Life insurance has a rich and extensive history, dating back to ancient civilizations. The concept of providing financial security for one's family in the event of death can be traced to ancient Rome and Greece, where funeral benefits were offered to the deceased's relatives. However, the modern life insurance industry as we know it today began to take shape in the 17th century with the establishment of the first insurance company in London, specializing in marine insurance. Over time, the focus shifted to life insurance, and in the 19th century, the first life insurance companies emerged, offering policies to individuals to ensure financial protection for their loved ones. This evolution has led to the diverse range of life insurance products available today, providing individuals with various options to secure their families' financial well-being.

What You'll Learn

- Origins: Ancient civilizations like the Babylonians and Egyptians had early forms of life insurance

- Medieval Europe: Guilds provided burial insurance, laying the foundation for modern life insurance

- th Century: Dutch East India Company offered early life insurance policies in the 1600s

- Industrial Revolution: Rapid urbanization and increased life expectancy fueled the growth of life insurance

- Modern Era: Technological advancements and regulatory changes transformed life insurance into a global industry

Origins: Ancient civilizations like the Babylonians and Egyptians had early forms of life insurance

The concept of life insurance can be traced back to ancient civilizations, where early forms of protection and financial security were established. One of the earliest known examples is found in ancient Babylon, where a system of financial agreements was in place as far back as 1750 BCE. This involved a type of insurance known as "groschen," which was a form of life insurance that provided financial support to the family of a deceased individual. The amount paid out was typically a fixed sum, and it was often used to cover funeral expenses and provide for the family's basic needs. This practice was an early attempt to ensure financial stability for the bereaved, demonstrating a rudimentary understanding of the value of life insurance.

Moving forward in time, the ancient Egyptians also had their own version of life insurance, which was deeply intertwined with their religious beliefs and practices. The Egyptians believed in an afterlife, and their life insurance system was closely tied to their funerary practices. They would often purchase "shadow" or "life" insurance, which was a type of contract where a person would pay a sum to a priest or a temple, and in return, the priest would provide for the deceased's family in their absence. This insurance was not about monetary gain but rather a way to ensure the deceased's comfort and well-being in the afterlife. The Egyptians' understanding of life insurance was not just about financial security but also about spiritual and religious obligations.

These ancient civilizations laid the foundation for what we now recognize as life insurance. The Babylonians and Egyptians' practices were early attempts to provide financial and spiritual support to the families of the deceased, offering a sense of security and peace of mind. Their ideas and systems, though primitive by today's standards, were significant steps in the evolution of life insurance, shaping its development and purpose over centuries. The study of these ancient origins provides valuable insights into the historical context and the transformation of life insurance into a sophisticated financial product.

Disability and Life Insurance: Paid-Up Policies at Risk?

You may want to see also

Medieval Europe: Guilds provided burial insurance, laying the foundation for modern life insurance

In the intricate tapestry of medieval Europe, a fascinating thread emerges in the form of guilds and their role in shaping the concept of life insurance. During this era, guilds, which were associations of craftsmen or merchants, played a pivotal role in providing financial security and peace of mind to their members. One of the most significant contributions of these guilds was their provision of burial insurance, a practice that laid the foundation for the modern life insurance industry.

Guilds, often referred to as 'brotherhoods', were more than just social clubs; they were essential support systems for their members. These organizations ensured that their craftsmen or merchants were cared for, especially in times of need. One of the most critical aspects of this care was the provision of financial assistance for funeral expenses upon the death of a guild member. This practice was a form of insurance, albeit rudimentary, as it guaranteed that the deceased's family would have the necessary funds to cover burial costs.

The concept of burial insurance was not merely a charitable act but a strategic move by guilds to maintain their membership and ensure the continuity of their trade. By providing financial support for funerals, guilds ensured that the deceased's family was taken care of, which in turn meant that the trade or craft would not be disrupted due to financial constraints. This practice fostered a sense of loyalty and commitment among guild members, as they knew their families would be protected even in the face of death.

Over time, this system evolved and expanded. Guilds began to offer more comprehensive financial support, including assistance with medical expenses, disability, and even retirement. These expanded benefits were a precursor to the diverse range of life insurance policies available today. The guild model provided a framework for organized groups to collectively manage risks and provide financial security, which was a significant step towards the development of modern insurance practices.

The impact of this medieval practice on the modern life insurance industry is undeniable. It demonstrated the potential for organized groups to provide financial security and peace of mind to their members. This concept of collective risk management and mutual support has been a cornerstone of life insurance ever since. The historical roots of life insurance, therefore, can be traced back to the humble beginnings of medieval guilds and their innovative approach to ensuring the well-being of their members.

Employee Life Insurance: Taxable or Not?

You may want to see also

17th Century: Dutch East India Company offered early life insurance policies in the 1600s

The concept of life insurance can be traced back to ancient civilizations, but it was during the 17th century that one of the earliest forms of life insurance emerged. This revolutionary idea was introduced by the Dutch East India Company, which played a pivotal role in the development of modern insurance practices.

In the 1600s, the Dutch East India Company, also known as the Dutch East India Trading Company, was a powerful and influential entity. It was established in 1602 and quickly became a dominant force in global trade. The company's extensive maritime network and global reach provided an opportunity to address the financial risks associated with the uncertainties of long-distance travel and trade.

The Dutch East India Company's life insurance policies were designed to protect the interests of its investors and crew members. They offered a unique form of insurance known as "ship insurance" or "seaman's insurance." This type of insurance provided financial security to the company's employees in the event of their death or disability while on board the company's ships. The policies were structured as a mutual agreement between the company and its crew, where the crew members would pay a premium, and in return, the company would provide a lump-sum payment to their beneficiaries upon their death or the company's dissolution.

This early form of life insurance was a significant innovation in the financial industry. It marked the beginning of structured risk management and the concept of insurance as a means to mitigate financial losses. The Dutch East India Company's policies were a response to the high mortality rates among sailors and traders during the 17th century, which were often due to maritime accidents, diseases, and the harsh conditions of travel. By offering financial protection, the company aimed to provide a sense of security and stability to its employees and their families.

The impact of the Dutch East India Company's life insurance policies extended beyond its immediate scope. It laid the foundation for the development of modern insurance practices and inspired other companies to explore similar concepts. Over time, life insurance evolved into a more comprehensive and regulated industry, with various forms of policies and coverage options. Today, life insurance is a vital financial tool, providing individuals and families with security and peace of mind.

Life Insurance for Sherpas: A Matter of Survival?

You may want to see also

Industrial Revolution: Rapid urbanization and increased life expectancy fueled the growth of life insurance

The Industrial Revolution, a period of immense technological and social change, significantly impacted the development of life insurance. One of the key factors that fueled the growth of life insurance during this era was the rapid urbanization and the subsequent increase in life expectancy.

As factories and industrial centers began to spring up across Europe and North America, people migrated from rural areas in search of employment opportunities. This mass movement of people led to the rapid expansion of cities, resulting in a significant shift in demographics. Urban areas became densely populated, with a diverse range of individuals from various social backgrounds living in close proximity. This urban transformation presented both challenges and opportunities for the insurance industry.

Increased life expectancy was another critical factor. The Industrial Revolution brought about improvements in living standards, healthcare, and sanitation. These advancements contributed to a longer lifespan for many individuals, particularly those in urban settings. With people living longer, the concept of financial security for their families or beneficiaries became more relevant. Life insurance companies recognized the growing demand for products that could provide financial protection during the extended periods of life.

The combination of rapid urbanization and increased life expectancy created a perfect storm for the life insurance industry. Insurance companies began to offer policies tailored to the needs of the urban population, providing financial coverage for the risk of death. These policies offered a sense of security to individuals, knowing that their families would be financially protected even if they were no longer around. As a result, life insurance gained popularity, and companies started to expand their operations to cater to the growing market.

The Industrial Revolution's impact on life insurance was transformative, shaping the industry into what it is today. It demonstrated how societal changes, such as urbanization and improved healthcare, can drive the development of financial products like life insurance. This period marked a significant shift in the perception of insurance, turning it from a luxury into a necessity for many families.

Joint Life Insurance: Cheaper Option for Couples?

You may want to see also

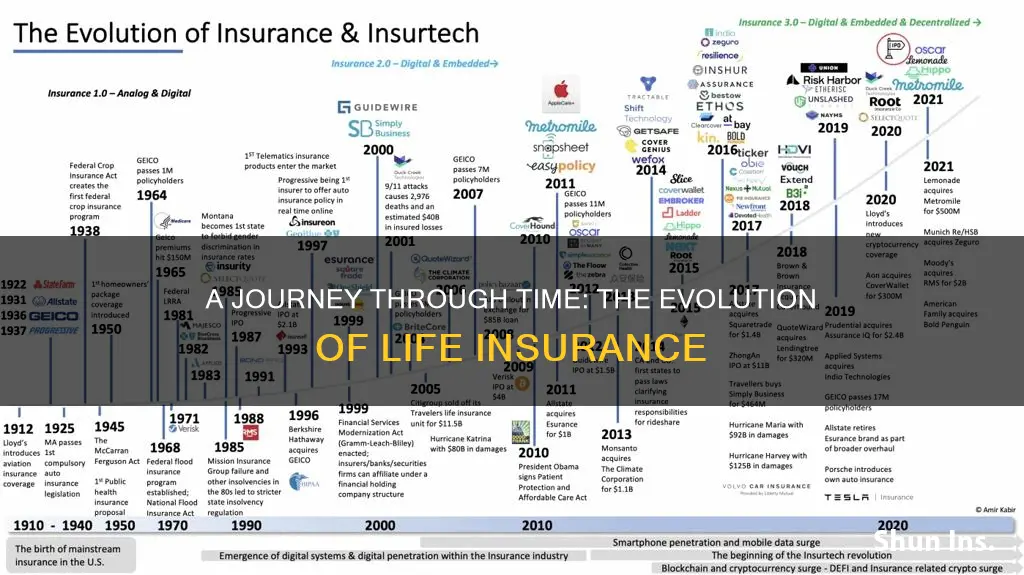

Modern Era: Technological advancements and regulatory changes transformed life insurance into a global industry

The modern era of life insurance has been characterized by significant technological advancements and regulatory changes that have transformed the industry into a global enterprise. In the late 19th and early 20th centuries, life insurance companies began to adopt new technologies, such as the use of calculators and statistical tables, to improve their underwriting processes and assess risk more accurately. This period also saw the introduction of standardized policies and the establishment of regulatory frameworks to ensure the stability and integrity of the industry.

One of the most significant technological advancements in life insurance was the development of computer systems and software. In the 1960s and 1970s, life insurance companies began to use computers to automate various processes, including policy administration, underwriting, and claims processing. This led to increased efficiency and reduced costs, allowing companies to offer more competitive rates and products. The use of computer systems also enabled the industry to expand its reach globally, as companies could easily manage policies and provide services across different jurisdictions.

Regulatory changes have also played a crucial role in shaping the modern life insurance industry. In the aftermath of the Great Depression, governments around the world implemented new regulations to protect consumers and ensure the financial stability of insurance companies. These regulations included requirements for capital adequacy, solvency margins, and regular financial reporting. For example, the United States introduced the National Insurance Consumer Protection Act (NICPA) in 1988, which set standards for policy disclosure and consumer protection. Similarly, the European Union's Solvency II directive, introduced in 2014, established comprehensive risk management requirements for insurance companies, aiming to enhance the stability and transparency of the market.

The global nature of the life insurance industry has been further emphasized by the increasing popularity of cross-border transactions and international operations. Life insurance companies now offer products and services to customers worldwide, often through a network of subsidiaries and branches. This expansion has been facilitated by technological advancements, allowing companies to efficiently manage international operations and comply with varying regulatory requirements across different countries.

In recent years, technological innovations have continued to drive the evolution of life insurance. The rise of digital platforms and online marketplaces has made it easier for consumers to compare policies and purchase insurance products. Additionally, the integration of artificial intelligence (AI) and machine learning algorithms has improved risk assessment and personalized product offerings. These advancements have not only enhanced the customer experience but also allowed life insurance companies to adapt to changing market dynamics and compete effectively in a global marketplace.

Debt-Free Life Insurance: What You Need to Know

You may want to see also