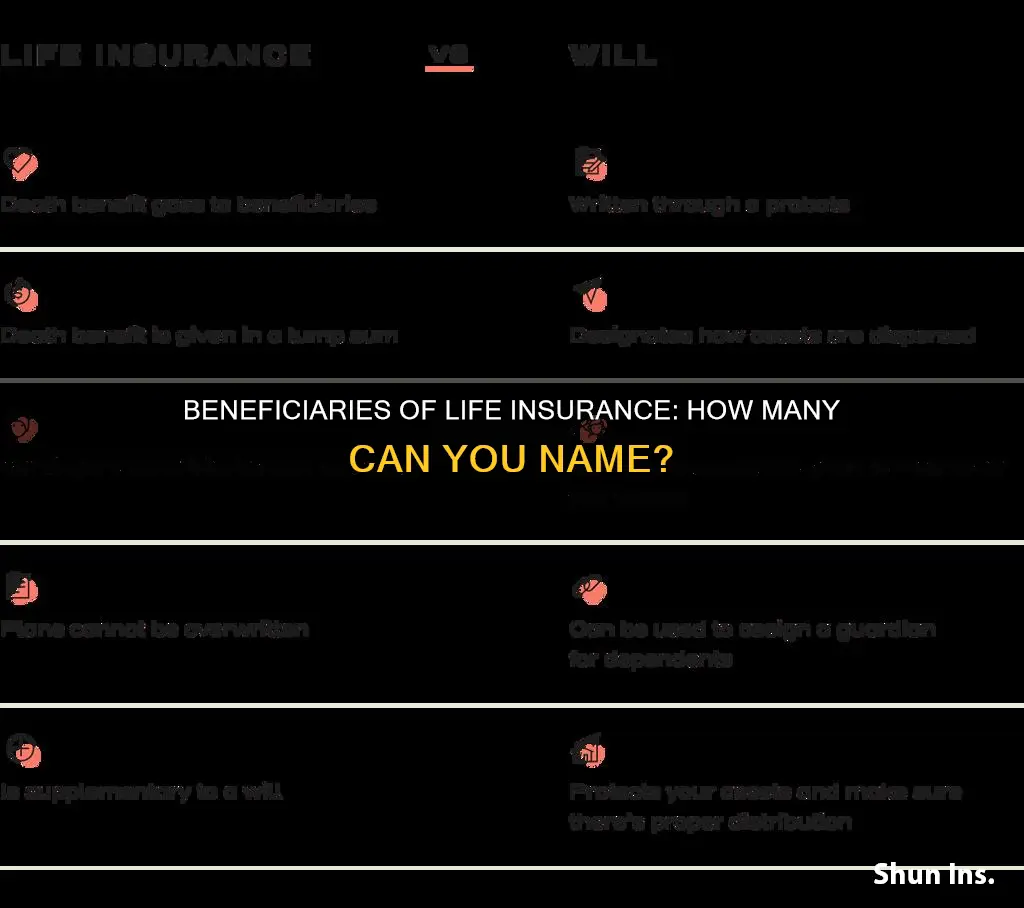

When taking out a life insurance policy, the policyholder must name one or more beneficiaries who will receive the death benefit if the insured passes away while covered by the policy. While you're only required to name one beneficiary, you can usually have as many as you want, but it's important to check your policy documents for any exceptions.

If you name more than one beneficiary, you'll need to decide how you want the money to be split between them. This is usually done by percentage. For example, you could have a 50/50 split or a 60/40 split.

There are two main types of life insurance beneficiaries: primary and contingent. The primary beneficiary is the first in line to receive the death benefit. A contingent beneficiary may receive the death benefit in place of the primary beneficiary if specific, predetermined provisions are satisfied. In most cases, this would be if the primary beneficiary is deceased or unreachable.

| Characteristics | Values |

|---|---|

| Number of beneficiaries | There is no set number of beneficiaries for a life insurance policy. You can have one or multiple beneficiaries. |

| Type of beneficiary | There are two main types of beneficiaries: primary and contingent. |

| Primary beneficiary | The primary beneficiary is the first in line to receive the death benefit. You can have multiple primary beneficiaries. |

| Contingent beneficiary | The contingent beneficiary will receive the death benefit if the primary beneficiary is deceased or unreachable. You can have multiple contingent beneficiaries. |

| Tertiary beneficiary | The tertiary beneficiary will receive the death benefit if both the primary and secondary beneficiaries are unable to do so. |

| Beneficiary designation | You can choose how you want the money to be split between beneficiaries, usually by percentage. The percentages must add up to 100%. |

| Beneficiary information | When naming a beneficiary, you must be specific. Most beneficiary designations require the person's full legal name and their relationship to you. |

What You'll Learn

Primary, secondary and tertiary beneficiaries

When buying a life insurance policy, you must designate at least one beneficiary—the person or entity who will receive the death benefit or payout from your policy when you pass away. However, you can name more than one beneficiary and specify how you want the proceeds to be split between them.

Primary Beneficiaries

The primary beneficiary is the person or entity that is chosen to receive the death benefit first, receiving the proceeds of your life insurance policy when you die. You can name more than one primary beneficiary and decide what portion of your death benefit will be paid to each. It is recommended that you always name a primary beneficiary.

Secondary Beneficiaries

The secondary beneficiary (also known as the contingent beneficiary) is the next in line to receive the proceeds of your policy should the primary beneficiary be unable to do so. Naming a secondary beneficiary is a good idea in case you and your primary beneficiary die at the same time, or if they are otherwise unable to accept the benefit.

Tertiary Beneficiaries

The tertiary beneficiary is the next in line to receive the death benefit if both the primary and secondary beneficiaries are unable to do so. While it is not required to name a tertiary beneficiary, it is always a good idea to have at least a secondary beneficiary in case your primary beneficiary dies before you.

Waepa Life Insurance: Afghanistan Coverage Explained

You may want to see also

Naming multiple beneficiaries

There are two aspects of beneficiary designation:

- You can list a primary beneficiary who will receive 100% of the proceeds. You can also name a secondary (or contingent) beneficiary to receive 100% of the proceeds in case your primary beneficiary cannot accept the benefits for any reason.

- You can elect to have multiple beneficiaries split the proceeds. The percentages received don't have to be the same, but you need to ensure 100% of the benefits are accounted for.

You can also deploy a mix of these strategies. For example, you can name one primary beneficiary who will receive the majority of the benefit, and then have multiple beneficiaries split the remainder.

It is critical that you designate beneficiaries correctly to ensure they receive benefits.

Child Life Insurance: What Parents Need to Know

You may want to see also

Revocable and irrevocable beneficiaries

When setting up a life insurance policy, you can decide who will receive the payout, also known as the death benefit, in the event of your death. You can choose to have one or multiple beneficiaries, and they can be family members, charitable organisations, or legal entities.

There are two types of beneficiaries: revocable and irrevocable. A revocable beneficiary can be removed or have their portion of the death benefit changed without being notified. The policy owner has full control and can make changes at any time without the consent of the revocable beneficiary.

On the other hand, an irrevocable beneficiary cannot be removed or have their portion of the death benefit altered without their consent. Irrevocable beneficiaries are often used in cases where financial security must be guaranteed, such as in loan agreements or divorce settlements, ensuring the beneficiary's rights are protected.

Revocable Beneficiaries

- Revocable beneficiaries are the default option when setting up a life insurance policy.

- The policy owner has full control and can make changes at any time without the consent of the revocable beneficiary.

- Revocable beneficiaries can be added, removed, or have their portion of the death benefit changed at the policy owner's discretion.

- Revocable beneficiaries do not need to be notified if the policy is cancelled.

Irrevocable Beneficiaries

- Irrevocable beneficiaries have guaranteed rights to the death benefit and cannot be changed without their consent.

- Irrevocable beneficiaries are often used in situations where financial support must be guaranteed, such as in divorce settlements or loan agreements.

- Once an irrevocable beneficiary is named, the policy owner typically needs their approval to make certain changes, such as taking out a policy loan or changing the contingent beneficiary.

- Removing an irrevocable beneficiary usually requires their consent, and they must sign off on any changes to forfeit their rights to the proceeds.

It is important to carefully consider the type of beneficiary when setting up a life insurance policy. While revocable beneficiaries offer flexibility, irrevocable beneficiaries provide added security and peace of mind, ensuring that the beneficiary's future is protected.

How to Apply for Life Insurance for Your Mother

You may want to see also

Naming minors as beneficiaries

When applying for life insurance, you will be asked to name a beneficiary for your policy. This is an important step in the buying process because providing their contact information is key to ensuring that a life insurance payout is received promptly. While choosing and naming a beneficiary is usually straightforward, it is important to ensure it is done correctly.

Minors can be named as primary or contingent beneficiaries. However, if the policyholder dies while they are still minors, the proceeds may be sent in their name to the legal guardian of the minor child's estate. The probate court will appoint a guardian for the child if the policyholder has not done so in their will. This is not an ideal scenario because there are fees associated with the court overseeing the distribution of inherited assets. The process and its associated costs could prevent the money from being utilized in the ways the policyholder envisioned.

To overcome this, the policyholder must assign a custodian for the children. A custodian serves as the guardian of the money and assets intended for the minor child, making way for valid transfers under the Uniform Transfers to Minors Act. A properly designated custodian may make decisions concerning those assets as long as the choices are in the best interests of the minor child. Once the child becomes a legal adult, the assets are turned over to them, and the custodian no longer has a role.

Another way to avoid the potential challenges of naming a child as a beneficiary is to name a trust instead. A revocable trust, also known as a living trust, is a popular estate planning tool that can be used to indicate who will receive the policyholder's assets when they die. Assets held within a trust are commonly things like money, a house, life insurance, and retirement plans. A trustee manages the trust and ensures the correct individuals receive their benefits in the event of the policyholder's death.

Usaa's Mortgage Life Insurance: What You Need to Know

You may want to see also

Naming charities as beneficiaries

Identifying the Right Charities

First, identify the causes you want to support. There are numerous charities doing wonderful work, and many of them have similar names or regional chapters. Take the time to zero in on the specific organisations you want to support and determine whether you want your donation to have a broader impact or a more local one. Ensure you obtain the organisation's full legal name and their tax identification number. You can usually find this information on their website or by checking aggregator sites like Charity Navigator.

Understanding the Benefits

Contacting the Charities

It is important to reach out to the chosen charities to confirm their eligibility and ability to receive donations. Charities with a 501(c)(3) status are qualified to receive such contributions. Discussing your intentions with the charities can help ensure that your donation is used in alignment with your wishes and prevent potential complications.

Updating Legal Documents

To name a charity as a beneficiary, you will need to modify key legal documents, such as your will or trust. Enlisting the assistance of a legal or financial advisor can simplify this process and ensure your wishes are correctly executed. They can guide you through the tax implications and help you optimise the potential benefits of your donation.

Using Life Insurance

Life insurance can be a valuable tool when naming charities as beneficiaries. It provides significant tax benefits, as the proceeds from a life insurance policy donated to a charity do not become part of the taxable estate. Additionally, donors may receive a tax deduction for the value of the policy when the charity is named as both the owner and beneficiary. Life insurance gifts can also result in a larger donation amount, providing charities with more resources to create an impact.

In conclusion, naming charities as beneficiaries of your life insurance policy can be a powerful way to support causes close to your heart and leave a positive, lasting legacy. It is essential to carefully plan, seek professional advice, and execute your intentions meticulously.

Elvis Presley's Life Insurance: Paid or Unpaid?

You may want to see also

Frequently asked questions

No, but it is highly recommended. If you don't, the payout from your policy will automatically become part of your "estate" and will have to go through probate, a legal process that costs money and slows down how quickly the money gets to loved ones.

You can have as many beneficiaries as you like. You can also specify how you want the proceeds split, by establishing various percentages.

The primary beneficiary is the person or entity that's entitled to your death benefit. You may choose to name multiple primary beneficiaries — you'll just need to decide what portion of your death benefit will be paid to each primary beneficiary.

A contingent beneficiary, or secondary beneficiary, would be the next in line to receive the proceeds of your policy should the primary beneficiary be unable to do so.

The application you fill out to apply for a life insurance policy will have a section where you are asked to write the name of your beneficiary or beneficiaries.