When it comes to choosing life insurance, it's important to consider your specific needs and financial goals. There are several factors to take into account, such as the coverage amount, policy type (term or permanent), and the reputation and reliability of the insurance company. Many people opt for term life insurance, which provides coverage for a specific period, often at a lower cost compared to permanent policies. Additionally, it's beneficial to compare quotes from multiple providers to ensure you get the best value for your money. With the right research and understanding of your requirements, you can make an informed decision on where to purchase life insurance that suits your individual circumstances.

What You'll Learn

- Age & Health: Younger, healthier individuals often get better rates

- Coverage Amount: Determine how much coverage you need based on your financial goals

- Term Length: Choose between term life (e.g., 10-year, 20-year) or permanent insurance

- Provider Reputation: Research and compare reputable insurance companies with strong financial ratings

- Online vs. Offline: Consider the convenience of online platforms or traditional agency visits

Age & Health: Younger, healthier individuals often get better rates

When considering life insurance, age and health are two of the most critical factors that can significantly impact your rates and overall experience. Younger, healthier individuals often find themselves in a favorable position when it comes to securing life insurance coverage. This is primarily because insurance companies assess risk based on these two key aspects, and younger, healthier individuals are generally considered less risky policyholders.

As a younger person, you likely have a longer life expectancy, which is a significant advantage. Insurance providers calculate premiums based on the expected duration of coverage, and a longer policy term means lower monthly payments. Additionally, younger individuals are less likely to have pre-existing health conditions or chronic illnesses that could lead to higher insurance premiums. This is especially true if you maintain a healthy lifestyle, as non-smokers and those with a balanced diet and regular exercise routine often receive more competitive rates.

Health plays a crucial role in determining your insurance rates. Insurance companies may offer lower premiums to individuals with a clean bill of health, as they are less likely to require frequent medical interventions or claim payouts. Maintaining a healthy weight, managing stress levels, and avoiding harmful habits like smoking or excessive alcohol consumption can all contribute to a more favorable insurance profile. Regular health check-ups and staying up-to-date with vaccinations and screenings can also ensure that you remain in good standing with your insurer.

It's important to note that while younger individuals may secure better rates, it doesn't mean that older or less healthy individuals cannot get life insurance. The key is to shop around and compare quotes from multiple insurance providers. Some companies specialize in offering coverage to individuals with pre-existing conditions or those who are older, and they may provide competitive rates tailored to specific health profiles. Additionally, improving your health through lifestyle changes can also make a significant difference in securing more affordable insurance.

In summary, being younger and healthier can indeed provide an advantage when it comes to life insurance. Lower premiums, longer policy terms, and a reduced risk profile are all benefits that can be enjoyed. However, it is essential to remember that insurance is a highly personalized product, and there are options available for individuals from all walks of life. By understanding your health status and shopping around, you can make an informed decision and find the best life insurance coverage to suit your needs.

Unum Life Insurance: What You Need to Know

You may want to see also

Coverage Amount: Determine how much coverage you need based on your financial goals

When considering life insurance, one of the most crucial aspects is determining the appropriate coverage amount. This decision is a personal and financial one, and it's essential to tailor it to your unique circumstances and goals. The coverage amount you choose will directly impact the financial security of your loved ones in the event of your passing.

To determine the right amount, start by evaluating your financial obligations and goals. Consider your current and future expenses, such as mortgage or rent payments, children's education costs, outstanding debts, and any other long-term financial commitments. These expenses represent the financial needs that your beneficiaries will need to cover in your absence. For instance, if you have a substantial mortgage and your children are still in school, you might want to ensure that the life insurance payout can cover these expenses for a significant period.

Additionally, think about your income and the potential loss of earnings. If you are the primary breadwinner in your family, the coverage amount should ideally be sufficient to replace your income for a reasonable period, allowing your beneficiaries to maintain their standard of living. This might include covering living expenses, daily costs, and any other financial responsibilities you have.

Another factor to consider is your long-term financial goals. Do you have plans for retirement savings, business ventures, or other significant financial milestones? If so, you may want to ensure that your life insurance policy can contribute to or cover these goals. For example, you might want to choose a coverage amount that can provide a lump sum for a business idea or a substantial portion of your retirement savings.

It's important to strike a balance between providing adequate financial security and ensuring that the policy remains affordable. A common approach is to aim for a coverage amount that is 10 times your annual income. However, this is just a starting point, and you should adjust it based on your specific circumstances. Some insurance providers also offer calculators or tools to help you estimate the right coverage amount based on your income, expenses, and goals.

Remember, the goal is to provide peace of mind and financial protection for your loved ones. By carefully assessing your financial obligations, income, and long-term goals, you can make an informed decision about the coverage amount that best suits your needs.

Life Insurance Basics: What You Need to Know

You may want to see also

Term Length: Choose between term life (e.g., 10-year, 20-year) or permanent insurance

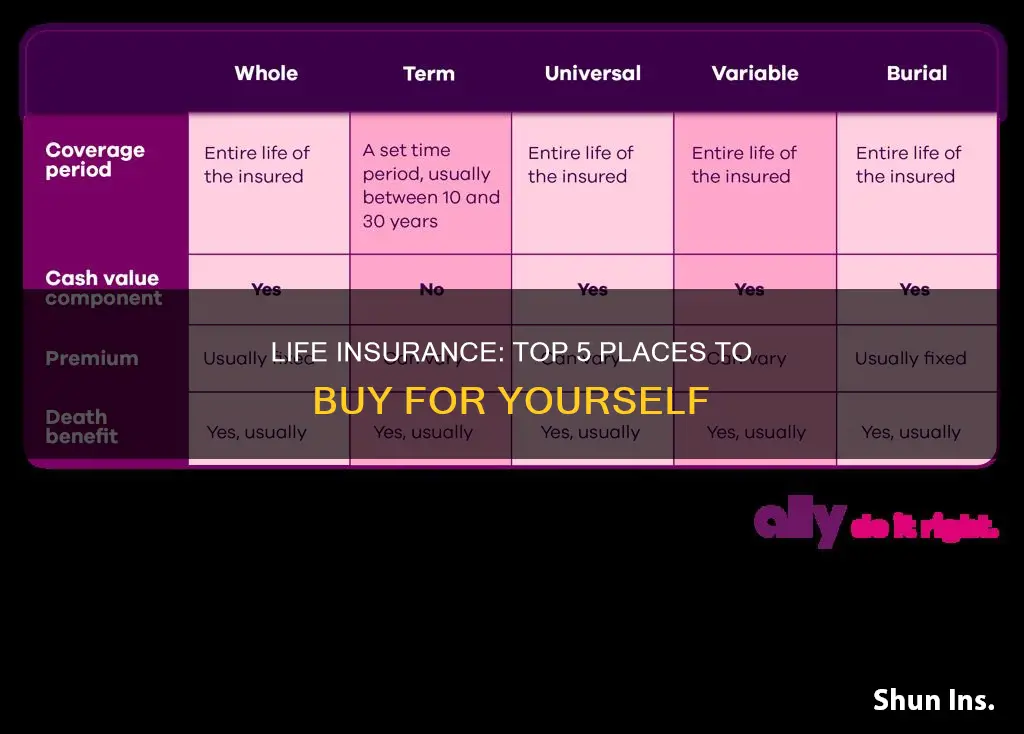

When considering life insurance, one of the most important decisions you'll make is the term length. This choice will significantly impact the coverage you receive and the overall cost of your policy. Here's a breakdown to help you decide between term life and permanent insurance:

Term Life Insurance:

- Temporary Coverage: Term life insurance provides coverage for a specific period, typically 10, 15, 20, or 30 years. This type of policy is ideal for individuals who want coverage for a particular period, such as until a child is financially independent or a mortgage is paid off.

- Affordable Premiums: During the term, term life insurance offers lower premiums compared to permanent policies. This affordability makes it accessible to a broader range of individuals, especially those on a budget.

- No Lapse in Coverage: If you outlive the term, the policy expires, and coverage ends. This can be a concern if you believe you'll need long-term insurance. However, it also means you won't be paying premiums for coverage you don't need.

- Flexibility: Term life insurance allows you to choose the term length that aligns with your specific needs. For example, a 10-year term might be suitable for covering a short-term debt, while a 20-year term could be more appropriate for long-term financial goals.

Permanent Insurance (Whole Life or Universal Life):

- Long-Term Commitment: Permanent insurance provides coverage for your entire life, as long as premiums are paid. This type of policy offers lifelong protection, ensuring your beneficiaries receive a death benefit regardless of when you pass away.

- Cash Value Accumulation: One of the key advantages of permanent insurance is the accumulation of cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. It also means that a portion of your premium contributes to building a savings component within the policy.

- Higher Premiums: Due to the long-term commitment and the additional features, permanent insurance typically has higher premiums compared to term life. However, the guaranteed death benefit and cash value can make it a more attractive option for those seeking long-term financial security.

- Investment Opportunities: Some permanent insurance policies offer investment options, allowing you to potentially grow your money over time. This can be beneficial for those who want to maximize their returns while still having insurance coverage.

When deciding on the term length, consider your financial goals, the duration of your financial obligations, and your long-term insurance needs. If you have specific short-term goals or debts to cover, term life might be the better choice. For those seeking long-term financial security and the potential for cash value accumulation, permanent insurance could be more suitable. It's essential to evaluate your financial situation and consult with insurance professionals to make an informed decision.

Amica's Life Insurance: What You Need to Know

You may want to see also

Provider Reputation: Research and compare reputable insurance companies with strong financial ratings

When considering where to purchase life insurance, provider reputation is a critical factor that can significantly impact your experience and the value you receive. Researching and comparing reputable insurance companies with strong financial ratings is essential to ensure you're making an informed decision. Here's a detailed guide on how to approach this aspect:

Understand Financial Ratings: Financial ratings are like grades given by independent agencies to assess the financial strength and stability of insurance companies. These ratings provide insights into the company's ability to pay out claims and honor its financial commitments. The most well-known rating agencies include A.M. Best, Moody's, and Standard & Poor's. These agencies evaluate companies based on various factors such as assets, liabilities, management, and business performance. A higher rating indicates a more financially stable company, which is crucial for long-term peace of mind.

Research and Compare: Start by researching insurance companies that are highly rated by reputable agencies. Look for companies with an 'A' or 'A+' rating, as these are considered excellent and indicate a strong financial position. You can find these ratings on the agencies' websites or through financial advisors. Compare multiple companies to gather a comprehensive understanding. Look for companies with a history of positive customer reviews and a track record of prompt claim settlements. Online reviews and customer testimonials can provide valuable insights into the overall customer experience.

Check for Regulatory Compliance: Ensure that the insurance providers you consider are licensed and regulated by the relevant authorities in your region. This ensures that they adhere to industry standards and legal requirements. You can verify this information on the regulatory body's website or by checking the company's license status. Regulatory compliance is essential to protect consumers and maintain fair business practices.

Consider Customer Service: Reputation also extends to the quality of customer service. A reputable insurance company should offer prompt and efficient support throughout the policy lifecycle. This includes easy accessibility for policy inquiries, claim processing, and assistance with policy changes or updates. Look for companies with a dedicated customer service team and multiple communication channels, ensuring you can reach out for help whenever needed.

Long-Term Reliability: Opt for insurance providers with a long-standing presence in the market. Established companies often have a more extensive network of agents and brokers, making it easier to find a local representative for policy management and support. Additionally, a longer history in the industry can indicate a company's ability to adapt to changing market conditions and maintain its reputation over time.

By focusing on provider reputation and financial ratings, you can narrow down your options and choose a life insurance company that is financially stable, customer-centric, and likely to provide reliable coverage for years to come. Remember, this research will contribute to a more secure and satisfying life insurance experience.

Understanding Tiaa Life Insurance: A Comprehensive Guide

You may want to see also

Online vs. Offline: Consider the convenience of online platforms or traditional agency visits

When it comes to purchasing life insurance, you have two main options: online platforms or visiting a traditional insurance agency. Both methods have their own advantages and can help you secure the coverage you need. Here's a breakdown of the convenience factors associated with each approach:

Online Platforms:

- Convenience: Online insurance marketplaces offer unparalleled convenience. You can access a wide range of life insurance products from various providers without leaving your home. With just a few clicks, you can compare policies, premiums, and coverage options from different companies. This is especially beneficial for those with busy schedules or limited mobility. You can research and purchase a policy at your own pace, without the need for appointments or travel.

- Accessibility: Online platforms provide 24/7 accessibility. You can visit the website or app whenever it suits you, making it convenient for last-minute decisions or quick policy changes. Additionally, online resources often offer comprehensive information, allowing you to understand the policy details thoroughly before committing.

- Customization: Many online insurance providers offer personalized quotes based on your specific needs. You can input your age, health status, and desired coverage amount to receive tailored recommendations. This level of customization ensures you get a policy that aligns perfectly with your requirements.

Traditional Agency Visits:

- Personalized Service: Visiting a local insurance agency provides a more personalized experience. You can meet with an insurance agent who will take the time to understand your unique circumstances, financial goals, and risk factors. This one-on-one interaction allows for a tailored recommendation and ensures that all your questions and concerns are addressed.

- Expert Advice: Insurance agents are trained professionals who can provide valuable guidance. They can explain complex policy details, help you navigate the various options, and offer advice on the best coverage for your situation. This expertise can be particularly useful for those who prefer a more hands-on approach and want to make an informed decision.

- Face-to-Face Interaction: Meeting in person allows for a more human connection, which can be comforting when making such an important financial decision. You can assess the agent's credibility, ask for references, and ensure they are licensed and reputable.

Making the Right Choice:

The decision between online and offline methods ultimately depends on your personal preferences and circumstances. Online platforms offer convenience, accessibility, and customization, making the process efficient and straightforward. On the other hand, traditional agency visits provide personalized service, expert advice, and a more traditional, human-centric approach. Consider your time availability, comfort with technology, and the level of guidance you require when making your choice.

TiAA Life Insurance: Is It a Good Option?

You may want to see also

Frequently asked questions

Selecting a life insurance policy is a personal decision, and it's essential to consider your unique needs and circumstances. Start by evaluating your financial goals and obligations. Determine the amount of coverage you require to secure your family's financial future in the event of your passing. Research different types of life insurance, such as term life, whole life, or universal life, and understand the benefits and costs associated with each. Compare policies from various insurance companies, considering factors like coverage amounts, premiums, policy terms, and additional features like riders or cash value accumulation. It's beneficial to consult a financial advisor or insurance professional who can provide personalized recommendations based on your specific situation.

Several factors contribute to the cost of life insurance premiums. Age is a significant determinant, as younger individuals typically pay lower rates due to longer life expectancies. Smoking or using tobacco products can increase premiums significantly due to the higher health risks associated with these habits. Your overall health and medical history play a crucial role; individuals with pre-existing health conditions or those who engage in high-risk activities may face higher premiums. Additionally, the chosen coverage amount and policy term impact the cost. Longer coverage periods and higher death benefits usually result in higher premiums. It's advisable to maintain a healthy lifestyle, quit smoking, and regularly review your health status to potentially secure more affordable rates over time.

Yes, it is possible to obtain life insurance even with pre-existing health conditions, but it may be more challenging and expensive. Insurers often consider factors like the severity and management of your health issues when determining eligibility and premium rates. Some companies offer specialized policies for individuals with specific health concerns, such as critical illness insurance or term life insurance with guaranteed acceptance. It's essential to disclose all relevant health information accurately during the application process. Working with an independent insurance broker or agent can help you find suitable options and navigate the process more effectively. They can assist in identifying insurers who specialize in providing coverage for individuals with pre-existing conditions.

Regularly reviewing and adjusting your life insurance coverage is crucial to ensure it remains appropriate for your evolving circumstances. Life events like marriage, the birth of a child, purchasing a home, or significant career changes can impact your insurance needs. It's recommended to review your policy annually or whenever there are substantial life changes. As you age, your coverage needs may change, and you might consider converting a term life policy to a permanent one or increasing the coverage amount. Additionally, regularly assessing your financial goals and obligations will help you determine if your current coverage is sufficient. Consulting with an insurance professional can provide valuable guidance on making these adjustments to ensure you have adequate protection throughout your life's journey.