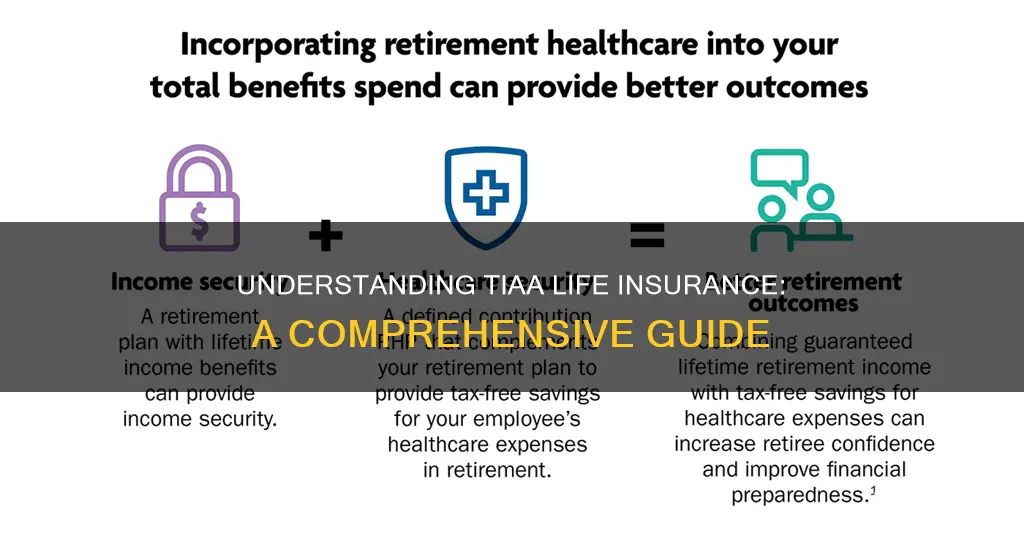

TIAALife Insurance is a comprehensive insurance plan designed to provide financial security and peace of mind to individuals and their families. It offers a range of benefits, including term life insurance, accidental death insurance, and critical illness coverage. This insurance plan is tailored to meet the unique needs of each policyholder, ensuring that they and their loved ones are protected against unforeseen circumstances. With its customizable features and competitive rates, TIAALife Insurance is an excellent choice for those seeking reliable and affordable coverage.

What You'll Learn

- Product Overview: Tiaa Life Insurance offers term life and permanent life policies

- Benefits: Provides financial security for beneficiaries in the event of death

- Eligibility: Open to eligible employees and retirees of participating institutions

- Premiums: Competitive rates based on age, health, and coverage amount

- Customer Service: Dedicated support for policyholders and beneficiaries

Product Overview: Tiaa Life Insurance offers term life and permanent life policies

Tiaa Life Insurance is a comprehensive insurance provider offering a range of life insurance products to meet diverse financial needs. The company specializes in providing term life and permanent life insurance policies, catering to individuals seeking protection and financial security for themselves and their loved ones.

Term Life Insurance:

Tiaa's term life insurance is a straightforward and cost-effective solution for those requiring coverage for a specific period. This policy provides a death benefit if the insured individual passes away during the term, offering financial security to beneficiaries. It is ideal for individuals who want temporary coverage, such as those with a mortgage or specific financial goals that require protection for a defined period. The term life insurance from Tiaa can be customized with various coverage options, allowing policyholders to choose the amount of coverage that aligns with their needs and budget.

Permanent Life Insurance:

In contrast, permanent life insurance offers long-term financial protection and a cash value component. This policy provides coverage for the entire life of the insured individual, ensuring a death benefit is paid to beneficiaries regardless of when the insured passes away. The permanent life insurance policy from Tiaa also includes an investment component, allowing policyholders to build cash value over time, which can be borrowed against or withdrawn as needed. This feature makes it a valuable tool for long-term financial planning and wealth accumulation.

Both term and permanent life insurance policies from Tiaa Life Insurance offer flexibility and customization. Policyholders can choose the coverage amount, term length, and various riders or add-ons to tailor the policy to their specific requirements. Additionally, Tiaa provides various payment options, including level premiums, to ensure affordability and convenience for policyholders.

When considering Tiaa Life Insurance, it is essential to evaluate your unique financial situation and goals. Term life insurance is suitable for temporary needs, while permanent life insurance provides lifelong coverage and investment opportunities. Consulting with a financial advisor or insurance professional can help you make an informed decision and ensure you select the right policy to meet your long-term financial objectives.

Life Insurance: When It's Not Worth the Cost and Commitment

You may want to see also

Benefits: Provides financial security for beneficiaries in the event of death

TIAALife Insurance, a product offered by TIAASupplemental Retirement Plan, is a financial tool designed to provide peace of mind and financial security for individuals and their loved ones. This type of insurance is specifically tailored to complement retirement plans, offering an additional layer of protection and benefits. One of its primary advantages is the provision of financial security for beneficiaries in the event of the insured's death.

When an individual purchases TIAALife Insurance, they essentially create a safety net for their family or designated beneficiaries. In the unfortunate event of the insured's passing, the insurance company pays out a death benefit, which can be a substantial financial sum. This benefit is designed to provide immediate financial support to the beneficiaries, ensuring they have the necessary resources to cover essential expenses, such as funeral costs, outstanding debts, or daily living expenses. The financial security offered by this insurance can be particularly crucial for those who have dependents, such as children or a spouse, who may rely on the insured's income.

The beauty of TIAALife Insurance lies in its ability to provide a sense of reassurance and stability during challenging times. It allows individuals to leave a lasting legacy for their loved ones, ensuring that their financial obligations are met even in their absence. This type of insurance is often seen as a valuable addition to retirement planning, as it complements other financial strategies and provides an extra layer of protection.

Furthermore, TIAALife Insurance offers flexibility in terms of coverage and payment options. Policyholders can choose the amount of coverage that aligns with their needs and financial capabilities. They can also select payment plans that suit their budget, ensuring that the insurance remains affordable and accessible. This flexibility empowers individuals to make informed decisions about their financial security and the security of their loved ones.

In summary, TIAALife Insurance is a comprehensive financial product that offers peace of mind and financial stability. Its primary benefit is providing financial security for beneficiaries, ensuring that their financial obligations are met in the event of the insured's death. With its customizable coverage and payment options, this insurance product empowers individuals to take control of their financial future and provide a lasting legacy for their loved ones.

Unveiling the Top-Rated Health Mark in Life Insurance

You may want to see also

Eligibility: Open to eligible employees and retirees of participating institutions

TIAALife Insurance is a comprehensive life insurance program designed to provide financial security and peace of mind to eligible participants. This insurance plan is specifically tailored for employees and retirees of participating institutions, offering a range of coverage options to suit individual needs. The eligibility criteria for TIAALife Insurance are straightforward, ensuring that those who have contributed to the success of their respective organizations can access this valuable benefit.

To be eligible for TIAALife Insurance, individuals must be employed by or retired from a participating institution. These institutions include various companies, universities, and other organizations that have partnered with TIAAA to offer this insurance program. The primary focus is on providing coverage to those who have dedicated their careers to these institutions, ensuring their financial well-being during their working years and beyond.

Employees and retirees of these participating institutions can enroll in TIAALife Insurance, which offers a range of coverage options. These options typically include term life insurance, which provides coverage for a specified period, and permanent life insurance, offering lifelong coverage. The plan is designed to be flexible, allowing participants to choose the level of coverage that aligns with their financial goals and needs.

The eligibility process is relatively simple. Participants need to complete the necessary enrollment forms, providing details about their employment status, retirement plans, and any other relevant information. Once approved, they can select their preferred coverage type and amount, ensuring they receive the level of protection they desire. It is essential to review the eligibility criteria and application process with the TIAAA representatives to ensure a smooth and efficient enrollment experience.

In summary, TIAALife Insurance is an exclusive benefit for eligible employees and retirees, offering a comprehensive approach to life insurance. By meeting the participation criteria, individuals can secure their financial future and gain the confidence that comes with knowing they are protected. This insurance program is a valuable addition to the benefits package offered by participating institutions, demonstrating a commitment to the well-being of their workforce.

Whole Life Insurance: Cash Value Accumulation Explained

You may want to see also

Premiums: Competitive rates based on age, health, and coverage amount

TIAALife Insurance offers a range of life insurance products designed to provide financial security and peace of mind to individuals and their families. When it comes to determining the cost of these policies, several factors come into play, and understanding these can help you make informed decisions.

The premium structure of TIAALife Insurance is competitive and tailored to individual circumstances. The primary factors influencing the premium rates are age, health, and the coverage amount you choose. Age is a significant determinant as younger individuals generally pay lower premiums due to their longer life expectancy. As you age, the risk of claiming on the policy increases, and thus, the premiums tend to rise. For instance, a 30-year-old might pay less for a similar policy compared to a 60-year-old.

Health also plays a crucial role in premium calculations. Insurers assess the overall health and medical history of the applicant. A person with a healthy lifestyle, no chronic diseases, and a clean bill of health from recent medical examinations is likely to be offered more competitive rates. Conversely, individuals with pre-existing conditions or those who smoke, drink heavily, or engage in extreme sports may face higher premiums as they pose a greater risk to the insurance company.

The coverage amount you select directly impacts the premium. Higher coverage amounts mean a larger financial benefit in the event of a claim, and thus, the premiums are adjusted accordingly. For instance, a policy with a $500,000 coverage amount might have a different premium structure compared to a $100,000 policy. The insurance company calculates the premium based on the likelihood of a claim and the potential payout, ensuring that the rates are fair and sustainable.

In summary, TIAALife Insurance's premium structure is designed to be competitive and fair, taking into account individual factors such as age, health, and the desired coverage amount. Understanding these factors can help you choose the right policy and ensure that you receive the best value for your insurance needs. It is always advisable to compare quotes from multiple providers to make an informed decision.

Life Insurance for College Students: Is It Necessary?

You may want to see also

Customer Service: Dedicated support for policyholders and beneficiaries

Tiaa Life Insurance offers a comprehensive customer service experience, ensuring that policyholders and beneficiaries receive dedicated support throughout their journey with the company. This commitment to customer satisfaction is a cornerstone of Tiaa's reputation as a trusted provider of life insurance solutions.

For policyholders, Tiaa provides a dedicated team of customer service representatives who are readily available to address inquiries and concerns. Whether it's understanding the terms of their policy, making changes to their coverage, or seeking guidance on their benefits, policyholders can reach out via multiple channels, including phone, email, and online chat. The company's representatives are trained to offer personalized assistance, ensuring that each policyholder's unique needs are met with efficiency and care.

In addition to direct support, Tiaa offers a wealth of resources to empower policyholders. Their website features an extensive knowledge base with articles, FAQs, and educational materials covering various aspects of life insurance. This self-service option allows policyholders to find answers to common questions and learn more about their policies at their convenience. Furthermore, Tiaa provides access to online tools that enable policyholders to manage their accounts, update personal information, and review their policy details independently.

Beneficiaries of Tiaa Life Insurance policies also receive dedicated support. When a policyholder passes away, the company's claims department takes on the responsibility of guiding beneficiaries through the claims process. This includes providing clear and timely communication regarding the necessary steps, documentation, and benefits they are entitled to. Tiaa's claims team is committed to ensuring a smooth and efficient experience during a challenging time, offering compassion and expertise to help beneficiaries navigate the process with confidence.

Tiaa's customer service philosophy extends beyond traditional support channels. They actively seek feedback from policyholders and beneficiaries to continuously improve their services. Regular surveys and feedback forms allow customers to share their experiences, suggestions, and concerns, which are then analyzed to implement necessary changes. By fostering an environment of open communication, Tiaa ensures that its customer service remains responsive and aligned with the needs of its clients.

Life Insurance Guaranty: Protecting Your Policyholder's Interests

You may want to see also

Frequently asked questions

TIAA Life Insurance is a comprehensive insurance policy offered by Teachers Insurance and Annuity Association (TIAA), a well-known financial services organization. It is designed to provide financial security and peace of mind to educators and their families. The policy offers various benefits, including term life insurance, permanent life insurance, and critical illness coverage.

TIAA Life Insurance is primarily available to current and retired educators who are members of the TIAA-CREF network. It is also accessible to their spouses and domestic partners. The eligibility criteria may vary based on factors such as age, health, and occupation.

This insurance policy offers several key features, including customizable coverage options, competitive rates, and the ability to convert term life insurance to permanent coverage. It also provides access to financial planning resources and educational benefits for eligible educators. Additionally, TIAA Life Insurance offers critical illness insurance, which can provide financial support during serious health conditions.