Life insurance is a financial tool that provides a safety net for individuals and their families. One of the key benefits of life insurance is the option to receive money back after the policyholder's death. This feature, often referred to as return of premium or survivorship benefits, offers financial security and peace of mind. With this type of policy, the insurance company returns a portion of the premiums paid by the policyholder over the years, providing a financial cushion for the beneficiary. This feature is particularly attractive to those who want to ensure their loved ones are financially protected while also potentially receiving a return on their investment.

What You'll Learn

- Return of Premium: Life insurance pays back the premiums paid over the policy term

- Cash Value Growth: Policies accumulate cash value, which can be borrowed or withdrawn

- Death Benefit: The primary purpose: a lump sum upon the insured's passing

- Investment Opportunities: Some policies offer investment options for potential returns

- Tax Advantages: Proceeds may be tax-free, depending on the policy type and jurisdiction

Return of Premium: Life insurance pays back the premiums paid over the policy term

Return of Premium: A Unique Life Insurance Feature

In the world of life insurance, there are various types of policies designed to offer financial protection and peace of mind to individuals and their loved ones. One such unique feature is the "Return of Premium" option, which provides a significant advantage to policyholders. This type of life insurance policy is structured to pay back the premiums paid by the policyholder over the entire term of the insurance. It is a distinctive aspect that sets it apart from traditional life insurance plans.

When considering life insurance, the primary goal is often to ensure financial security for one's family in the event of an untimely demise. However, the Return of Premium policy takes this a step further by offering a financial bonus. Over the policy term, typically 10, 15, or 20 years, the insurance company returns the total premiums paid by the policyholder. This feature is particularly attractive as it provides a sense of financial security and a guaranteed return on the investment. For instance, if a policyholder pays $100 per month for a 20-year term, they will receive a total of $24,000 back from the insurance company at the end of the term, assuming no claims were made.

This type of life insurance is especially beneficial for those who want to ensure their premiums are utilized efficiently. By offering a return of premiums, the insurance company encourages policyholders to view their investment as a long-term financial strategy rather than just a means of protection. It provides an incentive to stay with the policy for the entire term, ensuring the full benefit of the premiums paid. This is in contrast to traditional term life insurance, where premiums are typically paid upfront for the entire term, and no returns are offered.

The Return of Premium policy is a valuable option for individuals who prefer a more flexible and rewarding approach to life insurance. It allows policyholders to build a financial cushion while providing the essential coverage. This feature is particularly appealing to those who want to maximize their financial resources and ensure a positive return on their insurance investment. With this policy, individuals can have the peace of mind that their premiums are working for them, offering both protection and a financial bonus.

In summary, the Return of Premium life insurance policy is a unique and attractive feature in the insurance market. It provides a guaranteed return on the premiums paid, offering financial security and a sense of reward to policyholders. This type of policy is an excellent choice for those seeking a long-term financial strategy that combines protection and a positive return. By understanding and considering this option, individuals can make informed decisions about their life insurance needs and ensure a brighter financial future.

Life Insurance's 7702 Plans: What You Need to Know

You may want to see also

Cash Value Growth: Policies accumulate cash value, which can be borrowed or withdrawn

Life insurance with a cash value component offers a unique feature that can be a valuable financial tool: the ability to accumulate cash value over time. This cash value is essentially a savings component built into the policy, providing policyholders with several financial advantages. As the policyholder, you invest a portion of your premium payments into this cash value, which then grows over time, often through interest or investment returns. This growth can be a significant benefit, especially for those seeking long-term financial security and flexibility.

One of the key advantages of this feature is the potential for policyholders to access their cash value without sacrificing the insurance coverage. The cash value can be borrowed against, providing a source of funds that can be used for various purposes, such as starting a business, funding education, or covering unexpected expenses. This borrowing is typically interest-free, allowing policyholders to access funds without incurring additional debt. Additionally, if the policyholder decides to withdraw the cash value, they can take out the accumulated amount, providing financial flexibility and control.

The growth of cash value is often tied to the performance of the insurance company's investment portfolio. These investments can include a variety of assets, such as stocks, bonds, and real estate, which are carefully selected to maximize returns while maintaining the policy's stability. Over time, as the cash value grows, it can become a substantial asset, providing a financial safety net for the policyholder and their beneficiaries. This aspect is particularly beneficial for those who want to build a long-term savings strategy while also having a safety net in place for their loved ones.

It's important to note that the borrowing and withdrawal options come with certain risks and considerations. While borrowing against cash value can provide immediate financial relief, it may also reduce the overall death benefit available to beneficiaries. Withdrawals, if not managed carefully, could impact the policy's ability to accumulate sufficient cash value, potentially affecting the long-term financial security it provides. Therefore, policyholders should carefully evaluate their needs and consult with financial advisors to ensure they understand the implications of these features.

In summary, life insurance with cash value growth offers a unique combination of insurance protection and savings potential. The ability to accumulate cash value, borrow against it, and withdraw funds provides policyholders with financial flexibility and control. This feature can be a powerful tool for those seeking to build long-term wealth while also ensuring the financial security of their loved ones. Understanding the mechanics and implications of cash value growth is essential for making informed decisions about life insurance policies.

Max Life Insurance: Safe Investment Option?

You may want to see also

Death Benefit: The primary purpose: a lump sum upon the insured's passing

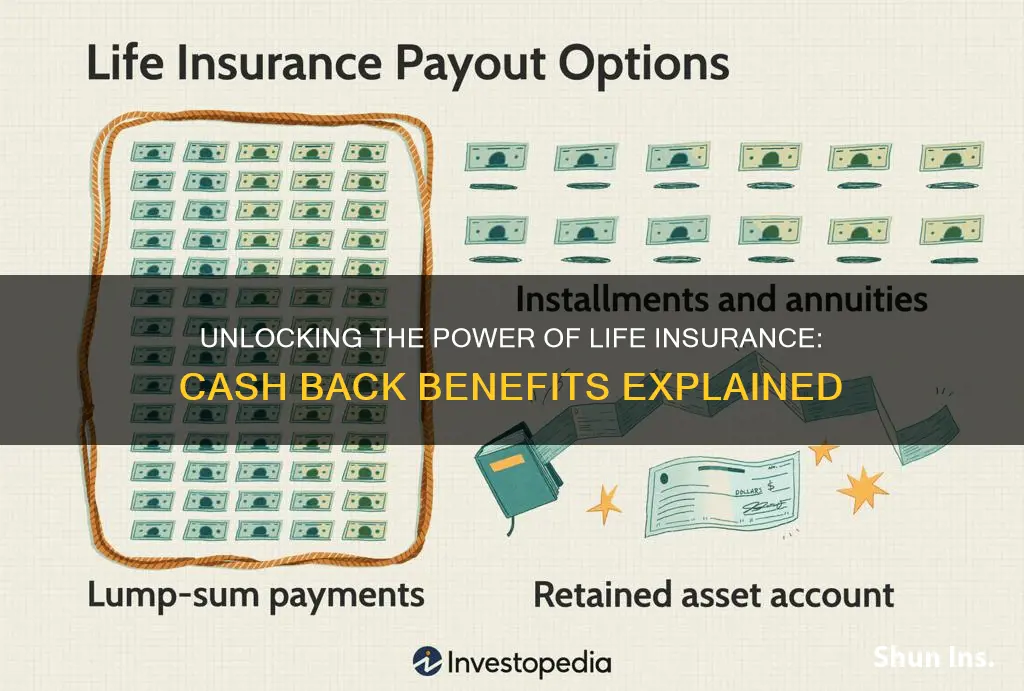

The death benefit is a crucial aspect of life insurance, especially when considering policies that offer a return of premium. This feature ensures that the insured's beneficiaries receive a financial payout in the event of their passing. The primary purpose of this benefit is to provide a lump sum amount to the designated recipients, offering financial security and peace of mind.

When an individual purchases a life insurance policy with a death benefit, they essentially agree to pay a certain amount of premium over a specified period. The insurance company, in turn, promises to pay out a predetermined sum to the policyholder's beneficiaries if the insured individual dies during the term of the policy. This payout is often referred to as the "death benefit." The amount can vary depending on the policy's terms and conditions, including the insured's age, health, and the chosen coverage amount.

Upon the insured's passing, the beneficiaries can claim the death benefit, which is typically paid out as a lump sum. This financial assistance can be a significant source of support for the family, covering various expenses such as funeral costs, outstanding debts, or even providing a financial cushion for the remaining family members. The lump sum nature of the payout ensures that the money is available immediately, allowing the beneficiaries to make quick decisions regarding its use.

One of the key advantages of a death benefit is its flexibility. Policyholders can choose how they want the death benefit to be paid out. It can be left as a lump sum, providing a one-time financial boost, or it can be structured as periodic payments, ensuring a steady income for the beneficiaries over an extended period. This flexibility allows individuals to tailor the policy to their specific needs and preferences.

Furthermore, the death benefit can also serve as a valuable tool for estate planning. By including life insurance with a death benefit in an estate plan, individuals can ensure that their assets are distributed according to their wishes. The lump sum payout can be used to pay off any outstanding debts, cover funeral expenses, and provide financial support to surviving family members, all while adhering to the insured's estate distribution plans.

California Life Insurance Test: Challenging or a Breeze?

You may want to see also

Investment Opportunities: Some policies offer investment options for potential returns

Life insurance with a return of premium feature is an attractive option for those seeking both financial protection and potential investment growth. This type of policy provides a unique combination of benefits, allowing individuals to secure their loved ones' financial future while also offering the possibility of generating additional wealth over time. One of the key advantages is the potential for investment opportunities within the policy itself.

Some life insurance companies offer investment-linked policies, which provide policyholders with the option to allocate a portion of their premium payments into various investment funds or portfolios. These investment options can range from stocks and bonds to mutual funds or even real estate investment trusts (REITs). By investing in these funds, the insurance company aims to generate returns that can be used to pay out the policy's death benefit when the insured individual passes away. This approach allows policyholders to potentially benefit from market growth and diversify their investments, all while having the insurance coverage they need.

When considering investment opportunities within life insurance, it's essential to understand the different investment options available. Policyholders can choose from a variety of investment strategies, each with its own level of risk and potential return. For instance, some policies may offer a conservative approach, investing primarily in government bonds and other low-risk assets, ensuring a steady but modest return. Others might provide a more aggressive strategy, allocating a larger portion of the premium to stocks and high-growth funds, which could result in higher potential gains but also come with increased risk.

The investment options within these policies often provide policyholders with regular updates on the performance of their investments. This transparency allows individuals to monitor the growth of their policy's value and make informed decisions about their insurance and investment strategy. Additionally, some policies may offer the flexibility to adjust investment allocations, enabling policyholders to rebalance their portfolio according to their risk tolerance and financial goals.

In summary, life insurance with a return of premium feature presents an opportunity to combine financial protection with potential investment growth. By offering investment options within the policy, individuals can secure their loved ones' financial future while also benefiting from market trends and diversifying their investments. It is crucial to carefully review the investment strategies and options provided by different insurance companies to make an informed decision that aligns with one's financial objectives and risk tolerance.

Creating Generational Wealth: Life Insurance as a Foundation

You may want to see also

Tax Advantages: Proceeds may be tax-free, depending on the policy type and jurisdiction

When it comes to life insurance, one of the key benefits that can often be overlooked is the potential for tax advantages. The tax implications of life insurance proceeds can vary significantly depending on the type of policy and the jurisdiction in which it is held. Understanding these nuances is essential for maximizing the financial benefits of your life insurance.

In many countries, life insurance policies offer tax advantages that can make the proceeds tax-free. For instance, in the United States, certain types of life insurance policies, such as term life insurance, are generally not subject to income tax when the proceeds are paid out upon the insured individual's death. This means that the beneficiary of the policy can receive the full amount without having to pay taxes on it. However, it's important to note that this tax-free status may not apply to all types of life insurance.

The specific tax treatment of life insurance proceeds is often tied to the policy's classification. For example, whole life insurance policies, which provide lifelong coverage and accumulate cash value over time, may offer different tax advantages compared to term life insurance. In some jurisdictions, the proceeds from whole life insurance may be subject to income tax, while in others, they might be exempt, especially if the policy has been held for a certain period.

Additionally, the jurisdiction in which the policy is issued plays a crucial role in determining tax-free status. Different countries have their own tax laws and regulations regarding life insurance. For instance, in some European countries, life insurance policies may be treated differently based on the tax treaty agreements between nations. Understanding these jurisdictional variations is vital for individuals and families who have international ties or are considering policies from different regions.

To ensure that you take full advantage of any tax benefits, it is advisable to consult with a financial advisor or tax specialist who can provide guidance tailored to your specific circumstances. They can help you navigate the complexities of different policy types and jurisdictions, ensuring that your life insurance strategy aligns with your financial goals and tax obligations. By doing so, you can make an informed decision and potentially maximize the tax-free benefits of your life insurance proceeds.

Does Life Insurance Blood Test for THC?

You may want to see also

Frequently asked questions

A whole life insurance policy with a return of premium (ROP) feature is a type of permanent life insurance that guarantees a return of the premiums paid by the policyholder over the term of the policy. This means that if you outlive the term or decide to surrender the policy, you will receive the accumulated cash value, which includes the premiums paid minus any fees and interest. This feature provides financial security and a guaranteed return on your investment.

Term life insurance with a money-back guarantee, often referred to as a return of premium term policy, offers a refund of the premiums paid if the policy is in force at the end of the term. This type of policy typically has a fixed term duration, such as 10, 15, or 20 years. If the insured individual is still alive at the end of the term, the insurance company returns the premiums paid, minus any fees, to the policyholder. It's a way to ensure that the policyholder gets their money back if they outlive the term or choose to end the policy early.

Yes, with a universal life insurance policy, you can typically surrender the policy and receive a refund of the cash value accumulated. The cash value is the investment component of the policy, which grows tax-deferred. When you surrender the policy, the insurance company will pay out the cash value, minus any outstanding loan balances and surrender charges (if applicable). This refund can be a significant benefit, especially if you've been paying premiums for a long time and the cash value has grown substantially.