefit when the insured person passes away. This benefit is typically paid out as a lump sum to the beneficiaries, who can use it for various purposes, such as covering funeral expenses, paying off debts, or funding education. The beauty of whole life insurance lies in its ability to provide this financial security without the need for frequent premium adjustments, which can be a concern with other insurance types.

Over time, whole life insurance also accumulates cash value, which can be borrowed against or withdrawn. This feature allows policyholders to access their funds for various financial needs, such as starting a business, investing, or funding retirement. The cash value grows tax-deferred, providing an additional financial benefit. As the policyholder ages, the cash value can be utilized to ensure the policy remains in force, even if the insured's health or financial situation changes.

In summary, whole life insurance is an excellent choice for those seeking long-term financial security and coverage. Its lifetime guarantee and ability to provide financial support to beneficiaries make it a reliable and valuable insurance product. With whole life, individuals can focus on living their lives to the fullest, knowing that their loved ones will be taken care of, no matter how long they live. This type of insurance is a wise investment for anyone looking to secure their family's future and ensure financial stability for generations to come.

Disputing Life Insurance Denials: What's the Time Limit?

You may want to see also

Frequently asked questions

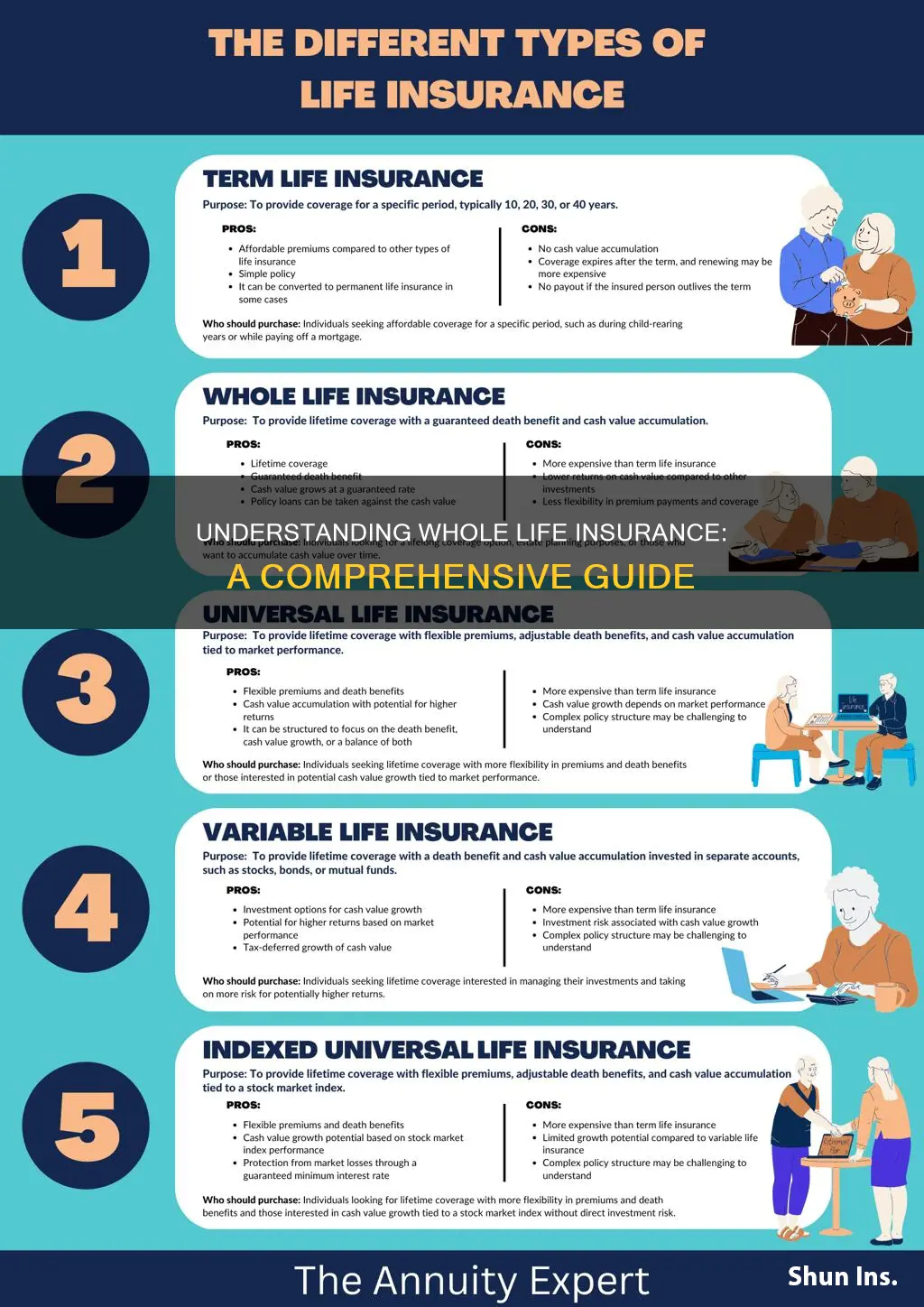

Whole life insurance is a permanent policy with a fixed death benefit and premium, providing coverage for the entire lifetime of the insured individual. It offers a guaranteed return on the investment component, known as the cash value, which can be borrowed against or withdrawn. Universal life insurance, on the other hand, is a type of permanent life insurance that provides coverage for the entire life of the insured. It offers flexibility in premium payments and death benefits, allowing policyholders to adjust these aspects over time. Universal life policies typically have a higher investment component compared to whole life, and the death benefit can increase or decrease based on the performance of the investment accounts.

Both whole and universal life insurance policies include an investment component, which allows policyholders to grow their money over time. The investment portion is typically managed by the insurance company and can offer various investment options. With whole life, the investment component is tied to the policy's cash value, which grows tax-deferred. This means the earnings on the investment are not taxed until they are withdrawn or the policy is surrendered. Universal life insurance provides more flexibility in investment choices, often offering a wide range of investment options, including stocks, bonds, and mutual funds. Policyholders can choose how to allocate their money among these options, allowing for potential higher returns but also carrying more investment risk.

Universal life insurance offers several advantages. Firstly, it provides more flexibility in premium payments, allowing policyholders to adjust payments based on their financial situation. This flexibility can be beneficial for those who prefer lower initial premiums and the option to increase payments later. Secondly, universal life policies often have a higher investment component, which can result in potentially higher returns over time. Additionally, the death benefit in universal life insurance can be adjusted, providing an advantage for those who want to ensure their beneficiaries receive the maximum benefit if needed. However, it's important to note that this flexibility comes with additional costs and the risk of outliving the policy if not managed properly.