Child life insurance is a type of insurance policy that covers the life of a minor child and is typically purchased by a parent, guardian, or grandparent. It can be structured as a term-based policy, which lasts until the child reaches adulthood, or as a permanent policy, which provides coverage for the child's entire life. The policyholder is usually the parent or grandparent, who is also often the beneficiary. Child life insurance policies are generally whole life insurance policies, which means they build cash value over time and can be accessed by the child for various purposes, such as college tuition or a down payment on a home. While the likelihood of a child's death is low, child life insurance can provide peace of mind and financial support in the event of a tragedy.

| Characteristics | Values |

|---|---|

| Type | Term or whole life insurance |

| Insured | Minor |

| Policyholder | Parent, grandparent or guardian |

| Beneficiary | Parent, grandparent or guardian |

| Coverage | Up to $500,000, but typically under $50,000 |

| Cost | Depends on age, health, policy type and other factors |

| Cash value | Grows over time, can be accessed while the child is alive |

| Transfer of ownership | Between 18-25 years old |

What You'll Learn

- Child life insurance is a permanent life insurance policy that provides a fixed death benefit to the beneficiary if the insured child dies while covered

- Child life insurance can be purchased as a standalone whole life policy for the child or as a rider to a parent or guardian's life insurance policy

- Child life insurance is usually purchased by a parent or guardian as a safety net in case their child passes away

- Child life insurance policies typically include or offer a guaranteed purchase option

- Child life insurance policies tend to be whole life products — a type of permanent life insurance

Child life insurance is a permanent life insurance policy that provides a fixed death benefit to the beneficiary if the insured child dies while covered

Child life insurance is usually offered in the form of term or whole life insurance. Term life insurance provides coverage for a set period, often until the child becomes an adult, while whole life insurance offers lifelong coverage. Whole life insurance is more expensive but provides more features, such as cash value accumulation and the ability for the child to maintain coverage as an adult.

The death benefit provided by child life insurance policies is typically low, usually $50,000 or less. However, some insurers offer coverage up to $500,000. The policyholder is generally a parent or grandparent, and the beneficiary is often a parent or guardian. The insured child becomes the policy owner once they reach adulthood and can continue the coverage, buy more, or cancel the policy.

One of the benefits of child life insurance is that it guarantees future insurability. The child can buy additional coverage without a medical exam, which is useful if they develop health issues or choose a risky career later in life. Additionally, the premiums for child life insurance are locked in at a low rate due to the child's young age, and these rates will remain fixed for the duration of the policy.

Another advantage of child life insurance is its potential as a savings vehicle for the child. The cash value component of the policy grows over time, tax-deferred, and can be accessed by the child in adulthood for various purposes, such as a down payment on a home or college tuition. However, it's important to note that the rate of return on these policies tends to be low compared to other investment options.

While child life insurance offers some benefits, there are also drawbacks to consider. The likelihood of a child's death is relatively low, so the risk of going without coverage may not outweigh the cost of the policy. Additionally, the coverage amounts are typically low and may not meet the child's future needs. Before purchasing child life insurance, it's essential to assess your budget, consider other investment options, and ensure that your own life insurance needs are adequately met.

Sleep Apnea: Impact on Life Insurance Policies

You may want to see also

Child life insurance can be purchased as a standalone whole life policy for the child or as a rider to a parent or guardian's life insurance policy

Child life insurance is typically purchased by a parent or guardian as a safety net in the case of their child's passing. It can be bought as a standalone whole life policy for the child or as an add-on (rider) to a parent's or guardian's term or permanent life insurance policy.

A standalone whole life policy for a child provides coverage for the child's entire life as long as the premiums are paid. The policy is owned by the purchasing adult until the child reaches the age of majority, as defined by state law, after which ownership can be transferred to the child. The policyholder can also be the beneficiary who receives a payout if the insured child dies. The beneficiary can use the death benefit to cover funeral expenses or take time off work.

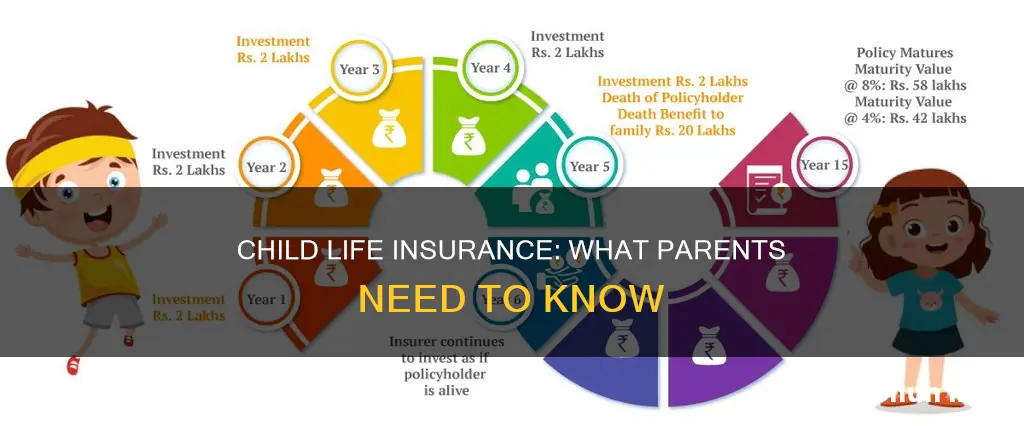

Whole life insurance for children has a low premium rate, which is locked in at the child's current age, and it accumulates cash value over time. This cash value can be used to pay for things like a down payment on a home, college tuition, or starting a business. However, the rate of return on whole life insurance plans for children is typically low.

On the other hand, a child rider is an extension of the parent's or guardian's life insurance policy, providing a small death benefit if the child dies. It is often more affordable than a standalone policy and can be converted into a separate policy for the child when they become an adult.

Whether to buy child life insurance depends on individual circumstances. Some reasons to consider it include:

- Guaranteeing the child's future insurability, especially if they have a serious medical condition or a family history of genetic medical conditions.

- Locking in lower premium rates.

- Using the policy as a savings vehicle for the child's future.

Life Insurance and Suicide: What Coverage Includes

You may want to see also

Child life insurance is usually purchased by a parent or guardian as a safety net in case their child passes away

Child life insurance covers the life of a minor and is typically purchased by a parent, guardian, or grandparent. These policies are often whole life products, which means coverage lasts for the child's entire life as long as the premiums are paid. Whole life insurance policies also build cash value over time, which can be used for various purposes, such as paying for college or a down payment on a home.

The coverage amounts for child life insurance tend to be low, usually under $50,000, and the premiums are locked in and won't increase. The average annual premium for a $25,000 policy on a newborn is around $166. Child life insurance can be purchased as a standalone whole life policy or as a rider to a parent or guardian's life insurance policy.

When deciding whether to purchase child life insurance, it's important to consider the pros and cons. One of the main advantages is that it guarantees future insurability, even if the child develops a chronic health condition or chooses a risky career. Additionally, the cash value of the policy can act as a savings vehicle for the child, which can be used for expenses like school fees or a down payment on a home.

However, there are also some disadvantages to consider. The chances of a child dying are relatively low, so the risk of going without coverage may not outweigh the cost of the policy. Additionally, there may be alternative ways to save for your child's future, such as investment options or 529 college savings plans, which could provide higher returns.

Ultimately, the decision to purchase child life insurance depends on individual circumstances and financial priorities. It's important to assess your budget and consider your own life insurance needs before buying a policy for your child.

Voya's Index Universal Life Insurance: Features Locked In?

You may want to see also

Child life insurance policies typically include or offer a guaranteed purchase option

The guaranteed purchase option can be useful if the child develops a chronic health condition, such as diabetes, or chooses a risky career, like becoming a firefighter. People with health problems or hazardous jobs typically pay much more than the average cost of life insurance. However, it is important to note that the coverage is usually issued at a standard (non-preferred) rate class, so it is more expensive than coverage that can be purchased if the child is in good health at age 18.

In addition, healthy applicants in their 20s are likely to secure competitive rates, so if you think your child won't need to find life insurance with a pre-existing condition, a child life policy may not be necessary. The coverage amounts are also typically low and may not meet future life insurance needs.

Overall, the guaranteed purchase option in child life insurance policies can provide peace of mind and financial protection, but it is important to weigh the pros and cons before deciding if it is the right choice for your family.

Understanding Tax on Life Insurance Payouts After Death

You may want to see also

Child life insurance policies tend to be whole life products — a type of permanent life insurance

Child life insurance policies are typically purchased by a parent or guardian as a safety net in the case of their child's passing. They can be term-based, lasting until the child becomes an adult, or permanent. Permanent life insurance policies, also known as whole life insurance policies, are a type of life insurance that provides coverage for the entirety of the policyholder's life.

Whole life insurance policies for children have several benefits. Firstly, they offer lifelong coverage as long as the premiums are paid. This means that even if the child develops a health condition later in life or takes up a dangerous hobby, they will still be covered. Secondly, whole life insurance policies build cash value over time. A portion of the premium goes towards building this cash value, which can be accessed by the policyholder for any reason. This can be particularly beneficial for children who may need financial support for college tuition, a down payment on a home, or other essential needs.

Additionally, whole life insurance policies for children often have locked-in, lower rates due to the child's young age. This means that premiums will be lower than if the child were to wait to get their own policy as an adult. Whole life insurance policies for children can also provide peace of mind for parents, knowing that their child will have financial protection and security throughout their life.

However, there are also some potential drawbacks to consider. Whole life insurance policies for children tend to have low rates of return, and the coverage amounts are typically low and may not meet the child's needs in adulthood. Additionally, purchasing a whole life insurance policy for a child is a long-term financial commitment, and premiums will need to be paid for decades to maintain coverage.

QSuper: Life Insurance Coverage and Your Options

You may want to see also

Frequently asked questions

Child life insurance is a type of life insurance policy that covers the life of a minor, with the parent or guardian as the beneficiary. It can be purchased as a standalone whole life policy or as a rider to a parent or guardian's life insurance policy.

Child life insurance provides a death benefit that can help cover funeral costs or other expenses in the event of the child's death. It can also be used as a long-term savings mechanism, as the policy includes a cash value component that grows over time. Additionally, it guarantees future insurability, even if the child develops a health condition or chooses a risky career later in life.

Whole life insurance policies for children have a low rate of return compared to other investment options, such as a 529 college savings plan. There are also long-term expenses associated with child life insurance, as premiums must be paid for decades to maintain coverage.