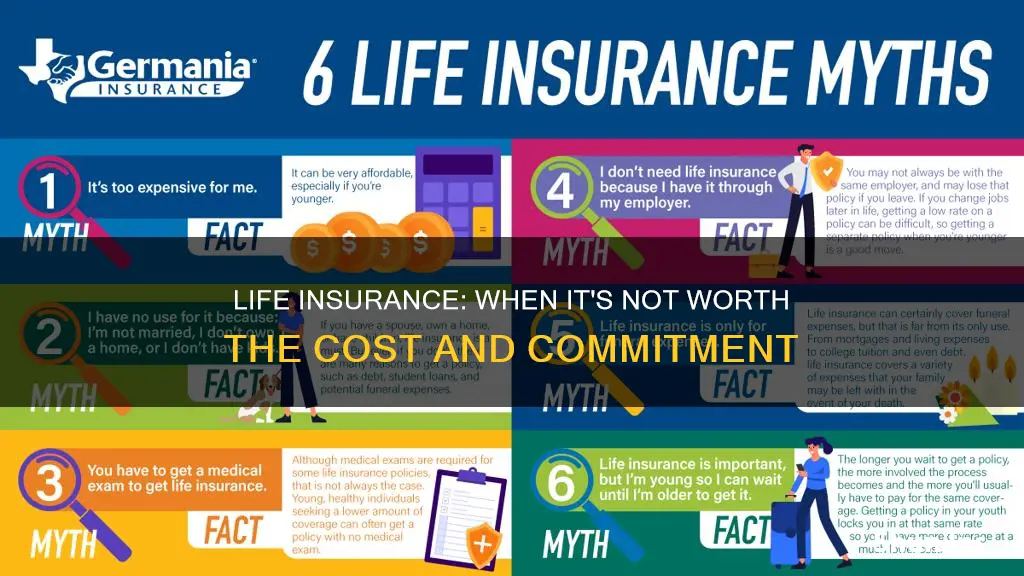

Life insurance is not worth it if you have no dependents or debt. It might also not be worth it if you're young, without debt, and have no dependents. However, if you have loved ones who rely on you financially, life insurance is worth it.

| Characteristics | Values |

|---|---|

| No dependents | Life insurance might not be worth it if you have no dependents. |

| No debt | Life insurance might not be worth it if you have no debt. |

| Savings | Life insurance might not be worth it if you have enough savings to cover your family's expenses. |

| Age | Life insurance might not be worth it if you are too young or too old. |

| Cost | Life insurance might not be worth it if the policy is too expensive. |

What You'll Learn

If you have no dependents or debt

If you don't have any dependents or significant debts, such as a mortgage or credit card bills, then there may be no need for life insurance. In this case, your loved ones would not require financial support, and the benefits of a life insurance policy would not be necessary.

However, it's important to consider potential future needs. For example, if you anticipate having dependents in the future, purchasing a policy earlier can lock in a lower premium. Additionally, life insurance can be used for estate planning or leaving a charitable gift.

- Directing your money into savings accounts, such as an RRSP or TFSA.

- Contributing to an RESP or children's insurance for a grandchild.

- Ensuring your will and estate planning are up to date.

Life Insurance: 10-Year Term Policy Explained

You may want to see also

If you're young and healthy

The Benefits of Life Insurance for Young and Healthy Individuals

Life insurance can provide peace of mind and financial protection for your loved ones if something happens to you. It ensures that your family will be taken care of financially and can help cover expenses like mortgage payments, funeral costs, and daily living expenses. If you have children, life insurance can also help secure their future by providing funds for their education and other long-term needs.

Another benefit of life insurance is that it can be used as a tool for estate planning. The death benefit from a life insurance policy can provide a tax-free, guaranteed payout to your beneficiaries, ensuring that your family doesn't have to cover your final expenses with their inheritance.

The Drawbacks of Life Insurance for Young and Healthy Individuals

One of the main drawbacks of life insurance is the cost. Life insurance premiums can be expensive, especially for permanent life policies, and it's essential to weigh this cost against your budget and financial goals. If you're young and healthy, you may not feel the need to purchase life insurance yet, especially if you don't have any financial or family commitments.

Additionally, life insurance policies can be complex, and understanding the different types and terms can be confusing. It's crucial to carefully consider your financial situation and goals before deciding if life insurance is worth it for you.

Alternatives to Life Insurance

- Directing your money into savings accounts, such as an RRSP or TFSA.

- Contributing to an RESP or children's insurance for a grandchild.

- Ensuring your will and estate planning are up to date.

Recommendations for Young and Healthy Individuals

In summary, while life insurance can provide valuable financial protection, it's important to carefully consider your personal circumstances and financial goals before deciding if it's worth it for you as a young and healthy individual.

Globe Life Insurance Rates: Rising or Stable?

You may want to see also

If you have ample savings to cover end-of-life costs

That being said, it's important to consider your overall financial situation and goals when deciding if life insurance is worth it. Life insurance can also be used for estate planning purposes, providing a tax-free inheritance to your beneficiaries. Additionally, permanent life insurance policies can accumulate cash value over time, offering a financial asset that grows tax-deferred. This can be advantageous if you're looking for both insurance and investment benefits.

It's also worth noting that life insurance premiums tend to increase with age, so if you're considering purchasing life insurance, it may be more cost-effective to do so while you're younger. Ultimately, the decision to buy life insurance depends on your individual circumstances, budget, and financial goals.

Metropolitan Life Insurance: What's the Deal with NYSRLS?

You may want to see also

If you have no financial dependents

Life insurance is primarily designed to provide financial protection for your loved ones in the event of your death. If you don't have any financial dependents, such as a spouse, children, or aging parents who rely on your income, then the need for life insurance is less pressing. In this case, you might want to consider other options for protecting your finances and planning for the future.

That being said, there are still some circumstances where life insurance could be beneficial even if you don't have financial dependents. For example, if you have debts that you don't want to pass on to your family or if you want to cover your final expenses, such as funeral costs. Additionally, if you anticipate having dependents in the future, purchasing a policy earlier can lock in a lower premium. Life insurance can also be used for estate planning or leaving a charitable gift.

It's important to note that life insurance may not be a priority purchase at every age or price. If you're young and healthy, you might not need to worry about your loved ones covering loans or credit card bills if you pass away prematurely. Similarly, if the policy is too expensive and you can't afford the premiums, it might not be worth purchasing.

In summary, while life insurance is often associated with providing financial protection for dependents, there are other factors to consider when deciding if it's worth it. It's important to evaluate your personal and financial situation, future plans, and the potential needs of your loved ones to make an informed decision.

Life Insurance: Estate or Beneficiary?

You may want to see also

If you can't afford the premiums

It's crucial to weigh the benefits of life insurance against your financial situation. If you have dependents or significant debts, life insurance can provide peace of mind and ensure your loved ones' financial security. However, if you don't have financial dependents and have sufficient assets to cover your final expenses, life insurance may not be necessary.

Additionally, there are alternative ways to support your family financially. You can focus on living a debt-free lifestyle, maximising your savings, and investing in other financial instruments such as stocks, bonds, or retirement accounts. These options provide flexibility and control over your funds, allowing you to build your financial security without the commitment of life insurance premiums.

In conclusion, when considering life insurance, carefully assess your financial situation, budget, and goals. If the premiums are not affordable in the long term, it may be wiser to explore alternative options to protect your loved ones' financial future.

Life Insurance: Benefits to Reap While Alive

You may want to see also

Frequently asked questions

Life insurance is generally not worth it if you have no dependents or significant assets. However, if you anticipate having dependents in the future, securing a policy early can lock in a lower premium.

Life insurance is not a priority purchase at every age. If you're young, healthy, and have no debt or dependents, you don't need to worry about your loved ones covering loans or credit card bills if you pass away prematurely.

No, life insurance is not worth it if you can't afford the premiums. You need to maintain premium payments to keep your coverage, and if you lapse in payments, you will lose coverage.