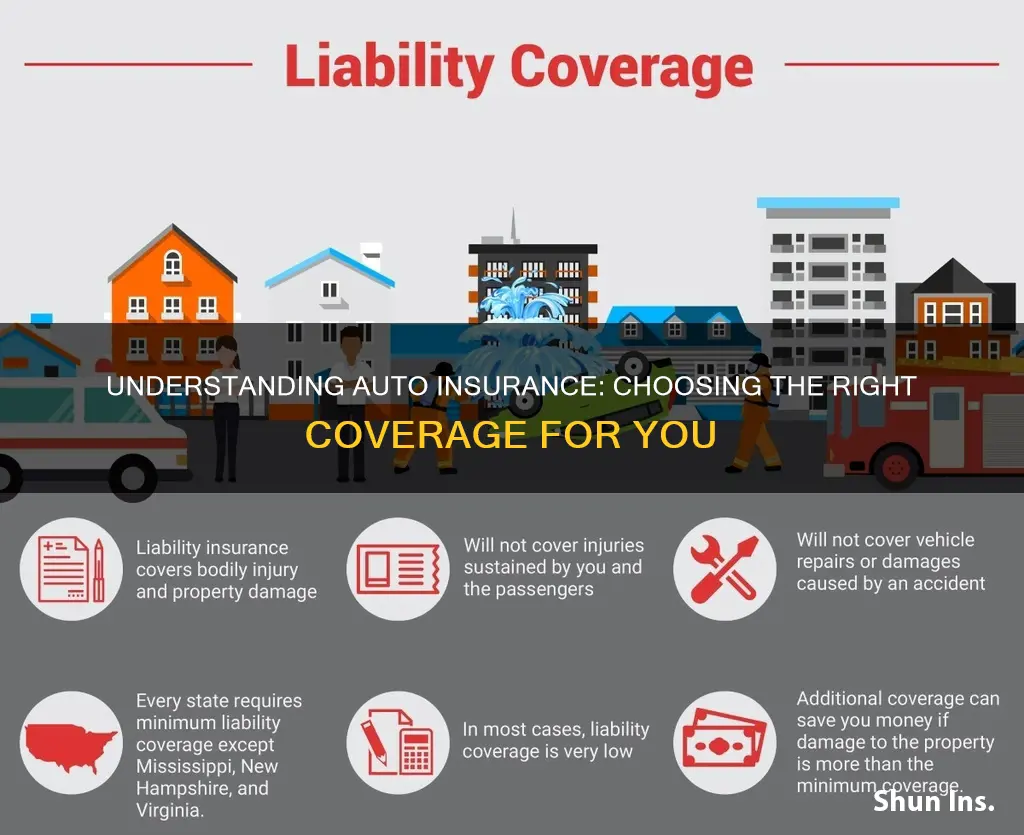

Auto insurance is a legal requirement for drivers in most places. It's important to understand what your policy covers and what it excludes so that you know what situations you may need to purchase additional coverage for. While different states mandate different types of insurance, most basic auto policies consist of bodily injury liability, personal injury protection, property damage liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Bodily injury liability covers costs associated with injuries and death that you or another driver causes while driving your car. Property damage liability will reimburse others for damage that you or another driver operating your car causes to another vehicle or other property, such as a fence, building, or utility pole. Medical payments or personal injury protection (PIP) provides reimbursement for medical expenses for injuries to you or your passengers. Uninsured motorist coverage reimburses you when an accident is caused by an uninsured motorist or in the case of a hit-and-run. Collision coverage reimburses you for damage to your car that occurs as a result of a collision with another vehicle or object when you are at fault. Comprehensive coverage provides protection against theft and damage caused by an incident other than a collision, such as fire, flood, or vandalism.

What You'll Learn

Understanding the basic types of auto insurance coverage

Auto insurance is a legal requirement for drivers in most places. It helps pay for the injuries and damage that can occur when you own and drive a car or other motor vehicle. The policy is a contract between you and your insurance company, and it is important that you understand it.

There are several types of auto insurance coverage, and while some are mandatory, others are optional. Here are the basic types of auto insurance coverage that you should know about:

Bodily Injury Liability

This covers costs associated with injuries and death caused by you or another driver while operating your car. It is required in almost every state and is essential for protecting yourself financially in the event of an accident.

Property Damage Liability

This coverage reimburses others for damage that you or another driver operating your car causes to another vehicle or other property, such as a fence, building, or utility pole. It is also required in most states.

Medical Payments or Personal Injury Protection (PIP)

This provides reimbursement for medical expenses for injuries to you or your passengers. It may also cover lost wages and other related expenses. PIP is required in some states, while medical payments coverage is mandatory in others.

Uninsured/Underinsured Motorist Coverage

This reimburses you when an accident is caused by an uninsured motorist or in the case of a hit-and-run. It can also cover costs when another driver doesn't have enough insurance to pay for the damages. This type of coverage is mandatory in some states but is generally recommended even if it's not required.

Collision Coverage

This optional coverage reimburses you for damage to your car that occurs as a result of a collision with another vehicle or object, such as a tree or guardrail. It also covers damage from potholes or if your car rolls over. Collision coverage is often required if your car is leased or financed.

Comprehensive Coverage

This provides protection against theft and damage caused by incidents other than collisions, such as fire, flood, vandalism, hail, falling objects, etc. Like collision coverage, it usually has a separate deductible. Comprehensive coverage is also typically required for leased or financed vehicles.

Glass Coverage

Windshield damage is common, and some auto policies include no-deductible glass coverage, which includes side windows, rear windows, and glass sunroofs. You can also purchase supplemental glass coverage separately.

Gap Insurance

If your car is leased or financed, it's important to remember that collision and comprehensive coverage only pay out the market value of your car, not what you paid for it. Gap insurance covers the difference between the market value of your car and what you still owe on it if it is totaled or stolen.

Emergency Roadside Assistance

While not required, roadside assistance can be a valuable addition to your policy. It provides assistance if you lock yourself out of your car, need a tow or jump start, get a flat tire, or run out of gas.

Rental Reimbursement Insurance

This optional coverage can help pay for a rental car or other transportation costs while your car is being repaired after an accident.

When choosing the correct auto insurance coverage, it's important to consider your specific needs and budget. You may also want to purchase higher levels of coverage than the state minimums to ensure you're adequately protected in the event of a serious accident.

Auto Insurance in Oklahoma: Why So Expensive?

You may want to see also

Knowing the minimum insurance requirements in your state

Bodily Injury Liability

This type of coverage is required in almost every state and protects you in the event that you or another driver operating your car cause injuries or death to someone else. The minimum coverage limits vary by state, with some states setting minimums as low as $15,000 per person and $30,000 per accident, while others require higher amounts. It is important to note that these minimums may not be sufficient to cover the costs of a serious accident, so consider purchasing higher levels of coverage if you can.

Property Damage Liability

Property Damage Liability coverage is also mandated by nearly every state. This coverage reimburses others for any damage that you or another driver operating your car cause to another vehicle or property, such as a fence, building, or utility pole. The minimum coverage limit for this type of liability is typically around $5,000, but it can vary depending on your state.

Medical Payments or Personal Injury Protection (PIP)

While not required in all states, many states mandate this type of coverage, which reimburses you and your passengers for medical expenses in the event of an accident. It may also cover lost wages and other related expenses.

Uninsured Motorist Coverage

Uninsured Motorist Coverage is frequently required by states and protects you in the event of an accident caused by an uninsured driver or a hit-and-run incident. You can also opt for Underinsured Motorist Coverage, which will cover costs when another driver doesn't have enough insurance to pay for the damages of a serious accident.

While the above-mentioned coverages are the most commonly required types of auto insurance, it is important to check with your state's Department of Motor Vehicles or a local insurance agent to confirm the specific minimum requirements for your state. Additionally, keep in mind that meeting the minimum requirements may not provide sufficient coverage for all situations, so it is always a good idea to consider purchasing additional coverage if your budget allows.

Auto Insurance: General's Cost Unveiled

You may want to see also

How to read and understand your auto insurance policy

Auto insurance policies can be confusing, as they are filled with legal jargon. However, it is a skill that all drivers should have to know what their policy covers and what its limits are. Here is a step-by-step guide to reading and understanding your auto insurance policy:

Start with the Declarations Page

This page is usually the first page of your policy documents and acts as a summary of your contract with your insurer. It includes:

- Coverages, limits of liability, premiums and deductibles

- Policy number

- Policy term

- Company and agency information

- Personal information, such as the name of the policy owner and the names of all the drivers listed on the policy

- Vehicle information, such as the year, make, model and vehicle identification number

- Endorsements, such as roadside assistance or accident forgiveness

- Discounts

- Financial institution information

Review the Insurance Agreement

This outlines exactly what you and your insurer have agreed to regarding coverage, including terms, conditions and exclusions.

Understand Key Terms in the Definitions Section

This section defines any key terms used in the policy. Refer back to this section often to clarify who and what is covered.

Be Aware of Exclusions

The exclusions list outlines any situations or circumstances not covered by your policy. It is important to understand what your policy does not cover to know when you may need to purchase additional coverage.

Understand the Different Types of Car Insurance

Car insurance is broken down into several categories, including bodily injury and property damage liability, medical and hospital expenses, personal injury protection, uninsured and underinsured motorist coverage, collision coverage, and comprehensive coverage. Some of these are mandatory, depending on your state, while others are optional but provide more robust coverage.

Review Your Policy Regularly

Review your coverage when the policy is up for renewal or after any major changes that could impact your car insurance, such as buying a new car or adding a new driver to your policy.

Understanding Auto Insurance: Letter of Experience Explained

You may want to see also

What is not covered by your auto insurance policy

Auto insurance policies vary, but there are some common exclusions that you should be aware of. Firstly, auto insurance typically does not cover mechanical failure or breakdown, rusting, wear and tear, freezing, explosion within the engine, and damage to tires unless these issues arise from an insured peril, such as a collision.

Secondly, your insurance company may deny coverage if you or anyone driving your vehicle with your consent is unable to maintain proper control due to driving under the influence of alcohol or drugs. Additionally, if you or the driver are convicted of certain criminal offences relating to the use, care, or control of the vehicle, your insurance company may also deny coverage. These offences include causing death or injury by criminal negligence, failure to stop at the scene of an accident, driving while impaired, and refusal to provide a breath sample to the police.

Thirdly, there is generally no coverage for anyone, including passengers, if someone drives your vehicle without your consent or if the driver is specifically excluded from your policy. Furthermore, if your vehicle is used to carry explosives, radioactive materials, or paying passengers, such as in a ridesharing service, your insurance policy may not cover you.

Finally, auto insurance policies usually do not cover commercial activities. If you use your vehicle for commercial purposes, such as delivering pizzas or driving for a transportation company, you will likely need a separate insurance policy or supplement to insure these activities.

The Future of Auto Insurance: Is 21st Century a Good Choice?

You may want to see also

How to save money on your auto insurance

Auto insurance is a necessity, but it can be expensive. Here are some ways to save money on your auto insurance:

Shop Around

First, it's important to shop around and compare rates from different insurance companies. Prices and coverage options vary, so getting multiple quotes can help you find the best deal. You can use online tools or work with an independent insurance agent to compare rates from different insurers.

Increase Your Deductible

You can also save money by increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible will lead to lower premiums, but make sure you can afford to pay the higher deductible if you need to file a claim.

Drop Unnecessary Coverage

If you have an older car, consider dropping collision and comprehensive coverage, which pays for damage to your vehicle. These coverages may not be cost-effective if your car is worth less than your annual premium plus the deductible. Evaluate whether the coverage is worth the cost, and consider setting aside the money you would have spent on premiums for repairs or a newer car.

Bundle Your Insurance Policies

You may be able to get a discount by bundling your auto insurance with other types of insurance, such as homeowners or renters insurance. Some insurers offer discounts for long-time customers as well, so it may be beneficial to stick with the same company.

Maintain a Good Credit History

In most states, insurance companies use your credit information when setting rates, and those with good credit tend to pay lower premiums. Establishing and maintaining a solid credit history can help you get better rates, but this practice is banned in California, Hawaii, Massachusetts, and Michigan.

Take Advantage of Discounts

Insurance companies offer a variety of discounts, so be sure to ask about what you may qualify for. Common discounts include those for low mileage, group insurance through your employer or alumni association, safe driving, and having a good student on your policy.

Choose a Cheaper Car to Insure

The type of car you drive also affects your insurance rates. Safe and moderately priced vehicles, such as small SUVs, tend to be cheaper to insure than expensive or flashy cars. When purchasing a new car, be sure to research the insurance costs for different models.

Improve Your Driving Record

A clean driving record can help you get lower insurance rates, so consider taking a defensive driving course to improve your skills and reduce your premiums. Speeding tickets and other violations can drive up your rates, so be sure to follow the rules of the road.

Consider Usage-Based Insurance

If you're comfortable with your driving behavior being tracked, usage-based or pay-per-mile insurance can help you save money. These programs typically offer a base rate plus a per-mile charge, so they can be a good option if you don't drive long distances or commute daily.

Switch Insurance Companies

Finally, don't be afraid to switch insurance companies to save money. Many people find that they can get a better deal by changing insurers, especially if their current company isn't offering any discounts. Review your coverage regularly and compare it with other options to ensure you're getting the best rate.

U.S.A.A. Home and Auto Insurance: Comprehensive Coverage for Members

You may want to see also

Frequently asked questions

Auto insurance is a type of financial protection that covers injuries and damage that can occur when you own and drive a motor vehicle.

The basic auto insurance policy mandated by most U.S. states provides financial protection if you or another driver using your car causes an accident that damages someone else's car or property, or injures someone.

There are several types of auto insurance coverage, including:

- Bodily Injury Liability

- Property Damage Liability

- Medical Payments or Personal Injury Protection (PIP)

- Uninsured Motorist Coverage

- Collision Coverage

- Comprehensive Coverage

- Glass Coverage

The amount of auto insurance you need depends on your state's requirements and your personal financial situation. In most states, you need at least $50,000 in bodily injury liability coverage and $25,000 in property damage liability coverage. It is recommended that you supplement your state's required auto insurance with enough extra coverage to match your net worth.