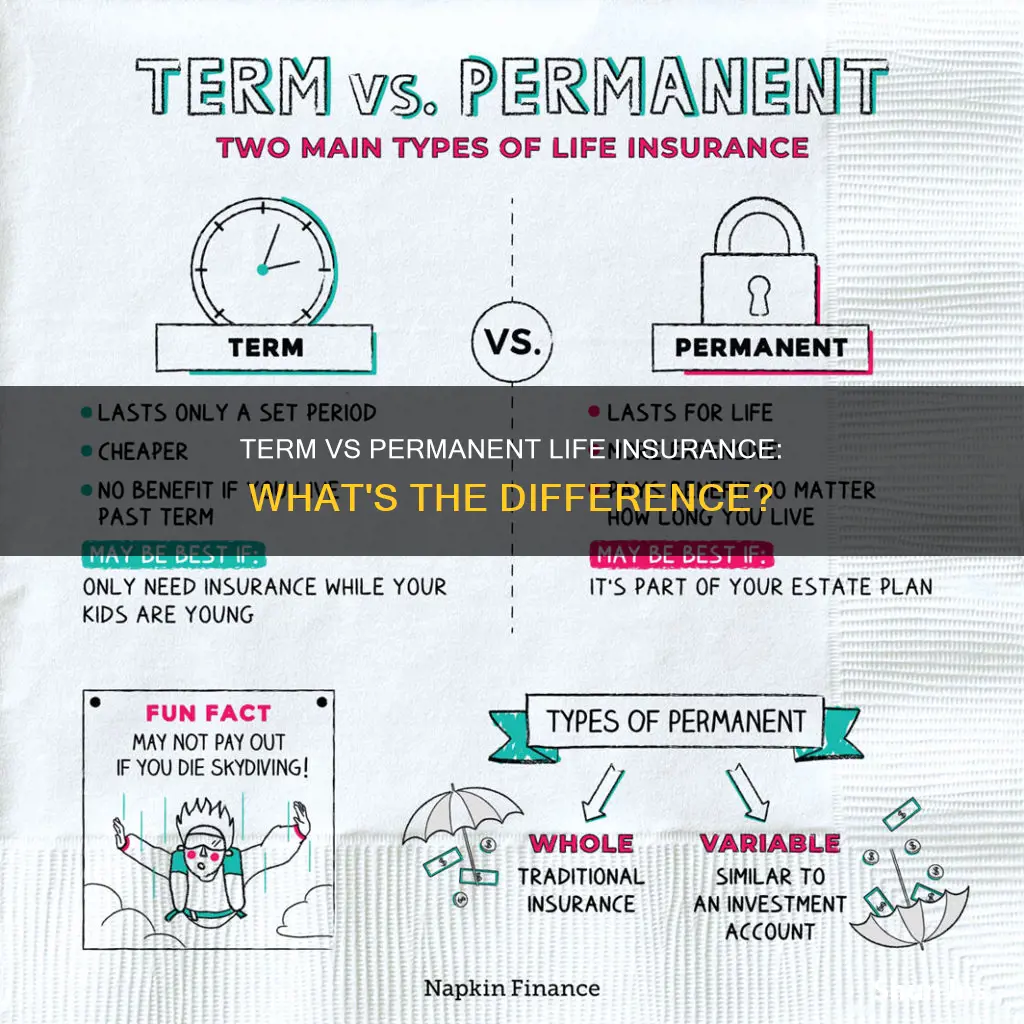

Life insurance is an important financial product that can provide peace of mind and financial security for individuals and their loved ones. When it comes to choosing a life insurance policy, one of the key decisions is whether to opt for term life insurance or permanent life insurance. Term life insurance is a type of coverage that provides protection for a specific period, such as 10, 15, or 20 years. It is generally more affordable and offers basic protection without any savings or investment components. On the other hand, permanent life insurance, which includes whole life and universal life, offers lifelong coverage and often includes a cash value component that grows over time. This cash value can be accessed by the policyholder during their lifetime, providing additional financial flexibility. While permanent life insurance is more expensive, it guarantees coverage for as long as the policyholder continues to pay the premiums. Ultimately, the choice between term and permanent life insurance depends on an individual's needs, budget, and financial goals.

What You'll Learn

- Length of coverage: Term life insurance is temporary, lasting for a set period, while permanent life insurance is lifelong

- Cost of premium: Term life insurance is initially cheaper, but permanent life insurance premiums remain the same

- Cash value: Term life insurance has no cash value, but permanent life insurance allows you to accumulate cash value

- Convertible policies: Term life insurance can be converted into permanent life insurance, but not the other way around

- Death benefits: Both types of insurance pay a death benefit, but permanent life insurance may be preferable if you want lifelong protection

Length of coverage: Term life insurance is temporary, lasting for a set period, while permanent life insurance is lifelong

Term life insurance is a temporary form of coverage that lasts for a set period, such as 10, 20 or 30 years. It provides coverage for a specified term and is ideal for those seeking short-term protection or additional coverage during specific periods. Term life insurance is typically more affordable than permanent life insurance, making it a good option for those on a budget or those who only need coverage for a limited time. It is also a good choice for young, healthy individuals who want simple and inexpensive coverage to pay off debts, cover funeral costs, or leave money to their partner.

On the other hand, permanent life insurance is designed to provide long-term, often lifelong, coverage. As long as the policyholder continues to pay the premiums, their coverage will remain in place. Permanent life insurance policies include whole life and universal life and are intended to offer lifelong financial protection. While permanent life insurance is more expensive, it provides the security of knowing that you are protected for life. It also offers additional benefits, such as the ability to build cash value over time, which can be accessed or borrowed against while the policyholder is alive.

The decision between term and permanent life insurance depends on individual needs and preferences. Term life insurance is suitable for those seeking short-term or additional coverage, flexibility, and affordable premiums. In contrast, permanent life insurance is designed for those who want lifelong protection, the ability to build cash value, and the security of knowing they are covered for life.

U.S.A.A. Life Insurance: Conversion Coverage Options Explored

You may want to see also

Cost of premium: Term life insurance is initially cheaper, but permanent life insurance premiums remain the same

When it comes to the cost of premiums, term life insurance is initially more affordable than permanent life insurance. However, it's important to note that term life insurance premiums tend to increase with each renewal, while permanent life insurance premiums remain the same. This means that over time, the cost of permanent life insurance may become more favourable compared to term life insurance.

Term life insurance offers coverage for a specific period, such as 10, 15, 20, or 30 years. The premiums for term life insurance are generally lower at the outset, making it a cost-effective option for those seeking short-term protection or working with a limited budget. However, it's important to consider that term life insurance premiums typically increase upon renewal. This can result in higher costs in the long run, especially if the policy is renewed multiple times.

On the other hand, permanent life insurance, which includes whole life and universal life, is designed to provide lifelong coverage as long as the policy remains in force. While permanent life insurance premiums are typically higher initially, they remain consistent throughout the duration of the policy. This stability can make it easier for individuals to plan their finances, knowing that their life insurance premiums will not fluctuate.

The difference in premium costs between term and permanent life insurance can be significant. Whole life insurance premiums can be approximately 17 times higher than those of term life policies with the same death benefit. This makes permanent life insurance a substantial financial commitment that may not be feasible for everyone.

It's worth noting that term life insurance premiums are based on factors such as age, health, and life expectancy. As a result, individuals who purchase term life insurance at a younger age may benefit from lower premiums compared to those who purchase it later in life. Additionally, term life insurance premiums are locked in for the selected coverage period, providing stability for that duration.

In summary, while term life insurance is initially more affordable, the premiums tend to increase with each renewal. On the other hand, permanent life insurance premiums remain consistent throughout the policy's duration, providing long-term stability in terms of cost. This makes permanent life insurance a more predictable expense, although it carries higher premiums from the outset.

Permanent Life Insurance: Cash Value and Benefits Explained

You may want to see also

Cash value: Term life insurance has no cash value, but permanent life insurance allows you to accumulate cash value

Term life insurance and permanent life insurance differ in several ways, one of the most significant being the accumulation of cash value. While term life insurance offers a simple and affordable way to provide financial protection for your loved ones in the event of your death, it does not offer any cash value benefits. On the other hand, permanent life insurance not only provides lifelong coverage but also allows you to accumulate cash value, offering a financial tool that can be utilised during your lifetime.

Term Life Insurance

Term life insurance is a straightforward type of insurance that covers you for a specified period, such as 10, 15, or 20 years. It is designed to provide financial protection for your loved ones in the event of your death during the specified term. The main benefit of term life insurance is the death benefit, which is a lump-sum payment made to your beneficiaries if you pass away during the policy term. Term life insurance is particularly attractive to those seeking affordable coverage, such as young individuals, families with growing children, or those on a budget.

One key feature of term life insurance is that it does not accumulate any cash value. This means there is no savings component, and the policy has no value beyond the guaranteed death benefit. If you outlive the policy term, the coverage ends, and there is no cash value to withdraw or borrow against. This lack of cash value accumulation keeps the cost of term life insurance premiums relatively low.

Permanent Life Insurance

Permanent life insurance, on the other hand, offers lifelong coverage and includes a cash value component. This means that a portion of your premium payments goes towards building cash value, which can grow over time. Unlike term life insurance, permanent life insurance allows you to access this accumulated cash value during your lifetime. You can choose to withdraw or borrow against the cash value to fund unexpected emergencies, milestone events, college tuition, or retirement income.

The cash value in a permanent life insurance policy grows at a guaranteed rate set by the insurer and is often tax-deferred. This means that you can accumulate cash value without paying taxes on the growth until you withdraw the funds. The ability to withdraw or borrow from the cash value makes permanent life insurance a flexible financial tool. However, it's important to note that any outstanding loans or withdrawals will typically reduce the final death benefit paid out to your beneficiaries.

In summary, the main difference between term and permanent life insurance regarding cash value is that term life insurance has no cash value component, while permanent life insurance allows you to accumulate cash value that can be accessed during your lifetime. Term life insurance offers a simple and affordable way to provide financial protection, while permanent life insurance adds the benefit of cash value accumulation, making it a more complex and expensive option.

Waepa Life Insurance: Afghanistan Coverage Explained

You may want to see also

Convertible policies: Term life insurance can be converted into permanent life insurance, but not the other way around

One of the main differences between term and permanent life insurance is that term life insurance can be converted into permanent life insurance, but not the other way around. This is known as a "convertible policy".

Term life insurance is a temporary form of coverage that provides protection for a set period of time, such as 10, 15, or 20 years. It is generally the most affordable type of life insurance and is ideal for people who want substantial coverage at a low cost. However, term life insurance does not offer any cash value accumulation, and the premiums typically increase upon each renewal.

On the other hand, permanent life insurance is designed to provide long-term, often lifelong, coverage. As long as the policyholder continues to pay the premiums, the coverage will remain in force. Permanent life insurance also offers a cash value component that grows over time and can be accessed or borrowed against. This makes it a more complex and expensive product compared to term life insurance.

While term life insurance is initially less expensive, permanent life insurance may be more cost-effective in the long run. This is because permanent life insurance never needs to be renewed, and the rates remain stable. Additionally, the cash value component of permanent life insurance can be a valuable financial tool, providing funds for retirement, college tuition, or other expenses.

The decision to choose between term and permanent life insurance depends on an individual's needs and circumstances. Term life insurance may be suitable for those who only need coverage for a specific period, such as when raising children or paying off a mortgage. On the other hand, permanent life insurance may be preferred by those who want lifelong coverage and are comfortable with the higher premiums.

Life Insurance Settlements: Roth Contribution Eligibility Impact?

You may want to see also

Death benefits: Both types of insurance pay a death benefit, but permanent life insurance may be preferable if you want lifelong protection

Both term and permanent life insurance policies pay a death benefit to the insured's beneficiaries after their death. However, term life insurance only covers the insured for a specific period, such as 10, 15, 20, or 30 years, while permanent life insurance provides lifelong protection. This key difference makes permanent life insurance preferable for individuals seeking long-term financial protection and a guaranteed payout to their beneficiaries.

Term life insurance offers short-term death benefit protection, typically ranging from 10 to 30 years. If the insured passes away during this period, their beneficiaries receive a lump-sum death benefit. However, if the policy expires before the insured's death, there is no payout. Term life insurance is ideal for those who only need coverage for a specific period, such as when raising children or paying off a mortgage. It is also a good option for those on a budget, as it is more affordable than permanent life insurance.

On the other hand, permanent life insurance, including whole life and universal life, offers long-term or lifelong coverage. As long as the insured continues to pay the premiums, their beneficiaries will receive a death benefit upon their death, regardless of when it occurs. Permanent life insurance is suitable for individuals who need long-term financial protection, want to create an inheritance for their heirs, or prefer stable premiums.

While term life insurance provides temporary protection, permanent life insurance offers the advantage of lifelong coverage. Permanent life insurance policies also accumulate cash value over time, which can be accessed by the insured during their lifetime. This cash value can be borrowed against or withdrawn to meet financial needs, such as college tuition or retirement expenses. However, it's important to note that any outstanding loans or withdrawals will reduce the final death benefit paid out to beneficiaries.

In summary, while both types of insurance offer death benefits, permanent life insurance stands out for its ability to provide lifelong protection and accumulate cash value. If you are seeking coverage that extends beyond a specific term and desire the added financial benefits that come with permanent life insurance, then permanent life insurance may be the preferable choice.

ACA and Pre-Existing Conditions: Life Insurance Impact

You may want to see also

Frequently asked questions

Term life insurance is a temporary form of life insurance, typically lasting between one and 30 years, or until a specific age. It provides a death benefit to the beneficiary, provided the policy is active and premiums are paid. Term life insurance is generally more affordable than permanent life insurance.

Permanent life insurance is designed to last a person's entire life. In addition to a death benefit, it features a cash value account that grows over time and can be used by the policyholder for loans or supplemental income. Permanent life insurance is generally more expensive than term life insurance.

Term life insurance is a cost-effective way to provide temporary financial protection for loved ones, especially during working years. It is ideal for those who want flexibility or are on a budget.

Permanent life insurance offers lifelong coverage and financial stability for dependents. It also has a savings component, which can be used to build wealth and provide an inheritance for heirs. The premium amount typically remains the same throughout the policy.

The choice depends on individual needs and circumstances. Term life insurance is suitable for short-term coverage or specific needs, while permanent life insurance is designed for lifelong needs and end-of-life expenses. Consider factors such as budget, assets, and the financial needs of your loved ones.