The terms life assured and life insured are often used in the context of insurance policies, particularly life insurance. While they may seem interchangeable, there is a subtle difference between the two. A life assured is the person whose life is covered by the insurance policy, meaning the insurance company is obligated to pay out a death benefit to the designated beneficiaries if the life assured passes away. On the other hand, a life insured is the individual who has taken out the insurance policy, making the payments to the insurance company to maintain coverage. In essence, the life insured is the policyholder, while the life assured is the individual whose life is protected by the policy.

What You'll Learn

- Legal vs. Financial: Life assured is a legal term, while life insured is a financial term

- Rights and Obligations: Assured has rights and obligations, insured has financial obligations

- Policy Ownership: Assured owns the policy, insured is the policyholder

- Beneficiary: Assured's beneficiary is legally recognized, insured's beneficiary is financially protected

- Tax Implications: Tax implications differ for assured and insured

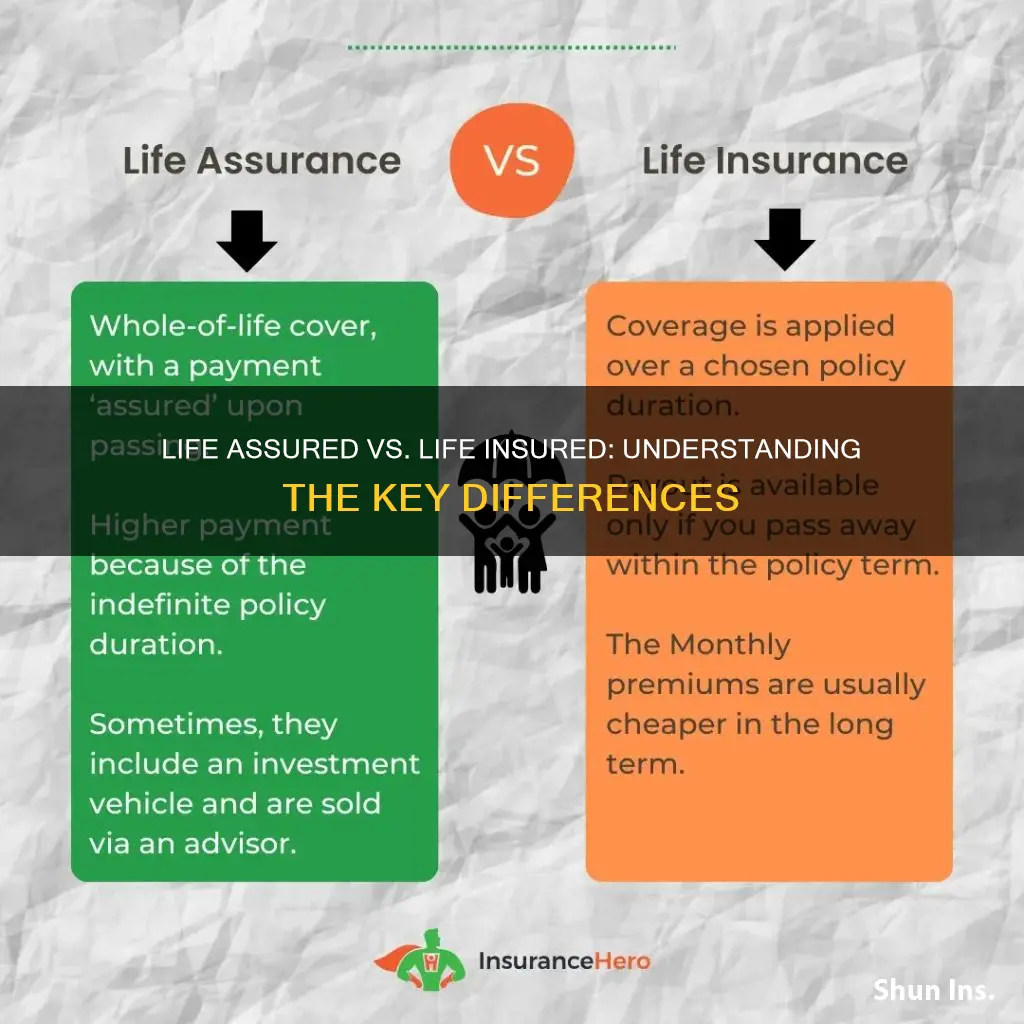

Legal vs. Financial: Life assured is a legal term, while life insured is a financial term

The terms "life assured" and "life insured" are often used in the context of insurance policies, but they represent different concepts and have distinct implications. Understanding the difference between these terms is crucial for individuals seeking insurance coverage and for those in the insurance industry.

Legal vs. Financial Context:

Life assured is a legal term primarily used in the context of insurance contracts and legal agreements. When an individual is referred to as a "life assured," it means they are the person whose life is covered by an insurance policy. In legal terms, the life assured is the beneficiary of the insurance contract, and the insurance company is obligated to provide financial benefits or compensation to the assured or their designated beneficiaries in the event of the assured's death or the occurrence of a specified event. This term is often used in the context of life insurance policies, where the insurance company promises to pay out a sum of money to the policyholder or their beneficiaries upon the death of the insured individual.

On the other hand, "life insured" is a financial term that refers to the individual whose life is covered by the insurance policy. The life insured is the person whose life is being protected and for whom the insurance coverage is in place. In a financial context, the insurance company takes on the risk of financial loss associated with the insured's death or the specified event. The insured individual pays premiums to the insurance company, and in return, the company provides financial protection to the insured and their beneficiaries.

Implications and Usage:

The distinction between these terms is essential because it clarifies the roles and responsibilities of both the individual and the insurance company. When someone is referred to as a life assured, it emphasizes the legal obligation and the contractual relationship between the insured and the insurance provider. This term is often used in the legal documentation and policies that outline the rights and benefits of the insured party. On the other hand, life insured highlights the financial aspect, where the insurance company's primary concern is managing the risk and providing financial security to the insured individual and their beneficiaries.

In summary, while both terms relate to insurance, "life assured" is a legal term focusing on the contractual obligations and rights of the insured party, whereas "life insured" is a financial term emphasizing the insurance company's role in providing financial protection and managing risks associated with the insured individual's life. Understanding these differences is vital for individuals to make informed decisions when purchasing insurance and for insurance professionals to communicate effectively with their clients.

Life Insurance for Kids: Worth the Cost?

You may want to see also

Rights and Obligations: Assured has rights and obligations, insured has financial obligations

The terms "life assured" and "life insured" are often used in the context of insurance, particularly in life insurance policies. Understanding the rights and obligations associated with each term is essential for policyholders and insurance providers alike.

When an individual is referred to as the "life assured," it signifies that they are the primary beneficiary of the insurance policy. The assured has certain rights and obligations that are integral to the policy's success. Firstly, the assured has the right to receive the death benefit or the proceeds of the policy in the event of their passing. This benefit is typically paid out to the beneficiaries named in the policy, providing financial security for their loved ones. Additionally, the assured has the right to make changes to the policy, such as adjusting the coverage amount or adding riders, as long as these changes are permitted by the insurance company.

On the other hand, the "life insured" is the individual whose life is being insured by the policy. The insured's obligations are primarily financial in nature. They are responsible for paying the premiums, which are the regular payments made to maintain the policy's validity. These premiums are essential to ensure that the insurance company can fulfill its obligations under the policy. The insured also has the obligation to provide accurate and complete information during the application process, including any relevant health or lifestyle details. This transparency is crucial for the insurance company to assess the risk and determine the appropriate premium rates.

In summary, the life assured has rights, such as receiving the death benefit and making policy changes, while the life insured has financial obligations, including paying premiums and providing accurate information. Understanding these roles and responsibilities is vital for both parties to ensure a smooth and beneficial insurance experience. It is always advisable to review the policy documents and seek clarification from the insurance provider to fully comprehend the rights and obligations associated with each term.

Term Life Insurance: Understanding Its Characterization

You may want to see also

Policy Ownership: Assured owns the policy, insured is the policyholder

The terms "life assured" and "life insured" are often used in the context of life insurance policies, and understanding the difference between them is crucial for anyone involved in the insurance process. When it comes to policy ownership, the assured and the insured have distinct roles and responsibilities.

In a life insurance policy, the "assured" is the individual whose life is being insured. This person is the primary focus of the policy, and their life is the subject of the insurance coverage. The assured is the one who benefits from the policy and receives the financial payout in the event of their death. For example, if a 30-year-old purchases a life insurance policy, they are the assured, and the policy benefits their beneficiaries upon their passing.

On the other hand, the "insured" is the person or entity that owns the policy and is responsible for paying the premiums. This individual or organization has the legal right to the policy's benefits and is typically the one who will receive the payout if the assured's life is insured under the policy. In the previous example, the insured could be the 30-year-old, who owns the policy and pays the premiums, or it could be an employer providing group life insurance to their employees.

The key difference here is that the assured is the one whose life is being protected, while the insured is the policyholder with the legal ownership and responsibility. This distinction is essential because it determines who has the authority to make decisions regarding the policy, such as changing beneficiaries or adjusting coverage amounts.

In summary, when discussing policy ownership, the assured is the individual whose life is insured, and they are the primary beneficiary of the policy. The insured, on the other hand, is the policyholder, responsible for premium payments and legal ownership. Understanding these roles is vital for effective communication and management of life insurance policies.

Understanding Modified Whole Life Insurance Cash Value

You may want to see also

Beneficiary: Assured's beneficiary is legally recognized, insured's beneficiary is financially protected

When it comes to life insurance, the terms "life assured" and "life insured" are often used, and understanding the difference between them is crucial, especially when considering the beneficiary's rights and protections.

The life assured is the individual whose life is being insured. This person is the primary focus of the insurance policy, and their life is the subject of the insurance contract. The assured's life is legally recognized and protected by the insurance company, which means that the assured's beneficiary, typically a spouse, child, or designated individual, has legal rights and entitlements. These rights often include receiving the death benefit or payout as specified in the policy. For example, if the life assured passes away, the beneficiary can claim the insured amount, ensuring financial security for their future needs.

On the other hand, the life insured refers to the insurance policy itself. It is the contract between the insurance company and the assured, outlining the terms and conditions of the coverage. The insured policy provides financial protection and ensures that the beneficiary is safeguarded in the event of the assured's death. When the assured dies, the insurance company is legally obligated to pay out the death benefit to the designated beneficiary. This financial protection is a key aspect of life insurance, as it provides a safety net for the beneficiary's financial well-being.

In summary, the key difference lies in the legal recognition and protection of the beneficiary's rights. The life assured's beneficiary is legally recognized and entitled to the death benefit, ensuring a sense of security and peace of mind. Meanwhile, the life insured policy provides the financial protection, safeguarding the beneficiary's interests and ensuring they receive the intended financial support. Understanding these distinctions is essential for individuals and their beneficiaries to make informed decisions regarding life insurance coverage.

Whole Life Insurance: Age Limit for Buyers?

You may want to see also

Tax Implications: Tax implications differ for assured and insured

The terms "life assured" and "life insured" are often used in the context of insurance policies, particularly life insurance. While they may seem interchangeable, there are some subtle differences that can impact the tax implications for each party. Understanding these differences is crucial for individuals and their financial advisors to make informed decisions.

When an individual is referred to as the "life assured," it means they are the person whose life is covered under the insurance policy. In this scenario, the assured is the policyholder, and they have a direct interest in the insurance contract. The assured typically pays the premiums to the insurance company, and the policy provides financial protection to the assured or their beneficiaries in the event of the assured's death. From a tax perspective, the assured may be able to claim certain tax benefits. For instance, in some jurisdictions, the assured can deduct the cost of life insurance premiums as a medical expense, especially if the policy is part of a larger health insurance plan. Additionally, the proceeds from a life insurance policy paid to the assured or their beneficiaries are generally tax-free, as they are considered death benefits.

On the other hand, when someone is "life insured," it means they are the person whose life is covered by the insurance policy, but they are not necessarily the policyholder. The insured individual is the one whose life is at risk, and the policy provides financial protection to their beneficiaries in the event of their death. The insured individual may or may not be aware of the policy's existence, and their role is primarily to ensure their beneficiaries receive the intended financial support. Tax implications for the insured individual are generally less favorable. The insured person may not have any direct tax benefits from the policy, and the proceeds paid to their beneficiaries are typically taxable as income. The insurance company may withhold taxes on these proceeds, and the beneficiaries will need to report the amount received as income on their tax returns.

In summary, the key difference in tax implications lies in the role and relationship of the individual to the insurance policy. As the life assured, individuals may enjoy tax benefits through premium deductions and tax-free death benefits. In contrast, as the life insured, individuals may face tax consequences for their beneficiaries, who will need to report the proceeds as income. It is essential to consult tax professionals and insurance advisors to navigate these complexities and ensure compliance with tax laws in your specific jurisdiction.

Understanding Variable Life Insurance Cash Value Changes

You may want to see also

Frequently asked questions

The terms "life assured" and "life insured" are often used interchangeably in the insurance industry, but they hold slightly different meanings. "Life assured" typically refers to the person whose life is covered by an insurance policy, meaning their life is the subject of the insurance contract. On the other hand, "life insured" is a more general term that can refer to anyone whose life is insured under a policy, encompassing both the insured individual and any beneficiaries named in the policy.

The distinction is primarily for administrative and legal purposes. The policyholder, who takes out the insurance policy, is the one who decides the terms and conditions, including the coverage amount and beneficiaries. The "life assured" is the central figure in the policy, whose life is the primary focus of the insurance coverage. The beneficiaries are the individuals who will receive the death benefit if the life assured passes away during the policy period.

Yes, in practice, both terms can be used interchangeably as they often refer to the same individual whose life is being insured. However, it's essential to understand the specific context and the insurance company's terminology to ensure clarity. Some insurance companies might use "life insured" to describe the entire policyholder and their beneficiaries collectively.

In certain cases, "life assured" might be used more specifically to refer to the individual whose life is the primary subject of the policy, especially when discussing the specific coverage and benefits for that particular person. Meanwhile, "life insured" could be used more broadly to describe the entire insurance arrangement, including the policyholder and any additional insured parties.

Understanding the difference can help policyholders make informed choices when selecting beneficiaries and determining coverage amounts. It ensures that the chosen terminology accurately reflects the intended recipients of the death benefit, providing clarity and avoiding potential confusion in the event of the life assured's passing.